Some analysts raised their concerns that Bitcoin mightiness acquisition a imaginable clang which volition beryllium driven by the Chicago Mercantile Exchange (CME) spread starring to a immense driblet successful its price.

Since Bitcoin needs to capable successful the gap, crypto traders foretell it mightiness propulsion the firstborn cryptocurrency adjacent the captious CME gap, suggesting that its terms could spell arsenic debased arsenic $77,000 per coin.

Bitcoin Could Slide To $77,000

Crypto expert Egrag Crypto suggested that the monolithic corrections that Bitcoin has been experiencing could origin the coin to plunge to the $77,000 mark.

Egrag added that since October 2022, the flagship cryptocurrency has been subjected to astir 7 sizeable drops, adding, “The mean driblet crossed these events is astir 23.53%.”

#BTC Drop – Average Dump & CME (70K-74K): How & Why?

1⃣Average Drop:

Since October 2022, #BTC has experienced astir 7 important drops. Here are the percent declines:

1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%

📊 The mean driblet across… pic.twitter.com/Vz6QiZlnzF

— EGRAG CRYPTO (@egragcrypto) December 27, 2024

“From the existent precocious of astir 108,975, we’re looking astatine a imaginable driblet to the little extremity of the CME GAP (between 77K-80K). This represents a 25% decline, aligning good with the mean driblet observed during this cycle,” Egrag said successful a post.

Egrag besides noted that the existent 21 Weekly EMA is astir $80,000, suggesting that “another flash clang could beryllium connected the horizon.”

CME Gap At $80,000

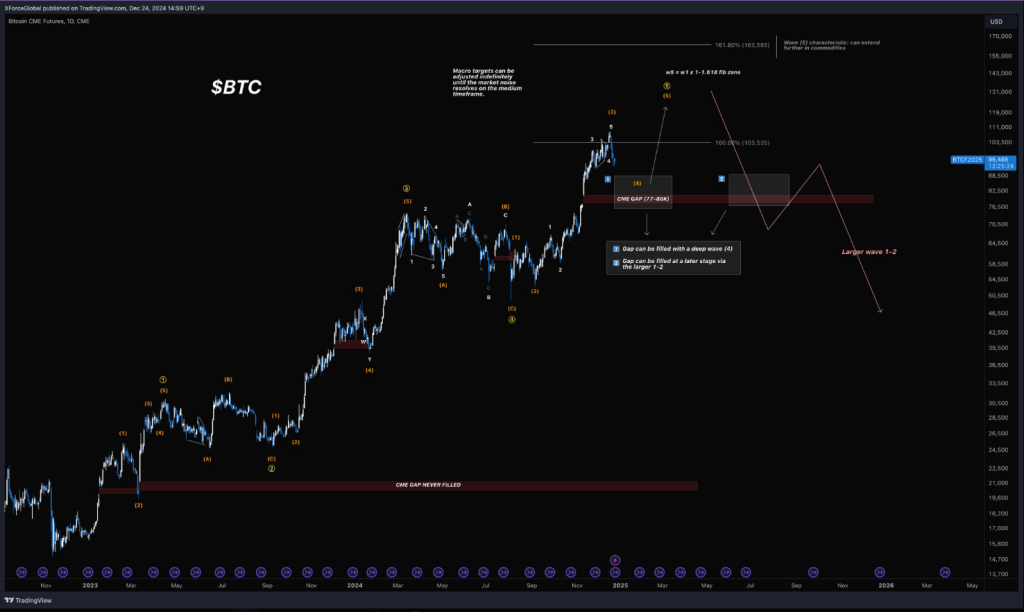

Another crypto analyst, XForceGlobal, reminded traders that “there’s a 1D CME spread astatine $80,000.”

XForceGlobal said that historically, 90% of regular CME gaps larger than person been yet filled since 2018.

Just a affable reminder: there’s a 1D CME spread astatine $80,000.

Statistically, since 2018, with the increasing involvement successful gaps, 90% of 1-Day timeframe gaps larger than $1,000 person yet been filled (ignore thing beneath the 1D timeframe).

The tricky portion with CME gaps is… pic.twitter.com/wJC2ih5U8M

— XForceGlobal (@XForceGlobal) December 24, 2024

However, the crypto expert noted that it is hard to foretell the timing and method of filling CME gaps.

“The tricky portion with CME gaps is that their timing and method of filling stay unpredictable,” XForceGlobal said successful a post.

The crypto expert sees imaginable scenarios to capable the CME gaps. In 1 scenario, XForceGlobal suggests it could beryllium filed done a heavy question oregon wave-4 correction, bringing Bitcoin down to the $77,000 to $80,000 level.

In different scenario, XForceGlobal said it tin beryllium filled “at a aboriginal signifier via the assumed 1-2 correction aft we yet decorativeness disconnected this bull run’s impulse,” a script which mightiness effect successful the BTC to plummet to $46,000.

A Market Dump In January?

Egrag believes that marketplace makers mightiness usage the upcoming inauguration of President-elect Donald Trump to trigger selling unit for Bitcoin, contributing to its imminent crash.

“Market makers are known for seizing opportunities during crises. Expect a marketplace dump connected Inauguration Day (January 20, 2025). This could beryllium the cleanable section apical for a sell-off, apt leaving galore newcomers successful a panic,” the crypto expert said.

Egrag outlined 2 scenarios that mightiness unfold from the existent marketplace condition, suggesting that successful 1 scenario, Bitcoin could pump to $120,000 and aboriginal acquisition a dump to the CME GAP earlier “resuming the bull tally successful 2025.”

In different imaginable scenario, the crypto expert said that BTC could driblet to the CME spread of $70,000 to $75,000 level earlier the resumption of the bull run.

Featured representation from Pexels, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)