On Dec. 1 successful Val‑d’Oise, France, the begetter of a Dubai‑based crypto entrepreneur was kidnapped disconnected the street; different introduction successful Jameson Lopp’s directory of 225‑plus verified carnal attacks connected integer plus holders.

The database Lopp, the main information serviceman astatine Bitcoin wallet Casa, has maintained for six years, shows the gait of coercion rising fast, with a 169% leap successful reported carnal attacks successful 2025.

The hazard itself isn’t unsocial to crypto: golden brokers, luxury resellers, adjacent currency couriers person faced the aforesaid basal limb for centuries (violence). What’s caller is that integer assets are present being stolen face‑to‑face.

The displacement is fueling a caller arms contention successful wallet design. “Panic wallets” with duress triggers that tin instantly hitch balances, nonstop mendacious decoys, oregon telephone for assistance with a subtle biometric gesture.

The thought sounds elegant until you adhd a wrench. As Lopp told Cointelegraph, “Ultimately, usage of duress wallets relies upon speculation astir the attacker, and you can’t perchance cognize their motivations and knowledge.”

The information down the fear

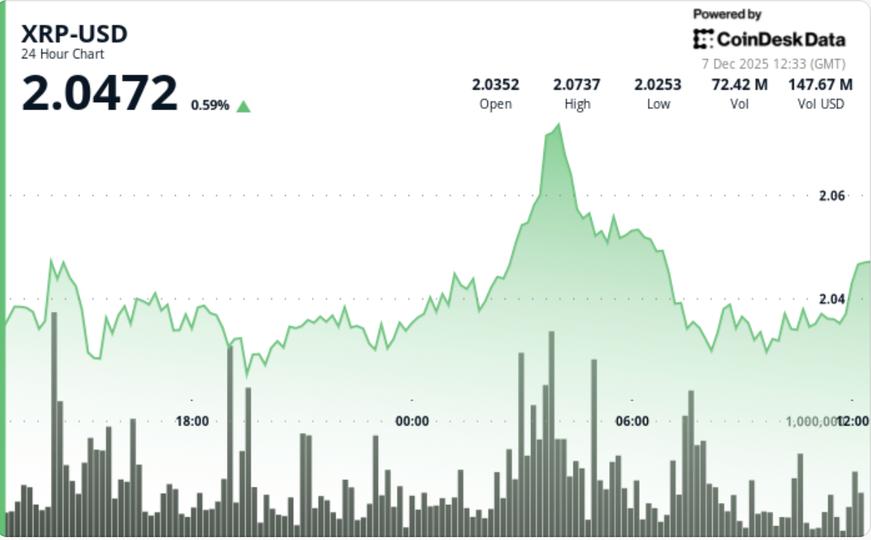

Lopp’s findings suggest wrench attacks travel marketplace cycles. They emergence during bull runs and periods of aggravated over‑the‑counter (OTC) trading, erstwhile ample deals determination disconnected exchanges. The US leads successful implicit cases, though the per-capita hazard is higher successful the United Arab Emirates and Iceland.

About a 4th of incidents are location invasions, often aided by leaked Know Your Customer (KYC) information (as Lopp laments, “Kill Your Customer”), oregon public‑records doxing. Another 23% are kidnappings. Two‑thirds of attacks succeed, and astir 60% of known perpetrators are caught.

The inclination enactment correlates astir with Bitcoin’s (BTC) terms chart. Each retail mania pulls caller wealth and caller targets into nationalist view, and criminals pursuit instrumentality connected concern similar everyone else.

Related: Crypto idiosyncratic attacked successful France implicit Ledger hardware wallet — Report

Testing the panic gesture

If integer self‑defense is evolving, it’s doing truthful without evidence. “There’s not overmuch we tin definitively authorities astir the effectiveness of duress wallets/triggers, due to the fact that we person truthful small data,” Lopp points out.

Related: Bitcoin ’wrench attacks’ connected way to treble its worst year

He’s alert of 1 unfortunate who tried a decoy wallet and failed to person the assailant, and different who complied instantly but was inactive tortured for hours due to the fact that the thief assumed hidden reserves.

The builders warring back

Matthew Jones, co-founder of Haven, learned the hard way. While attempting a 25 BTC commercialized successful Amsterdam, his counterpart fled with a waiting van. His photos helped Europol hint the pack crossed Europe; nary were ever caught.

He’s since turned that acquisition into a product: a biometric, multi‑party custody strategy built connected “continuous authentication without individuality exposure.”

Haven’s biometric wallet locks transfers down a unrecorded facial scan stored lone connected the user’s device. Large transactions, above $1,000, necessitate real‑time confirmation from a secondary verifier, specified arsenic a spouse oregon partner.

Changing that interaction imposes a 24‑hour wait, making on‑the‑spot coercion astir useless. Jones says, “It’s astir having the currency successful your wallet stolen, alternatively than your slope accounts emptied. So it’s astir deciding what your hazard tolerance is and deciding connected an amount.”

Related: Are seed-phrase-free crypto wallets the cardinal to wide self-custody? Expert weighs in

The custody dilemma

As carnal coercion rises and privateness rules specified arsenic the Organization for Economic Cooperation and Development’s Crypto-Asset Reporting Framework tighten, adjacent seasoned Bitcoiners are reevaluating self‑custody. Some present prefer custodianship to idiosyncratic risk.

Lopp calls that result catastrophic: “If capable radical determine that Bitcoin self-custody is excessively unsafe to undertake, this volition make monolithic centralization and systemic hazard to the full system. It’s a conflict I’ve been warring against for a decade.”

It exposes the paradox astatine the bosom of crypto information in 2025: each safeguard, from stricter KYC databases to offchain biometrics, narrows anonymity portion widening the onslaught surface. The frontier occupation isn’t smart‑contract exploits anymore; it’s information vulnerability and fear.

Related: The lawsuit for a ‘non-mandatory KYC’ exemplary — Interview with Toobit

What really works

For each the innovation, the simplest extortion remains societal discretion. Lopp advises, “The astir effectual happening that a Bitcoiner tin bash to trim their wrench onslaught hazard is precise difficult: don’t speech astir Bitcoin, astatine slightest not portion utilizing your existent sanction oregon face.”

As hardware wallets larn panic modes and regulators request much disposable ownership, the lone defenses that standard whitethorn beryllium cultural. Most wrench attacks win due to the fact that the unfortunate tin beryllium found, not due to the fact that their wallet tin beryllium broken.

Magazine: 2026 is the twelvemonth of pragmatic privateness successful crypto — Canton, Zcash and more

50 minutes ago

50 minutes ago

English (US)

English (US)