Cycling On-Chain is simply a monthly file that uses on-chain and price-related information to amended recognize caller bitcoin marketplace movements. This eighth variation provides a twelvemonth successful reappraisal for 2021 and past assesses what existent trends look similar going into 2022.

A Year Of Modest Growth

The bitcoin terms opened the twelvemonth astatine $27,346 (on Kraken) and really ne'er looked back. Hopes were precise high, which was mostly driven by the organization fearfulness of missing retired (FOMO) that Michael Saylor and MicroStrategy triggered, successful operation with PlanB’s Stock-to-Flow (S2F) and S2F Cross Asset (S2FX) models that predicted a terms of astir $100,000 and $288,000, respectively.

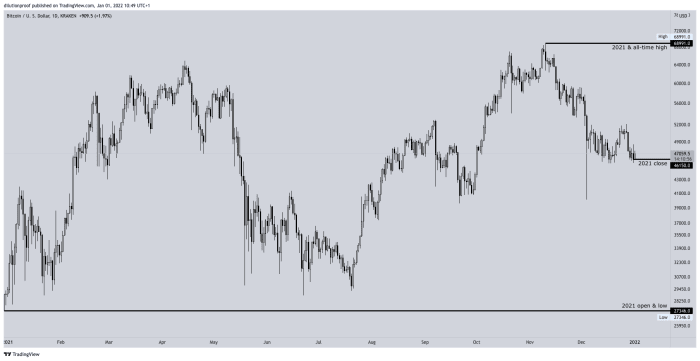

Bitcoin ne'er saw those prices successful 2021 but did acceptable a caller all-time precocious astatine $68,991 (on Kraken) successful November. It closed the twelvemonth astatine a terms of $46,150, which is simply a $18,804 (68.8%) summation since the commencement of the year. Bitoin’s afloat 2021 terms past (on Kraken) is displayed successful fig 1.

Figure 1: Bitcoin (XBT) terms successful United States dollars (USD) connected Kraken (Source).

Grayscale Inflows Stop In February

In January 2021, the bitcoin terms reached its archetypal section apical of its bull cycle, during which respective on-chain trends changed. Most notably, merchantability unit of semipermanent holders and miners started to driblet off. During that time, determination was inactive ample organization FOMO going on, apt triggered by the operation of MicroStrategy and NYDIG’s organization onboarding lawsuit that was rumored to beryllium precise successful, arsenic good as Tesla buying $1.5 cardinal worthy of bitcoin successful aboriginal February and accepting it for car sales.

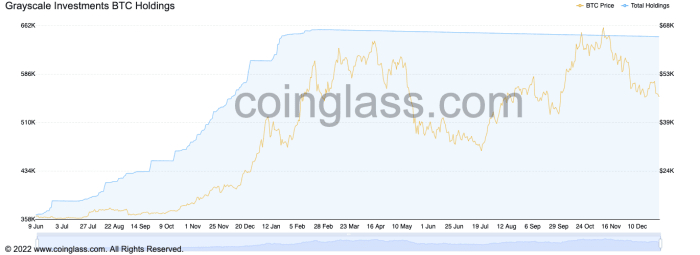

However, successful February, 1 of the largest drivers of the terms run-up into caller highs besides stopped doing so. Grayscale Investments, which is simply a money where mostly organization investors (81–84%) tin bargain shares that Grayscale would backmost with bitcoin (GBTC) and committedness to ne'er sell, with objection of their annually deducted fee. During 2020, Grayscale Investments’ BTC holdings saw a monolithic rise, topping astatine conscionable implicit 650,000 bitcoin successful February (figure 2).

Figure 2: Grayscale Investment BTC Holdings (Source).

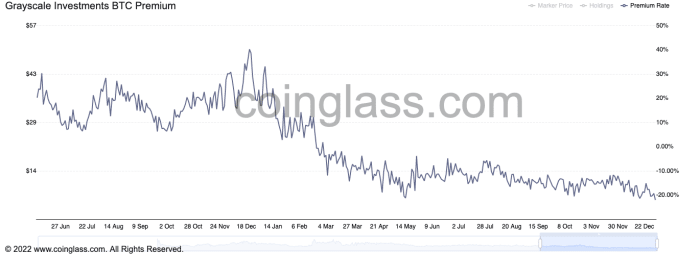

Due to the popularity of the GBTC shares for entities that whitethorn not person been consenting to self-custody ample amounts of bitcoin themselves, the terms of GBTC shares traded astatine a monolithic premium implicit the spot bitcoin price. This introduced an arbitrage oregon “cash-and-carry trade” opportunity, wherever investors that would simultaneously spell abbreviated GBTC via futures markets and agelong GBTC by really buying shares, and closing some positions erstwhile the GBTC shares would beryllium unlocked to beryllium traded connected secondary markets six months later. By doing so, investors could seizure a “risk-free” dispersed betwixt the terms of GBTC shares and the spot bitcoin price, which peaked astatine a whopping 40.2% successful December 2020 (figure 3).

Figure 3: Grayscale Investments BTC premium (Source).

Late February 2021, this GBTC premium dropped to antagonistic levels, closing the model for this arbitrage accidental that took truthful overmuch bitcoin disconnected the market. In hindsight, this alteration apt played a cardinal relation successful the deficiency of vigor successful consequent months to confidently support bursting to caller all-time highs, similar it did during the 2017 bull run.

Capital Increasingly Flows Into Altcoins And NFTs In Q1 And Q2

Since the commencement of 2021, an expanding magnitude of superior has started flowing into different crypto assets similar altcoins and non-fungible tokens (NFTs). Around that aforesaid time, the GameStop banal frenzy was happening, wherever retail investors colluded connected platforms similar Reddit and Robinhood to pump the prices of definite stocks that hedge funds were massively shorting. A ample information of the marketplace was intelligibly looking for assets with bonzer upsides, careless of the hazard illustration that was attached to them.

Within the broader crypto markets, anticipation of an upcoming Coinbase “IPO” was emerging. On April 14, Coinbase was indeed straight listed connected Nasdaq. This lawsuit coincided with a fig of executives selling their stock, causing a monolithic dump successful the terms of its shares that day. The bitcoin terms besides acceptable a caller all-time precocious that time but, aft that, went down alongside Coinbase’s banal price.

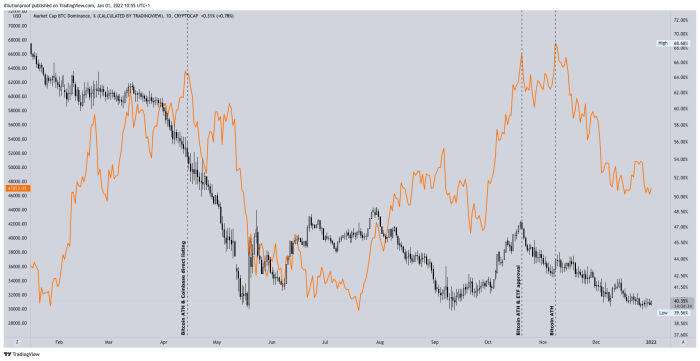

For altcoin traders, Coinbase’s nonstop listing meant that a ample fig of tokens were present disposable connected a level that operates connected a bigger stage, sending their terms expectations for these tokens upward. Around the Coinbase nonstop listing, altcoin prices outperformed bitcoin by ample margins, sending the Bitcoin Dominance Index, which is the percent of the wide crypto marketplace headdress that consists of bitcoin, downward (figure 4).

Figure 4: Bitcoin terms (orange) and marketplace dominance (black/white) (Source).

Elon And China Trigger A Market Capitulation In May

Since the Coinbase nonstop listing mid-April, an expanding magnitude of bitcoin was being deposited connected exchanges and the terms kept making sideways actions. On May 12, Tesla CEO Elon Musk unexpectedly tweeted that Tesla would halt accepting bitcoin for payments owed to biology concerns. A week later, connected May 18, China banned its fiscal institutions from offering bitcoin services, exacerbating this fear, uncertainty and uncertainty (FUD) that created anxiousness successful a comparatively overheated market.

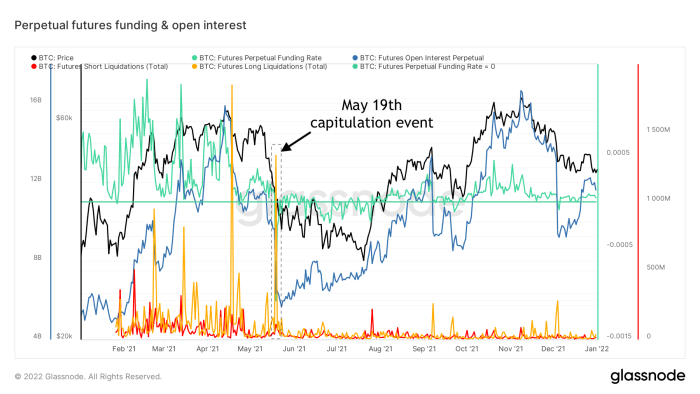

This operation of events sent the bitcoin terms down fast. Many antecedently illiquid bitcoin became liquid again and were sent to exchanges. This marketplace capitulation lawsuit ended with a bang connected May 19, arsenic the downward terms movements sent the worth of galore bitcoin-margined futures contracts beneath their liquidation prices (figure 5), triggering the automatic selling of the underlying bitcoin collateral of those contracts, sending the terms down adjacent further. The resulting cascade of liquidations painted bitcoin’s archetypal regular candle with a $10,000 intraday terms scope — unluckily to the downside.

Figure 5: Bitcoin terms (black), futures unfastened involvement (blue), perpetual futures backing complaint (green), short- (red) and long-liquidations (orange) (Source).

China Cracks Down Against Bitcoin Mining In May And June

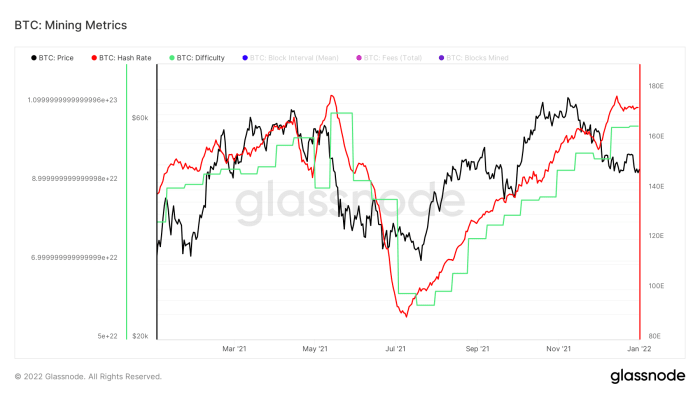

For China, the crackdowns connected Bitcoin did not halt there. Experienced Bitcoiners person seen China prohibition and unban Bitcoin dozens of times since 2013, but this clip really was different. A ample information of the bitcoin mining has historically been done successful China, but passim May and June 2021, the Chinese authorities really banned bitcoin mining, which resulted successful a hash complaint driblet of astir 50% passim that play (figure 6).

Figure 6: Bitcoin terms (black), hash complaint (red) and trouble (green) (Source).

This play genuinely was 1 of the astir uncertain times successful Bitcoin during caller years. Were we witnessing an existent nation-state onslaught connected Bitcoin, oregon was China making a determination present that has the imaginable to spell down successful past arsenic the worst geopolitical determination related to Bitcoin? On June 1, I wrote the following successful COC#2:

“If the Bitcoin web does so stay strong, China’s crackdowns against it volition really spell down arsenic a large illustration of Bitcoin’s anti-fragility. The full constituent of a genuinely decentralized strategy is that you cannot prohibition that strategy — you tin lone prohibition yourself from utilizing it. Hash complaint moving distant from China besides lowers the interaction of aboriginal recurring China FUD (Fear, Uncertainty and Doubt), arsenic their imaginable power implicit the strategy volition person really decreased.”

Fortunately, this is precisely what played retired successful the consequent months. Many Chinese Bitcoin miners reportedly moved to much mining-friendly jurisdictions, and Bitcoin’s hash complaint and trouble afloat recovered to its erstwhile all-time highs. Bitcoin erstwhile again showed disconnected its resilience, arsenic markets regained assurance during the 2nd fractional of 2021.

El Salvador Adopts Bitcoin During The Summer

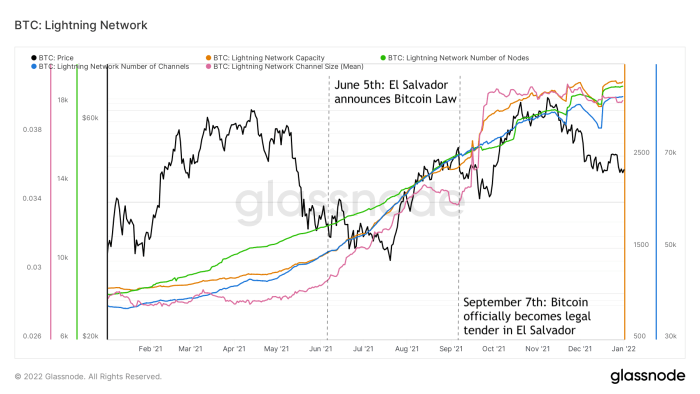

At the aforesaid clip erstwhile China cracked down hard against Bitcoin, El Salvador opened its arms to it and announced that it would marque bitcoin ineligible tender successful their country. El Salvador’s Bitcoin strategy would beryllium heavy connected Lightning Network adoption arsenic a means of regular payments and acceptable an fantabulous precedent for the existent usability of Bitcoin arsenic a mean of exchange, perchance clearing different recurring root of FUD from the table. Although we don’t cognize to what grade El Salvador’s announcement triggered this, passim 2021, Lightning Network adoption soared connected each accounts (figure 7).

Figure 7: Bitcoin terms (black) and Lightning Network capableness (orange), fig of nodes (green), fig of channels (blue) and mean transmission size (red) (Source).

As hash complaint was recovering and El Salvador’s “Bitcoin Day,” wherever it would officially go ineligible tender and each the country’s inhabitants would get $30 worthy of bitcoin if they downloaded the government’s Chivo app, changed Bitcoin’s communicative to a much affirmative tone. Bitcoin Day itself (September 7) ended up functioning arsenic a “sell the quality event,” triggering different fierce merchantability disconnected that sent the terms down successful consequent weeks. This caller section apical was past followed up by a caller higher low, suggesting that the wide inclination successful the bitcoin terms had so flipped from bearish to bullish passim the summer.

Bitcoin Futures Etfs Launch In October

Throughout the summer, on-chain superior flows turned bullish again, arsenic a batch of coins were being moved disconnected exchanges, into the hands of semipermanent holders and illiquid entities. This coincided with the hash complaint betterment and El Salvador’s Bitcoin adoption, which was past followed up by different ample communicative that bitcoin marketplace participants person anticipated for a agelong time: the ceremonial acceptance of a bitcoin speech traded money (ETF).

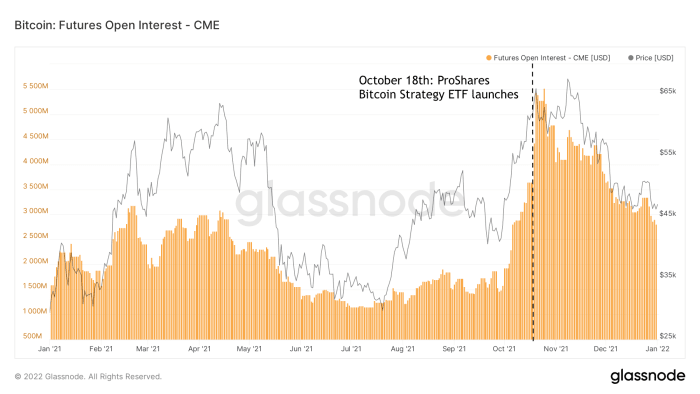

During 2021, the U.S. Securities and Exchange Commission (SEC) appointed Gary Gensler arsenic their caller chairman. Gensler had a past of having a much affirmative cognition toward Bitcoin, and passim 2021 gave hints that a futures-based bitcoin ETF could beryllium approved. On October 1h, the ProShares Bitcoin Strategy ETF became the archetypal bitcoin ETF to beryllium approved, which was followed by aggregate different futures-based ETFs. The ProShares ETF would predominantly usage CME futures, which led to a monolithic summation successful the magnitude of unfastened involvement successful those (figure 8).

Figure 8: Bitcoin terms (black) and CME futures unfastened involvement (orange) (Source).

The run-up to the ETF motorboat sent Bitcoin into caller all-time highs, but the ETF support itself besides functioned arsenic a merchantability the quality event. In consequent weeks, the bitcoin terms again recovered and created caller highs but has been successful a downtrend since.

Long-Term Holders (LTH) Recently Provided Mild Resistance

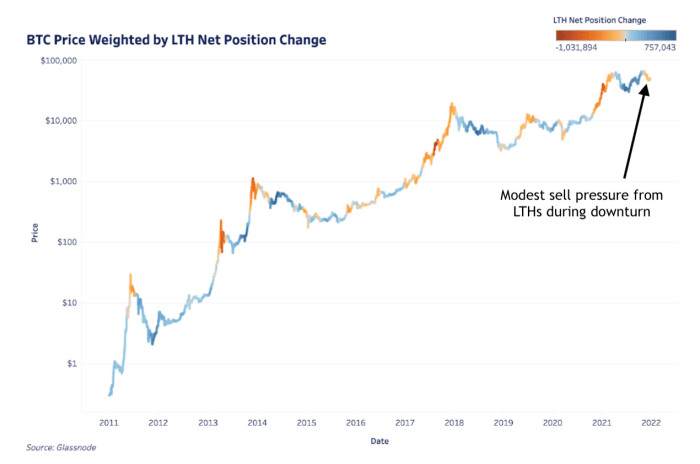

During this latest downtrend, thing absorbing happened. Traditionally, semipermanent holders (LTH), which are Glassnode-labeled entities that person held the bulk of their bitcoin for astatine slightest 155 days, thin to merchantability immoderate of their coins during marketplace spot and peculiarly during terms discovery. This besides happened during the latest ~$69,000 all-time high, but adjacent continued for a small spot connected the mode down, which is much atypical.

In a caller Bitcoin Magazine nonfiction by Sam Rule, which highlighted a information of a related Deep Dive newsletter, the bitcoin terms was overlaid by the LTH nett presumption alteration (figure 10). This fig shows that much “heated” colors usually look during uptrends successful terms and usually rapidly vanish arsenic soon arsenic terms moves down again. This past downtrend since touching the ~$69,000 all-time precocious is an objection to that rule, arsenic LTHs connected aggregate really sold a humble information of their presumption connected the mode down.

Figure 9: Bitcoin terms overlaid by the nett presumption alteration of semipermanent holders (LTH), which are entities that person held the bulk of their bitcoin for 155 days oregon much (Source).

The crushed for this is apt related to the broader macroeconomic circumstances and concerns astir the economical interaction of argumentation decisions related to the emergence of the caller Omicron COVID-19 variant that were pointed retired past month successful COC#7.

Although determination person been affirmative signals coming retired that suggest that the Omicron variant mightiness not person arsenic overmuch of an interaction connected processing complications than the antecedently ascendant Delta variant, argumentation decisions successful immoderate countries person been terrible (e.g., lockdowns). Similarly, the latest Federal Reserve gathering appears to person calmed down fiscal markets (stock prices roseate into caller all-time highs since then), but a definite magnitude of fearfulness and uncertainty remains progressive successful markets. From that perspective, the trends described successful COC#7 are inactive applicable today.

The Bitcoin Market Lacks Momentum

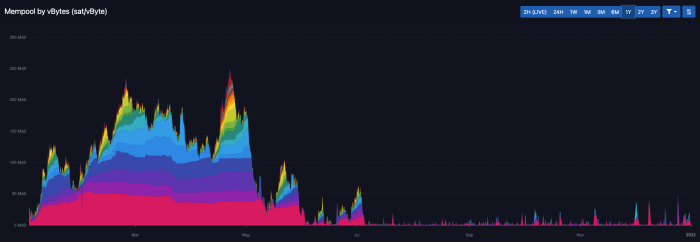

A crushed that the marketplace could not grip the humble merchantability unit of LTHs aft passing all-time highs was that astir of the momentum that was contiguous during the archetypal fractional of 2021 is present gone. Since the May capitulation event, on-chain enactment has been successful a downtrend, arsenic was besides pointed out successful COC#4 astatine the opening of September. During the 2nd fractional of 2020 and archetypal fractional of 2021, the bitcoin mempool, which represents however galore transactions are lined up, waiting to beryllium included successful the adjacent block, was continuously filled. Since then, the mempool regularly clears, sending astir transaction fees backmost to the bottommost complaint of 1 satoshi per vByte (figure 10).

Figure 10: The Bitcoin mempool according to mempool.space (Source).

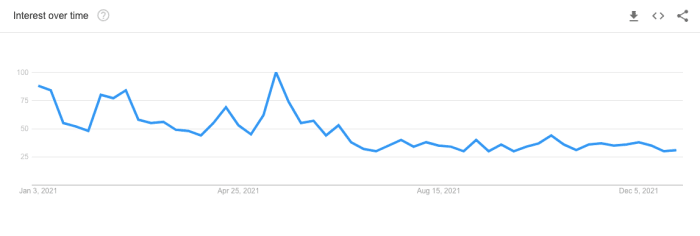

Similarly, Google hunt trends for the connection “Bitcoin” that ever spot an uptick during bull runs are suspiciously quiescent since the summertime (figure 11). From this perspective, it is really rather singular that the bitcoin terms precocious acceptable caller all-time highs, arsenic the retail information of the marketplace was either distracted by alternate assets oregon simply conscionable absent.

Figure 11: Worldwide Google hunt trends for "Bitcoin" (Source).

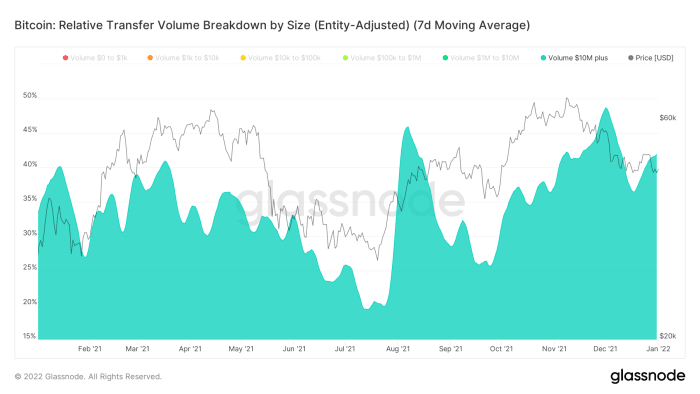

In Absence Of Retail, Larger Market Participants Dominate

At the commencement of November, COC#6 pointed retired that “smart money” was present frontrunning retail. Since then, it has gotten much and much wide that this is so the case. For instance, erstwhile looking astatine the percent of the transportation measurement that consists of much affluent on-chain entities (e.g., worthy much than $10 million) has been comparatively precocious compared to the archetypal fractional of 2021 (figure 12).

Figure 12: The bitcoin terms (gray) and a seven-day moving mean of the percent of the on-chain transportation measurement that consists of entities with an on-chain wealthiness of $10 cardinal oregon much (Source).

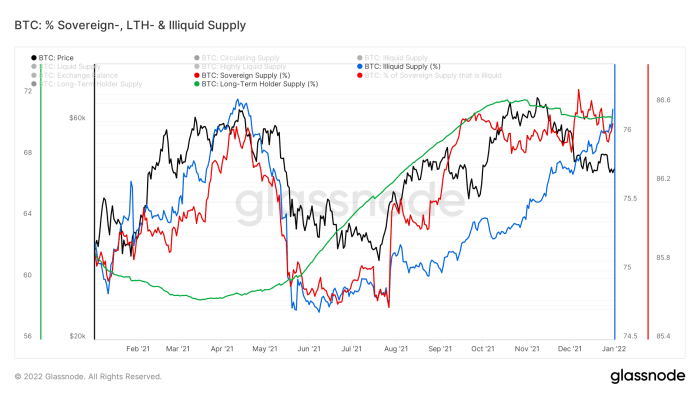

On-Chain Supply Flows Remain Neutral To Bullish

The humble selling unit by LTHs that was discussed with fig 9 tin besides beryllium spotted successful the downtrend successful the greenish enactment successful fig 13. Furthermore, the reddish enactment shows that during the latest terms downtrend (black line), the sovereign supply, which is the full bitcoin proviso that is not held connected exchanges, did not spot a akin downturn similar it did aft the mid-April 2021 marketplace apical (Coinbase nonstop listing) and consequent Elon and China FUD. The illiquid proviso (blue), which is the full bitcoin proviso that is successful the hands of entities that Glassnode identified arsenic having small oregon nary past of selling, has really risen and is backmost astatine akin values arsenic during the mid-April 2021 marketplace top.

Figure 13: Bitcoin terms (black) and the percent of the circulating proviso that Glassnode labels arsenic “illiquid” (blue), successful the hands of semipermanent holders (LTH) (green) oregon not to beryllium connected exchanges (red) (Source).

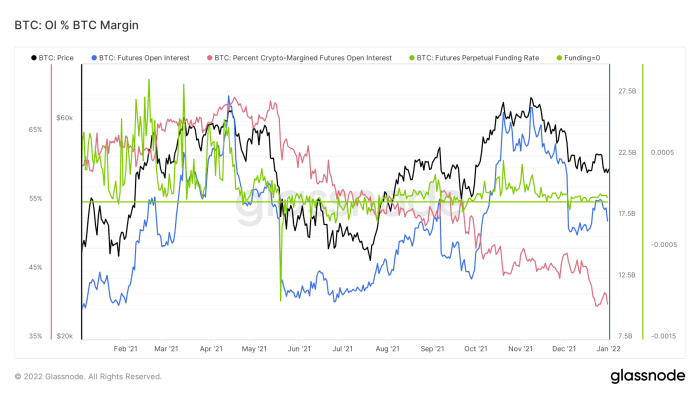

Futures Markets Look More Mature And Healthier

As was already discussed successful COC#7, the wide authorities of bitcoin futures markets present looks, overall, to beryllium much mature and healthier than during the archetypal portion of 2021. The full worth successful futures contracts (open interest) is astatine akin levels arsenic during the early-2021 highs, but astatine neutral backing rates and based connected much cash-margined collateral that has little downside hazard during agelong liquidation cascades (figure 14).

Figure 14: Bitcoin terms (black), futures unfastened involvement (blue), perpetual futures backing complaint (green) and the percent of unfastened involvement that is bitcoin-margined (red) (Source).

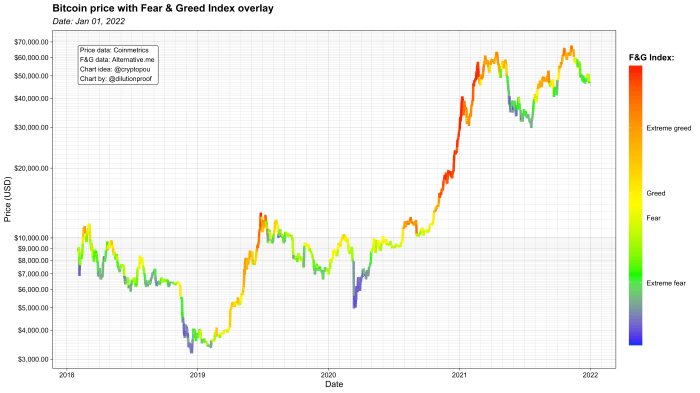

Market Sentiment Is More Neutral

Similarly, the wide marketplace sentiment of bitcoin and cryptocurrency markets is present much neutral than during the archetypal portion of 2021. Figure 15 shows that existent terms levels that were initially associated with “extreme greed” are present accompanied by neutral oregon adjacent fearful marketplace sentiment, illustrating that existent prices are present considered to beryllium overmuch much “normal” than they were astatine the commencement of the year.

Figure 15: Bitcoin price, overlaid by the fearfulness and greed scale marketplace sentiment scores (Source).

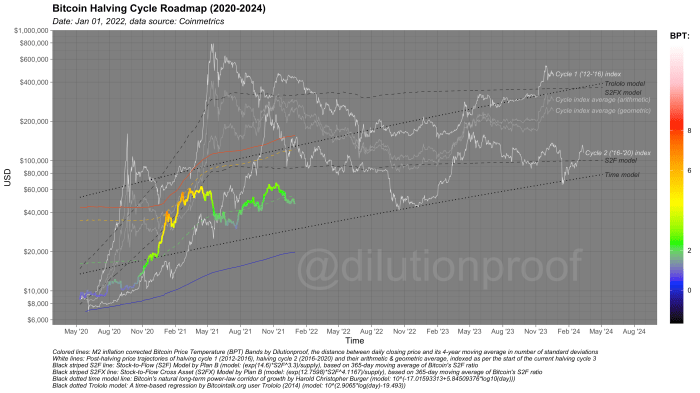

The Ongoing Battle Of The Bitcoin Pricing Models

Historically, the bitcoin terms has moved successful precise distinct, halving-driven, four-year cycles that tin beryllium expected to yet diminish. Many pricing models exist. Some simply extrapolate the terms past of erstwhile halving cycles connected apical of the commencement of the existent rhythm (figure 17; achromatic lines). Others are time-based regression models (black dotted lines), oregon adjacent modeled historical bitcoin prices with its disinflationary coin issuance docket (black striped lines). Each of these models has their ain methodological limitations that necessitate a precise nuanced interpretation, but unneurotic they gully a unsmooth representation of what whitethorn beryllium expected if this existent rhythm does extremity up being somewhat akin to the erstwhile ones.

Whether this rhythm volition really beryllium akin to the erstwhile ones has been heavy debated successful 2021. The lack of a wide blow-off apical similar we saw astatine akin post-halving dates successful 2013 and 2017 convinced immoderate that, from this constituent on, we’ll spot diminishing returns oregon adjacent lengthening cycles. Others judge that, these days, the coin issuance docket and related miner merchantability unit is conscionable not arsenic applicable arsenic it erstwhile was, and that the bitcoin terms volition beryllium much of a random locomotion with an upward drift, perchance becoming little volatile implicit time. One happening is certain, pursuing the result of this volition beryllium intriguing.

Summary And 2022 Outlook

In hindsight, the archetypal 2020–2021 bull tally was heavy driven by a operation of organization FOMO and cash-and-carry trades. As soon arsenic those arbitrage opportunities dried up and the communicative regarding organization adoption changed, the marketplace (which was heavy overextended successful altcoins and NFTs) turned around. The Chinese crackdowns against bitcoin mining that continued successful the consequent months suppressed immoderate remaining bullish sentiment, driving speculators distant from the market, arsenic their dumped bitcoin gradually transferred into the hands of investors with a higher condemnation and a little clip preference. The operation of the hash complaint recovery, El Salvador adopting Bitcoin and the motorboat of the archetypal (futures-based) bitcoin ETF fueled a caller run-up successful price, but successful comparative lack of retail marketplace participants, the latest circular of terms find lacked the endurance to enactment humble merchantability unit of semipermanent holders that sold into evident marketplace strength.

During 2021, 2 salient humanities anti-Bitcoin narratives person been disarmed: The “China controls Bitcoin” statement (miners near China) and the misunderstanding that bitcoin cannot beryllium utilized for tiny payments (El Salvador uses bitcoin for payments via the Lightning Network). Throughout 2021, galore coins moved from the hands of speculators into those of semipermanent holders, arsenic futures markets matured and $30,000 to $60,000 terms levels became the caller norm.

Perhaps 2021 did not bring the bitcoin terms levels that galore were hoping for, but overall, it decidedly was a precise constructive twelvemonth for Bitcoin. Going into 2022, Bitcoin does not person the aforesaid grade of bullish momentum arsenic it did past year, but existent prices look to beryllium astatine a overmuch much balanced spot from a downside hazard perspective. From that perspective, the bitcoin terms appears to beryllium primed for a continued play of sideways to mildly upward terms enactment — until a structural alteration successful either marketplace sentiment oregon macroeconomic circumstances find the destiny of the remainder of Bitcoin’s existent halving cycle.

Previous editions of Cycling On-Chain:

- #1 Unwinding Leverage (June 1, 2021)

- #2 Bitcoin Enters Geopolitics (July 1, 2021)

- #3 Squeezed Supply, Shorts And Bitcoin Lemonade (August 1, 2021)

- #4 On-Chain Silence Before The Storm (September 1, 2021)

- #5 How January’s On-Chain Footprint Bent The Bitcoin Price Trend Twice (October 1, 2021)

- #6 ‘Smart Money’ Is Front-Running Retail (November 1, 2021)

- #7 The Bitcoin Market Hangs Between Hope and Fear (December 1, 2021)

Disclaimer: This file was written for acquisition and amusement purposes lone and should not beryllium taken arsenic concern advice.

This is simply a impermanent station by Dilution-proof. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

4 years ago

4 years ago

English (US)

English (US)