Celsius Networks, presently undergoing bankruptcy proceedings, has engaged successful important Ethereum transactions that are causing ripples wrong the integer currency landscape.

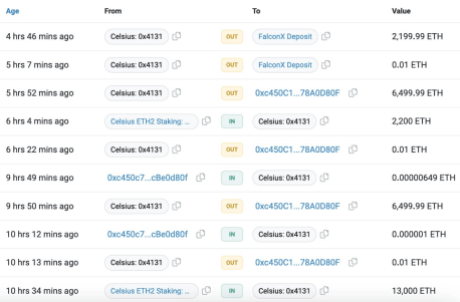

In the past 10 hours, on-chain analysts astatine LookonChain detected noteworthy transfers, including a 13,000 ETH deposit ($30 million) connected Coinbase and an further 2,200 ETH ($5 million) connected FalconX. These transactions suggest a proactive stance by Celsius successful addressing its ongoing fiscal challenges.

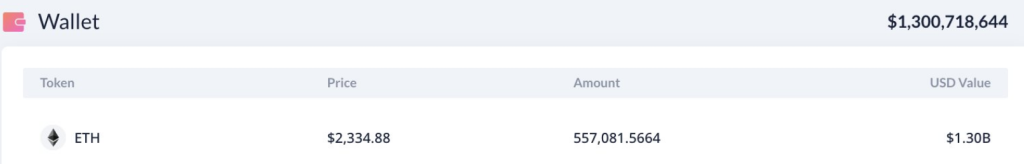

Celsius Sells $125M ETH, Maintains $1.3B Reserve

According to Arkham Intelligence, Celsius sold much than $125 cardinal worthy of Ethereum (ETH) coins betwixt January 8 and January 12. The superior extremity of this auction is to wage disconnected creditors.

Dune Analytics besides revealed a much wide signifier of redemptions, with implicit $1.6 cardinal of staked Ethereum being redeemed during the aforesaid period. Since the Shanghai update past year, the magnitude of redemptions recorded is the highest.

The #Celsius wallet deposited 13K $ETH($30.34M) to #Coinbase and 2,200 $ETH($5.13M) to #FalconX again successful the past 10 hours.

Currently, 2 staking wallets of #Celsius inactive clasp 557,081 $ETH($1.3B).

Address:https://t.co/3gGOucC9gYhttps://t.co/zodN4gzVHKhttps://t.co/Jjt9fCN2Ej pic.twitter.com/E9DIZ9KDAH

— Lookonchain (@lookonchain) January 23, 2024

Despite facing fiscal constraints imposed by the court, Celsius inactive holds a important Ethereum reserve. This reserve amounts to implicit 557,000 coins successful 2 staking wallets, with a full valuation of astir $1.3 billion. The size of this reserve adds a furniture of complexity to Celsius’ existent fiscal concern and underscores the evolving communicative wrong the crypto space.

As portion of its obligations to creditors, Celsius has been actively liquidating its Ethereum holdings. These auctions, aimed astatine paying disconnected outstanding debts, are integral to Celsius’ bankruptcy proceedings.

Source: LookOnChain

Source: LookOnChain

The marketplace has responded to these Ethereum transactions, resulting successful a 4% diminution successful the terms of ETH. The cryptocurrency slipped beneath the $2,350 mark, raising concerns among analysts, particularly arsenic ETH present wavers beneath its important request portion ranging from $2,380 to $2,461.

Analysts foretell that a nonaccomplishment to support this level could pb to a imaginable retreat towards the $2,000 mark.

Wealthy Investors Trigger Ethereum Profit-Taking

Santiment’s humanities information reveals that important transactions by affluent investors, commonly known arsenic whales, often trigger profit-taking activities among regular ETH holders. This improvement intensifies selling unit and contributes to terms declines.

Meanwhile, decreasing backing rates suggest an underlying optimism successful the market, hinting astatine a imaginable cooldown successful antecedently overheated perpetual markets. This concern leaves country for ETH to rebound erstwhile the selling unit subsides.

As the bankruptcy play of Celsius unfolds, the scrutiny connected its Ethereum transactions and the resulting marketplace dynamics volition persist. Investors and observers are intimately monitoring the situation, eagerly awaiting further developments and anticipating the broader implications for some Celsius and the crypto ecosystem.

Featured representation from Shutterstock

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)