There were galore ups and downs in May for the GameFi sector and cryptocurrency investors. Especially successful presumption of GameFi financing funds, it fell from a highest of $2.4 cardinal to $165 million, a driblet of 93.14%. This is the astir important driblet since 2021, which is little than everyone’s expectations for the GameFi market.

The erstwhile person Axie Infinity has besides been deed hard. The fig of players has been reduced from much than 100,000 to little than 10,000. Is determination a hazard of collapse? And StepN, which broke retired during the carnivore marketplace successful May, crashed conscionable arsenic quickly. Can it spot a reversal and proceed starring M2E successful the GameFi sector?

The pursuing is an overview of the wide GameFi market successful May and an overview of the changes successful each task done information analysis.

GameFi Market Overview

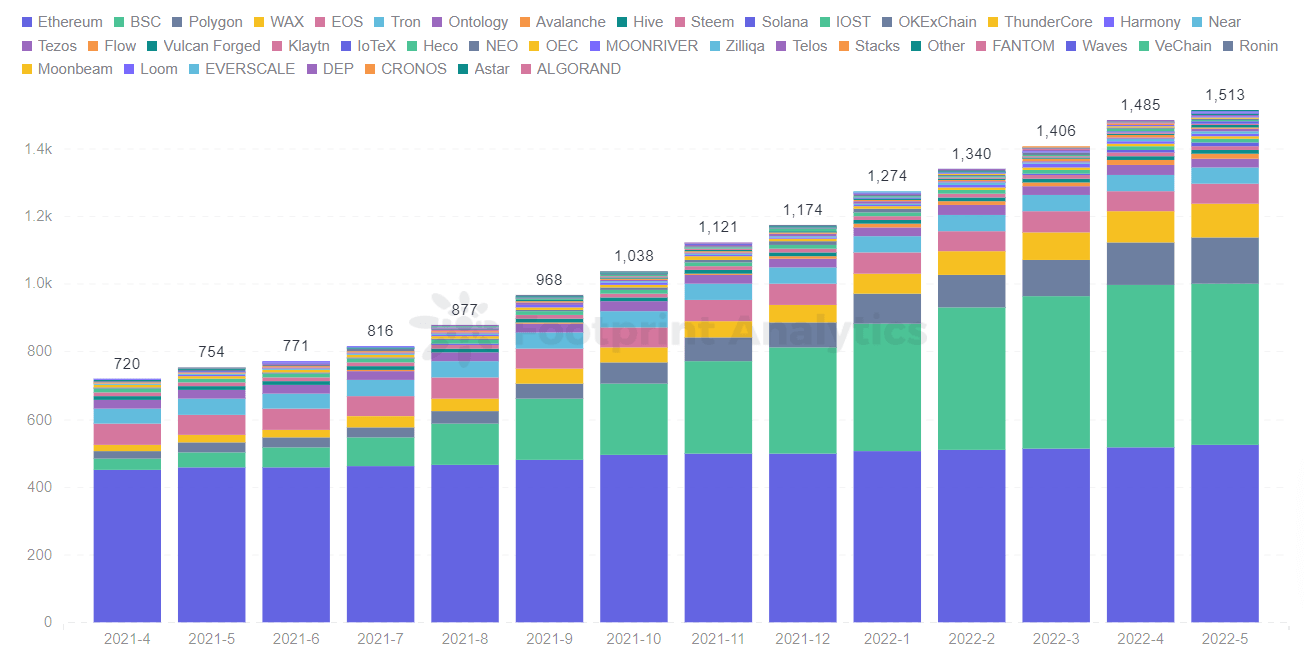

GameFi task number up 1.9% MoM, showing a slowdown

After BTC, ETH, LUNA, and StepN tanked, determination seems to beryllium a statement that a carnivore marketplace is truly here.

Regarding the fig of GameFi projects, determination was lone a 1.9% summation successful May, chiefly owed to the maturation of projects connected the Polygon chain. The maturation of the 2 main concatenation projects, Ethereum and BSC, has gradually slowed down.

Footprint Analytics – Number of GameFi Protocols by Chains

Footprint Analytics – Number of GameFi Protocols by ChainsEthereum’s precocious state fees and web congestion issues persist, which are large factors successful its nonaccomplishment to rapidly turn the fig of projects. After notable crippled projects similar StarSharks and Cryptomines failed to clasp users, BSC besides saw immoderate problems.

On the flip side, Polygon is the blockchain with the astir maturation successful the fig of projects this month.

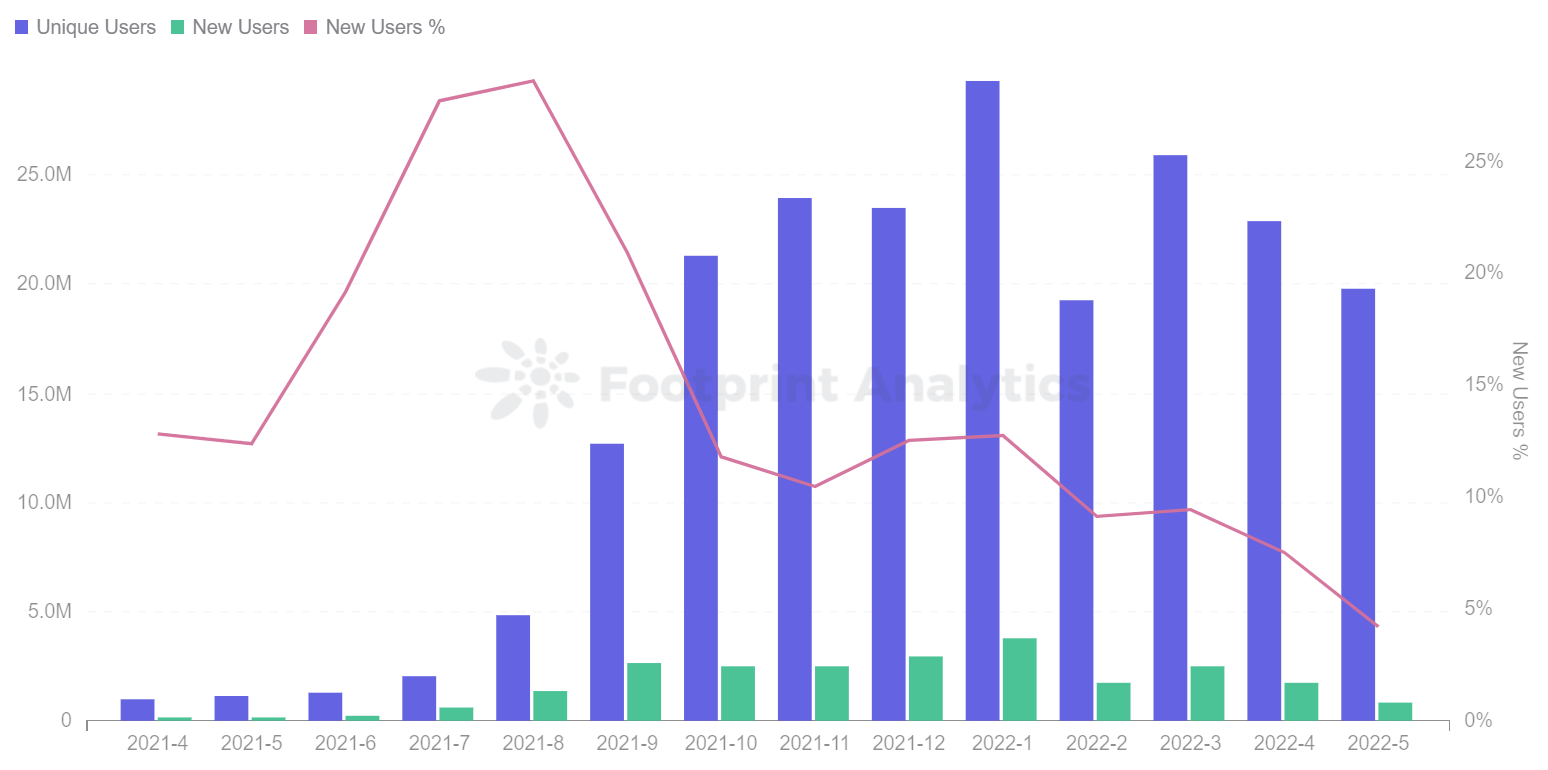

GameFi’s full progressive users and transaction measurement proceed to decline

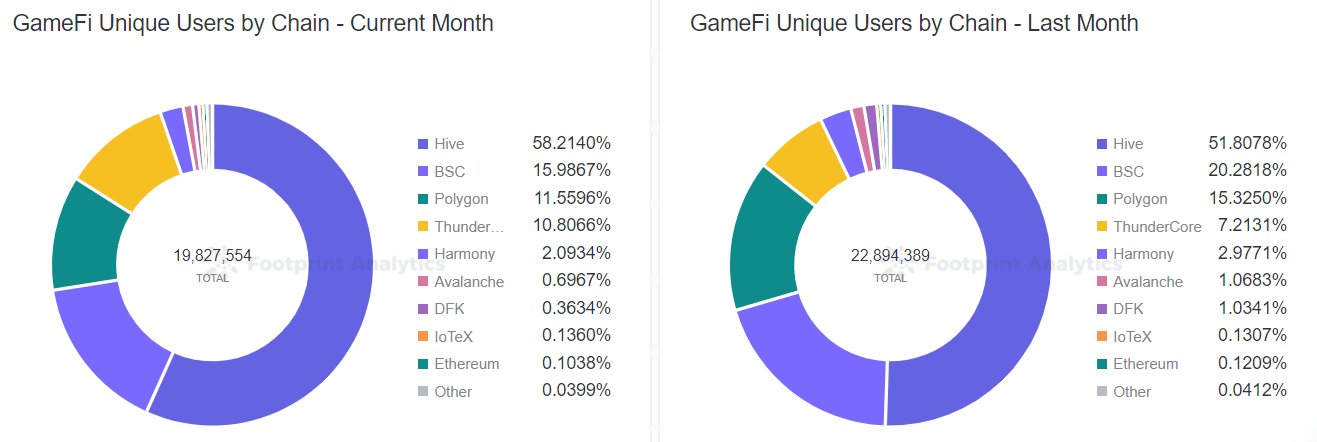

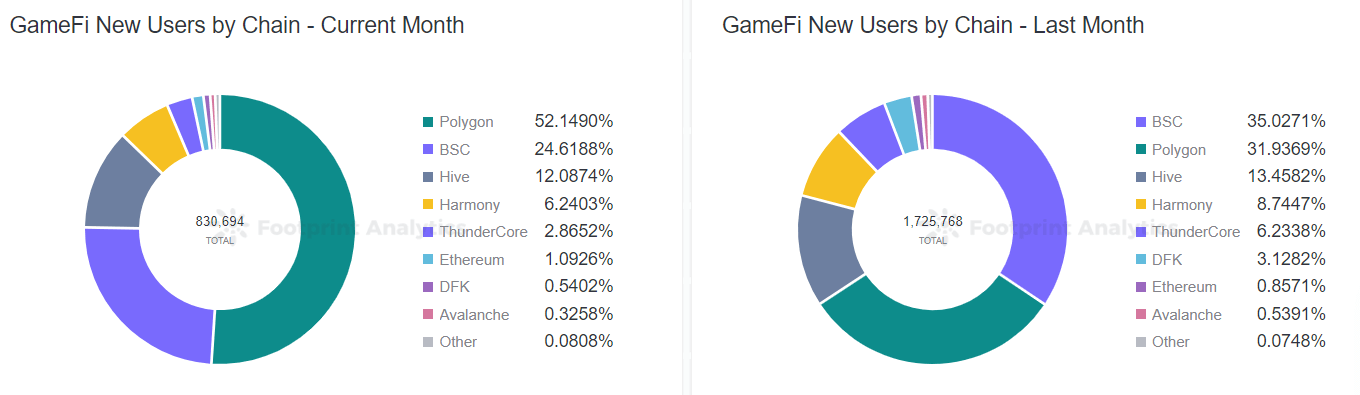

As of May 31, the full fig of progressive users was 19.83 million, including 830,000 caller users and 19 cardinal aged users. Total progressive users fell 13.4% compared to April.

Footprint Analytics – Monthly Gamers Trend

Footprint Analytics – Monthly Gamers TrendIt is chiefly affected by the fig of users of immoderate crippled projects connected the BSC chain. Both aged and caller users dropped by 5% to 10%. For example, StarSharks was favored by galore manufacture insiders earlier April, but it encountered a “death spiral” successful conscionable implicit a month, and the fig of users dropped from 10,000 to 100.

Footprint Analytics – GameFi Unique Users by Chain

Footprint Analytics – GameFi Unique Users by Chain Footprint Analytics – GameFi New Users by Chain

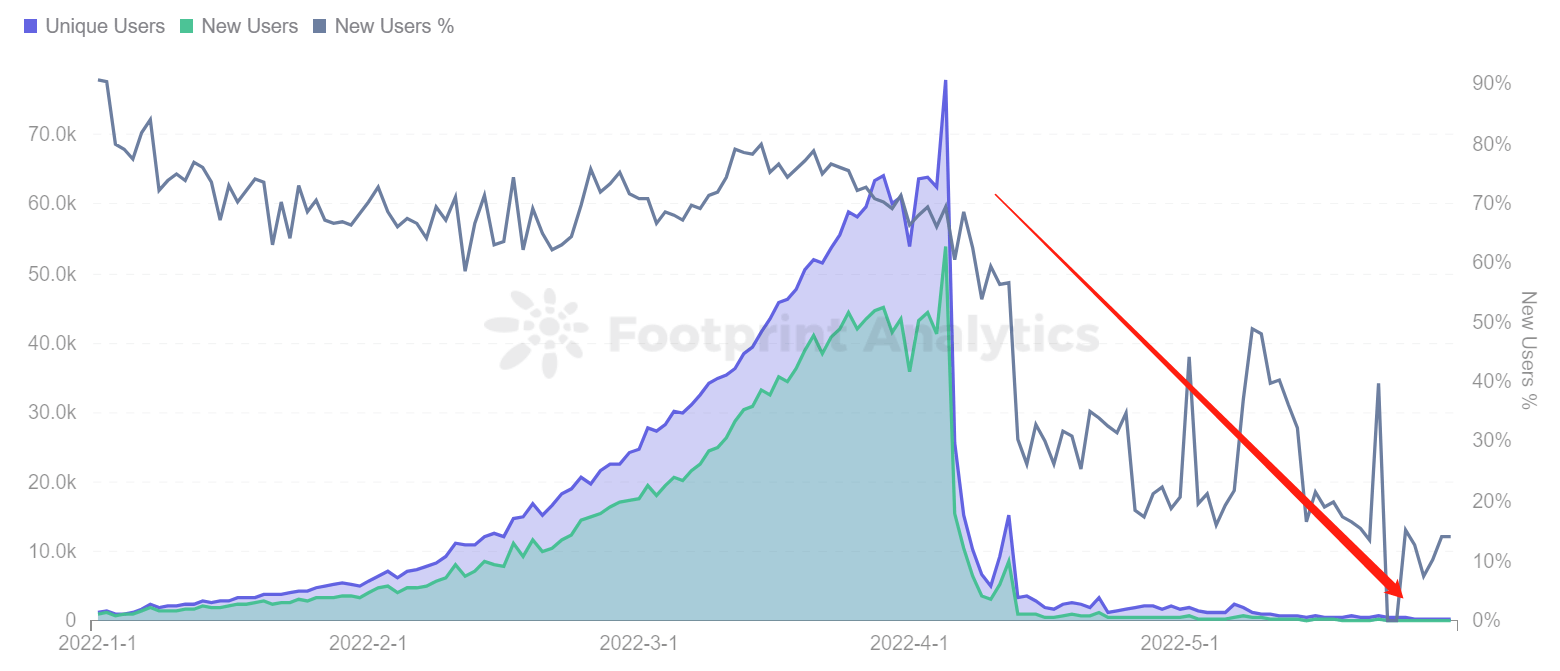

Footprint Analytics – GameFi New Users by Chain Footprint Analytics – StarSharks User Trend

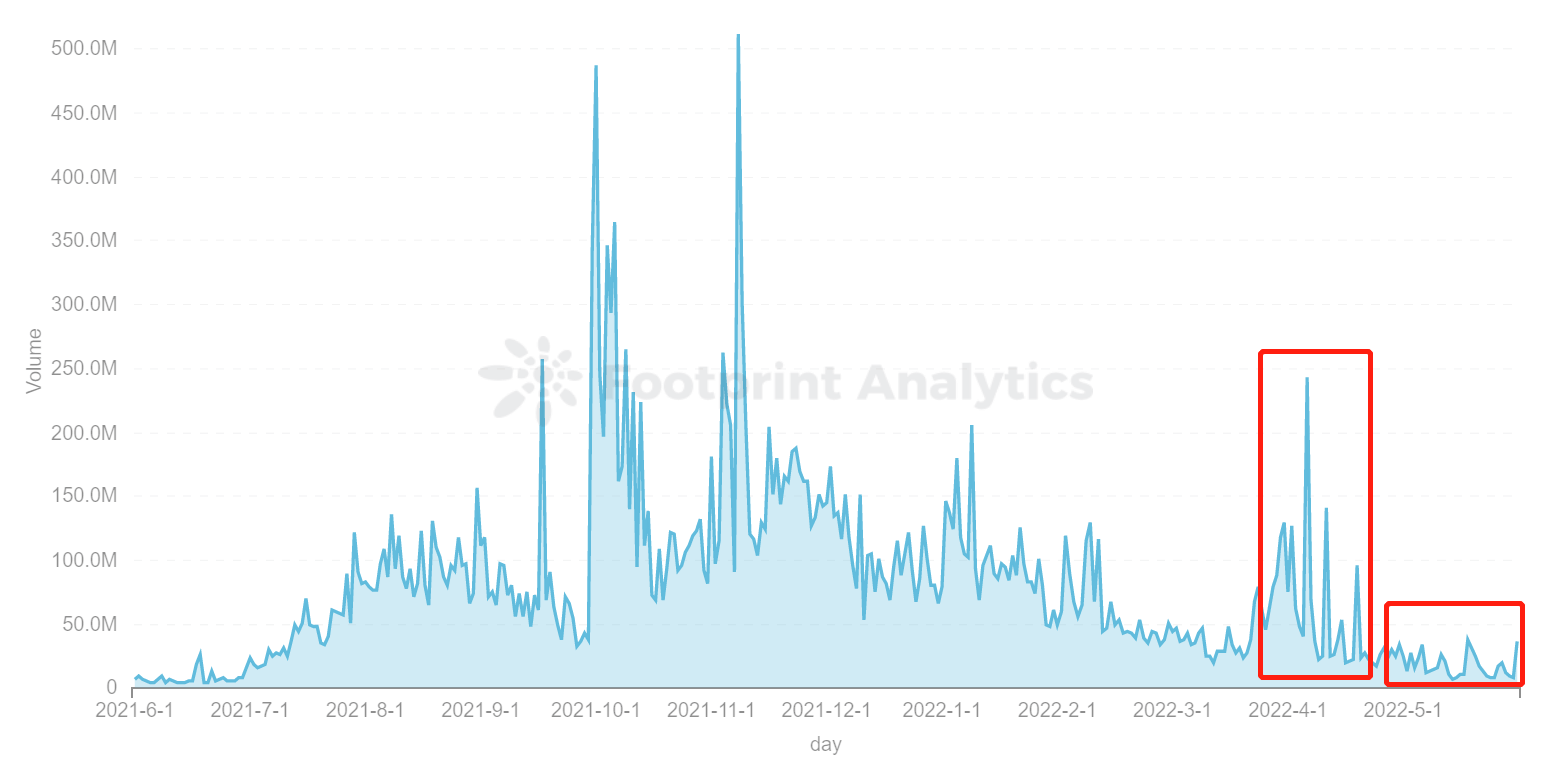

Footprint Analytics – StarSharks User TrendAccording to Footprint Analytics data, the wide regular trading measurement successful May decreased compared to April. Including apical GameFi projects, specified arsenic Axie Infinity’s mean transaction worth fell from $26.85 cardinal successful April to $7.14 million. Splinterlands’ mean transaction worth fell from April $4,118 to $2,724. CryptoMines’s transaction measurement astir halved.

Footprint Analytics – GameFi of Volume Trend

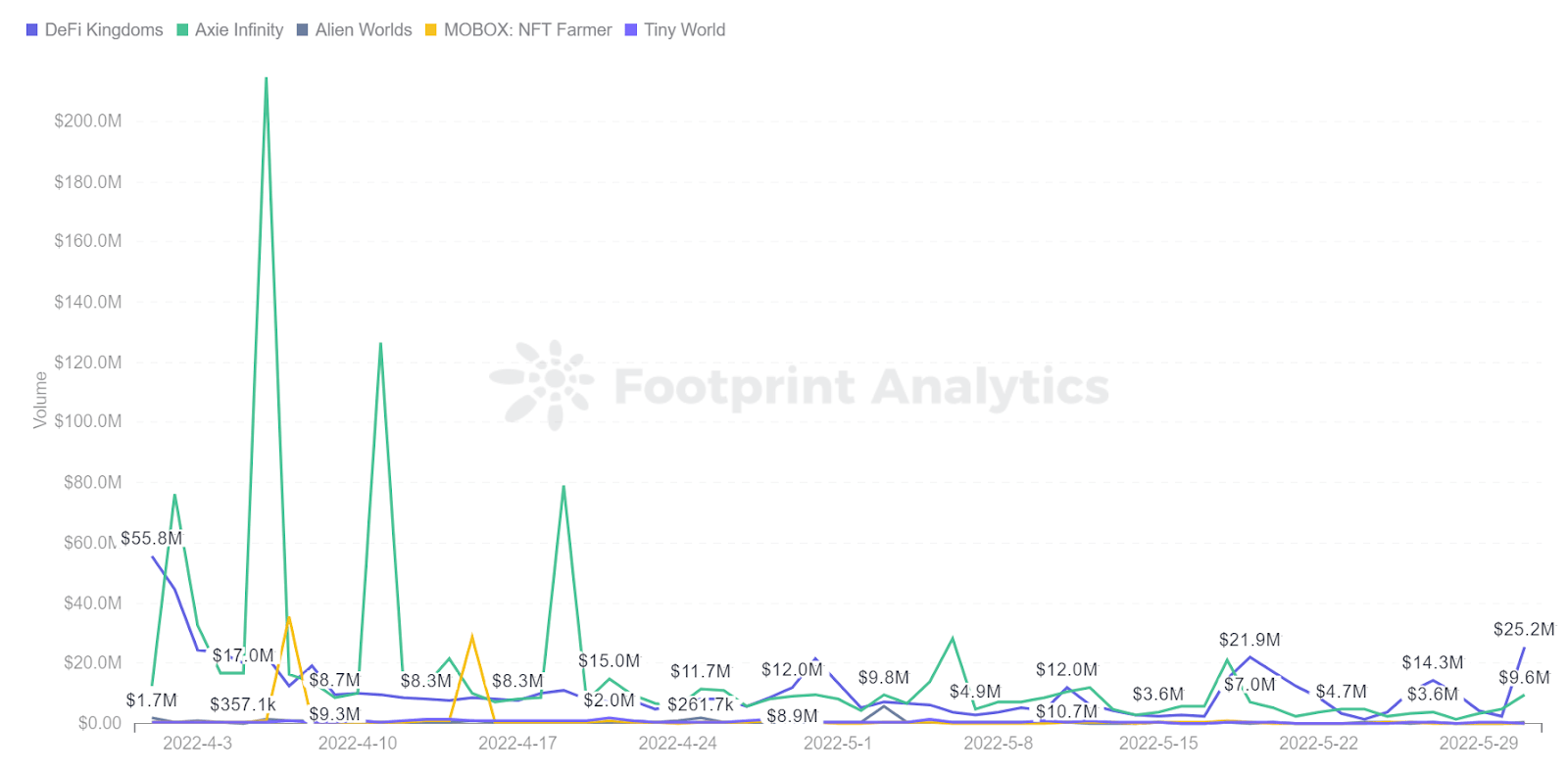

Footprint Analytics – GameFi of Volume Trend Footprint Analytics -Top 5 Games Trading Volume Trend

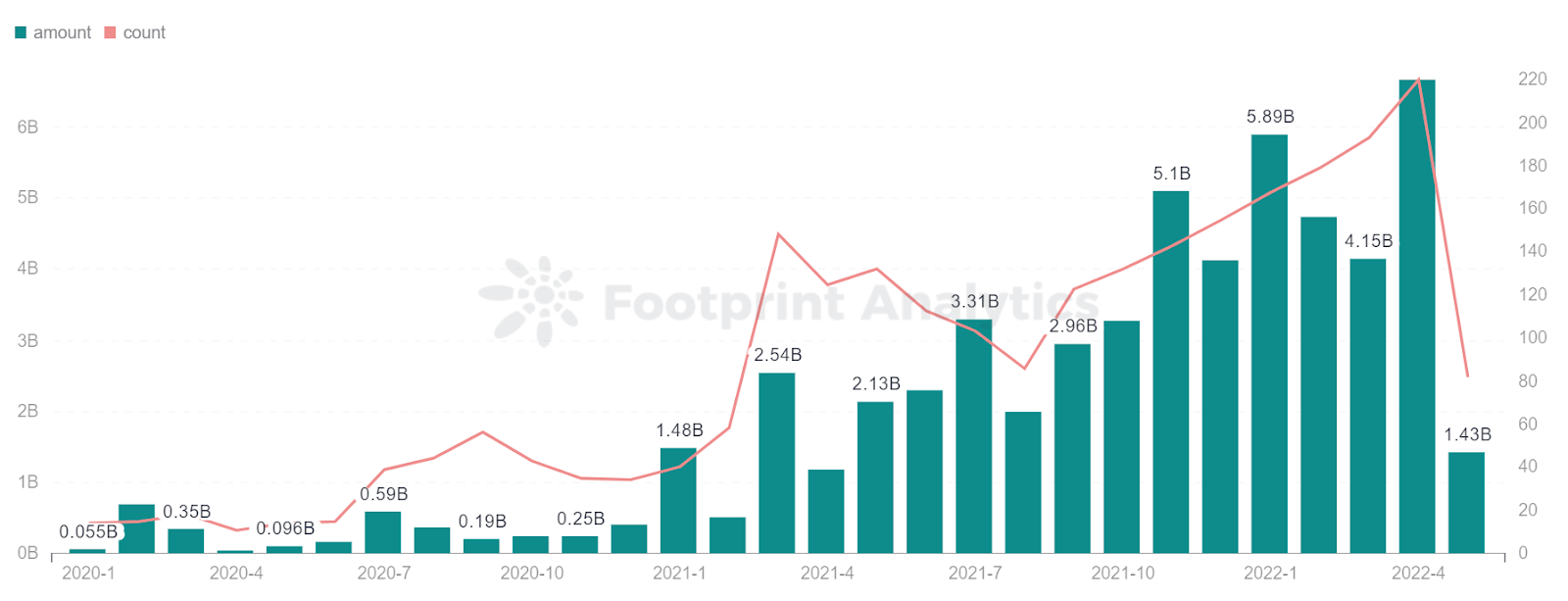

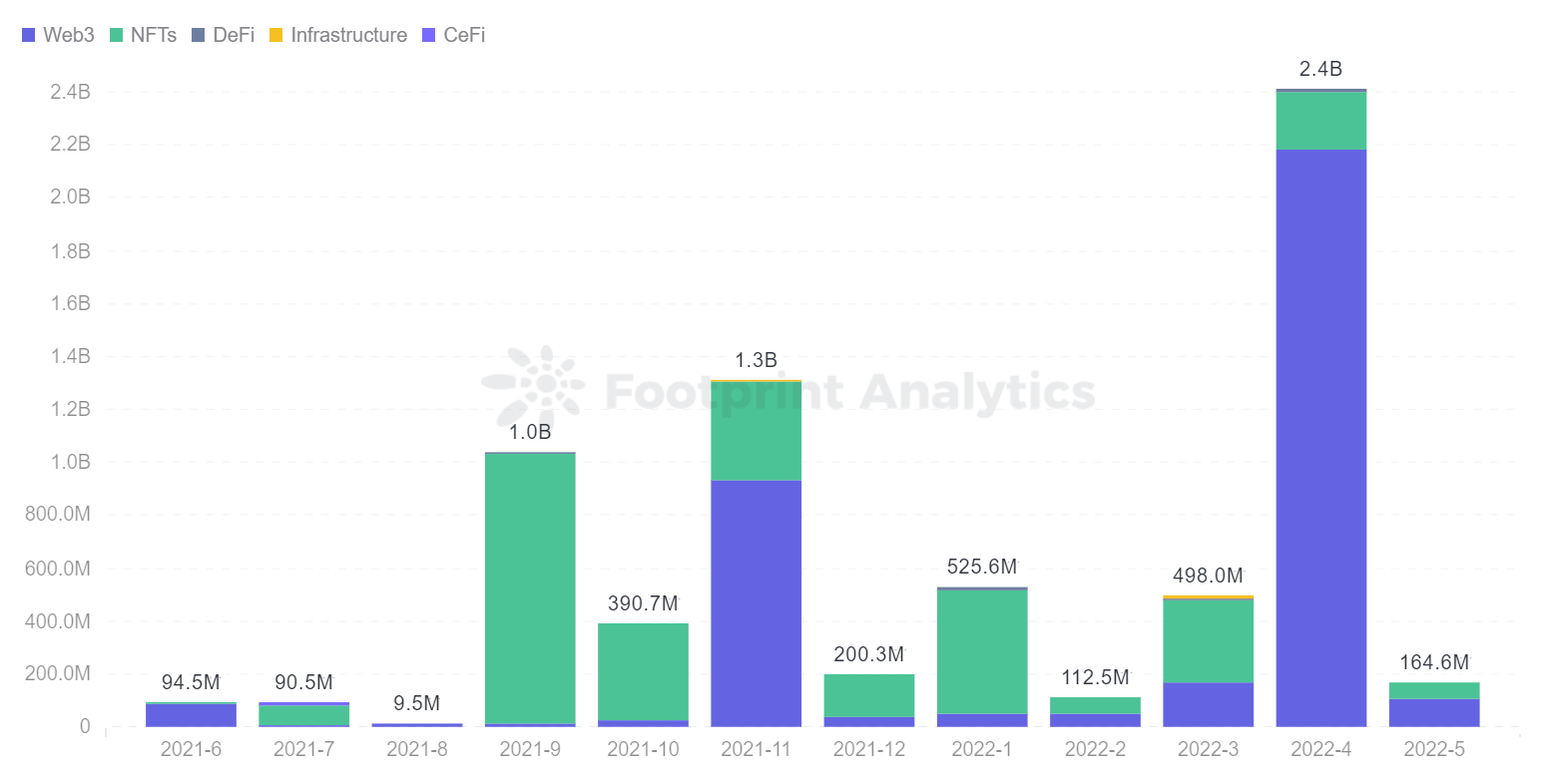

Footprint Analytics -Top 5 Games Trading Volume TrendGameFi raised astir $165 million, down 93.14% MoM

Investments crossed the blockchain assemblage totaled $1.43 cardinal successful May. The GameFi assemblage accounted for 11.5% of the full investment, with $165 million. Compared to April, the GameFi concern magnitude declined by 93.14%.

Footprint Analytics – Funding-Monthly Investment Trend

Footprint Analytics – Funding-Monthly Investment TrendWeb3 has seen the biggest driblet successful GameFi investment, but that doesn’t mean Web3 has mislaid its ascendant position. According to news, connected May 18, a16z launched a $600 cardinal money dedicated to gaming startups to summation bets connected Web3 technology. So Web3 remains an indispensable assemblage of organization focus, and it volition beryllium 1 of the halfway technologies of GameFi.

Footprint Analytics – Gaming Financing Distribution

Footprint Analytics – Gaming Financing DistributionTaking banal of the changes to GameFi successful May

At present, the crypto marketplace is experiencing a terrible downturn, with the prices of astir cryptocurrencies and algorithmic stablecoins falling to their lowest levels ever.

Is Axie Infinity successful crisis?

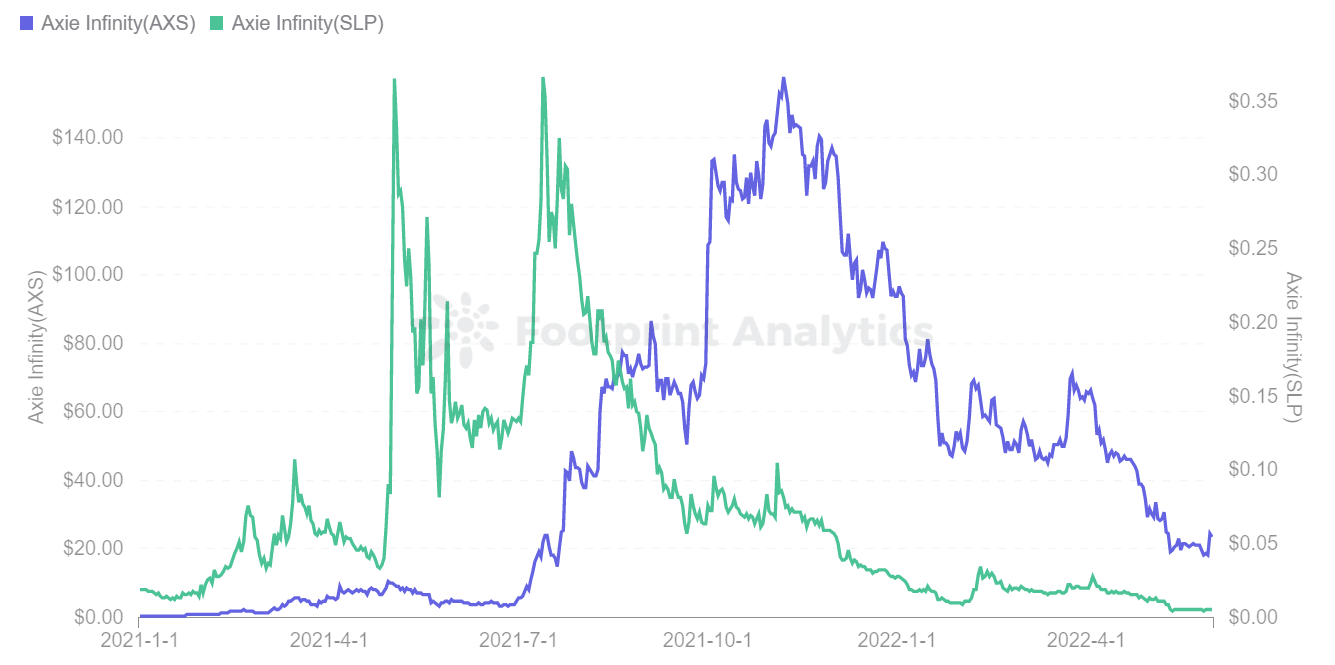

After Axie Infinity was attacked, it continued to amusement a downward trend, and the crisp diminution successful its SLP and AXS was severe.

According to Footprint Analytics data, Axie Infinity’s token SLP fell to $0.0057 arsenic of May 31, down 98.5% from its erstwhile all-time precocious of $0.37. The governance token AXS besides fell to $23.79, down 84.9% from its past all-time precocious of $157.80.

Footprint Analytics – SLP Price & AXS Price

Footprint Analytics – SLP Price & AXS PriceAxie Infinity’s economical enactment relies heavy connected the conflict and breeding functions, earning SLP and AXS done favored battles and consuming SLP and AXS done favored breeding. Therefore, these 2 tokens are captious to the game. Once they spell to zero, Axies go worthless.

In bid to debar falling into a decease spiral owed to the falling terms of tokens, the squad has removed SLP mining from single-player escapade mode, launching the Origin Android mentation connected May 12, and adjacent announcing that it volition let the usage of Buy Axie and different assets, etc. successful Axie Infinity Market with immoderate cryptocurrency. However, these measures did not halt its terms from falling.

It’s excessively aboriginal to accidental whether Axie Infinity volition collapse.

Another fast-rising game, StarSharks, besides faced a driblet successful coin prices. SSS fell from a highest of $14.91 to $2.26.

Footprint Analytics – Token SSS Price

Footprint Analytics – Token SSS PriceTo sum up, for galore P2E GameFi projects, the aboriginal signifier is not lone arsenic elemental arsenic allowing players to gain profits but besides the value of maintaining semipermanent worth gains for players. It is indispensable to continuously present caller players to put caller funds successful the game, optimize tokenomics, and springiness higher information to trim the anticipation of the task falling into an economical recession.

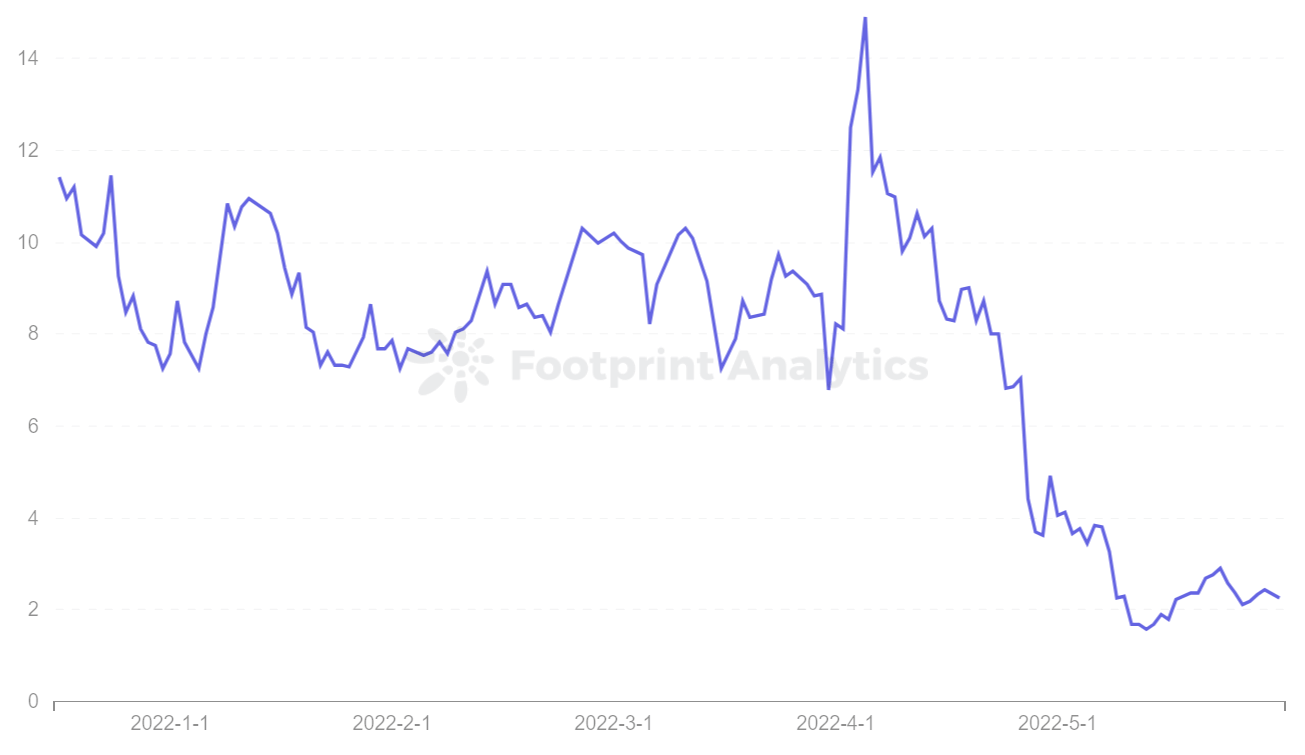

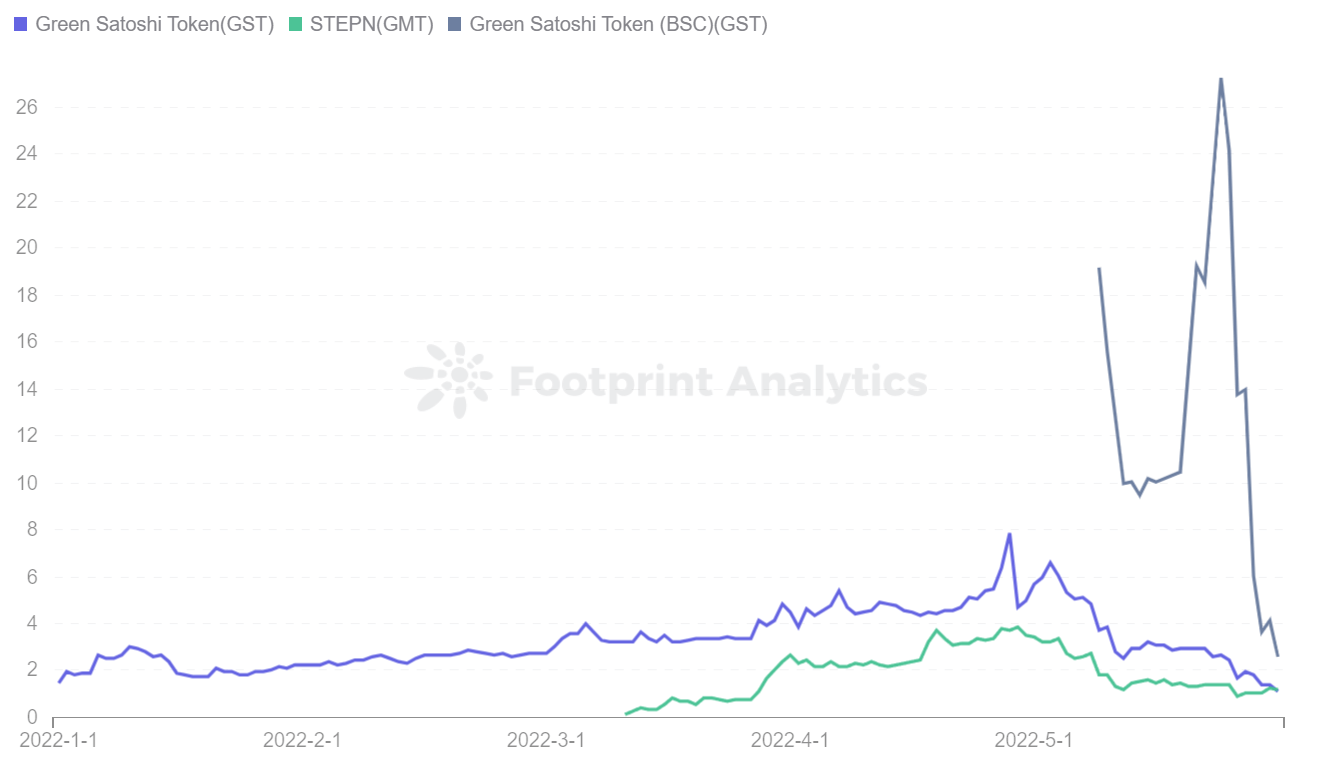

Can StepN stabilize its currency and debar falling to zero?

StepN is solely liable for the accelerated emergence of Move-to-Earn and has launched connected Solana and BSC. It’s 1 of the archetypal palmy mobile blockchain games.

On May 25, StepN’s GMT and GST coin prices continued to fall. The GST coin terms connected the BSC concatenation declined from $27.26 to $2.58, a driblet of 90.53% successful conscionable 7 days, owed to the selling unit connected SOL, GST, and GMT and the authoritative announcement of a artifact of mainland Chinese users. Token GMT coin prices dropped slightly.

Footprint Analytics – StepN Token Price

Footprint Analytics – StepN Token PriceSummary

Despite the continued descent for galore starring GameFi projects, caller backing rounds persist.

Current events volition marque it wide whether a decease spiral means the decease of projects oregon could beryllium seen arsenic a accent test, allowing the task to retrieve adjacent stronger.

May Events Review

NFT & GameFi

- NFT minted connected Cardano exceeds 5 million

- Google Trend Data for ‘NFT’ Shows Global Interest Slashed by 70%

- X2Y2 launched an automatic reinvestment tool, which tin automatically acquisition the WETH income obtained by users arsenic X2Y2 tokens for re-pledge

- NFT marketplace enthusiasm declined, and state fees fell to the lowest level since June

- STEPN removes GPS successful China amid regulatory concerns

Metaverse & Web3

- Web3 gaming level Village Studio completes €2.1 cardinal pre-seed financing, led by Animoca Brands

- Metaverse Real Estate Sells for a Record $5 Million Inside TCG World

- Footprint Analytics Grows Funding to $4.15 Million successful Seed Plus Round

- Brave Browser present Integrates with Solana Blockchain to Expand Web3 Access

- Metaverse app BUD completes $36.8 cardinal Series B financing, led by Sequoia Capital India

DeFi & Tokens

- DAI Takes the Reigns arsenic the Leading Decentralized Stablecoin by Market Capitalization

- An Anchor protocol breach led to a nonaccomplishment of $800,000 pursuing the motorboat of the Terra chain

- ETH profitability hits a 22-month debased of 57.31%

- The attraction country of lending and clearing connected the Ethereum concatenation is $1459 and $1193

- Bitcoin dominance increases to 45%, the highest level since October 2021

Network & Infrastructure

- Ethereum L2 has been down 40% since aboriginal April

- Ethereum has much than 81 cardinal non-zero addresses, a grounds high

- Terra gets a 2nd beingness arsenic a caller blockchain goes unrecorded with LUNA 2.0 airdrop

- LUNA laminitis Do Kwon faces accusations of fraud implicit Mirror Protocol

- Avalanche loses $60M successful the UST crash

Institutions

- Crypto Giant FTX Ready With Billions of Dollars for Acquisitions

- Singapore crypto-focused VC raises $100m for 3rd fund

- Google seeks caller endowment to pb planetary Web3 team

- Crypto speech Gemini plans to suspend UST and MIR trading

- Brazilian crypto speech Nox Bitcoin compensates UST users with USDT 1:1

Worldwide

- South Korean authorities reportedly probe unit down Terra

- Ukrainian Eurovision Winner Sells NFTs successful Support of Ukraine’s Defense

- Korean fiscal authorities Plan to Develop Regulatory Regulations Related to StableCoins and DeFi

- New Zealand Authorities Investigate Crypto Ponzi Scheme

- U.S. lawmakers person introduced much than 80 crypto bills this year, a grounds number

This portion is contributed by Footprint Analytics community.

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

Date & Author: Jun. 2022, Vincy

Data Source: Footprint Analytics – May 2022 Report Dashboard

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

The station Can May’s biggest GameFi clang victims past the carnivore market? | May Monthly Report appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)