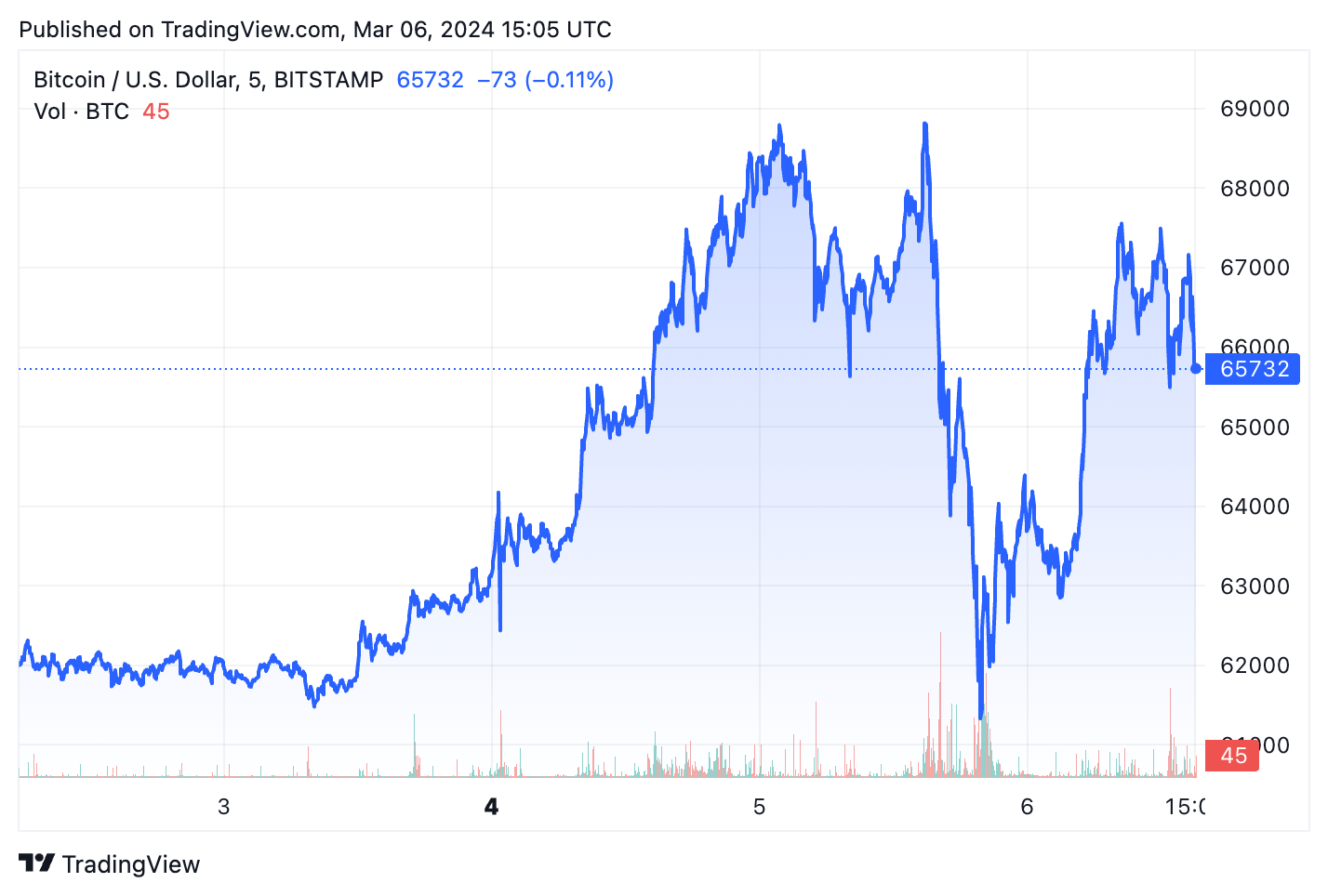

On Mar. 5, Bitcoin reached the all-time precocious it posted successful November 2021, breaking done $69,000 successful the precocious day UTC. However, Bitcoin’s stint astatine its ATH was highly little and was rapidly followed by a crisp 14% correction that pushed its terms down to $59,300. In the aboriginal greeting of Mar. 6, BTC regained immoderate of its mislaid footing but struggled to stabilize astatine $66,000.

Graph showing Bitcoin’s terms from Mar. 2 to Mar. 6, 2024, 15:05 UTC (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from Mar. 2 to Mar. 6, 2024, 15:05 UTC (Source: CryptoSlate BTC)The market’s aggravated terms volatility connected Tuesday, Mar. 5, translated to record-breaking trading volumes crossed centralized exchanges. With small information connected the measurement seen connected OTC desks and a lag successful information availability from spot ETFs, CEX measurement serves arsenic the champion barometer for marketplace enactment erstwhile it comes to Bitcoin.

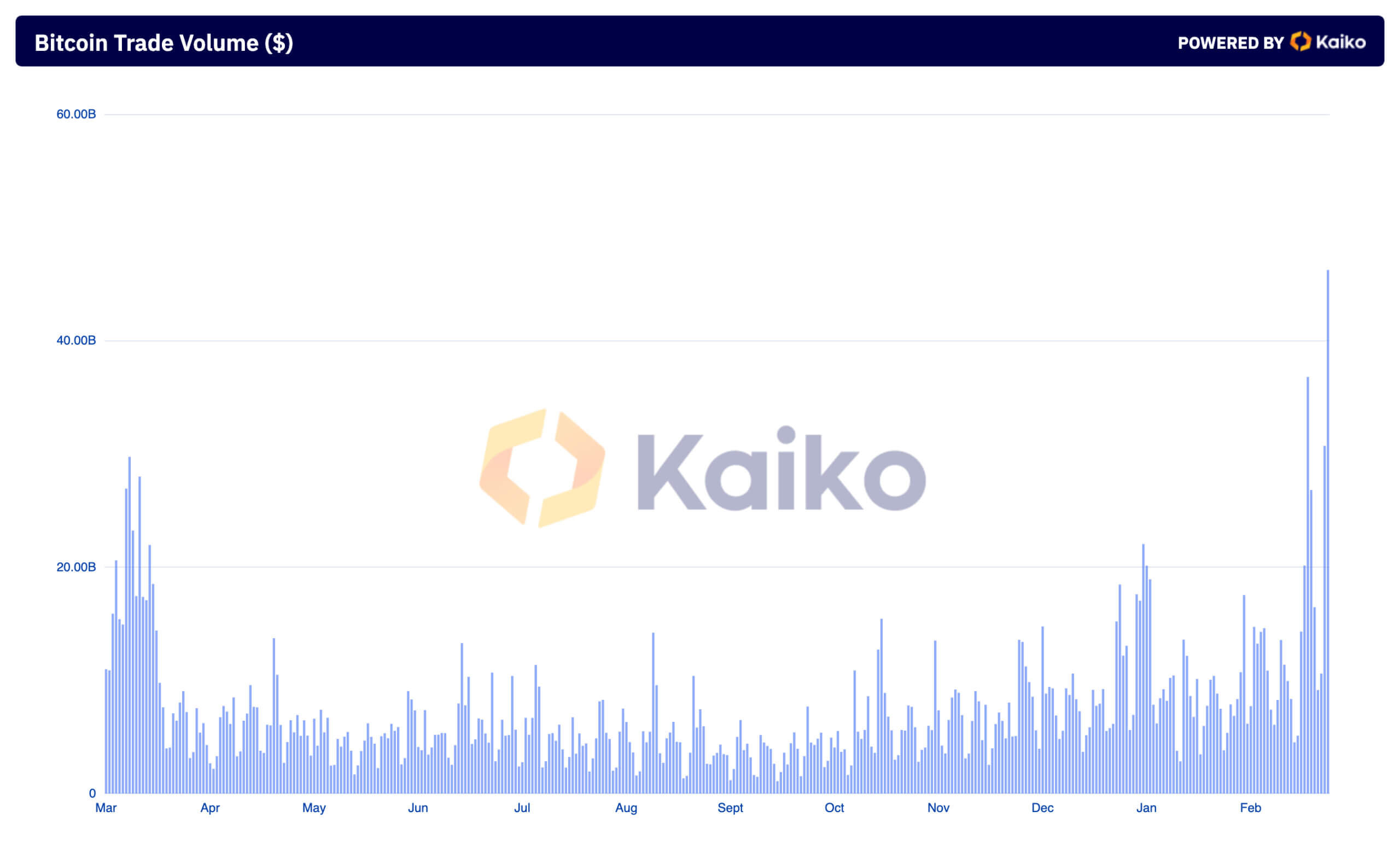

The investigation of Kaiko information by CryptoSlate revealed a 405% summation successful trading measurement successful trading measurement betwixt Mar. 2 and Mar. 5 — rising from $9.15 cardinal to $46.25 billion. This surge followed Bitcoin’s volatile terms action, showing an assertive absorption from traders to terms fluctuations.

Graph showing Bitcoin trading measurement connected centralized exchanges from Mar. 7, 2023, to Mar. 5, 2024 (Source: Kaiko)

Graph showing Bitcoin trading measurement connected centralized exchanges from Mar. 7, 2023, to Mar. 5, 2024 (Source: Kaiko)The summation successful trading measurement was mirrored by a maturation successful commercialized count, which escalated from 10.12 cardinal to 32.79 cardinal implicit the aforesaid period. This shows accrued engagement successful the marketplace and perchance a higher influx of retail and organization investors.

The changes seen successful the mean commercialized size further corroborate this. Between Mar. 2 and Mar. 5, the mean commercialized size accrued by implicit 55%, jumping from $904 to $1,410, showing larger superior movements wrong the marketplace arsenic traders rushed to capitalize connected the terms volatility.

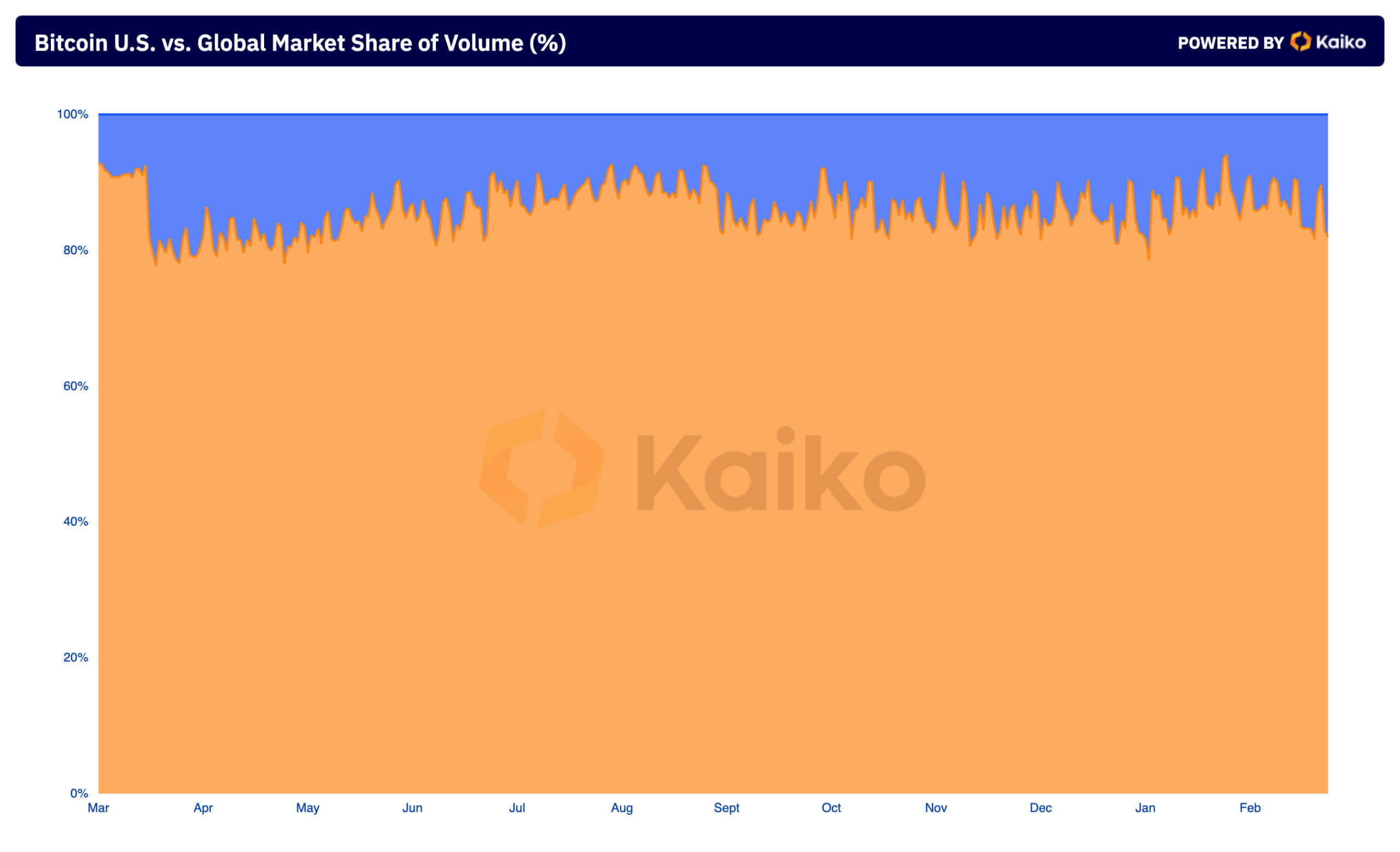

Analyzing the organisation of trading measurement betwixt US and planetary markets shows wherever astir of this measurement was coming from. The planetary marketplace has consistently dominated Bitcoin trading volume, arsenic antecedently covered by CryptoSlate. However, the US market’s stock of the measurement accrued from 11.6% connected Mar. 2 to 18.05% by Mar. 5, showing a important summation successful involvement from US-based investors during this volatile period.

Graph showing the organisation of Bitcoin trading measurement crossed planetary and US markets from Mar. 7, 2023, to Mar. 5, 2024 (Source: Kaiko)

Graph showing the organisation of Bitcoin trading measurement crossed planetary and US markets from Mar. 7, 2023, to Mar. 5, 2024 (Source: Kaiko)Keeping up with the semipermanent trend, Binance commanded a important bulk of the planetary trading measurement with 51.54%, portion Coinbase led the US speech marketplace with a 57.89% share. Binance and Coinbase’s dominance implicit the crypto marketplace has been well-known for years, and the 2 exchanges consistently relationship for a important information of planetary trading activity. The precocious attraction of trading connected the 2 exchanges, peculiarly during this week’s precocious volatility, shows traders similar to instrumentality to platforms with precocious liquidity and a large name.

Coinbase’s caller issues with relationship balances impacted the fig of trades executed done the platform, starring to a important outflow of BTC from the exchange. However, the interaction connected the wide trading measurement connected the speech seems to person been minimal, arsenic evidenced by Coinbase’s dominance successful the US market.

The aggravated terms volatility experienced during the week attracted important trading activity, drafting successful some existing and caller marketplace participants. The surge successful volume, commercialized count, and commercialized sizes shows traders were aggressively engaging with the market, responding to Bitcoin’s spike with larger commercialized sizes. This enactment shows centralized exchanges’ captious relation successful facilitating liquidity and providing terms discovery, peculiarly during important marketplace movements.

The station CEXs saw record-breaking trading measurement arsenic Bitcoin touched ATH appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)