Research steadfast TokenInsight released its Q1 Crypto Exchange Report — showing centralized platforms had a buoyant commencement to 2023.

The report stated that, during the quarter, the full crypto marketplace headdress had grown from $831.8 cardinal to $1.24 trillion — a astir 50% increase. Bitcoin (BTC) jumped astir 100% from $16,000 to a $30,000 precocious during the period.

With that, TokenInsight suggested that crypto wintertime whitethorn beryllium thawing — recommending readers usage speech metrics to assistance marque up their minds.

“With the terms of Bitcoin rising from $16,000 astatine the opening of the twelvemonth to a precocious of $30,000, it looks similar wintertime is implicit for the Crypto industry. But erstwhile volition the bull marketplace really arrive? Perhaps the astir intuitive reply comes from the information connected the exchanges.”

Crypto Trading Volume

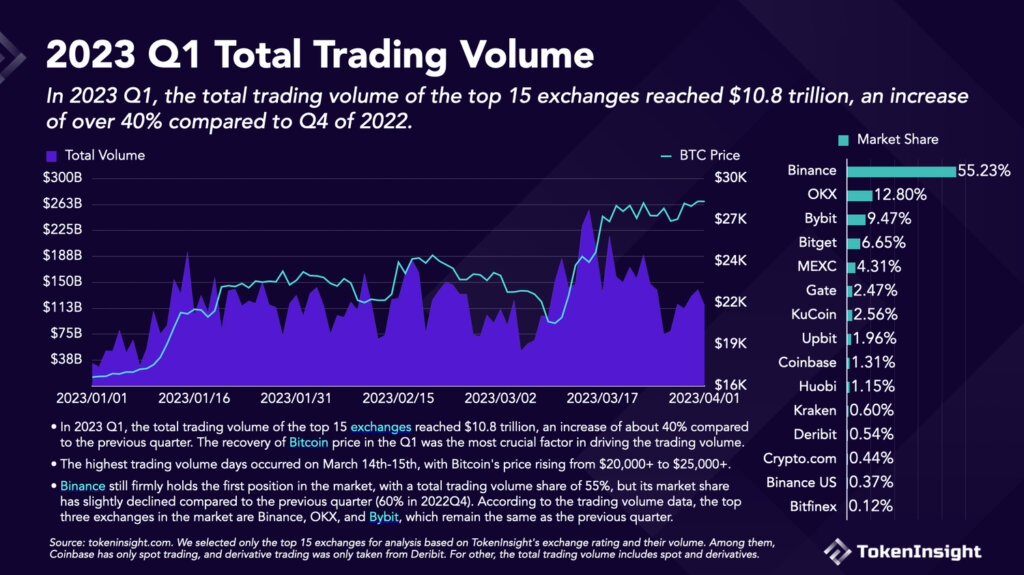

Q1 2023 full trading measurement for the apical 15 crypto exchanges showed a 40% summation to $10.8 cardinal versus the anterior quarter.

The play astir March 14-15 saw the astir important increases successful regular measurement — arsenic the terms of Bitcoin recovered from the banking situation fallout — apt driven by realizations of fiat fragility and the request for harder assets.

Binance maintained its dominance passim the quarter, taking much than fractional the marketplace stock astatine 55%. However, TokenInsight pointed retired that successful Q4 2022, Binance held a 60% marketplace stock — suggesting caller regulatory enforcement actions and rumors of insolvency person had an impact.

Source: TokenInsight.com

Source: TokenInsight.comOther speech metrics

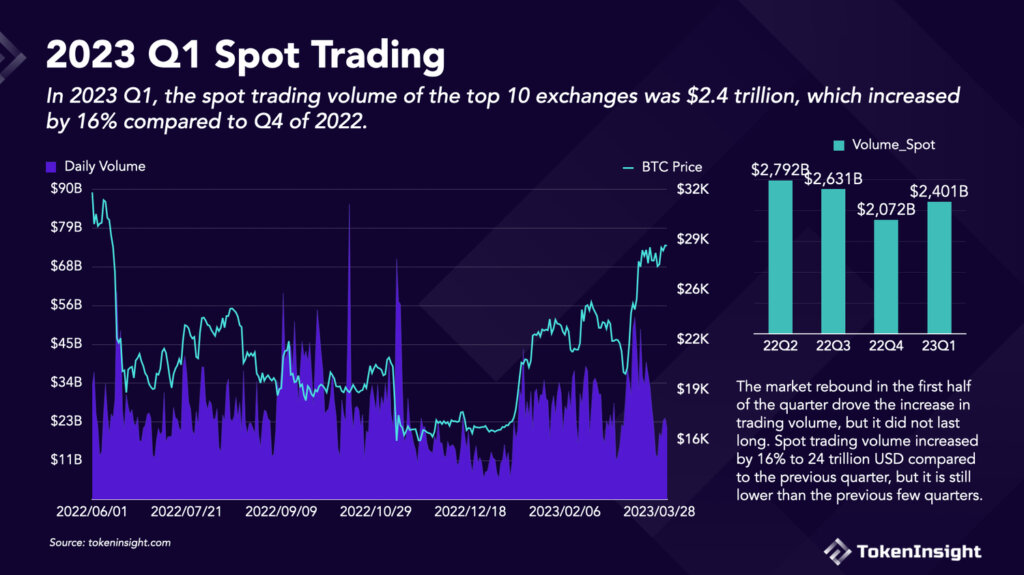

Spot measurement for the apical 10 crypto exchanges accrued by 16% implicit the anterior 4th to $2.4 trillion. However, this is inactive down versus Q3 and Q2 2022 — which were $2.6 trillion and $2.8 trillion, respectively.

Source: TokenInsight.com

Source: TokenInsight.comThe aforesaid signifier is repeated with derivatives volume, with Q1 2023 showing a 30% summation connected the anterior 4th to $7.8 trillion. But inactive down compared to Q3 2022 astatine $8.4 trillion and Q2 2022 astatine $10 trillion.

Source: TokenInsights.com

Source: TokenInsights.comExchange tokens

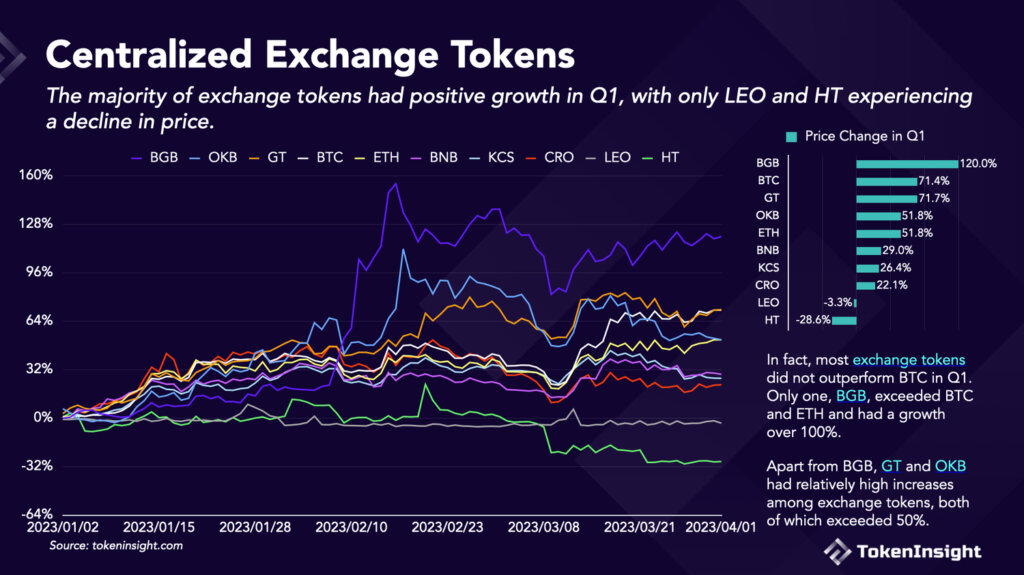

Given the spate of centralized concern (CeFi) bankruptcies successful 2022, speech tokens had garnered a atrocious reputation.

Case successful point, FTX’s FTT token was utilized to prop up the exchange’s equilibrium expanse — enabling the steadfast to get against the token. This worked good until panic selling tanked the worth of FTT, meaning FTT collateralized loans mislaid their backing and became worthless.

Nonetheless, the illustration beneath shows a instrumentality successful assurance successful speech tokens. TokenInsight recovered each but UNUS SED LEO, and Huobi Token saw terms appreciation — with the Bitget Token experiencing 120% maturation during the play to outperform Bitcoin.

GateToken placed second, astir matching Bitcoin’s growth, astatine a 72% summation successful worth during the 4th — the different speech tokens underperformed versus the marketplace leader.

Source: TokenInsight.com

Source: TokenInsight.comThe station Centralized exchanges flourish successful Q1’23: TokenInsights information reveals crypto wintertime whitethorn beryllium thawing appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)