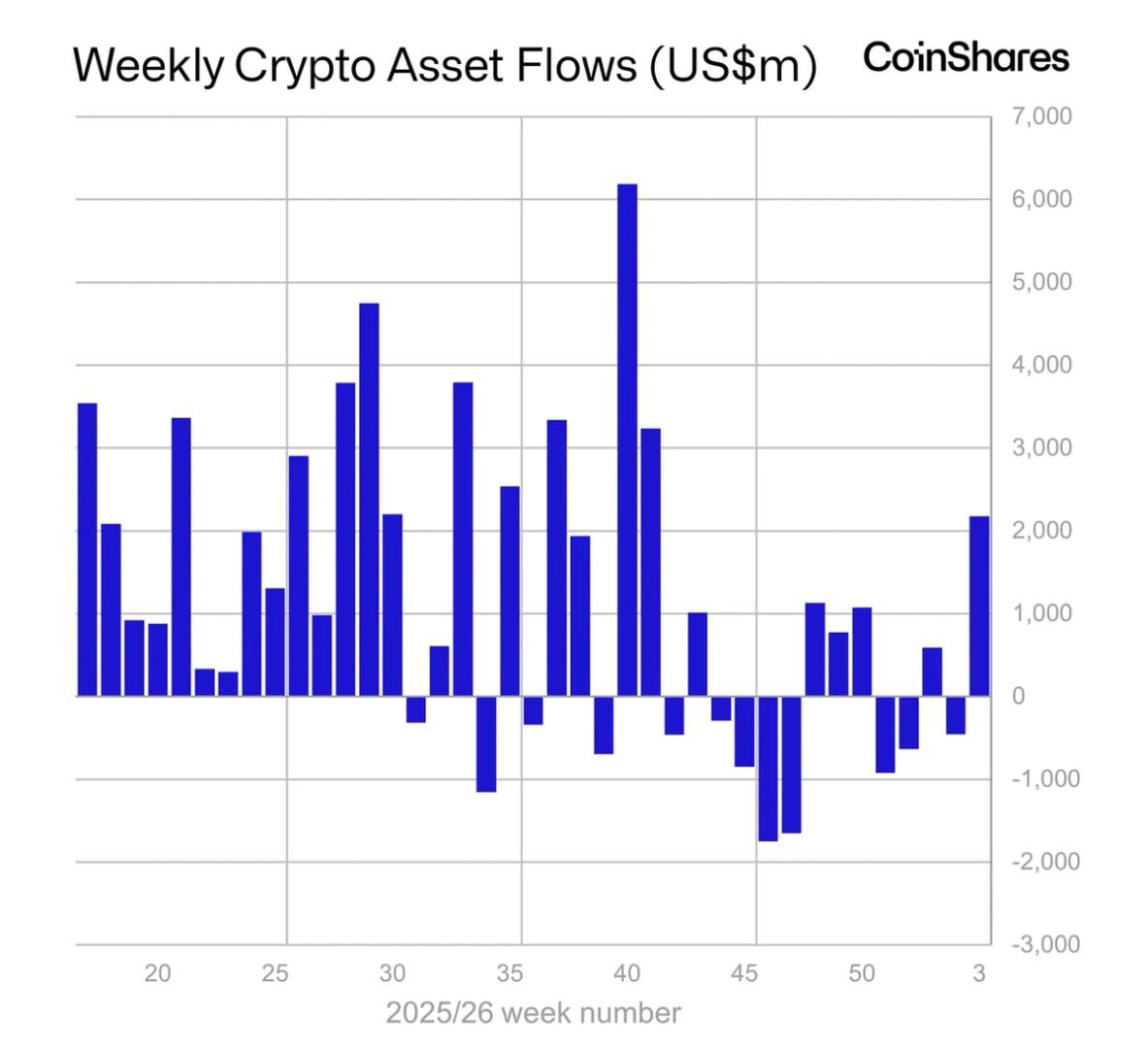

Last week saw a singular influx of superior into integer plus concern products, amounting to $346 million, according to CoinShares’ astir recent data. This fig represents the astir important play inflow successful a consecutive nine-week tally and marks a pivotal constituent past seen during the bull marketplace enthusiasm of precocious 2021. According to the reported figures, the inflow spike has propelled the full assets nether absorption (AuM) to a staggering $45.3 billion, the highest successful implicit eighteen months.

Canada and Germany accounted for 87% of the total, with inflows of $199.1 cardinal and $101.5 million, respectively. In contrast, the United States saw a comparatively humble $30 million, presumably arsenic investors clasp retired for a spot-based Exchange-Traded Fund (ETF) motorboat stateside.

However, the U.S. inactive has a acold higher magnitude of assets nether management, with $33.1 billion, implicit 10 times much than the adjacent highest country.

Bitcoin and Ethereum Lead the Charge

Bitcoin attracted $311.5 cardinal successful inflows past week, culminating successful year-to-date inflows surpassing $1.5 billion. This robust accumulation comes erstwhile short-sellers look to retreat, arsenic evidenced by the 3rd consecutive week of outflows astatine $900,000 from short-Bitcoin ETPs.

Ethereum followed suit with $33.5 cardinal successful inflows, contributing to a four-week full of $103 million. This inclination astir neutralizes the year’s anterior outflows and signifies a decisive displacement successful capitalist sentiment for the second-largest integer plus by marketplace capitalization.

Implications for the Crypto Market

The infusion of superior into different cryptocurrencies similar Solana, Polkadot, and Chainlink, though humble successful comparison, indicates a diversified concern involvement wrong the sector. The sustained usage of Exchange-Traded Products (ETPs) further highlights an accrued penchant for regulated fiscal instruments to summation crypto exposure, with ETPs accounting for 18% of full spot Bitcoin volumes past week.

This fiscal question aligns with the heightened anticipation of a US-based spot ETF. The emergence successful AuM and the accordant inflows into some superior and alternate integer assets suggest an progressively optimistic market, oregon astatine the precise least, betting connected the imaginable of a much regulated and accessible cryptocurrency concern landscape.

Butterfill stated determination has been “a decisive turn-around successful sentiment,” and the information appears to correspond a snapshot of an manufacture astatine an inflection point, with capitalist sentiment and marketplace dynamics aligning successful a mode that could specify the trajectory of the crypto marketplace for the foreseeable future.

View the afloat CoinShares play study connected James Butterfill’s Medium blog.

The station Canada and Germany predominate crypto ETP inflows arsenic grounds $346 cardinal added to funds appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)