With little than 2 days near until Ethereum transitions to a Proof-of-Stake system, each eyes are pointed astatine the Merge but galore are inactive disquieted whether it volition alteration the crypto marketplace for the better.

According to the latest study from analytics institution Nansen, the problems a PoS Ethereum volition look aren’t dismissible. However, the institution believes astir concerns are mostly unwarranted arsenic Ethereum volition upwind the tempest and look arsenic a stronger, much resilient chain.

Merging into a much centralized system?

One of the astir heated conversations astir the Merge has been astir the grade of centralization it volition bring to Ethereum.

Nansen reports that astir 80,000 unsocial addresses are acceptable to enactment successful staking connected Ethereum. And portion the fig looks high, looking astatine the scenery of intermediary staking providers shows that determination is rather a spot of centralization taking place.

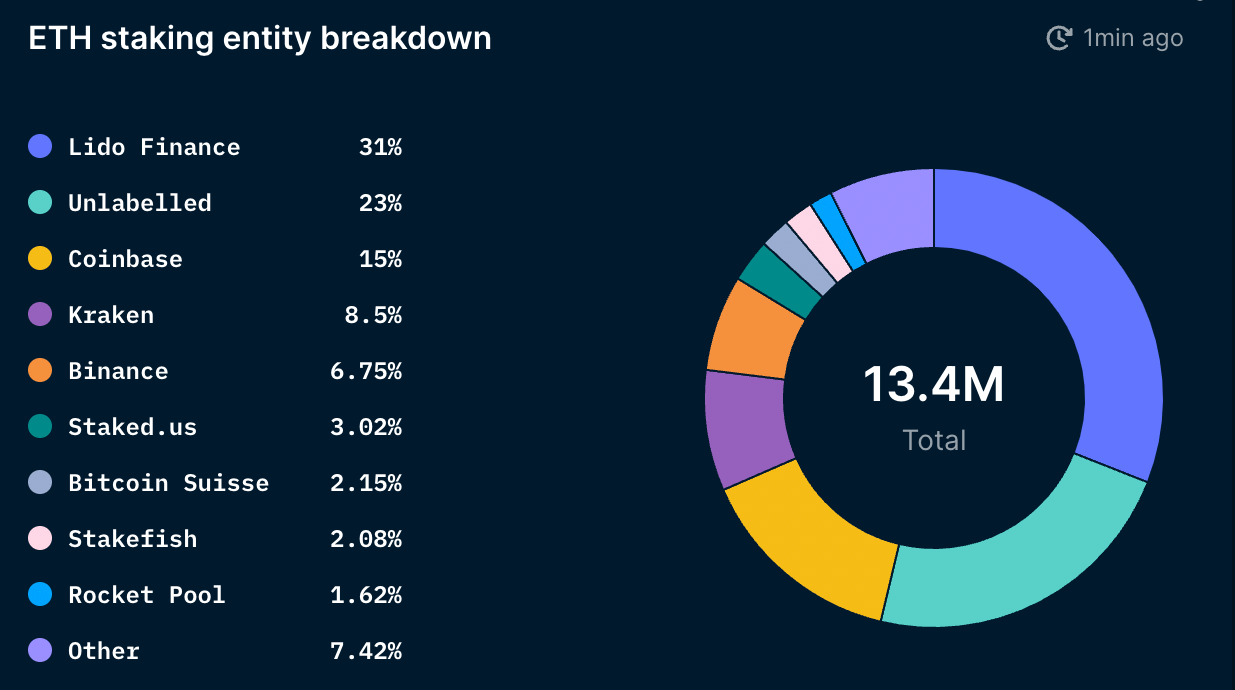

In total, 11.3% of the ETH proviso has been staked, oregon 13.5 cardinal ETH. Lido, a decentralized liquid staking protocol, accounts for 31% of the full staked ETH. Coinbase, Kraken, and Binance person astir 30% of the staked ETH.

Chart showing the organisation of staked ETH by entity (Source: Nansen)

Chart showing the organisation of staked ETH by entity (Source: Nansen)Exchanges similar Coinbase, Kraken, and Binance are required to comply with regulations successful the jurisdictions they run in. This is wherefore the largest portion of the marketplace isn’t focused connected the centralization issues that mightiness originate from them, but alternatively connected the centralization that tin originate from decentralized services similar Lido.

Zooming successful connected the liquid staking solution market, Lido’s stock becomes adjacent higher. According to Nansen, Lido accounts for 47% of liquid-staked ETH, portion Coinbase, Kraken, and Binance unneurotic relationship for 45%. Zooming into liquid staking providers excluding centralized exchanges shows the grade of Lido’s dominance — it accounts for 91% of the liquid staking market.

Lido is simply a work supplier governed by the Lido DAO, acceptable up to let aggregate validator sets. The operation of the DAO makes it hard for regulators to people it, but galore judge Lido’s weakness lies successful its token. Nansen noted successful the study that the centralization of the LDO token ownership whitethorn permission Lido susceptible and exposure it to centralization risks. The apical 9 wallets holding the LDO token clasp 46% of the governance powerfulness and could, successful theory, exert important power connected Ethereum validators.

“If Lido’s marketplace stock continues to rise, it is imaginable that the Lido DAO whitethorn clasp the bulk of the Ethereum validator set. This could let Lido to instrumentality vantage of opportunities similar multi-block MEV, transportation retired profitable artifact re-orgs, and successful the worst-case script censor definite transactions by enforcing oregon rewarding validators to run successful accordance with Lido’s wishes (via governance). This could airs problems for the Ethereum network,” Nansen said successful the report.

It’s important to enactment that Lido is actively moving connected mitigating these centralization risks. The level is considering introducing a dual-governance exemplary with LDO and stETH. But, alternatively than making stETH a governance token, it would lone beryllium utilized to ballot against a Lido connection that could adversely impact stETH holders.

No information of sell-offs and destabilization aft the Merge

Another large interest astir the Merge was the anticipation of it triggering a ample sell-off. In its report, Nansen notes that stakers volition not beryllium capable to dump their ETH connected the market. All of the staked ETH volition beryllium locked until the Shanghai upgrade, which is scheduled to instrumentality spot betwixt 6 and 12 months aft the Merge.

Staking rewards volition besides beryllium hard to sell. According to the report, determination is an exit queue successful spot for validators of astir 6 validators per epoch. With an epoch lasting astir 6.4 minutes, it would instrumentality astir 300 days for the 13 cardinal ETH staked to beryllium withdrawn.

When stakers are yet capable to withdraw, Nansen believes that it volition astir apt beryllium illiquid stakers that sell. The study besides notes that astir selling volition beryllium to instrumentality profits. If the marketplace remains neutral oregon somewhat bullish, astir of the unstaked ETH volition astir apt stay disconnected the market. Even if the bulk of illiquid stakers determine to sell, they lone marque up 18% of the full staked ETH — and astir apt won’t person the powerfulness to determination the marketplace significantly.

According to the report, different bully motion of stableness to travel is the accumulation spree seen among astute wealth wallets and wallets belonging to ETH millionaires and billionaires. Overall, ETH millionaires and billionaires person consistently been stacking Ethereum since the opening of the year. Smart wealth wallets, historically much focused connected trading than consecutive accumulation, besides look to beryllium expanding their holdings since dropping to a yearly debased successful June. This suggests that they are anticipating affirmative terms enactment pursuing the Merge.

Nansen concludes that astir of the things presently troubling Ethereum won’t person a antagonistic effect connected the web pursuing the Merge. The institution notes that contempt the issues with the liquid staking market, the Ethereum web is acceptable to travel retired of the Merge without large hiccups.

“The liquid staking marketplace appears to beryllium trending towards a ‘winner-takes-all’ scenario. However, this result should not harm Ethereum’s halfway worth proposition if the incumbent players are satisfactorily decentralized and decently aligned with the Ethereum community.”

The station Centralization, sell-offs, and web stability: What’s troubling Ethereum up of the Merge? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)