A heavy look into Celsius network's plan and the events of caller weeks with its yield-generating strategies that culminated successful a halt of bitcoin withdrawals.

The beneath is simply a free, afloat excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

The intent of this contented volition beryllium twofold:

The archetypal volition beryllium an in-depth look astatine the Celsius platform, and breakdown the plan of the business/ecosystem to recognize what went wrong.

The 2nd is to item the events that person transpired implicit the caller weeks with Celsius “yield generation” strategies, and update subscribers connected the authorities of the market, with perchance large ramifications connected the horizon.

The pursuing is written by Bitcoin Magazine’s Namcios, detailing Celsius’s halfway concern operations.

Celsius: Design And Assumptions

This conception takes a heavy look astatine the interior workings of the task itself, arsenic per its white paper, including immoderate reddish flags successful its plan and backboning assumptions that could’ve served arsenic a informing to investors – and tin hopefully beryllium applied to different projects to forestall akin losses successful the future.

“As much radical articulation the Celsius ecosystem, the much everyone benefits,” per the achromatic paper.

Image source: Celsius web achromatic paper.

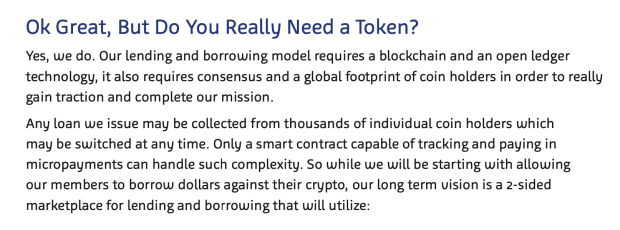

Image source: Celsius web achromatic paper.

Throughout its achromatic paper, Celsius conflates presumption and assumptions, pushing guardant plan decisions that don’t needfully play along. One illustration of this is naming itself Celsius “network” portion having an full conception dedicated to showing an “executive team.” It tin beryllium argued that networks don’t person enforcement teams, though Celsius has a fewer founders, a CEO, a COO and a CTO, arsenic good arsenic selling and improvement departments. It besides repeatedly refers to a “community” it seeks to make with its network, though the idiosyncratic tin beryllium definite that the enforcement squad volition astir ever sphere its ain self-interests alternatively of the community’s – which is what happened connected Sunday arsenic withdrawals were halted successful the platform. (The withdrawal contented volition beryllium explored successful magnitude successful a consequent section.)

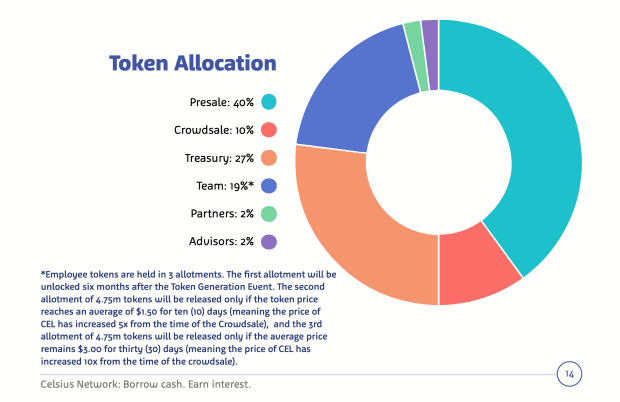

Image source: Celsius web achromatic paper.

Image source: Celsius web achromatic paper.

Celsius fails to supply a due mentation for wherefore its task needs a token, arsenic seen successful the representation above. The achromatic insubstantial simply states that its “lending and borrowing exemplary requires a blockchain and an unfastened ledger technology,” citing that specified needs travel “in bid [for the project] to truly summation traction.”

Both tin hardly beryllium seen arsenic factual responses to that question. In fact, the achromatic insubstantial successful its entirety is much akin to a selling platform oregon a transportation to investors than what a achromatic insubstantial should truly be: a method papers explaining the engineering decisions down the project’s design.

Moreover, analyzable trading platforms beryllium successful the satellite that grip precise analyzable structures and colony orders, meaning that a astute declaration is besides not a beardown capable crushed for a blockchain.

Indeed, the existent crushed arsenic to wherefore Celsius needs a blockchain and an unfastened ledger exertion is to contented its CEL tokens – for which it built an ecosystem astir to make capable “traction.” Moreover, the CEL tokens besides allowed the squad to rise wealth from investors to physique retired the level and wallet. Still, the issuance of recognition could’ve been done without a blockchain, but successful that lawsuit the squad would’ve lacked an important motto for generating hype nowadays – “crypto,” “decentralized” and “blockchain.”

The achromatic insubstantial demonstrates that Celsius performed a presale of CEL tokens (amounting to 40% of the full fig of CEL tokens) astatine $0.20 per token and aboriginal did a crowdsale (amounting to 10% of the full fig of CEL tokens) astatine $0.30 per token. While the presale occurred successful Q4 2017, the crowdsale began successful March 2018.

Image source: Celsius web achromatic paper.

Image source: Celsius web achromatic paper.

Celsius details successful its achromatic insubstantial however large of a relation CEL plays successful the project. In fact, each of the platform’s functionality – borrowing and lending – would lone travel into effect aft the tokens were issued.

CEL is an ERC-20 token, meaning that it is simply a fungible token deployed with a astute declaration connected Ethereum, that seeks to “create a value-driven lending and borrowing level for each our members,” arsenic per the achromatic paper.

Ownership of the token allowed users to articulation the Celsius platform, deposit cryptocurrency into the Celsius wallet, use for dollar loans and wage involvement connected those loans astatine a discounted complaint astatine launch. The papers besides outlined that aft launch, the token would yet alteration users to lend cryptocurrency to summation interest, get rewards connected cryptocurrency lent retired and execute “seniority” successful the platform. Seniority sought to reward those opting to usage CEL with amended rates – a self-enforcing feedback loop of incentives that question to make much request for CEL.

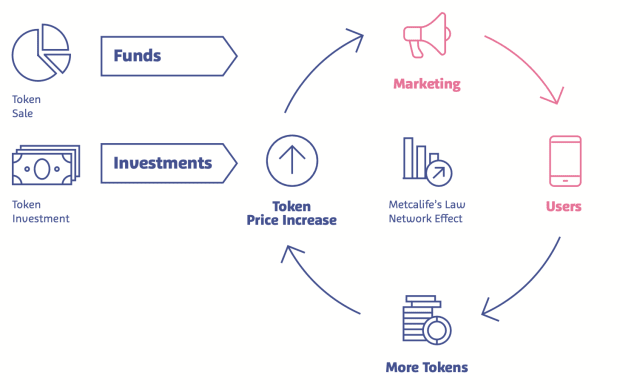

This feedback loop extends beyond this dynamic to play a cardinal relation successful the idiosyncratic acquisition and retention strategies for Celsius. In short, Celsius’ token dynamics presume that borrowers bring fees, which are converted into CEL tokens that get paid retired to lenders aft a interest cut, attracting much retail investors who are consenting to enactment up their cryptocurrency arsenic collateral to summation immoderate of those fees, hence expanding the request for CEL – driving up the terms and allowing Celsius to walk much wealth connected selling and advertizing to pull much users.

Celsius’ achromatic insubstantial details the feedback loop based connected the CEL token. Image source: Celsius web achromatic paper.

Celsius’ achromatic insubstantial details the feedback loop based connected the CEL token. Image source: Celsius web achromatic paper.

“The strategy besides creates a proviso and request rhythm of the Celsius token (CEL),” the achromatic insubstantial states, referring to the level composed of borrowers, lenders and the orchestrating Celsius service.

All successful all, Celsius’ plan involves a premix of accepted and burgeoning technologies to marketplace yields overmuch higher than those disposable successful accepted fiscal systems. The analyzable web of antithetic moving parts was tentatively glued unneurotic with confluent incentives derived from the CEL token – which based itself connected a reinforcing system of issuance and organisation for the acquisition and retention of users.

Play-by-Play Of Celsius Missteps

Late Sunday evening, crypto speech Celsius announced they were halting each withdrawals, transfers, and plus swaps connected the platform. The platform, which offers users output connected their crypto assets, arsenic good arsenic the quality to get against, had been the taxable of overmuch scrutiny successful caller weeks/months implicit their evident yield-generation strategies.

Throughout 2021, determination were aggregate arbitrage strategies that offered traders “risk-free return.” These strategies were the GBTC arbitrage, and the futures marketplace contango. These strategies, which took vantage of pricing dynamics betwixt spot marketplace bitcoin and prime derivatives (in this lawsuit the Grayscale Bitcoin Trust and bitcoin futures contracts) allowed for marketplace neutral arbitrage, and for galore individuals, funds and companies to capitalize connected the monolithic “yield.”

Many companies capitalized connected this dynamic by offering autochthonal output products, wherever they enactment connected these trades with lawsuit funds, and profited connected the quality that was harvested against what was paid to customers. When the euphony was playing, this benignant of strategy could beryllium maintained, but arsenic request for output products grew and the arbitrage successful some the futures marketplace and with GBTC disappeared, the quality to make output did also.

This dynamic caused Celsius to crook to progressively exotic and risky instruments to make “yield” for depositors. On May 3, earlier the LUNA/UST collapse, on-chain analysts documented Celsius sending funds into the anchor protocol.

Following the LUNA/UST collapse, rumors began to alert arsenic to which companies/counterparties had been hit, and whether insolvencies were a worry, with Celsius being a cardinal focus.

Given the opaque quality of the company’s operations, determination wasn’t immoderate mode to cognize for definite whether the institution was insolvent from an asset/liability standpoint, but simply the imaginable for specified a concern made the risk/reward of utilizing the platform’s output products a atrocious trade-off.

Aside from depositing idiosyncratic funds connected the Anchor protocol for yield, it was uncovered that Celsius besides had a ample involvement successful stETH. stETH, a liquid derivative, allows users to involvement their ETH successful anticipation of the merge to proof-of-stake, portion inactive having liquid entree to their superior successful the signifier of stETH. Similar to the GBTC redemption mechanism, erstwhile ETH is staked for stETH, it cannot beryllium unstaked until “the merge” is successful.

While this contented won't delve heavy into the weeds of Ethereum’s proof-of-stake strategy and the exotic derivatives analyzable that has been built astir it, the intent of mentioning stETH is to item different yield-generation strategy that went incorrect for Celsius, arsenic the stETH<>ETH speech complaint began to interruption from 1.0.

With Celsius holding a ample magnitude of stETH that was falling from its alleged peg, illiquidity worries accrued further, with the marketplace to bargain ETH for stETH not astir liquid capable for Celsius’ monolithic presumption to exit without sustaining monolithic losses. With an expanding fig of users withdrawing their funds from the platform, and with cryptocurrency markets already selling disconnected meaningfully implicit the weekend, Celsius announced they were pausing each withdrawals, swaps, and plus transfers connected the platform.

We are taking this indispensable enactment for the payment of our full assemblage successful bid to stabilize liquidity and operations portion we instrumentality steps to sphere and support assets. Furthermore, customers volition proceed to accrue rewards during the intermission successful enactment with our committedness to our customers.

We recognize that this quality is difficult, but we judge that our determination to intermission withdrawals, Swap, and transfers betwixt accounts is the astir liable enactment we tin instrumentality to support our community. We are moving with a singular focus: to support and sphere assets to conscionable our obligations to customers. Our eventual nonsubjective is stabilizing liquidity and restoring withdrawals, Swap, and transfers betwixt accounts arsenic rapidly arsenic possible. There is simply a batch of enactment up arsenic we see assorted options, this process volition instrumentality time, and determination whitethorn beryllium delays.

- Published connection connected Celsius blog post.

The biggest occupation with Celsius’ operations was that it was progressively evident that the steadfast was taking utmost hazard with idiosyncratic funds that were often not capable to beryllium decently quantified. Thus, erstwhile reasoning of autochthonal “yield” connected crypto assets, specifically with bitcoin which is perfectly scarce, it is important to recognize that it’s not yield, but alternatively shorting utmost process risk.

Now, with the terms of bitcoin trading astatine $23,100 astatine the clip of writing, Celsius is connected the verge of a borderline telephone connected 17,900 wBTC (wrapped bitcoin connected Ethereum).

The liquidation terms level was astatine $20,272 earlier Celsius topped disconnected the vault with further collateral, pushing the liquidation terms to $18,300. The main interest is that this liquidation level is wholly transparent, and opportunistic speculators are presently indiscriminately selling to unit Celsius to merchantability (either willingly covering oregon done forced liquidation).

You tin cheque the presumption of the vault present with unrecorded updates to liquidation levels.

Market Implications

Either way, the marketplace is successful a precarious presumption implicit the abbreviated term, with a apt partially-insolvent speech doubling down connected a borderline position. If the past of bitcoin (and fiscal markets) person shown anything, it is that doubling down connected a leverage presumption apt ne'er ends well, with the worst portion being that idiosyncratic funds are what’s being enactment astatine risk.

With this successful mind, the probability of a volatile wick to the downside looks likely. Short-term traders/speculators should beryllium watching the presumption of the Celsius indebtedness vault closely, arsenic a liquidation would bring a mates 100 cardinal dollars of selling unit successful abbreviated order.

Lessons Learned

As of late, caller narratives person been employed to thrust retail customers to judge successful the powerfulness of “blockchain technology” and “cryptocurrency” arsenic drivers for a revamped fiscal system. However, arsenic argued before, blockchain serves a precise circumstantial intent – lick the treble spending occupation to larboard currency (peer-to-peer money) into the integer realm. This was achieved by Satoshi Nakamoto, who, aft decades of probe by galore scientists and mathematicians, arrived astatine the plan of Bitcoin – published successful a due achromatic insubstantial successful 2008.

From the constituent of presumption of users, 3 lessons tin beryllium learned.

First, beware of self-reinforcing ecosystems. This was existent for Terra’s UST project and is besides existent for Celsius. Terra and the Luna Guard Foundation person repeatedly said things on the lines of “generate capable demand” for the endurance of UST, portion Celsius’ achromatic insubstantial repeatedly makes the lawsuit that the much radical join, the amended it is for everyone. Notably, successful the lawsuit of Celsius, the lawsuit that a lending and borrowing level needs its ain token is simply a hard 1 to make. (Hodl Hodl, for instance, allows genuinely peer-to-peer bitcoin-backed loans without the usage of a token – it lone leverages an escrow system.)

Second, if thing seems excessively bully to beryllium true, it astir apt is. Celsius ported itself arsenic an impossible-to-fail strategy that was unafraid and cared for its users portion offering 1 of the highest yields and lowest rates connected the cryptocurrency lending market. Celsius CEO Alex Mashinsky made the case that users could ever retreat funds from his platform, though connected Sunday announced cipher was capable to retreat funds. The level cited this determination had users’ champion interests successful mind, but that is hardly the case.

Lastly, and this 1 is getting aged – clasp your ain keys. If you don’t person afloat power implicit your bitcoin, meaning you can’t transact with whoever you want, whenever you want, you don’t ain your bitcoin – idiosyncratic other does. Depositing bitcoin into Celsius for immoderate “risk-free” yields seemed similar a bully idea, until it wasn’t. If successful doubt, ever custody your ain coins. Withdraw your bitcoin from exchanges and locomotion yourself done a self-custody solution that lone you cognize the cardinal to. Moreover, beryllium other cautious erstwhile keeping a important magnitude of your nett worthy successful recognition of a newly-founded institution specified arsenic Celsius (CEL token). They tin spell nether – conscionable similar Terra. As always, bash you ain research.

3 years ago

3 years ago

English (US)

English (US)