According to a caller study by information quality steadfast Messari, Cardano and its autochthonal token, ADA, experienced a notable diminution successful the 2nd 4th (Q2) of 2024, reflecting the broader downturn affecting the cryptocurrency market. Key show indicators besides showed important decreases successful assorted metrics.

Price Plunge, Market Cap Dips To $14 Billion

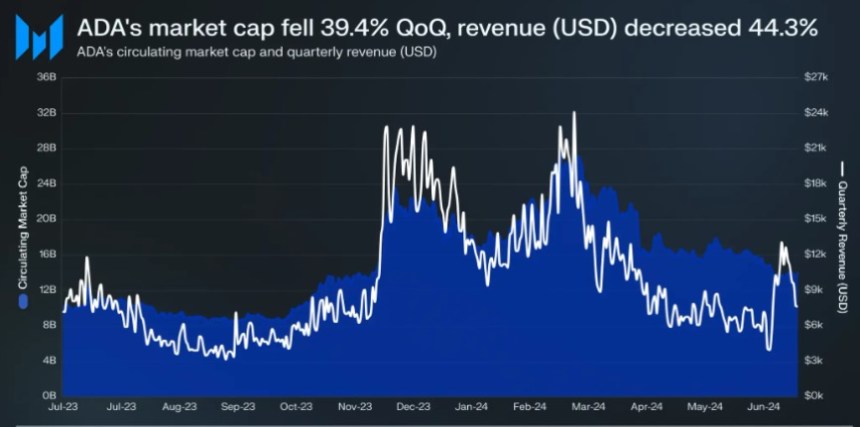

According to the report, ADA’s terms plummeted 39.7% to $0.39, portion its marketplace capitalization fell by 39.4% quarter-over-quarter (QoQ) to $14 billion.

Messari noted that this diminution was influenced by a flimsy summation successful circulating supply, which accounted for the insignificant discrepancy successful marketplace headdress figures. Consequently, ADA’s marketplace headdress ranking dropped from 9th to 10th place.

Market headdress and gross figures during Q2. Source: Messari

Market headdress and gross figures during Q2. Source: MessariTransaction fees connected the Cardano network, which are indispensable for processing transactions and covering retention costs, besides suffered. Revenue in USD decreased by 44.3% QoQ to $0.74 million, portion gross measured successful ADA fell by 28.0% to 1.60 million.

The platform’s mean regular transactions besides decreased by 27.5% QoQ to astir 51,400, and the fig of regular progressive addresses (DAAs) fell by 33.2% to 31,800.

Additionally, the mean transaction fee successful USD dropped 23.1%, from $0.21 to $0.16. However, the mean interest successful ADA saw lone a marginal diminution of 0.6%, remaining astatine 0.34.

Treasury Balance Grows

Despite these setbacks, the ratio of transactions to progressive addresses accrued by 8.4% QoQ to 1.62, suggesting a emergence successful “power users” engaging much often with the platform.

In presumption of staking metrics, full ADA staked and the staking complaint accrued slightly, though the full worth of staked ADA successful USD decreased importantly by 39.6% to $8.9 billion, chiefly owed to the falling terms of ADA.

Cardano’s treasury balance, measured successful ADA, roseate 5.8% QoQ to 1.57 billion, though its dollar worth decreased by 36.7% to $604.7 million. Currently, 20% of transaction fees are allocated to the treasury.

Decentralized exertion (DApp) enactment connected Cardano besides saw declines, with mean regular DApp transactions falling 35.7% QoQ to 34,300 and mean regular decentralized speech (DEX) measurement successful USD decreasing by 42.5% to $4.2 million.

Cardano TVL Drop Amid Market Downturn

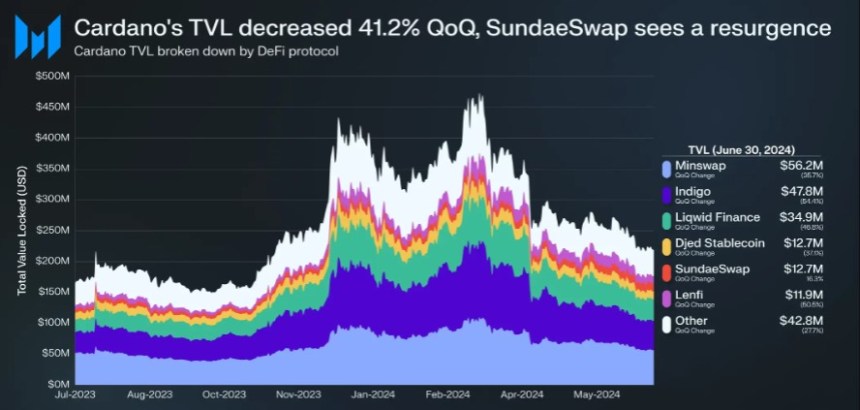

Total worth locked (TVL) connected Cardano dropped 41.2% QoQ to $219 million, pursuing a highest of $506 cardinal successful March 2024, driven by a broader crypto market downturn alternatively than Cardano-specific factors.

TVL alteration during Q2. Source: Messari

TVL alteration during Q2. Source: MessariMoreover, for the archetypal clip since the instauration of Cardano’s stablecoins successful precocious 2022, the stablecoin marketplace headdress connected the level decreased by 12.4% QoQ to $19.6 million. Average regular non-fungible token (NFT) income besides took a hit, plummeting 57.4% QoQ to nether 730 transactions.

Despite these challenges, the study highlights ongoing developments wrong Cardano’s ecosystem. The emergence of caller stablecoins similar USDM and MyUSD saw their marketplace caps emergence dramatically, indicating a displacement successful the landscape.

Additionally, upcoming upgrades, specified arsenic the Chang Hard Fork, committedness to summation Cardano’s governance capabilities, moving the web person to achieving its semipermanent goals of self-sustainability and participatory decision-making.

At the clip of writing, ADA was trading astatine $0.34, down 0.7% for the 24-hour period.

Featured representation from DALL-E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)