Oracle web Chainlink's (LINK) autochthonal token sharply rebounded with the broader crypto marketplace pursuing Federal Reserve Chair Jerome Powell's dovish remarks successful Jackson Hole, Wyoming.

LINK rallied 12% implicit the past 24 hours, hitting $27.8, its strongest terms since December. Bitcoin (BTC) appreciated 3.5% during the aforesaid period, portion the broad-market CoinDesk 20 scale jumped 6.5%.

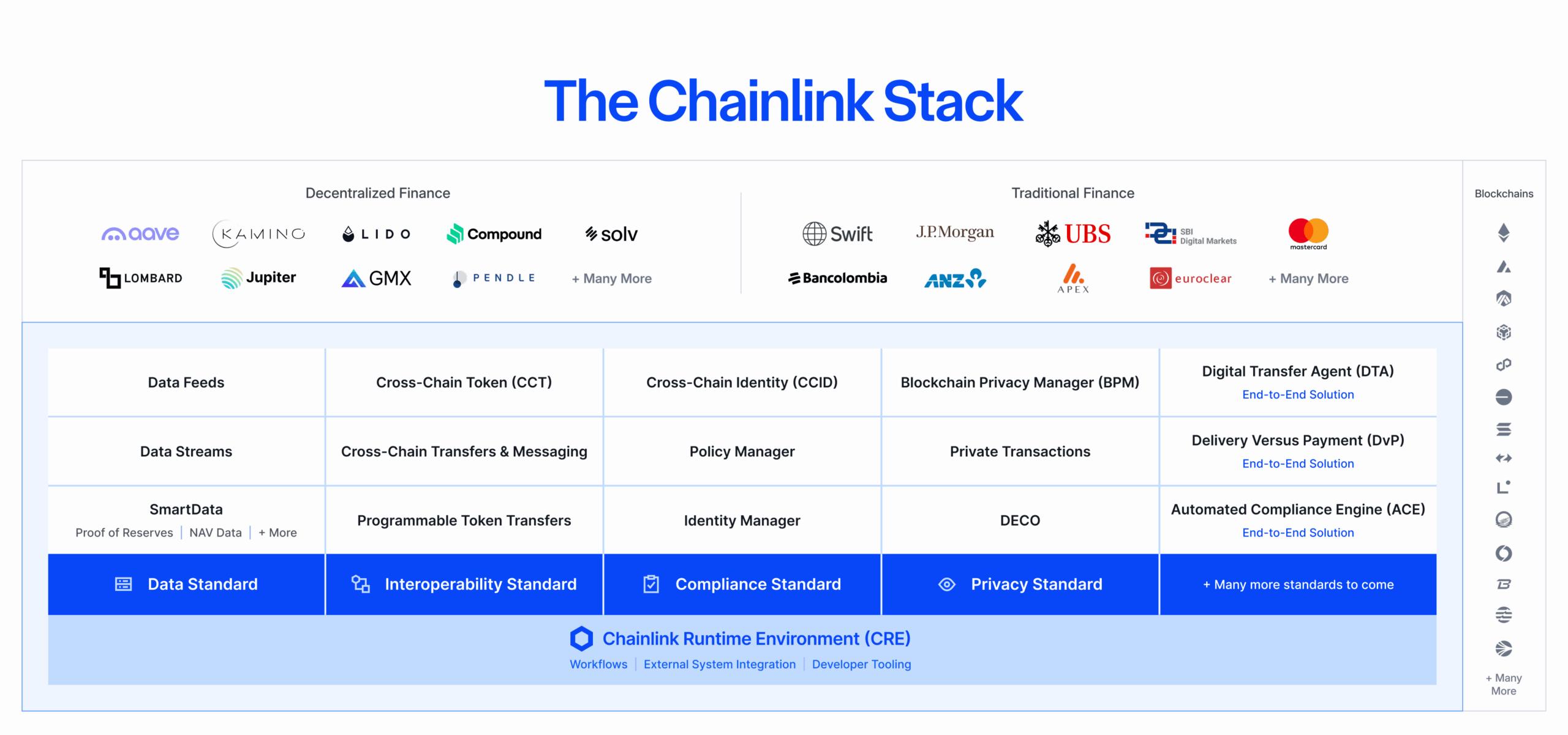

In protocol-specific news, Chainlink obtained 2 large information certifications this week: ISO 27001 and a SOC 2 Type 1 attestation, marking a archetypal for a blockchain oracle platform. The audits, carried retired by Deloitte, covered Chainlink’s terms feeds, proof-of-reserve services and the Cross-Chain Interoperability Protocol (CCIP).

The oracle supplier says the determination strengthens spot successful its information services and tin bolster adoption among banks, plus issuers and decentralized concern protocols.

Further supporting the rally, the Chainlink Reserve, which periodically purchases LINK tokens connected the unfastened marketplace utilizing protocol revenues, bought 41,000 tokens connected Thursday, worthy astir $1 cardinal astatine that time. That brought full holdings to 150,778 tokens, astir $4.1 cardinal astatine existent prices.

Technical analysis

- Support Levels: Substantial defence established astatine $24.15 with high-volume confirmation, according to CoinDesk Research's method investigation data.

- Resistance Penetration: Systematic advancement done $25.00, $25.50, and $26.00 levels with measurement validation from organization participants.

- Trading Volume Analysis: Exceptional 12.84 cardinal measurement surge during breakout phase, representing 5 times the 24-hour mean of 2.44 cardinal units.

- Consolidation Patterns: Extended choky scope consolidation astir $24.70-$25.10 preceding explosive institutional-driven breakout.

- Momentum Indicators: Sustained upward trajectory with measured beforehand characteristics and organization accumulation signals from firm treasury operations.

Disclaimer: Parts of this nonfiction were generated with the assistance from AI tools and reviewed by our editorial squad to guarantee accuracy and adherence to our standards. For much information, see CoinDesk's afloat AI Policy.

3 months ago

3 months ago

English (US)

English (US)