Last week, Cambridge University’s Cambridge Centre for Alternative Finance (CCAF) released an update to its heavy cited (and rightfully so) Cambridge Bitcoin Electricity Consumption Index (CBECI), which successful portion looks to uncover and stock the geographic determination breakdown of bitcoin miners globally.

The previous Cambridge update showed that China’s stock of mining went from 34.3% successful June 2021 to 0.0% successful July 2021 pursuing a crypto mining ban successful the country. Last week’s update showed that China’s stock of mining went from 0.0% successful August 2021 to … 22.3% successful September 2021.

Clearly thing is up here, truthful let’s dive in. While we are there, we’ll besides interaction connected 2 different bitcoin mining related topics: 1) hashprice and 2) mining institution woes.

You’re speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Sunday.

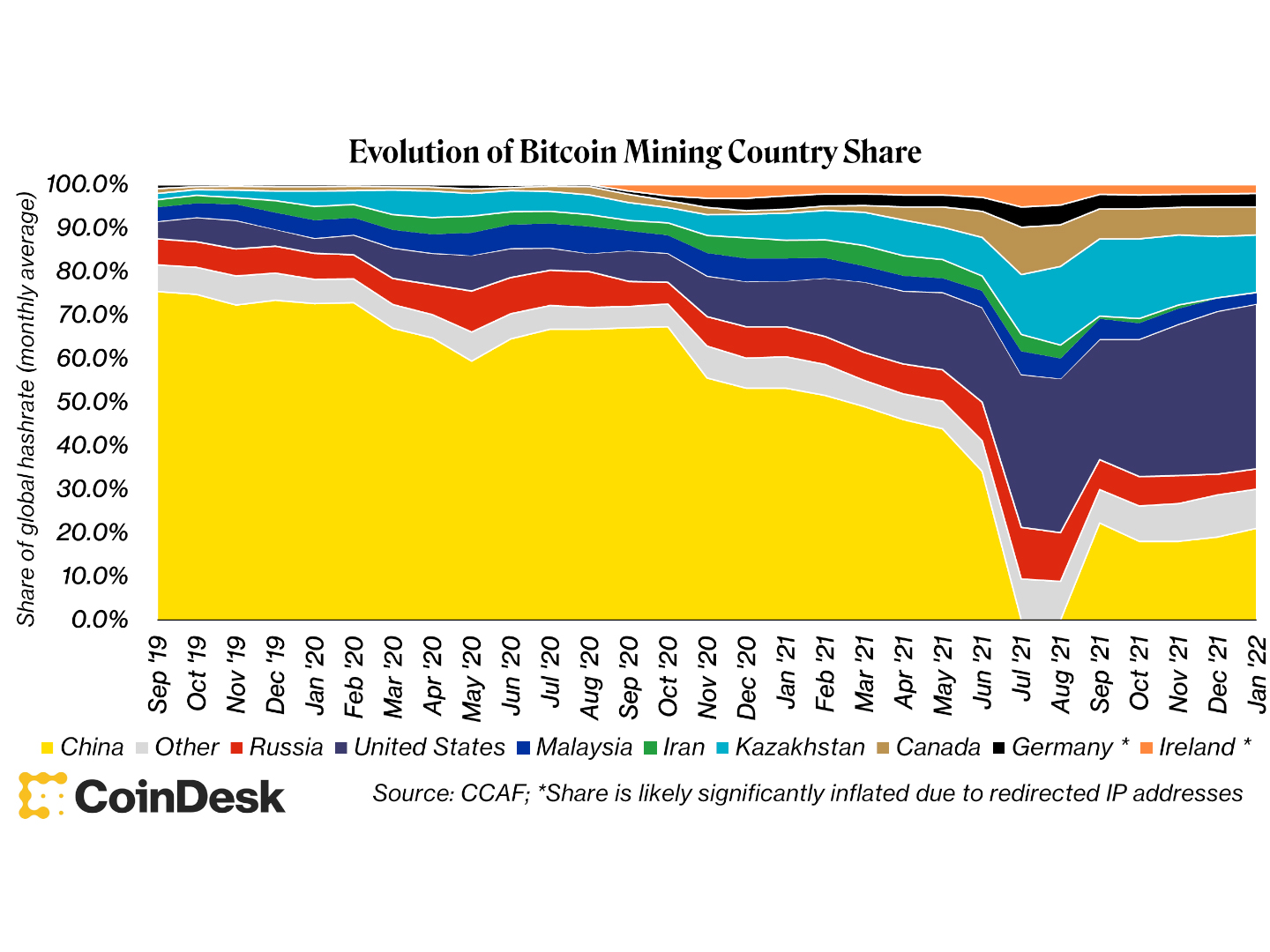

China banned bitcoin mining successful May 2021, and it showed up successful the data. By July, determination were virtually nary miners mining successful China. None successful August either. Then, successful September, astir each the miners who near came back. At least, that’s what the information shows:

(Cambridge Centre for Alternative Finance)

Perhaps it’s not evident truthful I’ll accidental it: That didn’t happen. Moving mining operations isn’t exactly easy. The bulk of mining operations isn't a fistful of hobbyists messing around; Bitcoin has agelong since graduated from that. Most miners are much decently characterized arsenic commercialized operations, paying triple nett leases for warehouse abstraction and depending connected fancy power acquisition agreements for electricity.

Bitcoin mining operations look similar this (check retired this amazing photojournalism effort from my colleagues):

(Sandali Handagama/CoinDesk)

The crushed the information looks similar this is owed to the data postulation method employed by the CCAF. The CCAF partnered with bitcoin mining pools to cod geolocational mining installation information based connected IP addresses (pools let a batch of antithetic miners to lend to mining, and the reward is past divided among them according to their processing publication to creaseless retired idiosyncratic miner income). Therein lies the contented and the CCAF warns arsenic much, stating:

It is nary concealed successful the manufacture that [miners] successful definite locations usage virtual backstage networks (VPNs) oregon proxy services to fell their IP addresses successful bid to obfuscate their location. Such behaviour whitethorn distort the illustration and effect successful an overestimation (or underestimation) of hashrate successful immoderate provinces oregon countries.

So the existent communicative of what I deliberation happened present is really rather boring.

Chinese miners were acrophobic that the authorities crackdown was serious, truthful they lied oregon spoofed their determination information and moved underground.

After immoderate time, Chinese miners realized, “Hey, this doesn’t look that scary,” truthful they felt comfy sharing their existent data.

That’s it. Like I suggested: really rather boring.

That’s not truly the full information though. The much disposable bitcoin mining operators did determination astatine slightest portion of their operations, and the maturation of non-China, mostly U.S.-located mining is good documented. To item that, hashrate – the computational powerfulness of the Bitcoin web – has grown 40% since the China ban. The CCAF, recognizing the oddity of the data, published a wonderfully titled blog post astir their update leaving america with this:

Most notably, however, is China’s evident comeback. Following the authorities prohibition successful June 2021, reported hashrate for the full state efficaciously plummeted to zero during the months of July and August. Yet reported hashrate abruptly surged backmost to 30.47 EH/s successful September 2021, instantly catapulting China to 2nd spot globally successful presumption of installed mining capableness (22.29% of full market). This powerfully suggests that important underground mining enactment has formed successful the country, which empirically confirms what manufacture insiders person agelong been assuming.

The operative connection present being “reported.” So yeah, it turns retired that China tin in information prohibition bitcoin mining again. Here’s to much China FUD (fear, uncertainty, doubt) successful our future. Alternatively, possibly everyone is messing with america and utilizing VPNs to alteration their determination to China to marque my occupation difficult.

Hashprice and mining institution woes

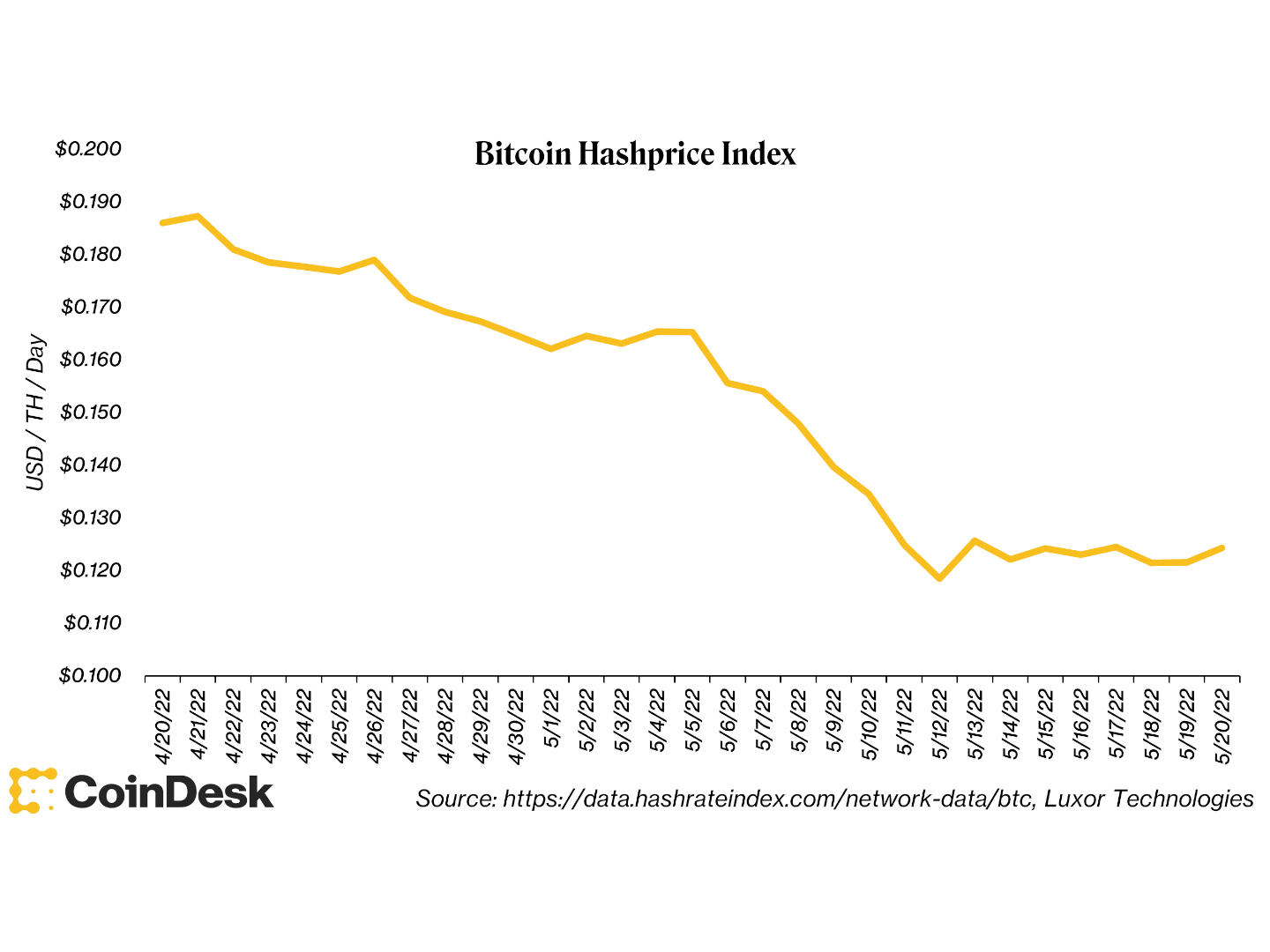

Amid falling bitcoin prices, determination is besides immoderate interest astir bitcoin miners and their profitability. There is simply a metric developed by Luxor Technologies called hashprice which represents the expected worth of mining. Hashprice is expressed arsenic a dollar per terahash per day, a terahash being the computational powerfulness provided by mining equipment. Here is however the past period has fared for hashprice.

(CoinDesk Research, Hashrate Index, Luxor Technologies)

Hashprice has trended down owed to 1) the USD terms of bitcoin falling, 2) much miners coming online and 3) the consequent accrued network difficulty (the web adjusts however hard it is to excavation astir each 2 weeks, based connected the magnitude of progressive mining power). Not precisely rosy, but it makes sense. And the diminution is acting arsenic a forcing relation for mining operators to buckle down oregon unopen down. Many manufacture practitioners are informing that this is the clip erstwhile “only the beardown volition survive.”

In theory, miners crook disconnected their machines whenever bitcoin prices driblet significantly, and it becomes unprofitable to support them running. This time, adjacent though hashprice has decreased, we haven’t seen this benignant of driblet off, and we person the nationalist mining institution filings to beryllium it. Public miners person each publically repped to thing on the lines of, “We are mining bitcoin, we privation to excavation much bitcoin, we are going to clasp arsenic overmuch of the bitcoin we excavation arsenic imaginable and we’re going to usage different sources of superior to money operations and growth.”

That could beryllium fine, but arsenic these miners consciousness much pressure, determination are imaginable obligations to superior providers they mightiness person to reply to. On apical of that, if the marketplace gets worse, these companies whitethorn request to bash something, similar start selling their bitcoin. These aren’t companies with the equilibrium sheets of Apple oregon Google; they much intimately lucifer startups that hap to commercialized connected the nationalist markets.

All said, determination is nary peculiar crushed to interest astir the mining manufacture arsenic a whole. Bitcoin mining volition beryllium fine, but the formed of characters mightiness alteration since the superior markets are disposable up until the infinitesimal they aren’t. Bitcoin volition beryllium amended for it, but determination mightiness beryllium immoderate symptom coming astatine the institution level.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)