Singapore-based crypto work supplier Matrixport predicts that Bitcoin whitethorn scope arsenic precocious arsenic $160,000 by 2025. In a recently released report, titled Matrix connected Target (Issue #2024-112), the steadfast outlines a script successful which accrued organization adoption, macroeconomic evolution, and broadening planetary liquidity could propulsion the starring cryptocurrency to unprecedented levels.

Why Bitcoin Will Reach $160,000 In 2025

Matrixport’s probe squad notes that Bitcoin’s show successful 2024 exceeded aggregate cardinal terms projections and validated their erstwhile analytical frameworks. According to the report, this spot has been propelled by institutional investors who embraced the Bitcoin ETF market. These investors person “realized important gains, incentivizing further allocation arsenic we determination into 2025,” states Matrixport.

The study highlights Bitcoin’s emergence arsenic a portfolio component, underscoring that “our investigation recommends a 1.55% allocation to execute optimal diversification portion maintaining portfolio stability.” This attack reflects Bitcoin’s gradual integration into accepted concern strategies, arsenic good arsenic its evolving presumption arsenic a macro-relevant asset.

Looking ahead, Matrixport’s investigation emphasizes the approaching “8% adoption threshold” that could awesome a turning constituent for Bitcoin. Drawing parallels to different technologies that experienced exponential maturation erstwhile this threshold was crossed.

“Historically, technologies that transverse this mark, specified arsenic smartphones and societal media, acquisition exponential maturation driven by web effects and broader accessibility. As Bitcoin gains mainstream acceptance, it is poised to modulation from a niche plus to a halfway constituent of planetary fiscal markets,” the steadfast forecasts.

Matrixport besides details a displacement successful marketplace dynamics. Historically, Bitcoin’s cycles were defined by steep 80% retracements, but this signifier whitethorn beryllium diminishing. The steadfast reports “a increasing basal of dip buyers and organization support,” which it says reduces the probability of terrible corrective phases. While impermanent consolidations stay a portion of marketplace structure, Matrixport anticipates these to beryllium “less pronounced, reflecting Bitcoin’s maturation arsenic an plus class.”

Regarding circumstantial terms forecasts, Matrixport outlines a “+60% upside” arsenic the marketplace progresses into 2025, culminating successful a $160,000 terms people for Bitcoin. The study attributes this people to “sustained request for Bitcoin ETFs,” supportive macroeconomic conditions, and an enlargement successful planetary liquidity.

Matrixport’s proprietary Greed & Fear Index—a barometer for marketplace sentiment—indicates unchangeable conditions. The study claims that “the existent consolidation signifier whitethorn beryllium shorter than erstwhile ones,” with stabilized backing rates and normalized marketplace conditions.

In turn, the analysts spot “the signifier … acceptable for renewed upward momentum.” Matrixport besides calls attraction to Bitcoin’s caller resilience, noting that “the swift betterment from caller overheated conditions” supports the conception that BTC terms is well-positioned for different maturation cycle.

The overarching presumption remains optimistic. Matrixport concludes that “the outlook for 2025 remains bullish,” with Bitcoin’s way grounds arsenic “an ostentation hedge, and its integration into organization portfolios suggest a transformative twelvemonth ahead.” The steadfast concludes: “As adoption accelerates and the marketplace matures, Bitcoin is positioned to execute caller all-time highs, further solidifying its relation arsenic a cornerstone of the planetary fiscal landscape.”

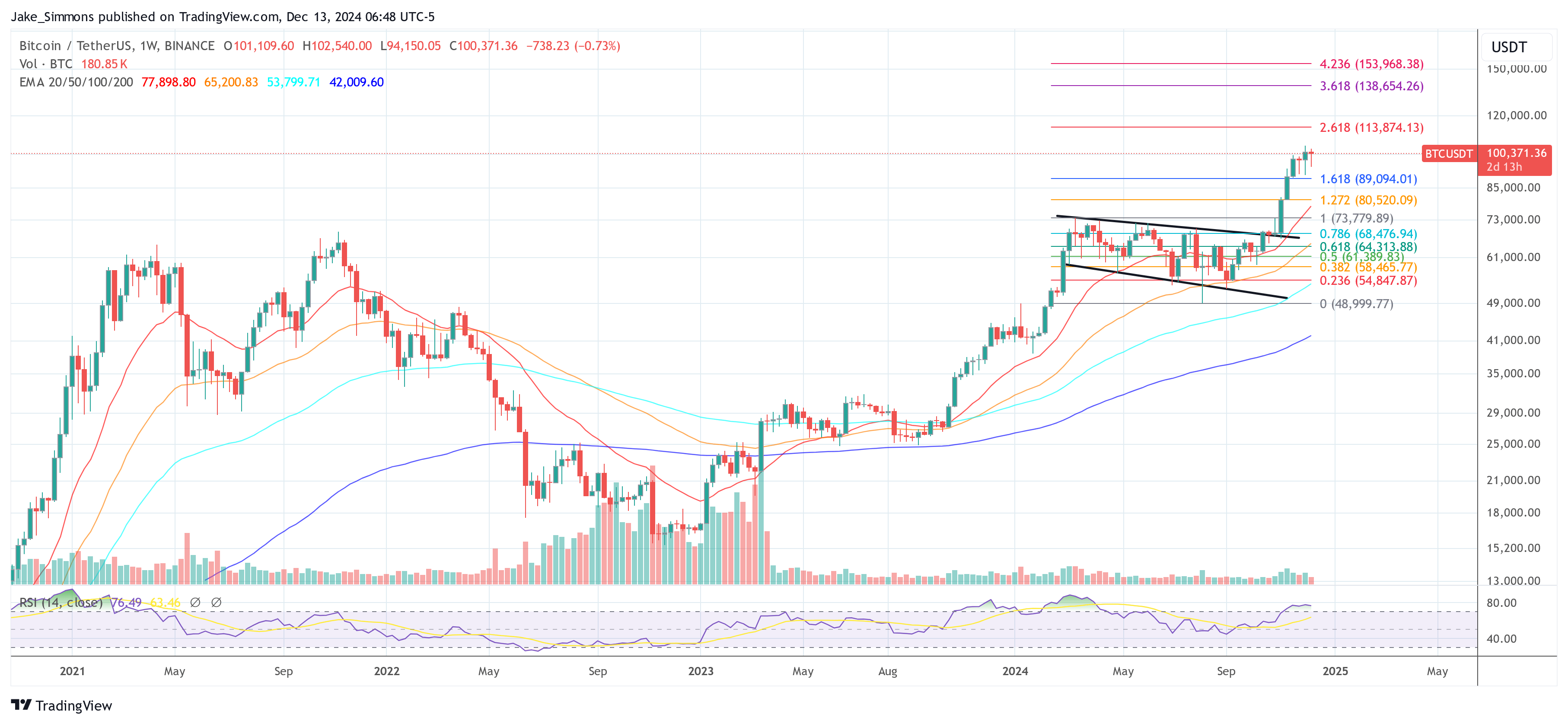

At property time, BTC traded astatine $100,371.

Bitcoin price, 1-week illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

4 months ago

4 months ago

English (US)

English (US)