"Wall Street is coming for bitcoin."

That operation utilized to spark some anticipation and fearfulness crossed crypto circles. Today, it's nary longer a aboriginal menace oregon a bullish promise—it's conscionable reality.

The archetypal premise of bitcoin (or crypto successful general)—an plus that is censorship-resistant and doesn't reply to immoderate accepted fiscal instauration oregon government—is fading accelerated arsenic Wall Street giants (as good arsenic almighty governmental figures) proceed to found their beardown foothold successful the integer assets space.

During the aboriginal years of the integer assets revolution, bitcoin was celebrated arsenic uncorrelated and unapologetically anti-establishment. TradFi plus classes similar S&P 500 would emergence and fall—bitcoin didn't care.

What bitcoin did attraction astir were the flaws successful the accepted fiscal system, which are inactive present to this day.

A large illustration successful BTC’s past that’s not-so-talked astir anymore is the 2013 Cyprus banking crisis.

The crisis, which occurred owed to overexposure of banks to overleveraged section spot companies and amid Europe’s indebtedness crisis, saw deposits supra 100,000 euros get a important haircut.

In fact, 47.5% of uninsured deposits were seized. Bitcoin’s effect was to determination sharply upward to, for the archetypal clip successful its history, transverse the $1,000 threshold.

After a prolonged carnivore marketplace implicit the collapse of Mt. Gox, the thought of wide adoption grew, with Wall Street's introduction into the assemblage seen arsenic a stamp of validation for bitcoin arsenic it meant much liquidity, wide adoption and terms maturity.

That changed everything.

The terms mightiness person matured, arsenic evidenced by waning volatility. But let’s look it—bitcoin is present conscionable different macro-driven hazard asset.

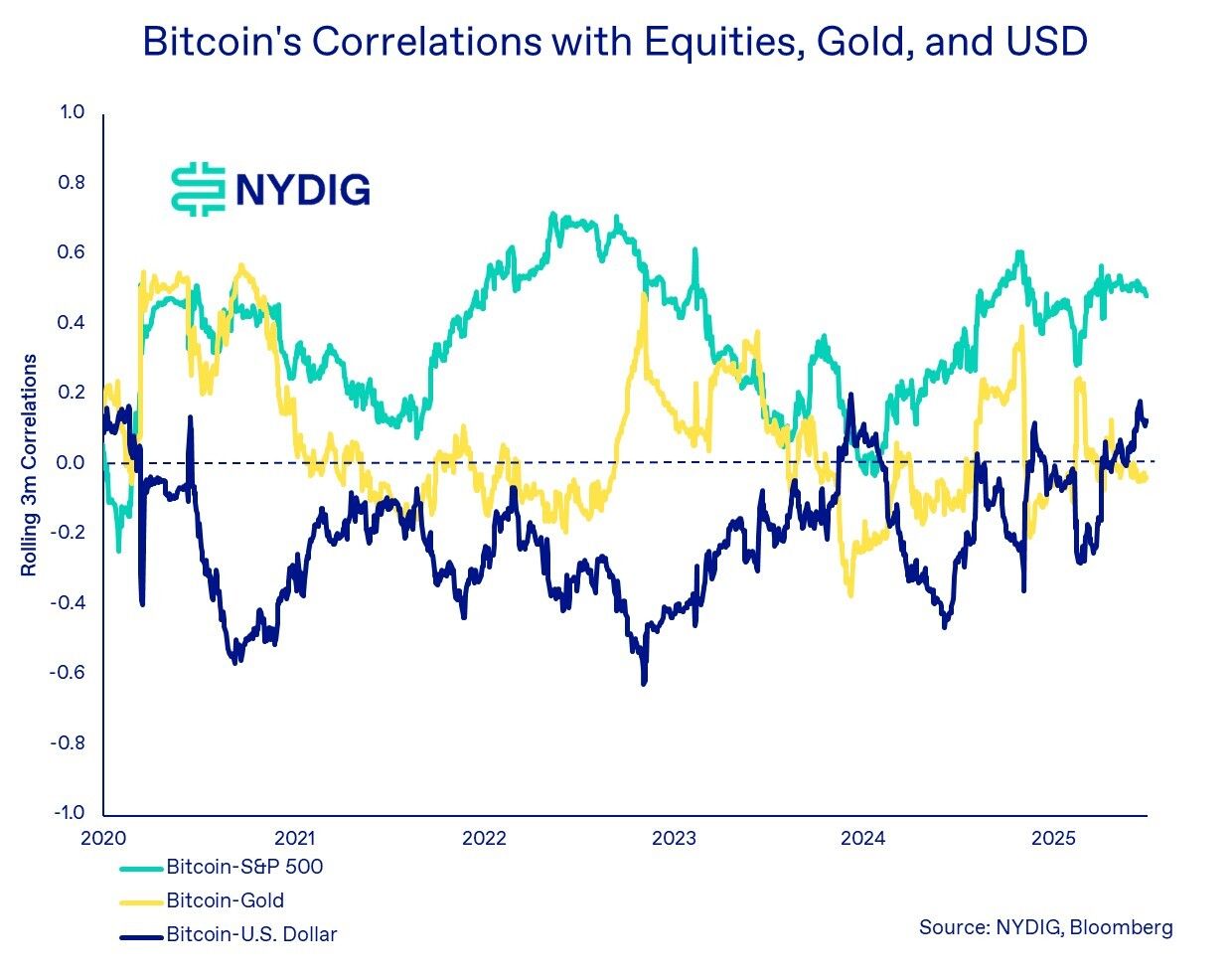

"Bitcoin, erstwhile celebrated for its debased correlation to mainstream fiscal assets, has progressively exhibited sensitivity to the aforesaid variables that thrust equity markets implicit abbreviated clip frames," said NYDIC Research successful a report.

In fact, the correlation is present hovering adjacent the higher extremity of the humanities range, according to NYDIG's calculations. "Bitcoin’s correlation with U.S. equities remained elevated done the extremity of the quarter, closing astatine 0.48, a level adjacent the higher extremity of its humanities range."

Simply put, erstwhile determination is humor connected the thoroughfare (Wall Street that is), bitcoin bleeds too. When Wall Street sneezes, bitcoin catches a cold.

Even bitcoin's “digital gold” moniker is nether pressure.

NYDIG notes that bitcoin’s correlation to carnal golden and the U.S. dollar is adjacent zero. So overmuch for the “hedge” argument—at slightest for now.

Risk asset

So wherefore the shift?

The reply is simple: to Wall Street, bitcoin is conscionable different hazard asset, not integer gold, which is synonymous with "safe haven."

Investors are repricing everything from cardinal slope argumentation whiplash to geopolitical tension—digital assets included.

"This persistent correlation spot with U.S. equities tin mostly beryllium attributed to a bid of macroeconomic and geopolitical developments, the tariff turmoil and the rising fig of planetary conflicts, which importantly influenced capitalist sentiment and plus repricing crossed markets," said NYDIG.

And similar it oregon not, this is present to stay—at slightest for a abbreviated to medium-term.

As agelong arsenic cardinal slope policy, macro, and war-linked reddish headlines deed the tape, bitcoin volition apt determination successful tandem with equities.

"The existent correlation authorities whitethorn persist arsenic agelong arsenic planetary hazard sentiment, cardinal slope policy, and geopolitical flashpoints stay ascendant marketplace narratives," NYDIG's study said.

For the maxis and semipermanent holders, the archetypal imaginativeness hasn't changed. Bitcoin's constricted supply, borderless access, and decentralized quality stay untouched. Just don't expect them to interaction terms enactment conscionable yet.

For now, the marketplace sees bitcoin arsenic conscionable different banal ticker. Just equilibrium your commercialized strategies accordingly.

3 months ago

3 months ago

English (US)

English (US)