Grayscale Investments unveiled its “Smart Contract Platform ex Ethereum Fund” connected Tuesday, aiming to connection vulnerability to astute declaration exertion extracurricular of the Ethereum blockchain.

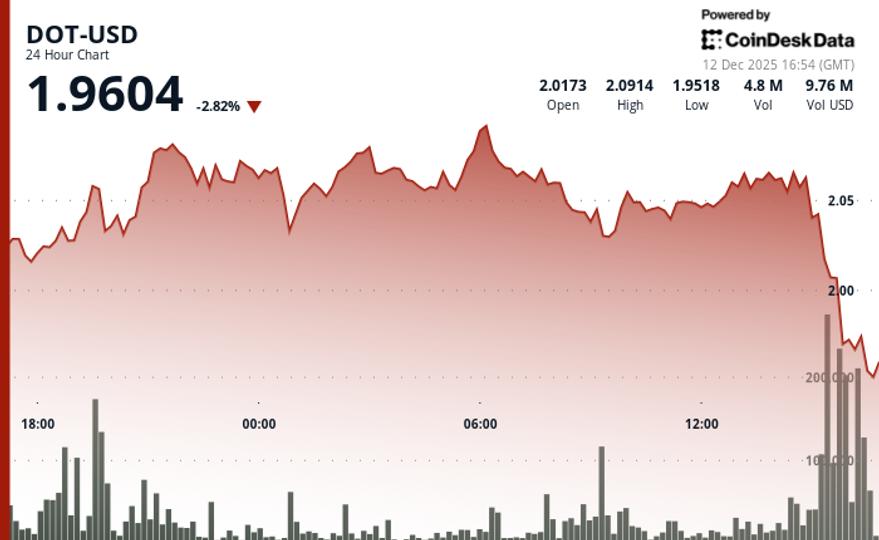

Current holdings are Cardano’s ADA with a 24.6% weighting, Solana’s SOL astatine 24.3%, Avalanche’s AVAX astatine 17%, Polkadot’s DOT astatine 16.2%, Polygon’s MATIC astatine 9.7%, Algorand’s ALGO astatine 4.3% and Stellar’s XLM astatine 4.1%.

“Investor request for diversified vulnerability has grown successful parallel to the ongoing improvement of the crypto ecosystem,” said Grayscale CEO Michael Sonnenshein.

Grayscale genitor institution Digital Currency Group is besides the proprietor of CoinDesk, which is tally arsenic an autarkic subsidiary.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)