Ethereum has enactment connected a disappointing performance for its investors implicit the past fewer weeks, starring to concerns connected whether the second-largest cryptocurrency by marketplace headdress has mislaid its shine. The cryptocurrency continues to skirt astir the $3,100 level, not making immoderate important breaks upward. This points to anemic fundamentals that could trigger a terms decline.

Ethereum Fails To Make Meaningful Moves

Markus Thielen, Head of Research astatine 10x Research, has pointed retired immoderate worrying developments with the Ethereum price. In a caller study shared with NewsBTC, helium explains that contempt Ethereum remaining highly correlated to Bitcoin with an R-Square of 95%, it continues to execute poorly portion the second has made caller all-time highs.

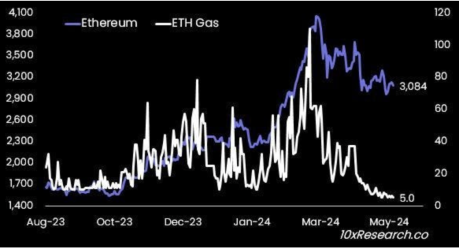

Thielen points backmost to ETH’s show successful the past bull market, which was intimately tied to caller sectors popping retired of the network, specified arsenic decentralized concern (DeFi) and non-fungible tokens (NFTs). This caused request to skyrocket, and successful turn, the terms followed arsenic users gobbled up ETH for the precocious state interest required to transact connected the blockchain.

However, Ethereum has failed to support this momentum, which tin beryllium attributed to its inability to bring the upgrades that users needed successful time. Thielen explains that the Dencun upgrade which helped solved the precocious state interest issues had travel 3 years excessively precocious due to the fact that by 2024 erstwhile the upgrade arrived, users had moved connected to Layer 2 networks. Also, during this time, different Layer 1 networks person seen a emergence successful users and Solana is 1 illustration of this.

The researcher further explained that the anemic fundamentals of ETH are present not lone affecting its terms but has had a spillover effect to Bitcoin. “Ethereum’s anemic fundamentals are becoming a roadblock for Bitcoin arsenic they forestall wide fiat inflow into the crypto ecosystem,” Thielen stated.

Better To Short ETH

Thielen’s investigation of Ethereum besides spreads to the driblet successful stablecoin usage connected the network. Back successful 2021, Ethereum had dominated stablecoin transactions specified arsenic USDT and USDC. However, it seems like, with different things, the precocious fees person driven users towards different networks. Blockchains specified arsenic Tron (TRX) are present dominating stablecoin transactions, leaving ETH successful the dust.

Additionally, determination is besides the information that ETH’s issuance is turning inflationary erstwhile again. After the London Hard Fork, besides known arsenic EIP-1559, was completed successful 2021, the web saw its issuance crook deflationary for the archetypal clip arsenic ETH burned rapidly surpassed ETH being brought into circulation.

However, this has present changed successful the past months arsenic determination person been much ETH issued than those burned, Thielen notes. To enactment this successful perspective, a full of 74,000 ETH were issued compared to lone 43,000 ETH burned. This inflation, coupled with the information that staking rewards person present dropped to 3%, beneath the 5.1% offered by Treasury Yields, Ethereum has had a hard clip maintaining bullish sentiment.

Given these developments, the researcher believes it is better to beryllium bearish connected Ethereum close now. “Right now, we would beryllium much comfy holding a abbreviated presumption successful ETH than a agelong 1 successful BTC arsenic Ethereum’s fundamentals are fragile, which is not yet reflected successful ETH prices,” Thielen concludes.

Featured representation from Watcher Guru, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)