Call it impervious of chutzpah.

Chris Larsen, 1 of the co-founders of beleaguered crypto-payments institution Ripple, has devoted a reported $5 cardinal of his idiosyncratic luck to a nationalist run seemingly aimed astatine making Bitcoin greener.

In concern with Greenpeace and different organizations, Larsen is backing a bid of ads implicit the adjacent period calling connected bitcoiners to “Change the Code, not the Climate.” The goal, according to Bloomberg, is to unit the Bitcoin assemblage to marque a modulation distant from power-intensive proof-of-work mining to a proof-of-stake strategy that uses overmuch little energy.

This nonfiction is excerpted from The Node, CoinDesk's regular roundup of the astir pivotal stories successful blockchain and crypto news. You tin subscribe to get the full newsletter here.

At archetypal glance, Larsen’s proposition is appealing. The biology interaction of proof-of-work mining is possibly Bitcoin’s astir substantive drawback and a continuing headwind for the wide nationalist cognition of crypto. For example, the rhetoric of biology harm has helped make large and sometimes misplaced hostility to non-fungible tokens (NFTs) successful the creation world.

But the absorption to Larsen’s effort among manufacture leaders and observers has been disbelief and suspicion. That’s successful portion because, nevertheless lukewarm and fuzzy Larsen’s extremity seems to be, the campaign’s recommendations are highly risky, thoroughly impractical and possibly adjacent nonsensical. More importantly, Larsen’s motives for the connection are highly suspect: After all, arsenic a co-founder of Ripple, helium has arguably spent the past decennary successful contention with Bitcoin.

The archetypal occupation with Larsen’s docket is that switching Bitcoin to proof-of-stake information would impact unthinkable risk. The alteration would beryllium truthful cardinal that it astir apt couldn’t beryllium implemented with a accepted “hard fork,” successful which immoderate web members spell to an incompatible mentation of the Bitcoin software. Hard forks person been utilized to make modified versions of Bitcoin before, astir prominently with the Bitcoin Cash secession from Bitcoin successful 2017.

But Bitcoin Cash and akin forks lone altered method parameters already defined wrong the proof-of-work system, specified arsenic artifact size. A proof-of-stake strategy operates connected fundamentally antithetic information architecture, and truthful alternatively than changing existing parameters, a proof-of-stake-based Bitcoin would apt impact a ground-up redesign. Rather than a specified “fork,” that would impact a overmuch much analyzable task of migrating existing wallet balances to a caller web with the “Bitcoin” name.

Ethereum’s modulation from proof-of-work to proof-of-stake shows what this mightiness look like. Ethereum 2.0 won’t beryllium a nonstop continuation of the existent Ethereum chain, but a managed modulation to a caller system. A “Beacon Chain” for the caller strategy has been moving successful parallel with Ethereum 1.0 for years now, and merging the 2 has been cautiously managed by a beardown halfway radical of Ethereum companies and developers.

There’s small accidental of a likewise aligned and influential radical emerging to negociate specified a modulation for Bitcoin. One crushed is persistent distrust of proof-of-stake information itself: “Proof of Stake is not lone little secure, it is wholly pointless and insecure,” Swan Bitcoin CEO Cory Klippsten argued successful a enactment to CoinDesk. “Without PoW, immoderate strategy volition go political, moving struggle solution to a quorum.”

Many successful the Bitcoin ecosystem besides person interests and agendas that could diverge sharply erstwhile large web changes are connected the table. For instance, bitcoin miners who person spent millions of dollars connected specialized chips called ASICs (application-specific integrated circuits) for proof-of-work mining are radically improbable to enactment a proof-of-stake transition.

Furthermore, arsenic erstwhile CoinDesker Noelle Acheson points out, genuinely transitioning Bitcoin to a caller exemplary would apt necessitate convincing each those miners to halt extending the proof-of-work chain. That would successful crook necessitate persuading exchanges worldwide to halt trading tokens from the PoW concatenation – a astir intolerable task.

These realities assistance explicate wherefore Larsen’s connection has been met not conscionable with disagreement from bitcoiners, but with vociferous and often highly idiosyncratic repudiation. Bitcoin, conscionable similar Twitter oregon Facebook, depends importantly connected “network effects” – it is much useful, the much radical usage it. While a connection similar Larsen’s mightiness person zero accidental of convincing each bitcoiner to power to a caller proof-of-stake system, it mightiness sway immoderate of them, triggering a “hard fork” successful the community, if not successful the web proper.

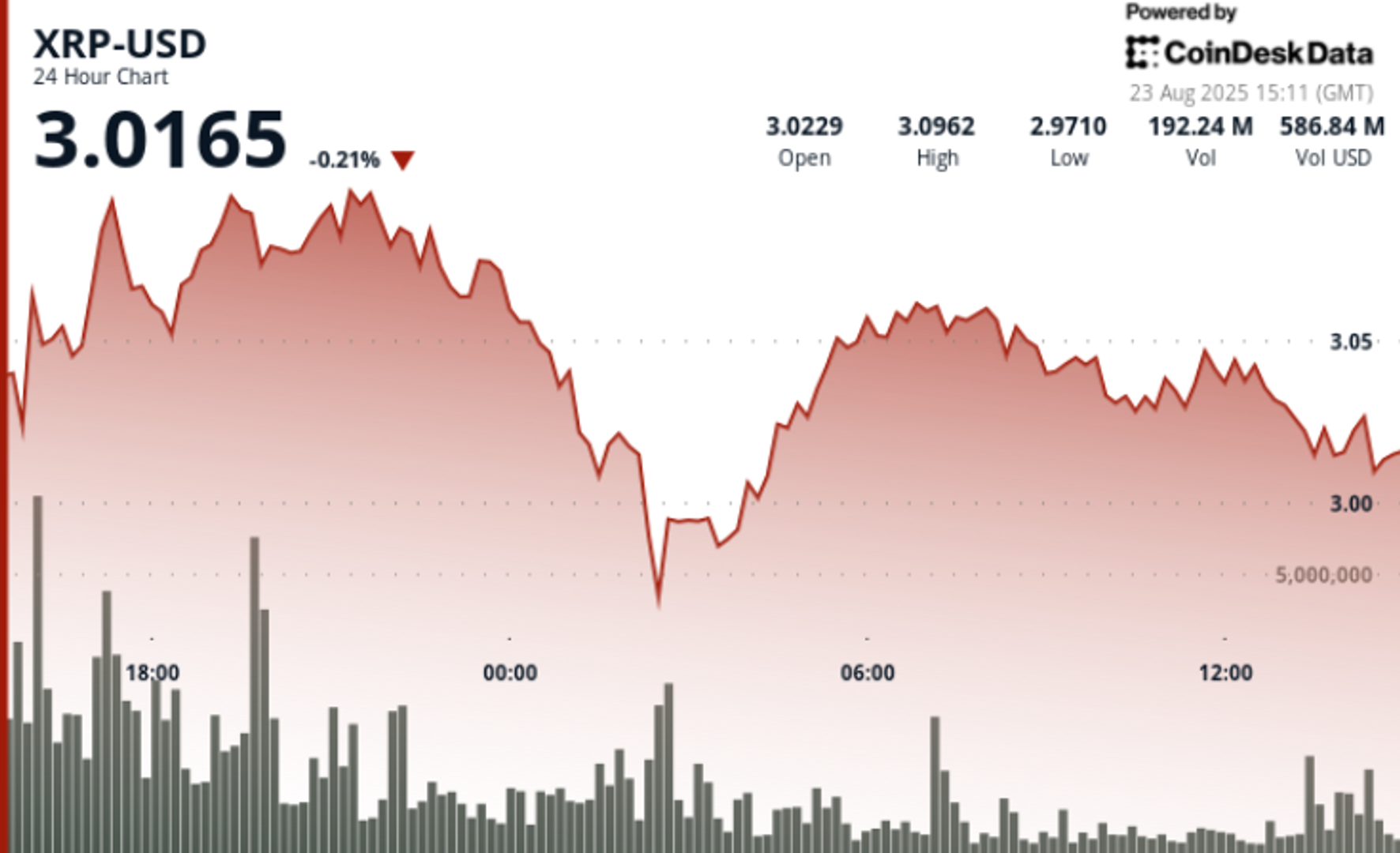

That fragmentation could weaken Bitcoin – and Larsen’s inheritance seems to person invited uncharitable speculation astir the campaign's existent intentions. Over the people of the past decade, Ripple has often seemed to reason that the XRP token created by its co-founders is simply a superior strategy to Bitcoin, and the institution has sold implicit $1.3 cardinal of the token to the nationalist contempt comparatively small occurrence successful its program to make an interbank transportation system.

That has led to a massive, ongoing battle with the U.S. Securities and Exchange Commission, and near galore bitcoiners with enduring hostility to Larsen and the full Ripple organization, which galore spot arsenic inherently and profoundly hostile to Bitcoin.

Ryan Selkis, laminitis of Messari, a crypto information provider, responded to quality of Larsen’s run by declaring that “The Ripple execs are scum.” Matt Walsh of Castle Island Ventures, a broadly BTC-aligned task firm, Tuesday greeting alluded to Larsen arsenic making “billions dumping unregistered securities that look similar fidget spinners connected retail investors past [using] the proceeds to lecture existent entrepreneurs connected their bitcoin businesses.” (Ripple’s logo resembles the fashionable toy.)

For his part, Larsen told Bloomberg, “If I was acrophobic astir Bitcoin arsenic a competitor, astir apt the champion happening I could bash is fto it proceed connected this way … This is conscionable an unsustainable path.”

The statement astir Bitcoin and vigor is inactive precise overmuch a unrecorded one, and Larsen’s doomsaying could good beryllium correct. But he’s intelligibly not the close messenger.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)