Bankrupt crypto lender Celsius volition unstake 206,300 Ethereum, worthy astir $470 million, arsenic portion of efforts to facilitate the organisation of assets to creditors, according to a Jan. 4 statement connected societal media level X (formerly Twitter).

Celsius said the planned “significant” unstaking lawsuit volition hap successful the adjacent fewer days and further revealed that its staked Ethereum holdings provided the failed institution a “valuable staking rewards income” to offset definite costs incurred passim its restructuring process.

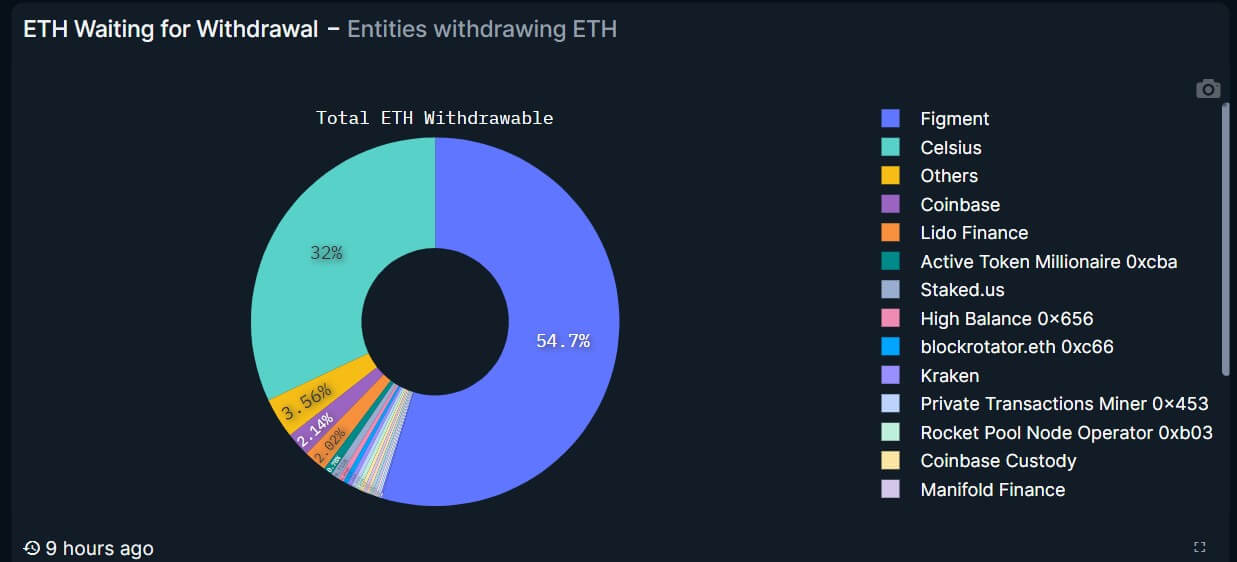

Following the news, Nansen’s Ethereum Shanghai (Shapella) Upgrade dashboard shows that the lender wants to retreat 206,300 ETH, oregon 32% of each ETH awaiting withdrawal, valued astatine astir $470 million.

Staked Ethereum Pending WIthdrawals (Source: Nansen)

Staked Ethereum Pending WIthdrawals (Source: Nansen)The dashboard further shows that the steadfast is among the apical 10 firms that person withdrawn their staked ETH since withdrawals were enabled past year. Celsius has withdrawn a full of 40,249 ETH arsenic of property time.

Additionally, Celsius’s determination has led to a notable surge successful the Ethereum validator exit queue. According to information from beaconcha.in, the queue has spiked to implicit 16,000 today, a grounds high, and the waiting clip has extended to astir six days.

Meanwhile, the caller announcement signifies advancement successful Celsius’s restructuring travel and the imminent instrumentality of customers’ assets. The tribunal has already approved a restructuring program that could alteration creditors to retrieve up to 79% of their holdings.

Nevertheless, criticisms person emerged owed to the lack of a disclosed effectual organisation date, with customers expressing weariness implicit continual mentation updates.

What does this mean for ETH price?

Crypto assemblage members are acrophobic that Celsius’s determination mightiness increase the selling unit connected the second-largest integer plus by marketplace capitalization.

Last December, CryptoSlate reported that the bankrupt lender sold $250 cardinal of integer assets, including Ethereum, successful 30 days. At the time, observers suggested that the steadfast was selling to capitalize MiningCo, a Bitcoin mining institution that creditors of the failed steadfast would own.

However, Celsius said, “Eligible creditors volition person in-kind distributions of BTC and ETH arsenic outlined successful the approved Plan.”

The station Celsius to unstake $470M Ethereum amid restructuring efforts, raising marketplace concerns appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)