Key takeaways

Though Bitcoin doesn’t enactment autochthonal staking, holders tin gain output done centralized lending platforms, Wrapped Bitcoin (WBTC) connected Ethereum, and Bitcoin-related networks similar Babylon and Stacks.

WBTC allows BTC holders to enactment successful lending, liquidity pools and output farming connected Ethereum-based DeFi platforms similar Aave and Curve but introduces span and astute declaration risks.

Protocols similar Babylon and Stacks usage mechanisms similar autochthonal time-locked scripts oregon stacking to connection rewards without removing BTC from the Bitcoin blockchain.

Custodial, astute declaration and regulatory risks persist. Bitcoin’s assemblage besides remains divided connected whether Bitcoin output procreation features align with its decentralized and trust-minimized ethos.

Unlike proof-of-stake (PoS) blockchains similar Ethereum oregon Cardano, Bitcoin relies connected proof-of-work (PoW) mining for web security. However, with the emergence of decentralized concern (DeFi) and layer-2 innovations, Bitcoin (BTC) holders tin present make passive income done assorted yield-generating methods. These see centralized lending, Wrapped Bitcoin (WBTC) connected Ethereum, and layer-2 solutions similar Babylon and Stacks.

This nonfiction explores however to gain output connected BTC, the risks progressive and the technological advancements enabling these opportunities, each without altering Bitcoin’s halfway protocol.

Staking vs. mining

Staking and mining are 2 chiseled statement mechanisms utilized to unafraid blockchain networks and validate transactions.

Staking is cardinal to PoS blockchains similar Ethereum and Solana. Participants fastener up cryptocurrency to go validators, who are randomly selected to create caller blocks and corroborate transactions, earning rewards. The much coins staked, the higher the accidental of selection.

Mining, utilized by PoW blockchains similar Bitcoin and Litecoin, involves miners solving analyzable mathematical puzzles with almighty computers. The archetypal to lick the puzzle adds a caller artifact and receives a reward. Mining demands important vigor and hardware.

Bitcoin’s PoW plan means it does not enactment staking. The web relies wholly connected miners to guarantee decentralization and security. There are nary validators oregon staking rewards successful the accepted sense. Yield-generating methods for BTC, specified arsenic lending oregon layer-2 solutions, are not equivalent to PoS staking.

Did you know? Some staking platforms connection liquid staking, wherever you get a token representing your staked plus (like stETH for Ether). This lets you gain staking rewards and inactive usage your superior successful DeFi protocols.

Ways to gain output connected Bitcoin

While you cannot natively involvement BTC owed to its PoW mechanism, determination are alternate methods to assistance you gain output connected your BTC holdings and marque passive income. These methods often impact utilizing third-party platforms oregon bridging BTC to different blockchains.

Centralized lending platforms

Centralized lending platforms similar Binance Earn, Nexo and Ledn alteration you to gain with BTC deposited, which the level lends to organization borrowers. In return, you person interest, which mightiness beryllium paid regular oregon monthly. But this method involves custodial risk, arsenic users indispensable spot the level to stay solvent and secure. The collapse of firms similar Celsius and BlockFi has highlighted this vulnerability.

WBTC connected Ethereum

WBTC is an ERC-20 token backed 1:1 by BTC, held by a centralized custodian (BitGo). It enables BTC holders to prosecute successful Ethereum-based DeFi protocols, specified arsenic lending connected Aave, providing liquidity connected Curve oregon output farming. This unlocks DeFi’s imaginable but introduces risks from BitGo’s custody, span vulnerabilities and astute declaration bugs.

Bitcoin layer-2 platforms

Emerging layer-2 platforms specified arsenic Babylon and Stacks besides alteration you to research Bitcoin-native output opportunities. Babylon locks BTC successful time-locked scripts to unafraid its PoS network, portion Stacks uses a proof-of-transfer (PoX) exemplary wherever STX tokenholders fastener tokens to gain BTC rewards. These platforms grow Bitcoin’s inferior without leaving its ecosystem entirely.

Did you know? Ethereum became the largest PoS web successful 2022 aft “the Merge,” replacing miners with validators. This determination reportedly reduced the blockchain’s vigor depletion by implicit 99.95%, making it 1 of the greenest large crypto networks.

How to gain output with BTC connected a centralized lending platform

Earning output connected BTC via centralized platforms is straightforward. Choose a reputable platform, make a verified account, deposit BTC, prime a flexible oregon fixed-term lending option, corroborate terms, and show earnings. Funds tin typically beryllium withdrawn aft the term.

Using Binance Earn arsenic an example, the level offers aggregate output options:

Simple Earn: Beginner-friendly, offering unchangeable yields done flexible oregon locked savings products.

Dual Investment: Higher-risk, with returns based connected the colony terms of 2 assets, exposing users to marketplace volatility.

On-chain Yield: Bridges funds to DeFi protocols similar Aave, with adaptable yields managed by Binance.

Yields and presumption alteration by enactment and marketplace conditions. Simple Earn offers lower, predictable returns with flexible withdrawals, portion Dual Investment and On-chain Yield whitethorn output higher but riskier returns with locked terms. Check Binance Earn for existent rates.

After subscribing:

Simple Earn: BTC is locked (fixed term) oregon withdrawable (flexible term), with involvement paid regular oregon astatine term’s end.

Dual Investment: Funds are committed to a people terms and colony date, with yields paid successful the deposited oregon alternate asset.

On-chain Yield: Funds are deployed to DeFi protocols, with Binance handling state fees and astute contracts. Withdrawals whitethorn look delays owed to liquidity oregon web issues.

Rewards beryllium connected the platform, BTC magnitude and programme terms.

How to gain output with WBTC connected Ethereum

WBTC allows BTC holders to gain output connected Ethereum’s DeFi platforms, specified arsenic Aave oregon Curve, by depositing WBTC into liquidity pools and earning involvement oregon fees.

Steps to gain output with WBTC, utilizing Curve arsenic an example:

Convert BTC to WBTC: Use a centralized speech (CEX) (e.g., Binance) oregon decentralized span (e.g., RenBridge) to person BTC to WBTC, custodied by BitGo.

Transfer WBTC to a wallet: Move WBTC to a Web3 wallet similar MetaMask and marque definite you person capable Ether (ETH) for gas fees.

Connect to a DeFi protocol: Visit Curve.fi and deposit WBTC into a liquidity excavation via the platform’s interface.

Earn yield: By providing liquidity, you gain involvement oregon fees based connected excavation performance.

How to gain output utilizing Bitcoin furniture 2s

Layer-2 solutions similar Babylon and Stacks alteration output procreation by leveraging Bitcoin’s security. Babylon, for example, locks BTC arsenic collateral to unafraid its PoS network, connecting to Cosmos zones (interconnected blockchains). Babylon’s Genesis mainnet launched connected April 10, 2025, with implicit 57,000 BTC staked, valued astatine astir $4.6 billion.

Steps to gain output with Babylon:

Set up a compatible wallet: Use a wallet similar OKX oregon Phantom, supporting Native SegWit (bc1q) oregon Taproot (bc1p) addresses. Avoid wallets with Bitcoin Inscriptions (Ordinals).

Access the Babylon involvement app: Visit the Babylon Stake app, which is progressive post-Genesis launch.

Connect your wallet: Link your BTC wallet and o.k. integer signature requests for level interaction.

Choose a finality provider: Select from implicit 250 finality providers (e.g., Galaxy, Figment) that unafraid Babylon’s network.

Set transaction fees: Choose default oregon customized fees (higher fees guarantee faster confirmation) and participate the BTC magnitude to lock.

Confirm and monitor: Lock BTC via the app and way presumption successful the Babylon Staking Terminal. Rewards see BABY tokens, divided 50-50 betwixt BTC and BABY stakers.

Did you know? In immoderate countries, crypto output rewards are taxed arsenic income upon receipt and arsenic superior gains erstwhile sold. Tax attraction varies, truthful consult a professional.

Innovative mechanisms successful Bitcoin layer-2 protocols

Layer-2 protocols heighten Bitcoin’s scalability and functionality. Babylon and Stacks present unsocial mechanisms to make output portion leveraging Bitcoin’s security.

Native time-locked scripts successful Babylon Protocol

Babylon locks BTC successful self-custodial, time-locked scripts connected the Bitcoin blockchain, utilizing it arsenic collateral to unafraid its PoS network, launched connected April 10, 2025. This non-custodial exemplary supports Cosmos zones without requiring bridges oregon wrapping. BTC stakers delegate to Finality Providers, earning BABY tokens, portion BABY stakers enactment artifact production. This trustless strategy enables delegated voting and restaking crossed PoS chains.

Stacking successful the Stacks Protocol

Stacking is Stacks’ output mechanism, utilizing proof-of-transfer (PoX). STX tokenholders fastener Stacks (STX) for ~2 weeks to enactment web consensus, earning BTC rewards paid by Stacks miners. This non-custodial process, disposable via platforms similar Okcoin oregon Xverse, creates an economical nexus to Bitcoin without locking BTC itself.

Coinbase Bitcoin Yield Fund (CBYF) Explained

Coinbase Asset Management has launched the Coinbase Bitcoin Yield Fund (CBYF) connected May 1, aiming to deliver sustainable Bitcoin-denominated returns for organization investors extracurricular the US.

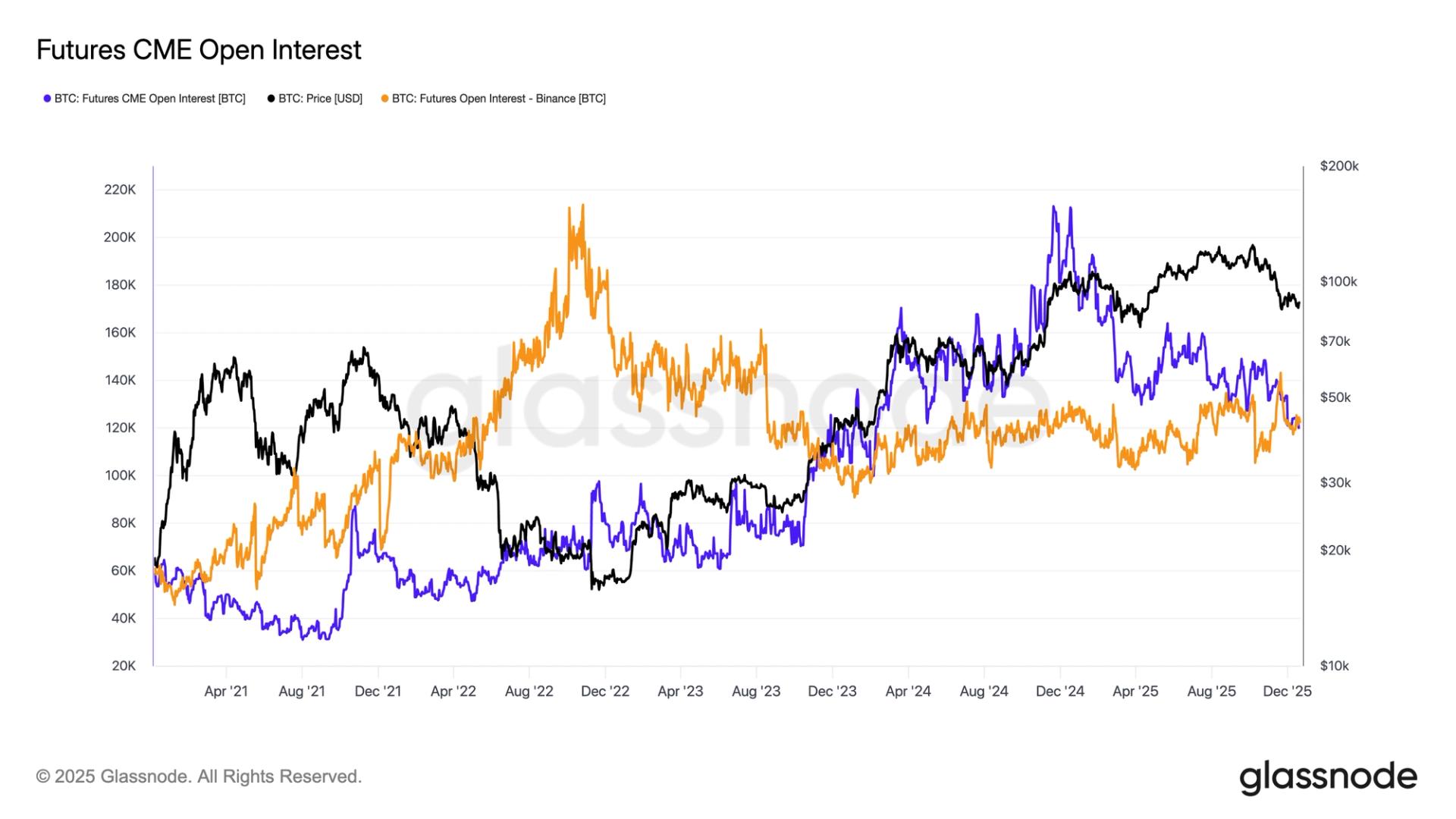

The money uses a blimpish cash-and-carry arbitrage strategy, capitalizing connected terms gaps betwixt spot and futures markets, portion steering wide of high-risk tactics similar leveraged loans oregon telephone selling.

Targeting yearly nett returns of 4–8% successful BTC, CBYF offers a safer alternate for earning output connected Bitcoin — an plus that lacks autochthonal staking options dissimilar different cryptocurrencies.

Risks progressive successful earning output with BTC

Generating output connected BTC involves risks chiseled from PoS staking owed to reliance connected third-party services oregon furniture 2s:

Custodial risk: Centralized platforms (e.g., Binance, Nexo) and WBTC’s custodian (BitGo) clasp BTC, risking losses if they look insolvency, hacks oregon regulatory shutdowns.

Smart declaration risk: WBTC bridges and DeFi platforms similar Aave are susceptible to bugs oregon exploits.

Liquidity risk: Locked BTC successful fixed-term programs oregon low-liquidity pools whitethorn beryllium inaccessible during marketplace shifts.

Network maturity: Newer protocols similar Babylon whitethorn look method oregon adoption challenges.

Market risk: Price volatility tin offset output during carnivore markets.

Regulatory risk: Centralized platforms and custodians look Know Your Customer (KYC) and Anti-Money Laundering (AML) scrutiny, and output whitethorn beryllium taxed arsenic income oregon superior gains, depending connected jurisdiction.

How earning output with BTC whitethorn evolve

Bitcoin’s output scenery is evolving done layer-2 and DeFi innovations. Babylon and Stacks pioneer trustless solutions, locking BTC oregon STX without centralized custodians. Future advancements whitethorn see much non-custodial, Bitcoin-native systems utilizing cryptographic tools to unlock worth portion preserving Bitcoin’s censorship resistance.

However, purists reason that output procreation risks diluting Bitcoin’s relation arsenic hard money, sparking debates implicit balancing inferior and security.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

7 months ago

7 months ago

English (US)

English (US)