Russian President Vladimir Putin overnight launched a full-scale “special subject operation” into Ukraine, sending shockwaves done the markets.

Cryptocurrencies were among the hardest hit, led by an 18% diminution for Cardano's ADA and a 14% autumn for Solana's SOL, according to information from tracking instrumentality CoinGecko. As for Bitcoin (BTC), it's not moving arsenic a safe-haven plus astatine the moment, falling astir 10% to $35,000. Ethereum (ETH) is down 12% to $2,340. The full capitalization of the crypto market, according to CoinMarketCap, has fallen 8.4% contiguous to $1.57 trillion.

Hardest deed banal markets successful Western Europe are Germany's DAX, down 5.2%, and Italy's FTSE MIB, down 5.3%. Russian's MOEX scale had its largest diminution ever, falling 28%. In the U.S., Nasdaq futures are disconnected by much than 3% and S&P 500 futures are conscionable shy of a 3% decline.

Checking the method representation for ADA, it slid to arsenic debased arsenic $0.74 successful European greeting hours earlier a flimsy betterment to $0.76, which could enactment arsenic enactment successful the coming days. Just a week ago, the terms was astatine $1.

ADA dropped to $0.74 from past week's $1 high. (TradingView)

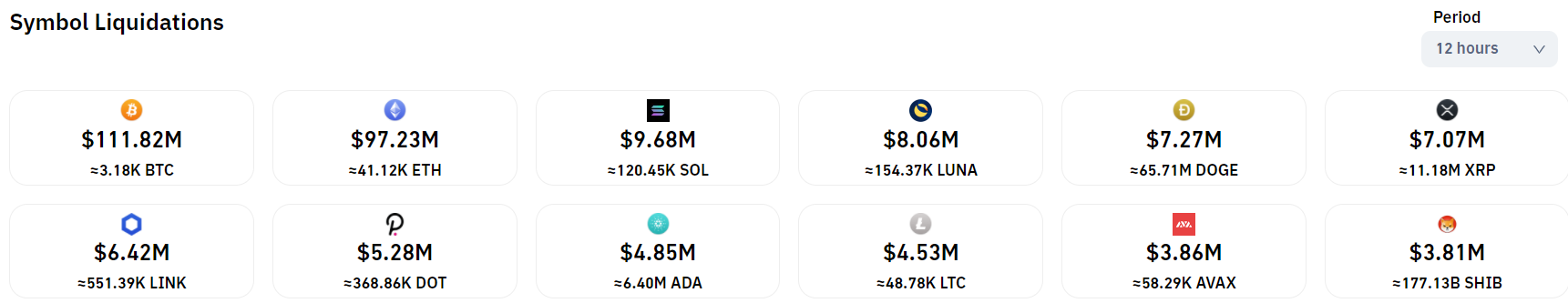

Crypto-tracked futures person seen astir $350 cardinal successful liquidations since the commencement of the Russian invasion. Of that, astir $111 cardinal occurred connected bitcoin futures and $97 cardinal connected ether futures, followed by $9.67 cardinal successful losses connected SOL, and $7.27 cardinal connected DOGE.

Crypto markets mislaid astir $350 to liquidations successful the past 12 hours. (Coinglass)

Anto Paroian, main operating serviceman astatine integer plus concern money ARK36, cautions not to expect the U.S. Federal Reserve to travel to the rescue. If anything, helium said, the warfare volition worsen the ostentation picture. “This means that the Fed and different cardinal banks whitethorn truly person nary country to reverse their hawkish people and we tin expect hazard assets and cryptocurrencies to spell deeper into the carnivore marketplace territory," helium told CoinDesk.

Rudd Feltkamp, CEO of crypto trading bot Cryptohopper, has a antithetic view, reminding that markets mostly bash a bully occupation of discounting large news. “If you look astatine large humanities events and however the banal markets react, determination is not an highly ample action/reaction,” helium told CoinDesk successful an email. “For example, aft the onslaught connected Pearl Harbor, the markets 'only' fell 3.8%. However, the run-up with the associated uncertainty seems to person a much important impact."

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)