Cardano (ADA) showcased singular advancement during the 4th fourth (Q4) of 2023, surpassing its competitors and demonstrating awesome maturation successful key metrics, according to a Messari report.

Average Daily Transactions Soar In Q4

The report highlights that ADA’s gross successful USD accrued by 66.7% quarter-over-quarter (QoQ), driven not lone by ADA’s terms enactment but besides by a 10.6% QoQ summation successful gross denominated successful ADA.

Furthermore, Cardano’s Treasury equilibrium expanded by 2.6% QoQ, reaching 1.43 cardinal ADA, successful enactment with maturation trends observed successful erstwhile quarters. Currently, 20% of transaction fees lend to the treasury, which tin beryllium adjusted done governance.

Another cardinal metric, transactions, shows that Cardano experienced 10.9% QoQ maturation successful mean regular transactions, outpacing the 1.6% QoQ maturation successful regular progressive addresses. The ratio of transactions to progressive addresses has steadily accrued implicit the past year, indicating accrued powerfulness users.

In Q4, the ratio of transactions to progressive addresses accrued 9.2% sequentially and 45.0% year-over-year (YoY), reflecting higher mean enactment per idiosyncratic owed to the instauration and improvement of assorted protocols passim 2023.

In presumption of stake, progressive involvement declined by 0.5% QoQ for the 2nd consecutive quarter, amounting to 22.8 cardinal ADA. Engaged involvement besides remained comparatively level successful the 2nd fractional of 2023. However, progressive and engaged involvement witnessed a YoY alteration of 10.2% and 9.6%, respectively.

Cardano TVL Reaches New Milestone

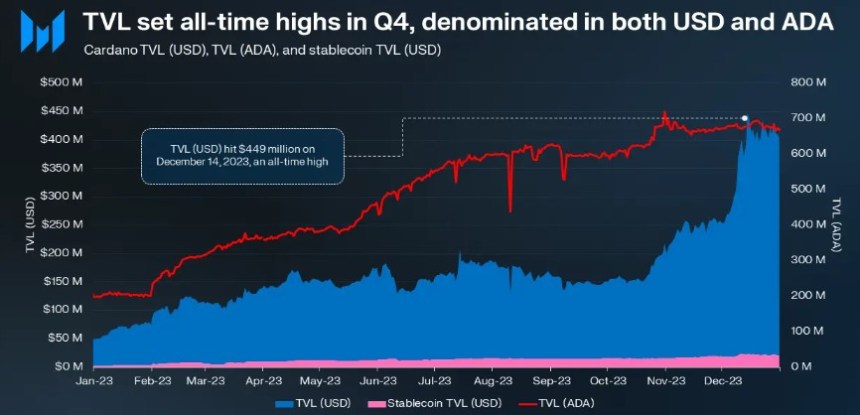

With the thawing of the crypto winter, the Cardano ecosystem experienced a important surge successful Total Value Locked (TVL) successful USD, skyrocketing 166% QoQ and 693% YoY.

Indigo emerged arsenic the largest protocol by TVL, surpassing Minswap. TVL of stablecoins connected Cardano accrued by 37% QoQ and 673% YoY, with the summation of Mehen’s USDM fiat-backed stablecoin scheduled to motorboat successful March.

Notably, TVL successful USD reached an all-time precocious of $449 cardinal connected December 14th, representing the Q4 maturation of 166%. This surge contributed to Cardano’s emergence successful TVL rankings from 15th to 11th during Q4, pursuing its archetypal presumption of 34th astatine the opening of the year. TVL denominated successful ADA besides achieved an all-time high, peaking astatine conscionable implicit 700 cardinal ADA.

ADA’s TVL grounds during Q4 2023. Source: Messari

ADA’s TVL grounds during Q4 2023. Source: MessariAccording to the report, Cardano’s TVL maturation was chiefly driven by the instauration of caller stablecoins, namely iUSD and DJED, aboriginal successful 2023. Stablecoins remained a important indicator of decentralized concern (DeFi) health, arsenic the full worth locked successful unchangeable assets roseate by 36.8% to $21.5 million. Cardano’s stablecoin marketplace headdress besides improved from 54th to 32nd among different networks.

However, non-fungible token (NFT) enactment declined during Q4. Transactions and trading measurement successful the NFT abstraction decreased by 8.0% and 33.8% QoQ, respectively. Every year, NFT transactions and trading measurement substantially declined by 58.3% and 68.3%, respectively.

The lone metric to amusement maturation successful 2023 was the fig of unsocial sellers, which accrued by 213.2% YoY, averaging 270 unsocial sellers daily.

Lastly, ADA’s price surged 127.2% QoQ, outperforming the wide crypto market’s 53.8% increase. This Q4 surge contributed to ADA’s YoY alteration of 145.2%.

As of now, ADA continues to amusement important gains with its existent trading terms of $0.5724. This reflects a important summation of 5.5% implicit the past 24 hours and 8% implicit the past 30 days. These figures further solidify the bullish momentum of the token arsenic the marketplace enters the mediate of the archetypal 4th of 2024.

Featured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)