Many cryptocurrency lending schemes are eerily akin to banks’ abilities to indebtedness retired wealth and make indebtedness done fractional reserve banking.

Margarita Groisman graduated from the Georgia Institute of Technology with a grade successful concern engineering and analytics.

(Source)

(Source)

Since modern capitalism's emergence successful the aboriginal 19th century, galore societies person seen a meteoric emergence successful wealthiness and entree to inexpensive goods — with the enactment coming to an extremity years aboriginal with immoderate benignant of large restructuring triggered by a large satellite event, specified arsenic a pandemic oregon a war. We spot this signifier repetition again and again: a rhythm of borrowing, indebtedness and high-growth fiscal systems; past what we present telephone successful America “a marketplace correction.” These cycles are champion explained successful Ray Dalio’s “How The Economic Machine Works.” This nonfiction aims to analyse whether a caller monetary strategy backed by bitcoin tin code our systematic indebtedness issues built into the monetary system.

There are countless examples successful past to exemplify the semipermanent occupation with utilizing indebtedness and wealth printing to lick fiscal crises. Japan’s inflation pursuing World War II owed to printing monetization of fiscal debt, the eurozone indebtedness crisis, and what seems to beryllium starting successful China, opening with the Evergrande crisis and existent property marketplace illness successful prices and unfortunately, many, galore much cases.

Understanding Banking’s Reliance On Credit

The cardinal occupation is recognition — utilizing wealth you don’t person yet to bargain thing you can’t spend successful cash. We volition each apt instrumentality connected a ample magnitude of indebtedness 1 day, whether it’s taking connected a owe to concern a house, taking connected indebtedness for purchases similar cars, experiences similar college, and truthful on. Many businesses besides usage ample amounts of indebtedness to behaviour their day-to-day business.

When a slope gives you a indebtedness for immoderate of these purposes, it deems you arsenic “credit-worthy,” oregon thinks that determination is simply a precocious accidental your aboriginal net and assets combined with your grounds of outgo past volition beryllium capable to screen the existent outgo of your acquisition positive interest, truthful the slope loans you the remainder of the wealth needed to acquisition the point with a mutually-agreed upon involvement complaint and repayment structure.

But wherever did the slope get each that currency for your ample acquisition oregon the concern activities? The slope doesn’t manufacture goods oregon products and is truthful generating other currency from these productive activities. Instead, they besides borrowed this currency (from their lenders who chose to enactment their savings and other currency successful the bank). To these lenders, it whitethorn consciousness arsenic if this wealth is readily disposable for them to retreat astatine immoderate moment. The world is that the slope loaned it retired agelong ago, and charged involvement fees importantly much than the involvement they wage retired to currency deposits, truthful they tin nett from the difference. Furthermore, the slope really loaned retired overmuch much than lenders gave them connected the committedness of utilizing their aboriginal profits to wage backmost their lenders. Upon a saver’s withdrawal, they simply determination astir idiosyncratic else’s currency deposit to guarantee you tin wage for your acquisition close away. This is evidently an accounting oversimplification, but fundamentally is what happens.

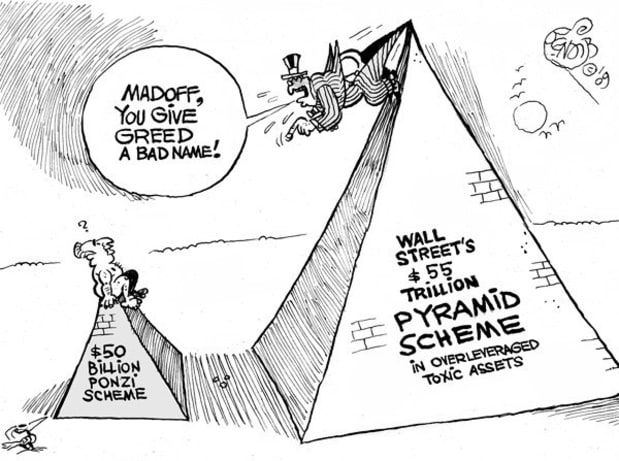

Fractional Reserve Banking: The World’s Biggest Ponzi Scheme?

“Madoff and Pyramid Schemes” (Source)

“Madoff and Pyramid Schemes” (Source)

Welcome to fractional reserve banking. The world of the wealth multiplier strategy is that connected average, banks indebtedness retired ten times much cash than they really person deposited, and each indebtedness efficaciously creates wealth retired of bladed aerial connected what is simply a committedness to wage it back. It is often forgotten that these backstage loans are what really creates caller money. This caller wealth is called “credit” and relies connected the presumption that lone a precise tiny percent of their depositors volition ever retreat their currency astatine 1 time, and the slope volition person each their loans backmost with interest. If conscionable much than 10% of the depositors effort to retreat their wealth astatine erstwhile —for example, thing driving user fearfulness and withdrawal oregon a recession causing those who person loans not being capable to repay them — past the slope fails oregon needs to beryllium bailed out.

Both of these scenarios person occurred galore times successful galore societies that trust connected credit-based systems, though it mightiness beryllium utile to look astatine immoderate circumstantial examples and their results.

These systems fundamentally person a built-in failure. At immoderate point, determination is simply a guaranteed deflationary rhythm wherever the indebtedness indispensable beryllium paid back.

Society Pays For The Bank’s Risky Loans

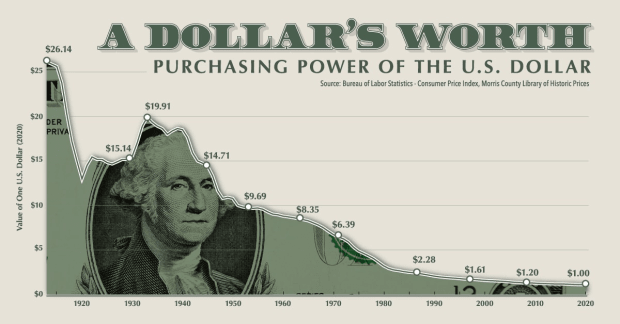

There is simply a batch to sermon successful presumption of however the cardinal slope attempts to halt these deflationary cycles by decreasing the outgo for businesses to get wealth and adding newly-printed wealth into the system. Fundamentally though, short-term solutions similar this cannot enactment due to the fact that wealth cannot beryllium printed without losing its value. When we adhd caller wealth to the system, the cardinal effect is that we are transferring the wealthiness of each idiosyncratic successful that nine to the bleeding slope by decreasing the spending powerfulness of the full society. Essentially, that is what happens during inflation: Everyone, including those not primitively progressive successful these recognition transactions, gets poorer and has to wage backmost each the existing recognition successful the system.

The much cardinal occupation is simply a built-in maturation assumption. For this strategy to work, determination indispensable beryllium much students consenting to wage for the expanding costs of college, much radical looking to deposit and get loans, much location buyers, much plus instauration and changeless productive improvement. Growth schemes similar this don’t enactment due to the fact that yet the wealth stops coming and individuals don’t person powerfulness to efficaciously transportation the spending powerfulness of the colonisation to wage these debts similar banks do.

The strategy of recognition has brought galore societies and individuals into prosperity. However, each nine that has seen existent semipermanent wealthiness procreation has seen that it comes done the instauration of innovative goods, tools, technologies and services. This is the lone mode to make existent semipermanent wealthiness and bring astir growth. When we make products that are new, utile and innovative that radical privation to bargain due to the fact that they amended their lives, we get collectively wealthier arsenic a society. When caller companies find ways to marque goods we emotion cheaper, we get collectively wealthier arsenic a society. When companies make astonishing experiences and services similar making fiscal transactions instant and easy, we get collectively wealthier arsenic a society. When we effort to make wealthiness and monolithic industries that trust connected utilizing recognition to stake connected risky assets, marque marketplace trades and marque purchases beyond our existent means, past nine stagnates oregon places itself connected a trajectory toward decline.

Would it beryllium imaginable to determination toward a strategy with a much semipermanent focused outlook with slower but dependable maturation without the symptom of utmost deflationary cycles? First, utmost and risky recognition would request to beryllium eliminated which would mean overmuch slower and little short-term growth. Next, our never-ending currency printer would request to extremity which would pb to utmost symptom successful immoderate areas of the economy.

Can Bitcoin Address These Issues?

Some accidental that bitcoin is the solution to these problems. If we determination to a satellite wherever bitcoin is not conscionable a caller signifier of commodity oregon plus class, but really the instauration of a newly-decentralized fiscal structure, this modulation could beryllium an accidental to rebuild our systems to enactment semipermanent maturation and extremity our addiction to casual credit.

Bitcoin is constricted to 21 cardinal coins. Once we scope the maximum bitcoin successful circulation, nary much tin ever beryllium created. This means that those who ain bitcoin could not person their wealthiness taken from the elemental instauration of caller bitcoin. However, looking astatine the lending and recognition practices of different cryptocurrencies and protocols, they look to reflector our existent system’s practices, but with adjacent much risk. In a newly-decentralized monetary system, we indispensable marque definite we bounds the signifier of highly-leveraged loans and fractional reserves and physique these caller protocols into the speech protocol itself. Otherwise, determination volition beryllium nary alteration from the issues astir recognition and deflationary cycles arsenic we person now.

Cryptocurrency Is Following The Same Path As Traditional Banking

It is simply truly bully concern to indebtedness retired wealth and warrant returns, and determination are galore companies successful the cryptocurrency ecosystem making their ain products astir highly risky credit.

Brendan Greeley writes a convincing statement that loans cannot beryllium stopped conscionable by switching to cryptocurrencies successful his effort “Bitcoin Cannot Replace The Banks:”

“Creating caller recognition wealth is simply a bully business, which is why, period aft century, radical person recovered caller ways to marque loans. The U.S. historiographer Rebecca Spang points retired successful her publication ‘Stuff and Money successful the French Revolution’ that the monarchy successful pre-revolutionary France, to get astir usury laws, took lump-sum payments from investors and repaid them successful beingness rents. In 21st-century America, shadiness banks unreal they are not banks to debar regulations. Lending happens. You can’t halt lending. You can’t halt it with distributed computing, oregon with a involvement to the heart. The profits are conscionable excessively good.”

We saw this hap conscionable precocious with Celsius arsenic well, which was a high-yielding lending merchandise that did fundamentally what banks bash but to a much utmost grade by lending retired importantly much cryptocurrency than it really had with the assumptions that determination would not beryllium a ample magnitude of withdrawals astatine once. When a ample magnitude of withdrawals occurred, Celsius had to halt them due to the fact that it simply did not person capable for its depositors.

So portion creating a acceptable constricted proviso currency whitethorn beryllium an important archetypal step, it doesn’t really lick the much cardinal problems, it conscionable cuts retired the existent anesthetics. The adjacent measurement towards gathering a strategy astir semipermanent and stabilized growth, assuming aboriginal usage of an exchange, is standardizing and regulating the usage of recognition for purchases.

Sander van der Hoog provides an incredibly utile breakdown astir this successful his enactment “The Limits to Credit Growth: Mitigation Policies And Macroprudential Regulations To Foster Macrofinancial Stability And Sustainable Debt?” In it, helium describes the quality betwixt 2 waves of credit: “a ‘primary wave’ of recognition to concern innovations and a ‘secondary wave’ of recognition to concern consumption, overinvestment and speculation.”

“The crushed for this somewhat counter-intuitive effect is that successful the lack of strict liquidity requirements determination volition beryllium repeated episodes of recognition bubbles. Therefore, a generic effect of our investigation seems to beryllium that a much restrictive regularisation connected the proviso of liquidity to firms that are already highly leveraged is simply a indispensable request for preventing recognition bubbles from occurring again and again.”

The wide boundaries and circumstantial recognition rules that should beryllium enactment successful spot are extracurricular of the scope of this work, but determination indispensable beryllium recognition regulations enactment into spot if determination is immoderate anticipation of sustained growth.

While van der Hoog’s enactment is simply a bully spot to commencement to see much stringent recognition regulation, it seems wide that mean recognition is an important portion of maturation and is apt to nett affirmative effects if regulated correctly; and abnormal recognition indispensable beryllium heavy constricted with exceptions for constricted circumstances successful a satellite tally connected bitcoin.

As we look to beryllium gradually transitioning into a caller currency system, we indispensable marque definite that we don’t instrumentality our old, unhealthy habits and simply person them into a caller format. We indispensable person built-in stabilizing recognition rules close into the system, oregon it volition beryllium excessively hard and achy to modulation retired of the dependence connected casual currency — arsenic it is now. Whether these beryllium built into the exertion itself oregon successful a furniture of regularisation is yet unclear and should beryllium a taxable of importantly much discussion.

It seems that we person travel to simply judge that recessions and economical crises volition conscionable happen. While we volition ne'er person a cleanable system, we whitethorn so beryllium moving toward a much businesslike strategy that promotes semipermanent maintainable maturation with the inventions of bitcoin arsenic a means of exchange. The suffering caused to those who cannot spend the inflated terms of indispensable goods and to those who spot their beingness savings and enactment vanish during crises that are intelligibly predictable and built into existing systems bash not really person to hap if we physique amended and much rigorous systems astir recognition successful this caller system. We indispensable marque definite we don’t instrumentality our existent nasty habits that origin bonzer symptom successful the agelong word and physique them into our aboriginal technologies.

This is simply a impermanent station by Margarita Groisman. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)