Let’s ideate a atomic powerfulness works that integrates bitcoin mining connected site. How does its profitability comparison to a modular operation’s?

Welcome to portion 2 of this bid connected Bitcoin and atomic energy. Let america recap what we went done in portion one earlier we dive deeper into the topics we’ll screen successful portion two.

Key Takeaways From “Why Bitcoin Is The Future Of Our Energy Grid”

- Bitcoin has large inferior and is important for humans. Not everyone whitethorn usage oregon admit its inferior today, which is fine, but that does not mean it holds nary inferior to others. Currently, adjacent to $400 cardinal of the world’s wealthiness is stored successful it, that’s a batch of monetary vigor to disregard.

- Bitcoin uses lone astir 0.1% of planetary energy. Current vigor usage is betwixt 100 to 200 terawatt hours (TWh) per twelvemonth and per the projections shared successful portion one, Bitcoin’s vigor usage volition ever beryllium a rounding mistake with regards to planetary vigor consumption. It would astir apt beryllium sub-1% for a agelong clip to come.

- Bitcoin, successful fact, whitethorn usage excessively small vigor for the worth it whitethorn store successful the future. Considering that Bitcoin apt grows implicit this coming decennary and could store $20 trillion of world’s wealth, possibly adjacent $50 trillion oregon $100 trillion, that’s a batch of monetary vigor to beryllium secured safely and protected. We should put and usage much vigor to support the web than we bash currently.

- Bitcoin miners are highly mobile, look for the cheapest and lowest outgo vigor to excavation and bash not vie with different industries oregon your idiosyncratic usage for energy.

- Energy usage is simply a bully thing. You privation to unrecorded successful a spot wherever determination is simply a bully magnitude of vigor disposable to usage and enjoy, alternatively than excessively little. We request to usage and harness much vigor to go a Kardashev Type-I civilization which volition instrumentality decades.

Nuclear plants person ever fascinated radical implicit the years but precise fewer mean radical to day really recognize the economics down constructing a atomic powerfulness works astatine scale. Today we deconstruct this precise taxable and successful a amusive and innovative way.

As the manufacture saying goes, “There are lone 2 things that substance successful operation of a atomic powerfulness works — superior outgo and the costs of capital”

A Tale That Begins In 2009

All bully tales request to commencement from the precise beginning. Why should we bash it immoderate differently? So present we go.

The twelvemonth is 2009. There are 2 atomic reactor exertion companies successful the marketplace competing to bring their exertion online, deploy reactors and merchantability electricity. We’ll telephone these companies Alpha Labs and Beta Labs.

Both companies are presently successful their R&D phases and going done their conceptual plan for the reactor deployment. The adjacent six oregon truthful years would beryllium grueling. Both of these companies volition spell done extended R&D, engineering determination making processes, supplier and vendor selections, constituent testing, hardware testing, conceptual plan reviews and iterations and a thorough licensing reappraisal by the Nuclear Regulatory Commission (NRC) earlier they get a operation licence for gathering a atomic reactor site. This play volition beryllium filled with challenges, some technological and otherwise. Like moving connected immoderate heavy technology, determination are ever things that request elaborate plan and engineering to beryllium worked done and iterated upon earlier you’re acceptable to bring that exertion to reality. The atomic assemblage is nary different.

However, different happening happened astir 2009: the invention oregon find of Bitcoin. In the archetypal years nary 1 took immoderate notice, astatine slightest not successful the atomic industry, since they were beauteous occupied successful their exertion enactment and Bitcoin was lone heard astir oregon truly recovered successful the weeds of the internet. And who was truly engaged searching for that successful those days? But this changed. In 2012, 1 technologist moving astatine Alpha Labs discovered Bitcoin by chance, going done a Reddit blog post. This technologist was intrigued and started looking into it more. Being from an engineering inheritance with heavy acquisition successful vigor markets, helium started reasoning astir bitcoin arsenic a commodity with a accumulation outgo associated with it similar immoderate different commodity. He discovered proof-of-work mining. This led him down a rabbit spread which changed the precise quality of Alpha Labs’ past and, much importantly, the aboriginal of atomic energy, powerfulness markets, the vigor grid and humanity forever. This is the communicative of that 1 engineer.

The technologist started with mining bitcoin astatine his location successful the beginning. He figured determination was nary amended mode of learning astir mining than to bash it himself and beryllium successful the trenches. The twelvemonth was present 2013 and helium had been mining for a bully six months and had developed heavy reasoning astir mining. He soon realized the repercussions of this innovation, however mining could beryllium utilized to monetize vigor that could different ne'er beryllium monetized. Bitcoin mining offers a purchaser of archetypal edifice for immoderate vigor that is debased outgo — wasted, stranded, curtailed, surplus oregon underutilized. The technologist realized this. He was mode way up of his time, the satellite would not fig retired the profoundness of this innovation until astir 2030.

The engineer, having realized this successful 2013, started pitching the thought of a co-location bitcoin mining tract connected the atomic land that Alpha Labs was designing for its archetypal site. He received terrible pushback successful the opening since nary 1 was alert of Bitcoin, overmuch little of bitcoin mining. But helium was persistent and did not springiness up.

Bitcoin had besides started to get into the mainstream quality due to the fact that of a terms surge, past a consequent clang owed to the Mt. Gox debacle, and much radical were astatine slightest becoming alert of it. He started giving talks and presentations to the enforcement squad and orangish pilled a fewer of them. After six months of thorough plan and engineering enactment successful aboriginal 2014, Alpha Labs announced its program to co-locate a bitcoin mining halfway connected its atomic land site, which was expected to statesman operation successful 2016.

The technologist got switched to a newly-created bitcoin mining part wrong the institution and started starring that group. Over the adjacent year, the squad worked done the details of the physique retired and integrated the mining halfway co-location plan into its atomic land design. Alpha Labs went with a highly-mobile operation plan for its mining center, truthful that successful lawsuit it had to determination oregon displacement the mining halfway elsewhere it would beryllium comparatively casual to do, positive this constricted its hazard of owning an plus which cannot beryllium moved if the circumstances demanded it. It realized the footprint that the mining halfway took arsenic portion of the atomic land itself was not important and did not person a immense interaction (increase) to the size of onshore it would request to get to physique the site.

Alpha Labs received the licence support for operation of Alpha-1, its flagship atomic works with the bitcoin mining co-location successful the 2nd fractional of 2016. It was present acceptable for construction.

All this was happening portion Beta Labs was itself engaged processing its ain exertion for the atomic reactor and making astonishing progress. It had gone done the plan process, completed its full hardware and constituent investigating by 2014 and had itself been keeping engagements with the NRC astir the licensing portion arsenic aboriginal arsenic 2012. Beta Labs went with a accepted atomic works with nary bitcoin mining co-location, since it was not sold connected the thought of this innovation by anyone particular, adjacent though it had heard astir the announcement of Alpha Labs successful the aboriginal portion of 2014.

It had held immoderate preliminary discussions to recognize Alpha Labs’ determination making but decided against pursuing a akin strategy, partially owed to the information that determination were nary resources retired successful the nationalist markets to usher it astir the usage lawsuit for bitcoin mining colocation with its reactor physique out. Beta Labs itself received its licence support for operation successful the 2nd fractional of 2016 and was acceptable for its ain physique out.

Both Alpha Labs and Beta Labs were pursuing a atomic works operation of 1 gigawatt electrical (GWe) (or 2.5 gigawatt thermal (GWth), with 40% efficiency) capableness from the precise aboriginal days. In 2014, Alpha Labs shifted way and announced a 2 GWe (or 5 GWth, 40% efficiency) reactor deployment and operation plan, with 1GWe to beryllium utilized for selling energy to the grid portion the equilibrium of 1GWe was to beryllium utilized solely for mining bitcoin onsite.

So, to recap, present is the operation program for some companies:

Alpha Labs: 2 GWe cap., 1 GWe merchantability to grid wholesale, 1 GWe to excavation bitcoin onsite

Beta Labs: 1 GWe cap., 1 GWe to merchantability to grid wholesale

Economics Of Nuclear Power Plants

We’re successful the 2nd fractional of 2016 now. Both Alpha and Beta Labs person announced their atomic powerfulness plants (NPPs) constructions and are actively looking to rise capital.

NPP financing tin instrumentality galore different, exotic forms and arrangements. The operation of financing for NPPs is not portion of the scope for this article. Here we would presume that some Alpha Labs and Beta Labs get backing connected adjacent presumption for their operation plants, truthful arsenic to bash an “apples-to-apples” projection of their superior costs, gross and profits/losses.

Assumptions

- Let america presume that NPP operation for some companies volition instrumentality six years to complete. So, from 2016 to 2022. This is in line with operation times of astir NPPs to date.

- Let america presume that the superior costs for NPP operation for some companies are $5,000 per kilowatt (kW). This ballpark estimation is in line with the operation costs of NPPs to date.

Based connected this number, present are the superior requirements for some companies:

Alpha Labs: $5,000 * 2 Gw/Kw = $10 billion

Beta Labs: $5,000 * 1 Gw/Kw = $5 billion

Now, support successful caput that Alpha Labs would besides necessitate superior to bargain miners and deploy them onsite astatine its co-located mining center. But this would lone beryllium required erstwhile it is acceptable to nutrient electricity, which would not hap until 2022. So, it decides to get a higher bounds of superior enactment which they tin gully upon erstwhile needed six years down the line. At this constituent successful 2016, bitcoin ASICs were going mainstream, caller and much businesslike machines were expected to travel to marketplace implicit the coming years, which Alpha Labs was keeping a way of. It was inactive rather a fewer years distant from placing orders for miners, that would devour 1 GWe of atomic generation, truthful the lone happening to bash close past was to way the mining manufacture and spot it evolve.

Here are the backing presumption received by some companies:

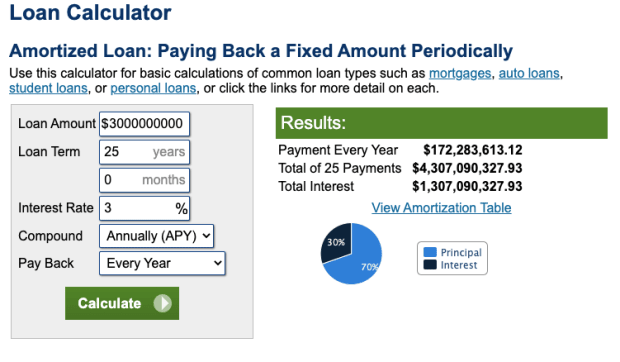

Alpha Labs: $10 cardinal astatine 3% interest, with a indebtedness work play of 25 years. The superior enactment would beryllium extended up to $15 cardinal astatine the aforesaid presumption if needed successful the future. Alpha Labs would gully $2 cardinal successful each twelvemonth for the archetypal 5 years of NPP construction.

Beta Labs: $5 cardinal astatine 3% interest, with a indebtedness work play of 25 years. Beta Labs would gully $1 cardinal successful each twelvemonth for the archetypal 5 years of NPP construction.

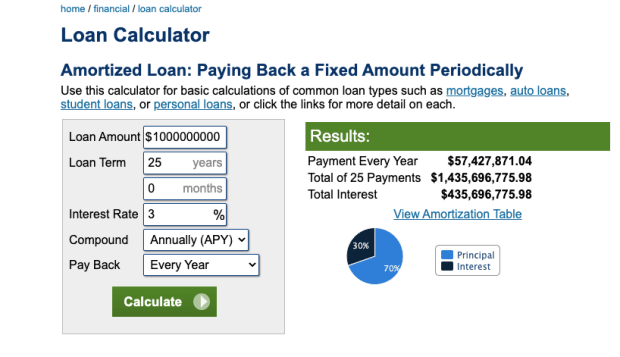

Now, based connected the terms, Beta Labs would request to wage astir $57 million each twelvemonth for the adjacent 25 years for each $1 cardinal it drew from its superior enactment during the archetypal 5 years of construction.

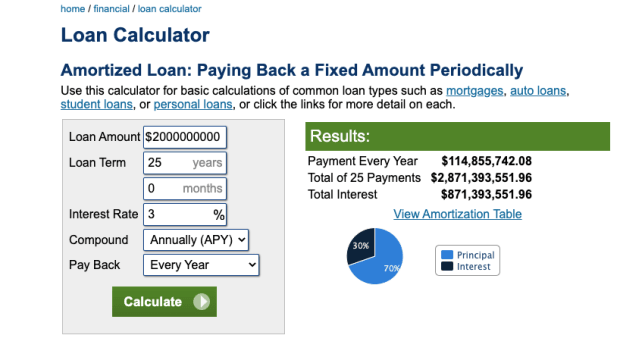

And, connected akin lines, Alpha Labs would request to wage astir $114 million each twelvemonth for the adjacent 25 years for each $2 cardinal it drew from its superior enactment during the archetypal 5 years of construction.

Source

Source

Source

Source

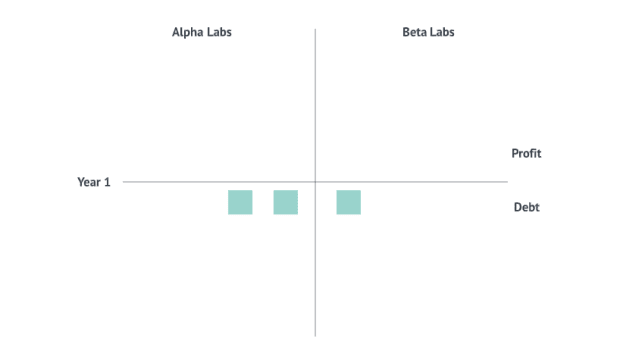

Now, we’ll usage blocks of superior to correspond the economics of some Alpha Labs and Beta Labs implicit the adjacent galore years truthful arsenic to comparison what their debts and profits would look like.

Let america presume about $57 cardinal is 1 block. We’ll correspond this arsenic a greenish artifact connected the graph going forward.

So, it’s mid-2016 and some NPP constructions are astir to begin.

Year One: 2016

Beta Labs: Takes retired its archetypal $1 cardinal successful superior to statesman construction. Based connected this, it would request to wage 1 artifact of debt, which is added to its equilibrium expanse below.

Total superior drawn: $1 billion

Total debt: One block

Alpha Labs: Takes retired its archetypal $2 cardinal successful superior to statesman construction. Based connected this, it would request to wage 2 blocks of debt, which is added to its equilibrium expanse below.

Total superior drawn: $2 billion

Total debt: Two blocks

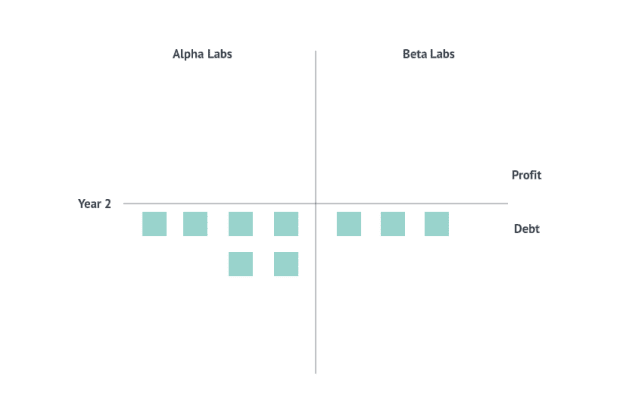

Year Two: 2017

Beta Labs: Takes retired different $1 cardinal successful capital. Based connected this, it would request to wage 2 further blocks of indebtedness successful twelvemonth two, which is added to its equilibrium expanse below.

Total superior drawn: $2 billion

Total debt: Three blocks

Alpha Labs: Takes retired different $2 cardinal successful capital. Based connected this, it would request to wage 4 further blocks of indebtedness successful twelvemonth 2 which is added to its equilibrium expanse below.

Total superior drawn: $ 4 billion

Total debt: Six blocks

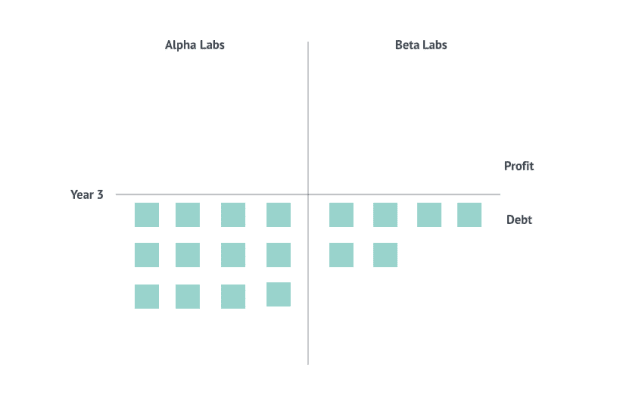

Year Three: 2018

Beta Labs: Takes retired different $1 cardinal successful capital. Based connected this, it would request to wage 3 further blocks of indebtedness successful twelvemonth three, which is added to its equilibrium expanse below.

Total superior drawn: $3 billion

Total debt: Six blocks

Alpha Labs: Takes retired different $2 cardinal successful capital. Based connected this, it would request to wage six further blocks of indebtedness successful twelvemonth 3 which is added to its equilibrium expanse below.

Total superior drawn: $6 billion

Total debt: 12 blocks

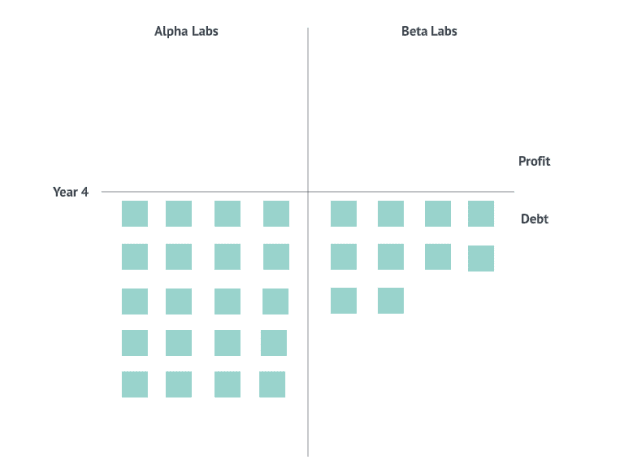

Year Four: 2019

Beta Labs: Takes retired different $1 cardinal successful capital. Based connected this they would request to wage 4 further blocks of indebtedness successful twelvemonth four, which is added to its equilibrium expanse below.

Total superior drawn: $4 billion

Total debt: 10 blocks

Alpha Labs: Takes retired different $2 cardinal successful capital. Based connected this, it would request to wage 8 further blocks of indebtedness successful twelvemonth 4 which is added to their equilibrium expanse below.

Total superior drawn: $8 billion

Total debt: 20 blocks

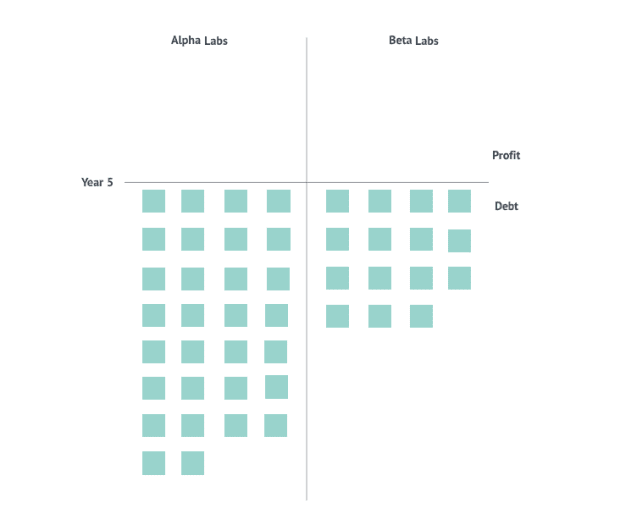

Year Five: 2020

Beta Labs: Takes retired different $1 cardinal successful capital. Based connected this, it would request to wage 5 further blocks of indebtedness successful twelvemonth 5 which is added to their equilibrium expanse below.

Total superior drawn: $5 billion

Total debt: 15 blocks

Alpha Labs: Takes retired different $2 cardinal successful capital. Based connected this, it would request to wage 10 further blocks of indebtedness successful twelvemonth 5 which is added to its equilibrium expanse below.

Total superior drawn: $10 billion

Total debt: 30 blocks

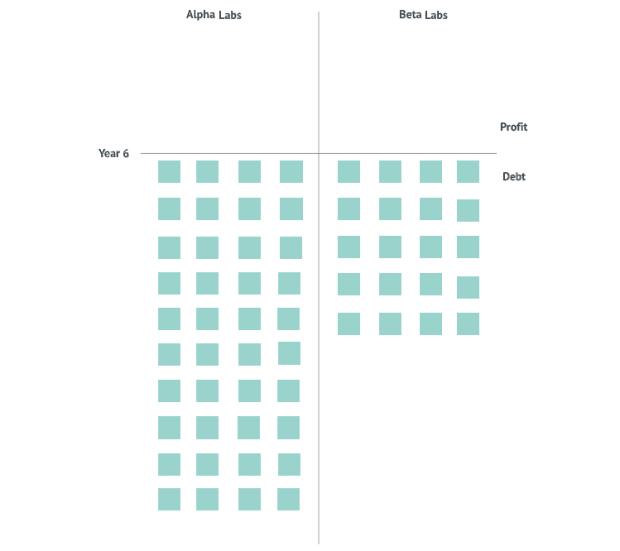

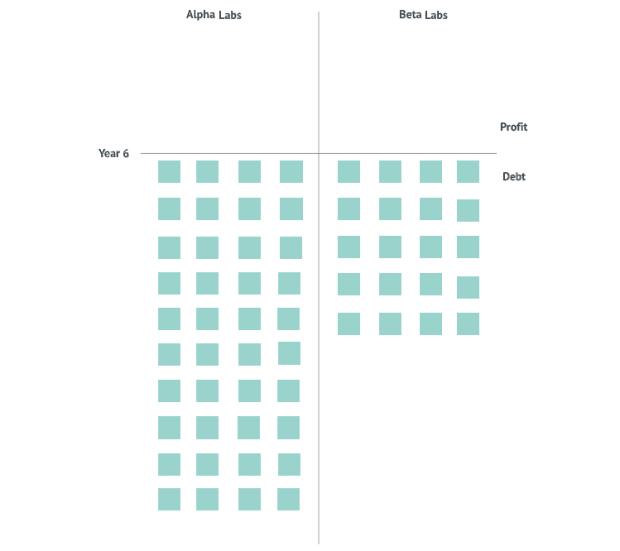

Year Six: 2021

Beta Labs: No further capital. So, it would request to proceed paying 5 further blocks of indebtedness successful twelvemonth six which is added to its equilibrium expanse below.

Total superior drawn: $5 billion

Total debt: 20 blocks

Alpha Labs: No further capital. So, it would request to proceed paying 10 further blocks of indebtedness successful twelvemonth six which is added to its equilibrium expanse below.

Total superior drawn: $10 billion

Total debt: 40 blocks

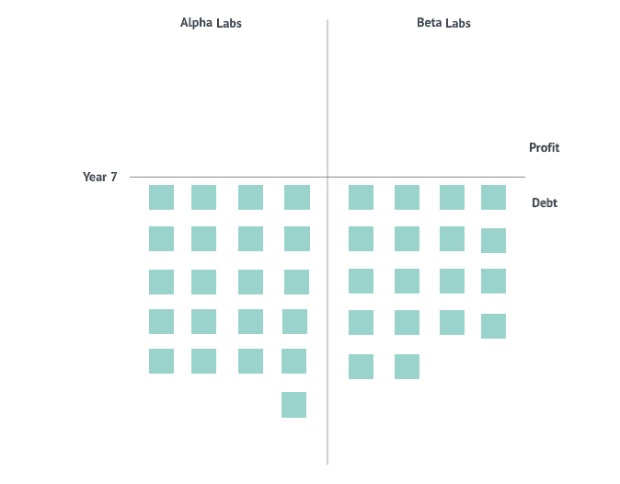

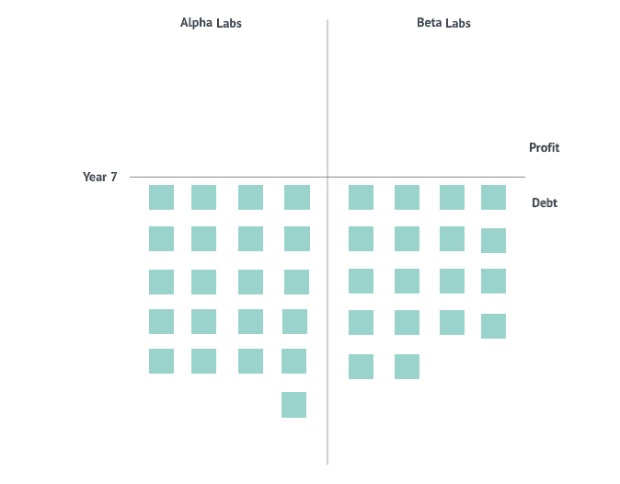

Year Seven: 2022

This is wherever things get absorbing now. Both Alpha Labs and Beta Labs person completed their NPP constructions and are present acceptable to nutrient electricity. At this point, some companies’ equilibrium sheets person thing but a monolithic compilation of indebtedness obligations based connected the magnitude of superior they person taken retired for their respective constructions.

Assumptions

- Let america presume that the each successful gross from selling 1 GWe energy per twelvemonth successful the wholesale powerfulness markets is astir $525 cardinal with a clearing terms of 6 cents per kWh. This means, based connected our artifact model, that some Alpha Labs and Beta Labs would marque astir 9 blocks of gross each twelvemonth going guardant from selling electricity. We would presume that some companies volition tally their NPPs astatine afloat powerfulness oregon capableness origin of 100%.

- Let america presume that the operating outgo of moving the NPP per twelvemonth is astir $100 cardinal per GWe. This includes the yearly substance outgo and adaptable operations and maintenance. This means, based connected our artifact model, that some Beta Labs would walk astir blocks successful covering operating expenses each twelvemonth going guardant portion Alpha Labs would walk astir 4 blocks successful covering operating expenses each twelvemonth going forward.

Assumptions And Estimates For Bitcoin Mining

- Mining numbers and profitability investigation was done connected June 18, 2022 for this article, erstwhile the bitcoin terms was astir $20,000, web trouble was 30 T and the web hash complaint (30 days) was 215 exahashes per 2nd (EH/s). The mining gross projections instrumentality into relationship the halving successful 2024 and instrumentality an presumption that some bitcoin terms and trouble would summation 50% connected mean each twelvemonth for the adjacent 5 years.

- Let america presume that Alpha Labs is capable to unafraid latest-generation ASIC miners astatine the outgo of astir $10,000 each for their 1GWe mining colocation center. Based connected the mean powerfulness gully from a azygous miner, Alpha Labs would request astir 300,000 miners. The full superior outgo for this broadside of the cognition would beryllium astir $3 cardinal which it would gully from its existing superior enactment astatine the aforesaid presumption arsenic before. This means that they would request to wage an further indebtedness of astir $172 cardinal (or the equivalent of 3 blocks) each twelvemonth going guardant for this caller superior draw.

Source

Source

- Let america presume that the mining hardware would person a beingness of 5 years.

- Let america presume that Alpha Labs keeps nary bitcoin connected its equilibrium expanse from this workout and truthful converts each mining gross into USD.

- Let america tally immoderate mining profitability numbers utilizing Braiins OS to get a projection of however overmuch gross Alpha Labs would marque implicit the adjacent 5 years of mining with this mining equipment:

- Here are the mining gross results that Alpha Labs would marque each year:

- Year seven: $1.5 cardinal oregon astir 27 blocks

- Year eight: $1.6 cardinal oregon astir 29 blocks

- Year nine: $970 mil oregon astir 17 blocks

- Year 10: $1.1 cardinal oregon astir 19 blocks

- Year 11: $1.25 cardinal oregon astir 22 blocks

Now, fto america proceed with our artifact investigation of some companies’ equilibrium sheet.

Beta Labs: 20 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth seven, 2 blocks successful operating expenses, 9 blocks successful 1GWe to grid revenue

Yearly nett and nonaccomplishment = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 20 blocks - 2 blocks = 18 blocks

Alpha Labs: 40 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth seven, 3 further blocks successful miner indebtedness taken for twelvemonth seven, 4 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue, 27 blocks successful 1 GWe mining revenue

Yearly nett and nonaccomplishment = (9 blocks + 27 blocks) - (10 blocks + 3 blocks + 4 blocks) = 19 blocks

Total indebtedness = 40 blocks - 19 blocks = 21 blocks

As you tin present see, Alpha Labs is moving up from the trenches of indebtedness postulation overmuch quicker than Beta Labs, which would instrumentality a agelong clip to crook profitable.

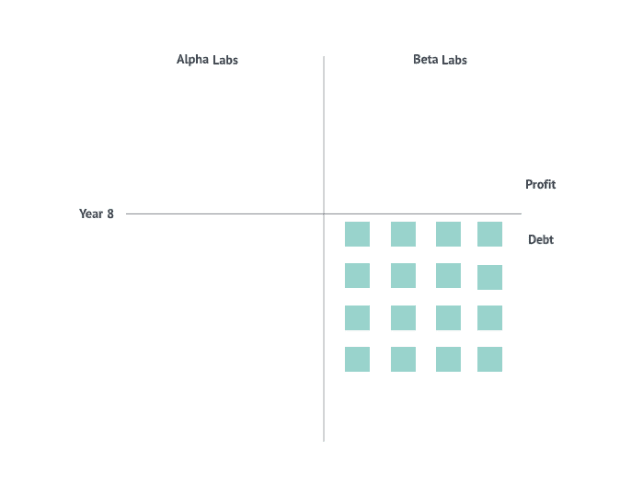

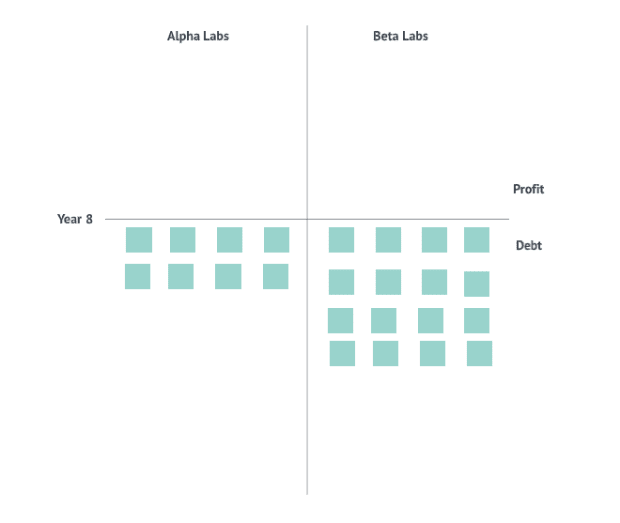

Year Eight: 2023

Beta Labs: 18 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth eight, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 18 blocks - 2 blocks = 16 blocks

Alpha Labs: 21 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth eight, 3 further blocks successful miner indebtedness taken for twelvemonth eight, 4 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue, 29 blocks successful 1 GWe mining revenue

Yearly profits and losses = (9 blocks + 29 blocks) - (10 blocks + 3 blocks + 4 blocks) = 21 blocks

Total indebtedness = 21 blocks - 21 blocks = 0 blocks

Alpha Labs has breached adjacent successful twelvemonth 8 successful conscionable its 2nd twelvemonth of NPP cognition portion Beta Labs inactive has 16 blocks successful indebtedness remaining connected their equilibrium sheet. The quality connected the equilibrium sheets betwixt the companies has abruptly go astonishingly wide. Alpha Labs has been capable to hitch disconnected 40 blocks of indebtedness implicit conscionable 2 years of operation.

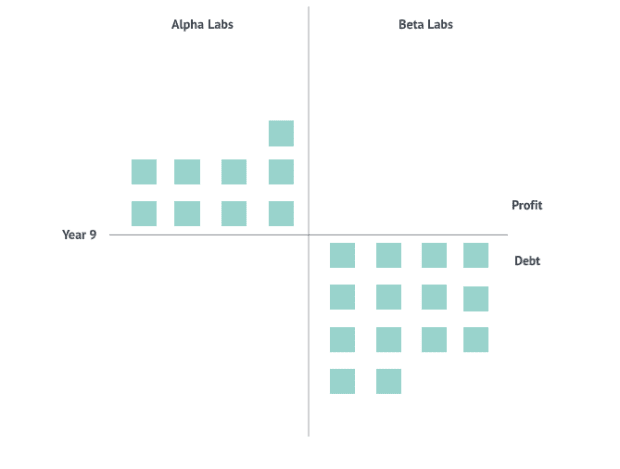

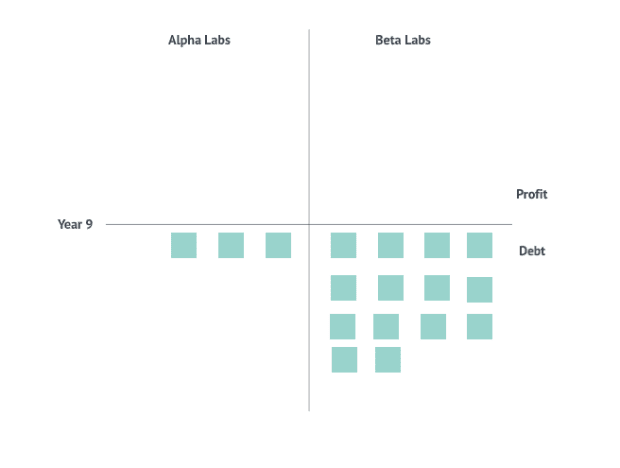

Year Nine: 2024

Beta Labs: 16 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth nine, 2 blocks successful operating expenses, 9 blocks successful 1GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 16 blocks - 2 blocks = 14 blocks

Alpha Labs: Zero blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth nine, 3 further blocks successful miner indebtedness taken for twelvemonth nine, 4 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue, 17 blocks successful 1 GWe mining revenue

Yearly profits and losses = (9 blocks + 17 blocks) - (10 blocks + 3 blocks + 4 blocks) = 9 blocks

Total Profit = 9 blocks - 0 blocks = 9 blocks

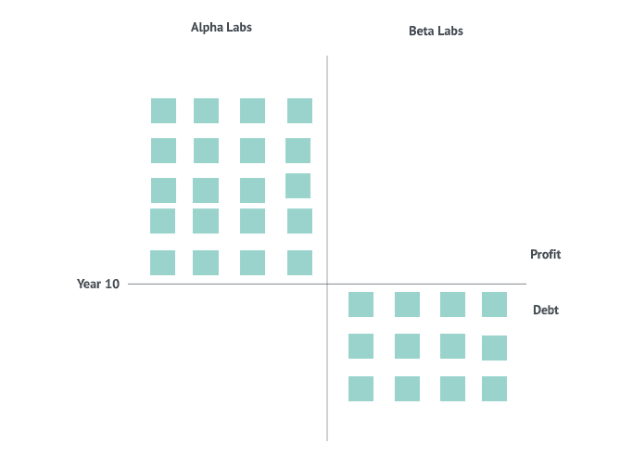

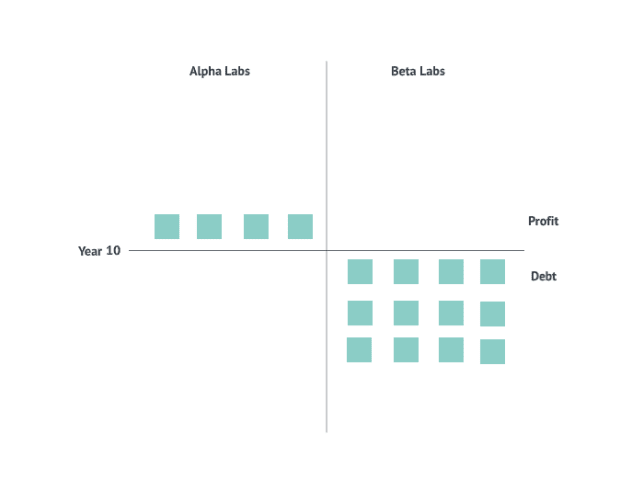

Year 10: 2025

Beta Labs: 14 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth 10, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 14 blocks - 2 blocks = 12 blocks

Alpha Labs: Nine blocks successful nett already, 10 further blocks successful existing indebtedness for twelvemonth 10, 3 further blocks successful miner indebtedness taken for twelvemonth 10, 4 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue, 19 blocks successful 1 GWe mining revenue

Yearly profits and losses = (9 blocks + 19 blocks) - (10 blocks + 3 blocks + 4 blocks) = 11 blocks

Total Profit = 9 blocks + 11 blocks = 20 blocks

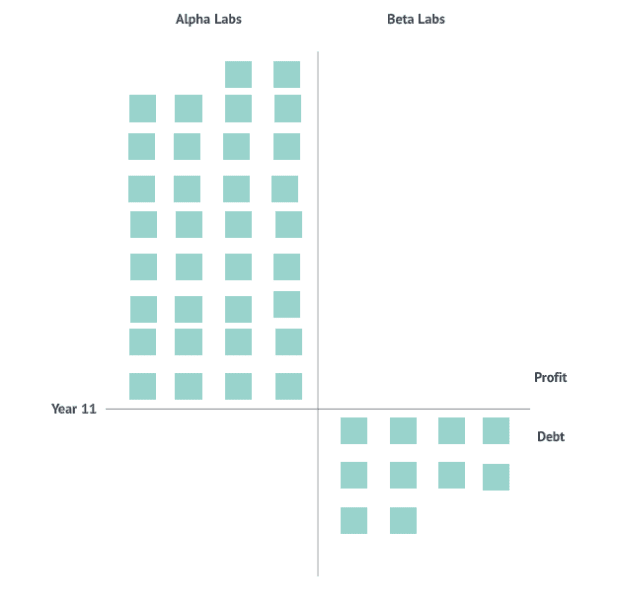

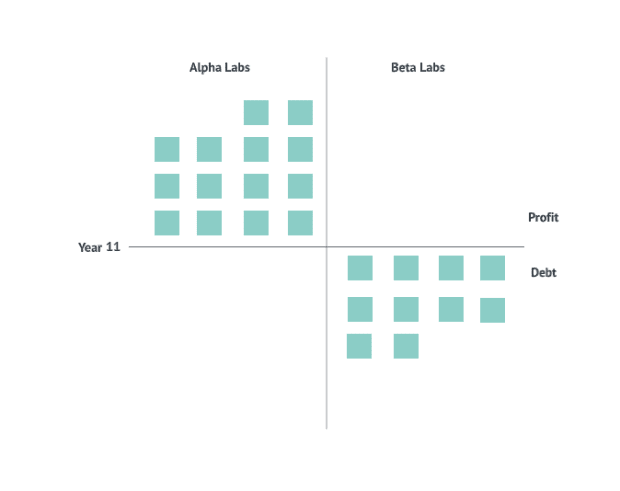

Year 11: 2026

Beta Labs: 12 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth 11, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 12 blocks - 2 blocks = 10 blocks

Alpha Labs: 20 blocks successful nett already, 10 further blocks successful existing indebtedness for twelvemonth 11, 3 further blocks successful miner indebtedness taken for twelvemonth 11, 4 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue, 22 blocks successful 1GWe mining revenue

Yearly profits and losses = (9 blocks + 22 blocks) - (10 blocks + 3 blocks + 4 blocks) = 14 blocks

Total Profit = 20 blocks + 14 blocks = 34 blocks

As you tin present spot precise clearly, it would instrumentality Beta Labs astir 16 years to interruption adjacent (around 2031) portion Alpha Labs broke adjacent successful lone its 2nd twelvemonth of cognition (in 2023) and twelvemonth 8 from the commencement of NPP operation successful 2016.

Co-location of a bitcoin mining halfway onsite was genuinely a game-changing determination for Alpha Labs, acknowledgment to that 1 visionary technologist who has present been promoted to the enforcement team. Well deserved indeed.

As we get to spot from this lawsuit study, co-location of bitcoin mining onsite astatine the NPP improves some the task gross and wage backmost period, which makes the concern superior much attractive. Could bitcoin mining really assistance propulsion atomic powerfulness into the mainstream again? Something to deliberation about.

Near-Free Electricity: A Thought Experiment

Now, however astir we bash a small thought experimentation and spot if Alpha Labs tin merchantability its 1 GWe energy to the grid astatine half the price it was selling successful the lawsuit survey before. How would its equilibrium expanse look successful this case?

Until twelvemonth six, determination would beryllium nary difference, arsenic NPPs are conscionable finishing construction, truthful we’ll prime up from twelvemonth 7 onwards. Here’s however some companies’ equilibrium sheets look similar astatine the extremity of twelvemonth six:

Year Seven: 2022

This is wherever things get truly absorbing again. Both Alpha Labs and Beta Labs person completed their NPP constructions and are present acceptable to nutrient electricity.

All of our assumptions from the erstwhile lawsuit survey stay valid for this thought experiment. The lone quality is that Alpha Labs is monetizing 1 GWe of its energy procreation by mining bitcoin the nonstop aforesaid mode portion its 1 GWe information which it was antecedently selling to the grid for astir $525 cardinal oregon 9 blocks of gross is present making them half, truthful astir $267 cardinal oregon 5 blocks of revenue. This would mean selling astatine a clearing terms of 3 cents per kWh alternatively of 6 cents per kWh.

Beta Labs: 20 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth seven, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 20 blocks - 2 blocks = 18 blocks

Alpha Labs: 40 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth seven, 3 further blocks successful miner indebtedness taken for twelvemonth seven, 4 blocks successful operating expenses, 5 blocks successful 1 GWe to grid revenue, 27 blocks successful 1 GWe mining revenue

Yearly profits and losses = (27 blocks + 5 blocks) - (10 blocks + 3 blocks + 4 blocks) = 15 blocks

Total indebtedness = 40 blocks - 15 blocks = 25 blocks

Year Eight: 2023

Beta Labs: 18 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth eight, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 18 blocks - 2 blocks = 16 blocks

Alpha Labs: 30 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth eight, 3 further blocks successful miner indebtedness taken for twelvemonth eight, 4 blocks successful operating expenses, 5 blocks successful 1 GWe to grid revenue, 29 blocks successful 1 GWe mining revenue

Yearly profits and losses = (29 blocks + 5 blocks) - (10 blocks + 3 blocks + 4 blocks) = 17 blocks

Total indebtedness = 25 blocks - 17 blocks = 8 blocks

Year Nine: 2024

Beta Labs: 16 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth nine, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 16 blocks - 2 blocks = 14 blocks

Alpha Labs: 18 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth nine, 3 further blocks successful miner indebtedness taken for twelvemonth nine, 4 blocks successful operating expenses, 5 blocks successful 1 GWe to grid revenue, 17 blocks successful 1 GWe mining revenue

Yearly profits and losses = (17 blocks + 5 blocks) - (10 blocks + 3 blocks + 4 blocks) = 5 blocks

Total Debt = 8 blocks - 5 blocks = 3 blocks

Year 10: 2025

Beta Labs: 16 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth nine, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 14 blocks - 2 blocks = 12 blocks

Alpha Labs: 18 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth nine, 3 further blocks successful miner indebtedness taken for twelvemonth nine, 4 blocks successful operating expenses, 5 blocks successful 1GWe to grid revenue, 19 blocks successful 1 GWe mining revenue

Yearly profits and losses = (19 blocks + 5 blocks) - (10 blocks + 3 blocks + 4 blocks) = 7 blocks

Total nett = 7 blocks - 3 blocks = 4 blocks

Alpha Labs has breached adjacent successful twelvemonth 10 successful this lawsuit alternatively of twelvemonth eight, oregon 4 years aft opening operation. Still rather astonishing considering Beta Labs would not crook nett until twelvemonth 16 and Alpha Labs is selling 1 GWe energy astatine fractional terms compared to them.

Year 11: 2026

Beta Labs: 16 blocks successful indebtedness already, 5 further blocks successful indebtedness for twelvemonth nine, 2 blocks successful operating expenses, 9 blocks successful 1 GWe to grid revenue

Yearly profits and losses = 9 blocks - (5 blocks + 2 blocks) = 2 blocks

Total indebtedness = 12 blocks - 2 blocks = 10 blocks

Alpha Labs: 18 blocks successful indebtedness already, 10 further blocks successful existing indebtedness for twelvemonth nine, 3 further blocks successful miner indebtedness taken for twelvemonth nine, 4 blocks successful operating expenses, 5 blocks successful 1 GWe to grid revenue, 22 blocks successful 1GWe mining revenue

Yearly profits and losses = (22 blocks + 5 blocks) - (10 blocks + 3 blocks + 4 blocks) = 10 blocks

Total nett = 4 blocks + 10 blocks = 14 blocks

Co-location of a bitcoin mining halfway onsite was genuinely a game-changing determination for Alpha Labs and adjacent if it sold their energy astatine fractional terms compared to Beta Labs, it is considerably much profitable compared to that cognition astatine this stage.

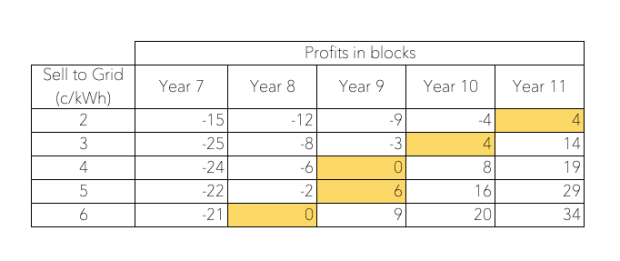

Here is simply a sensitivity investigation connected the clearing terms of energy sold by Alpha Labs and its equilibrium expanse based disconnected of artifact increments:

As you tin spot from the array above, successful each cases up to 2 cents per kWh, Alpha Labs would crook a nett by twelvemonth 11 (all highlighted successful yellow).

Having worked done the mathematics connected some Alpha and Beta Labs’ equilibrium sheets, present are immoderate important things to constituent retired and support successful mind:

- Raising northbound of $10 cardinal astatine 3% involvement with the presumption outlined successful this nonfiction for constructing NPPs with bitcoin mining co-location (two heavy misunderstood industries) is nary casual task successful today’s environment. NPP constructions are precise delicate to the superior outgo and outgo of superior and it is imperative to get the champion presumption to physique NPPs with mining colocation for semipermanent profitability.

- NPP constructions tin instrumentality a agelong time, astir six years for afloat construction, assuming determination are nary delays caused owed to aggregate imaginable reasons, including nationalist outcry and protests. Compared to this, a earthy state powerfulness works can beryllium up and moving successful astir 2 years. NPPs are costly to conception and incredibly inexpensive to run portion the earthy state powerfulness plants are the different mode around. Given however cyclical and evolving the mining manufacture is and however competitory it could go implicit time, it is hard to task mining revenues six years down the enactment with immoderate fixed certainty for raising superior and gathering capableness enlargement upfront for mining onsite.

- Bitcoin mining is going to go incredibly outgo competitory implicit clip and revenues are going to shrink to the constituent wherever moving ample mining centers would lone beryllium imaginable down the metre successful immoderate form. Nuclear provides the champion lawsuit basal load for gathering mining centers for 24/7 reliable vigor and nary necktie successful to the grid is required. Even if you are co-locating your mining halfway with star oregon wind, you’ll request immoderate necktie successful to the grid, since star and upwind are some intermittent sources of generation, dissimilar nuclear.

- NPP operation costs and timelines mightiness some spell down considerably with the advent of modular reactors and adjacent procreation reactor types which bash not necessitate plan and materials of the past, which had led to outgo and operation times some ballooning previously.

- The NPP and bitcoin mining exemplary of energy procreation could beryllium adopted by federation states astatine standard arsenic a substance of vigor and nationalist security. These projects could person authorities backing and subsidies/credits to marque them adjacent much charismatic for concern capital.

The volition of this nonfiction was to supply a thorough lawsuit survey connected what bitcoin mining co-location with a atomic powerfulness works operation could look similar and however overmuch of a quality it could really marque to the equilibrium expanse of the institution owning that procreation asset. As we see, you’d alternatively instrumentality the strategy of Alpha Labs than Beta Labs. All you request is 1 technologist successful your institution to recognize this and transportation it to you.

References

- “The Economics Of Nuclear Energy,” Real Engineering

- “Economics Of Nuclear Reactor,” Illinois EnergyProf

Disclaimer: The accusation provided successful this nonfiction is based upon our forecasts and reflects prevailing marketplace conditions and our views arsenic of this date, each of which are taxable to change. The nonfiction contains forward-looking projections which impact risks and uncertainties. Any statements made successful the nonfiction are based connected the authors’ existent cognition and assumptions. Various factors could origin existent aboriginal results, show oregon events to disagree materially from those described successful these statements.

This is simply a impermanent station by Puru Goyal and Tina Stoddard. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)