The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

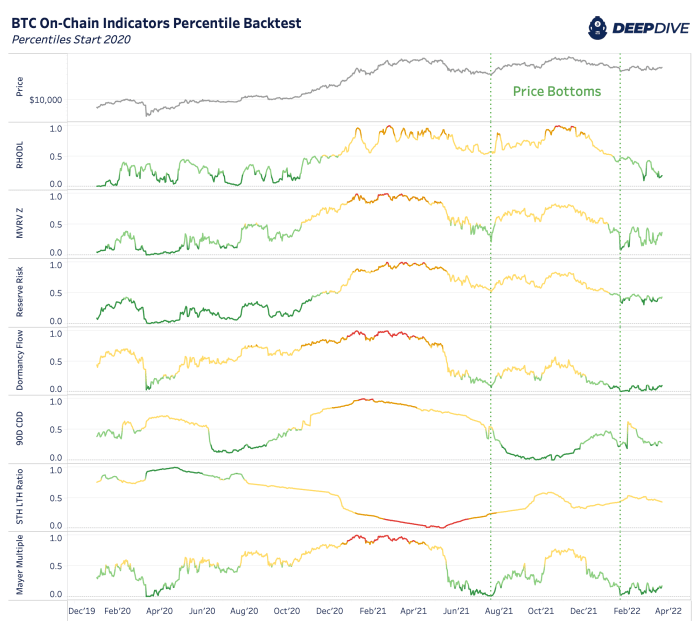

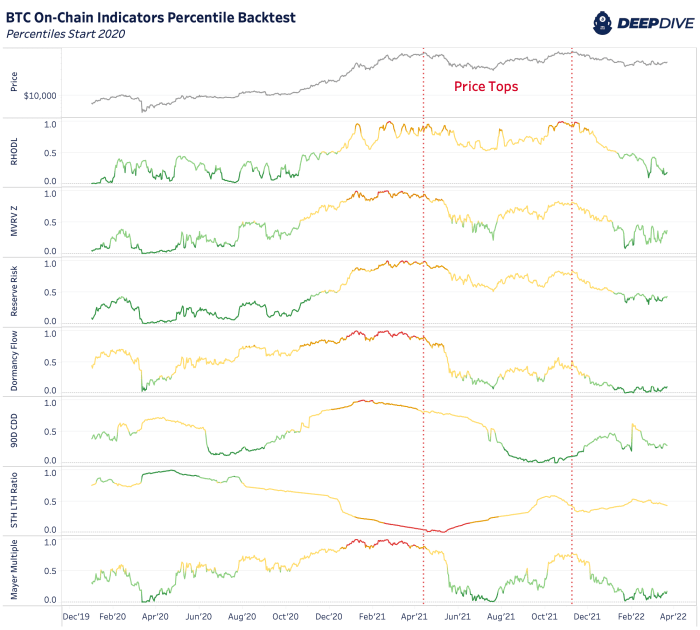

In erstwhile Daily Dives and analyses, we’ve highlighted the value and trends of large on-chain cyclical indicators crossed the realized HODL ratio, market-value-to-realized-value z-score, reserve risk, dormancy flow, 90-days coin days destroyed and the ratio betwixt short-term holders and semipermanent holders. The investigation contiguous covers these metrics successful aggregate including the Mayer Multiple.

By nary means are these metrics cleanable astatine predicting the marketplace successful the abbreviated word but they bash supply america with invaluable insights connected erstwhile the marketplace whitethorn beryllium astatine a secular oregon cyclical turning point. We similar to usage these metrics unneurotic to get confluence astir semipermanent signals and changing behaviors successful the market.

One mode to bash that is to look astatine these apical on-chain metrics crossed their humanities percentile distributions successful antithetic clip periods. To marque consciousness of the percentile information for each metric, we conception the percentiles into 5 antithetic groups and colors ranging from acheronian greenish to green, yellow, orangish and red. Lower percentiles correspond to the greens portion higher percentiles correspond to orangish and red.

Below you tin spot however immoderate of the champion on-chain indicators did good astatine identifying the March 2020 bottommost and the April 2021 top.

As for the April 2021 top, each indicator successful this investigation was showing overheated signs close earlier oregon during the terms peak.

The caveat present is that arsenic bitcoin matures and volatility falls, comparing on-chain indicators to the afloat past whitethorn not springiness the champion results for their predictive powerfulness successful the future. If we’re to proceed to spot little blow-off-top events successful terms past that volition besides beryllium reflected successful galore indicators.

Final Note

There are cardinal on-chain indicators that are invaluable successful determining semipermanent rhythm tops and bottoms. Yet arsenic Bitcoin matures and changes, truthful bash the analytical predictive powerfulness of these metrics.

3 years ago

3 years ago

English (US)

English (US)