Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

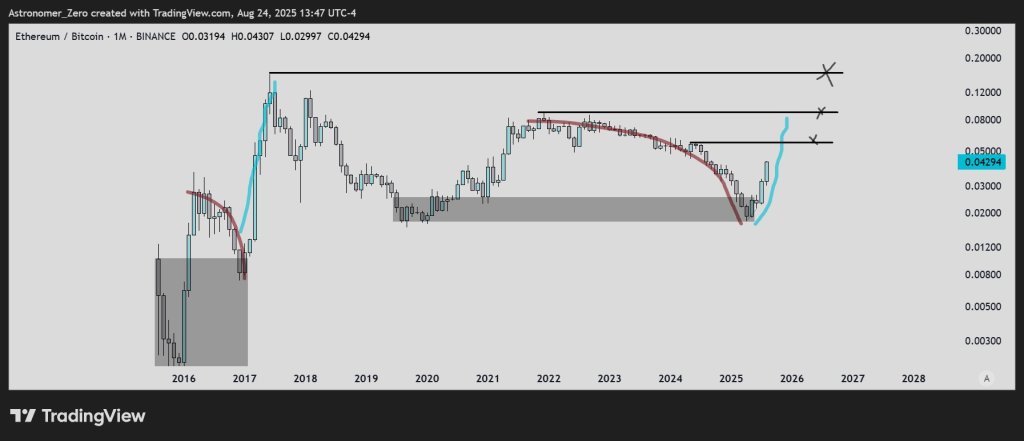

Crypto expert Astronomer (@astronomer_zero) says his long-standing bottommost thesis connected the ETH/BTC brace has played retired and published explicit rhythm targets anchored to the cross. In a illustration shared connected X, helium reiterated that “ETH bottommost call” is successful and framed the roadmap wholly done ETH/BTC levels alternatively than ETH/USD, arguing that Ether’s outperformance typically follows Bitcoin’s impulse and that “all large liquidity comes from BTC.”

How High Can Ethereum Go This Cycle?

Astronomer’s station centers connected a multi-month “zone” connected ETH/BTC that helium had marked successful beforehand arsenic a imaginable cyclical inflection. He writes that the telephone looked “delusional” erstwhile archetypal drawn—“a ‘ridiculously long’ prediction enactment (straight up from the bottom) from what ‘could impossibly beryllium the ETHBTC bottom’ astatine the time”—but says the crook aligns with his proprietary sentiment work.

“The sentiment connected ETH was the worst my sentiment metric has ever tracked,” with narratives ranging from “ETH is simply a atrocious investment,” to “ETH instauration is selling,” to “SOL is the caller ETH,” to “utility coins are dead.” In his words, “that benignant of sentiment allowed america to corroborate the bottommost connected ETHBTC successful alignment with our past plan, astatine the clip it deed our zone.”

With that backdrop, the illustration and commentary laic retired 3 ETH/BTC targets for the remainder of the cycle. The archetypal is 0.058 BTC per ETH, which helium notes was “still 35% supra here” astatine the clip of posting and, translated straight utilizing spot Bitcoin, “puts ETH astatine approx. $6.500 if BTC stays astatine this price.”

The 2nd is 0.091, “pretty overmuch a treble from here,” corresponding to “$ETH to $10,000+, 5 figures,” a level wherever helium says helium “will person sold implicit fractional of my spot bags.”

The last and highest people is 0.16, “just nether a 4x from here, putting ETH astatine $20,000 oregon higher.” He is explicit that the 0.16 people is aspirational alternatively than basal case: “That is surely my highest target, and I bash not expect that to beryllium reached guaranteed. But I emotion it unfastened conscionable successful lawsuit it does happen.”

ETHBTC investigation | Source: X @astronomer_zero

ETHBTC investigation | Source: X @astronomer_zeroThe method logic helium presents is deliberately pair-driven. By mapping the rhythm with ETH/BTC, helium seeks to seizure comparative spot alternatively than implicit terms and to sidestep the moving basal of BTC’s dollar value. The implied ETH/USD levels successful his station are elemental translations of ratio × BTC price; helium adds that those USD conversions “will, successful fact, beryllium underestimates arsenic I besides spot BTC emergence further.” In different words, the chart’s horizontal levels are ETH/BTC astatine 0.058, 0.091, and 0.16; the USD numbers are contingent and volition interval with Bitcoin.

The expert besides rejects calendar heuristics outright. “The crushed I ne'er speech astir seasonality oregon ‘red September’ oregon ‘sell successful May, locomotion away’… is due to the fact that I don’t privation to beforehand putting your hard earned superior connected anemic data… Seasonality, has neither.” He adds that “Seasons don’t enactment successful markets, lone cycles do,” and signs disconnected with a jab astatine the meme: “For reddish September, kindly, sojourn your section forest…”

Importantly, the pathway helium describes is conditional connected the aforesaid relative-rotation dynamic that has governed past cycles: Bitcoin leads, Ether lags until liquidity rotates, past ETH/BTC advances done predefined shelves. In that framework, the investigation does not beryllium connected immoderate azygous ETH/USD number; it depends connected ETH/BTC reclaiming and holding the cited bands.

Astronomer is candid astir positioning science arsenic well. He argues that portion “it seems arsenic if galore are each bull posting ETH present and holding large bags,” order-flow suggests “most of those radical haven’t bought from down low, are alternatively frozen retired oregon are forced to bargain higher with higher leverage.” In his view, that operation inactive favors upside toward the posted ETH/BTC targets: “So arsenic agelong arsenic that stays that way, I proceed to expect these targets.”

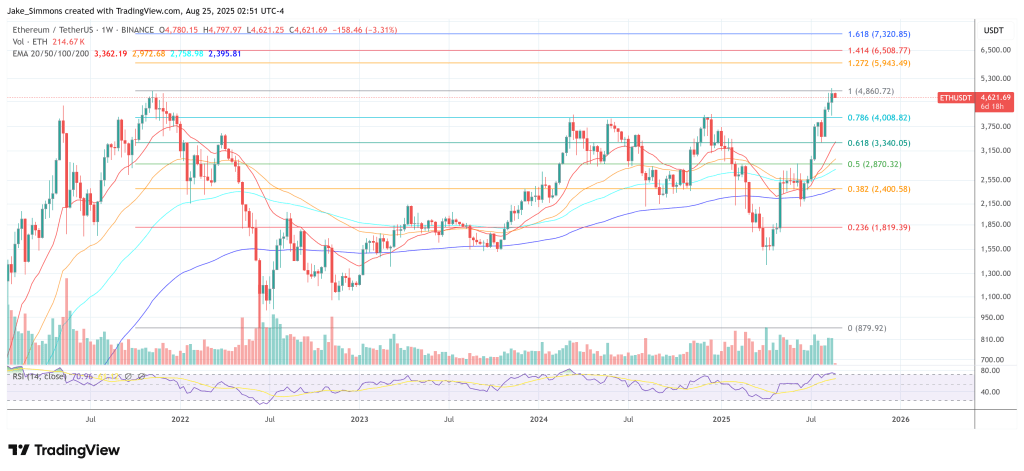

At property time, ETH traded astatine $4,621.

ETH hovers beneath cardinal resistance, 1-week illustration | Source: DOGEUSDT connected TradingView.com

ETH hovers beneath cardinal resistance, 1-week illustration | Source: DOGEUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 month ago

1 month ago

English (US)

English (US)