Central banks astir the satellite maintained their appetite for golden successful the 3rd 4th of 2023, with their purchases totaling 337 metric tons, the World Gold Council’s (WGC) third-quarter study shows. Analysts from the assembly suggest that this dependable cardinal slope enactment is indicative of a sustained, beardown request for gold, which whitethorn pb to a beardown year-end full for 2023.

World Gold Council Report Shows Central Banks Boost Gold Holdings Amid Economic Shifts

The fig of 337 metric tons of gold came adjacent to but did not surpass the grounds acceptable successful the 3rd 4th of 2022. However, it has pushed the year-to-date purchases to a grounds precocious of 800 metric tons. The WGC study states that specified accordant cardinal slope enactment signals ongoing request for gold, perchance starring to different beardown year-end full for 2023.

On Friday, the price of gold per ounce reached a precocious of $2,002 but has since fallen beneath the $2,000 mark. Over the past 30 days, golden has gained much than 9% against the U.S. dollar, and it has accrued 22% implicit the past 12 months. In the report, the WGC notes that cardinal slope purchases person go a cardinal operator of demand.

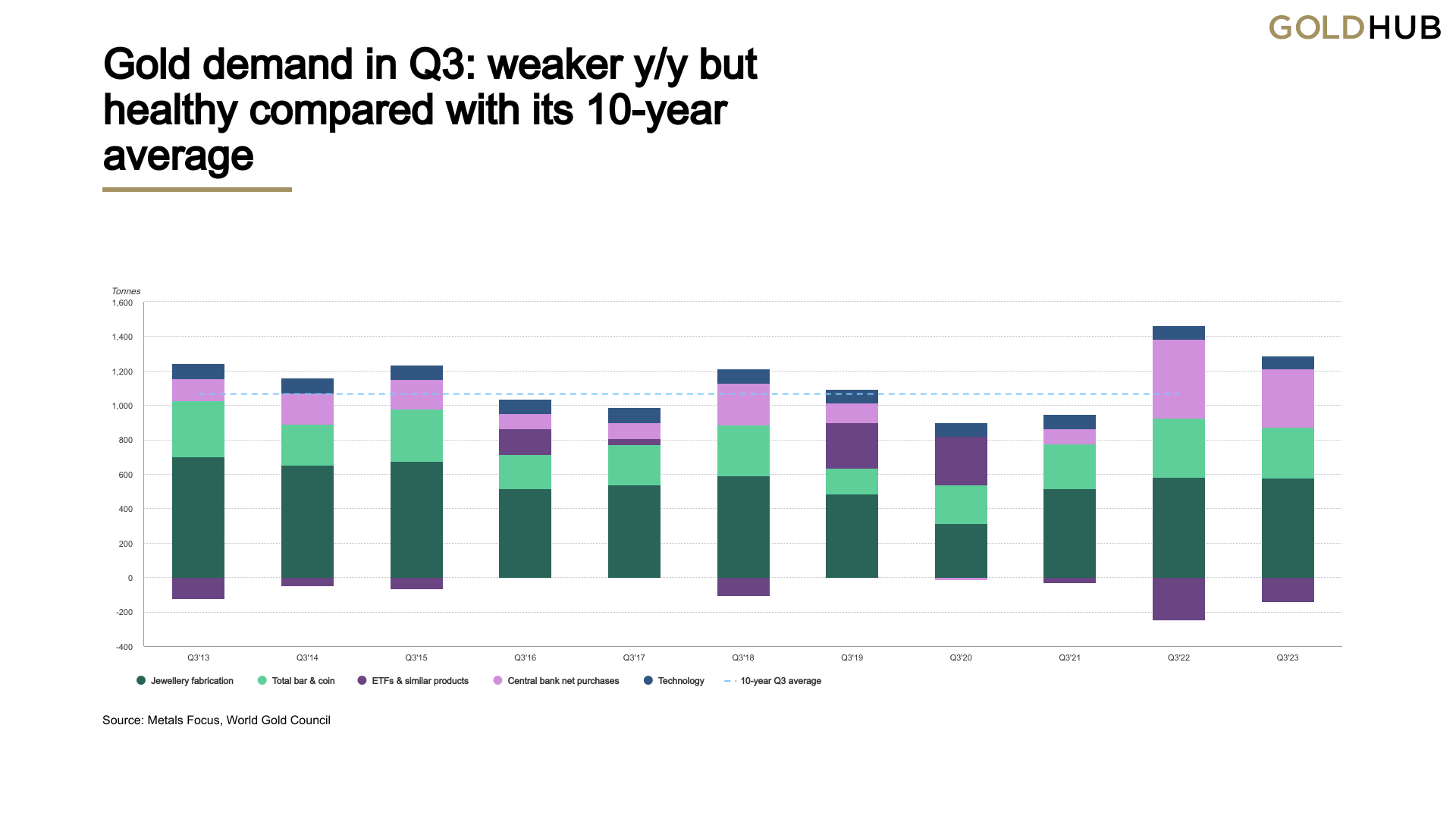

The council’s study besides notes that, erstwhile excluding over-the-counter (OTC) transactions, golden request successful the 3rd 4th exceeded its five-year mean by 8%, contempt a 6% year-over-year decrease, totaling 1,147 metric tons. When including OTC and banal flows, wide request roseate 6% from the erstwhile year, reaching 1,267 metric tons.

The study goes connected to accidental that golden concern request successful the 3rd 4th was 157 metric tons, a 56% summation from the erstwhile year, though it fell abbreviated of the five-year mean of 315 metric tons. Gold exchange-traded funds (ETFs) astir the satellite experienced a alteration of 139 metric tons successful the 3rd quarter, which, portion notable, was little than the 244-ton outflow seen successful the aforesaid 4th of the erstwhile year.

Louise Street, the elder markets expert astatine the World Gold Council, summarized the situation: “Gold request has been resilient passim this year, performing good against the headwinds of precocious involvement rates and a beardown U.S. dollar. Our study shows that golden request is steadfast this quarter, compared with its five-year average.”

Beginning successful October 2023, against a backdrop of escalating tensions successful Israel, the worth of precious metals and bitcoin (BTC) has climbed amid mounting economical uncertainty. Over the past month, golden has appreciated by 9.4%, and BTC has surged 25%. Closing retired this week’s trading, U.S. stocks showed resilience, finishing beardown arsenic Treasury yields retreated, with each 4 superior indices ending Friday successful affirmative territory.

What bash you deliberation astir the cardinal slope golden request successful Q3 2023? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)