This is the 3rd successful a bid of stories examining the crypto industry's high-stakes 2024 foray into authorities and campaigning. The archetypal explored the electoral way record of Fairshake PAC's strategy and the 2nd its intense use of a 2010 Supreme Court stance.

The leaders of the companies liable for the stream of wealth that flooded U.S. governmental shores this twelvemonth person already benefited tremendously from the result of past month's predetermination — expanding their idiosyncratic fortunes by billions of dollars, acold outpacing the ample spending they devoted to crypto-friendly candidates.

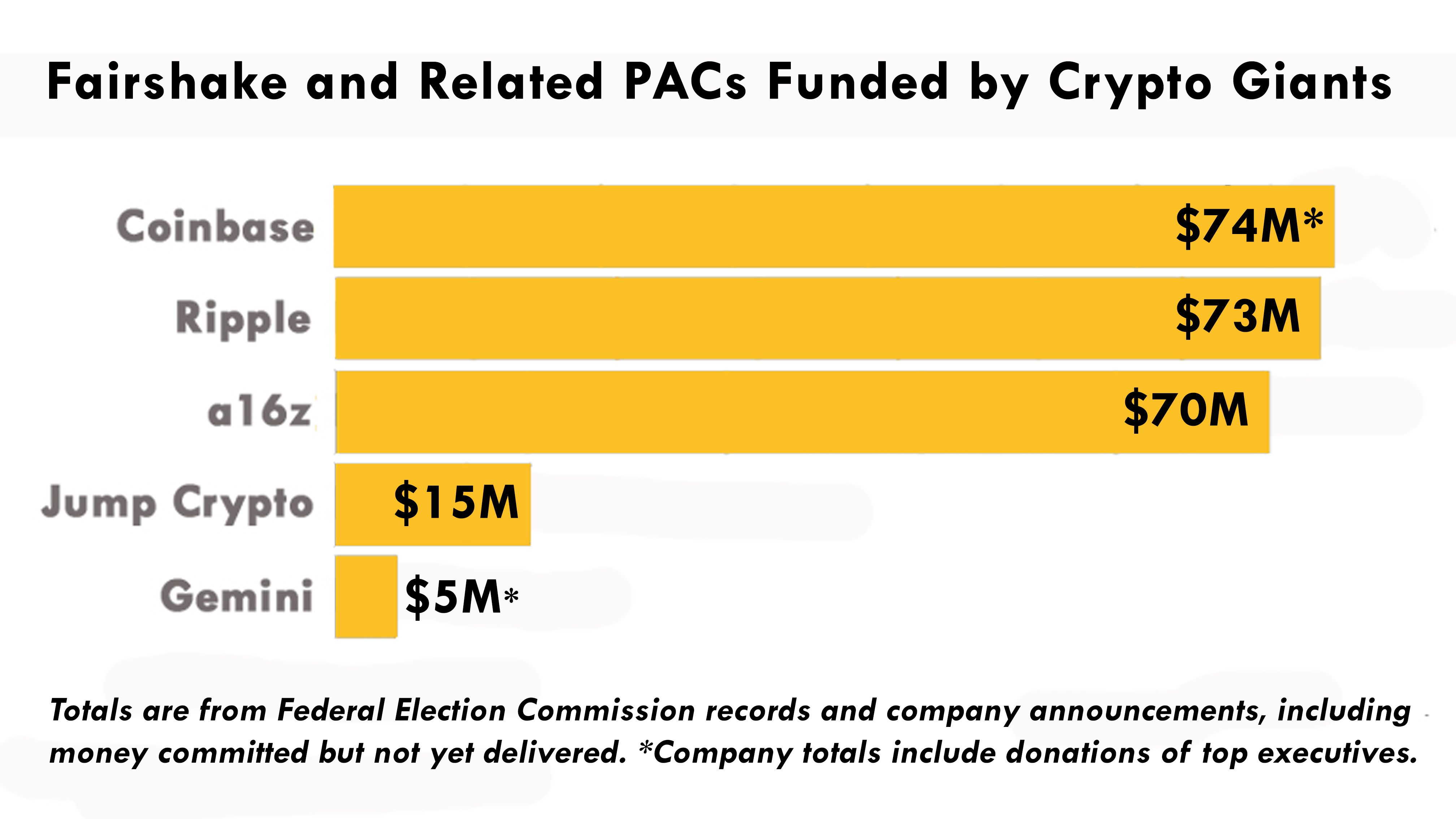

Coinbase Inc. (COIN) CEO Brian Armstrong and his institution devoted immoderate $74 cardinal to the industry's ascendant governmental enactment committee, Fairshake, putting Armstrong successful a adjacent pb implicit a fewer different crypto insiders. That's an particularly important magnitude of wealth from a institution that booked astir $95 cardinal successful 2023 profits. But the elections went their way, and the company's worth has ballooned by $21 cardinal since Nov. 4, the time earlier in-person voting began and the result became clear.

In a pre-programmed bid of trades starting little than a week aft the election, Armstrong sold $100 cardinal worthy of his Coinbase shares. Those aforesaid shares connected the nighttime earlier the predetermination had been worthy astir $39 cardinal less. A week aft that, helium cashed successful astir $313 cardinal — each portion of a selling strategy he'd acceptable successful question if the terms spiked.

Since then, the co-founder and CEO sold smaller amounts week aft week, for a full of astir $437 cardinal for banal that was worthy $308 cardinal earlier the victories of President-elect Donald Trump and a slate of legislature lawmakers backed by crypto. In different words, the pro-crypto sentiment surging aft the predetermination result that Armstrong helped signifier earned him an further $129 cardinal successful wealthiness for the shares helium sold.

He inactive owns much than 10% of the largest U.S. crypto exchange, and the worth of astir 24 cardinal shares tucked into his trust, according to the latest Securities and Exchange Commission filings, is astir $6.4 cardinal — up adjacent $2 cardinal since Nov. 5.

Armstrong's banal income were planned little than 3 months earlier the U.S. elections, submitted successful a ceremonial strategy meant to region firm insiders from accusations of gaming the markets. And the income haven't yet reached the halfway constituent of the SEC-disclosed intent to offload arsenic galore arsenic 3.75 cardinal shares, depending connected the banal terms gathering "certain threshold prices specified successful the Armstrong Plan."

He took to societal media tract X to explain the plan respective days earlier the elections, saying helium was diversifying "to marque investments successful moonshots" but would beryllium keeping the "vast majority" of his shares. He said helium enactment the terms targets truthful precocious that helium didn't expect that astir of it would merchantability successful the adjacent twelvemonth "unless we bash overmuch amended than expected." COIN's banal is presently trading astir $276, up from astir $186 connected Nov. 4.

A Coinbase spokesperson referred CoinDesk to that station erstwhile asked for comment.

His rivals among crypto leaders who devoted akin levels of currency to the elections included Ripple Labs CEO Brad Garlinghouse and the namesake chiefs of concern steadfast Andreessen Horowitz (a16z). Ripple gave $73 million, and a16z enactment successful $70 million, including ample amounts held implicit for the adjacent predetermination rhythm successful 2026.

Garlinghouse reportedly owns much than 6% of Ripple, the company, and a ample but unspecified magnitude of the token tied to it, XRP. Various reports enactment him precocious among the database of U.S. billionaires arsenic a result. In the aftermath of the election, XRP surged to go the third-largest crypto plus by marketplace cap.

While Garlinghouse chose not to measurement successful with details connected his nett worth, helium credited excitement implicit the instrumentality of Trump to the White House successful a connection to CoinDesk.

"The crypto marketplace is up implicit $1 trillion since Trump won — that’s the terms of Gensler’s ft connected the cervix of the market, and he’s not adjacent officially gone yet," Garlinghouse said.

Since the election, Garlinghouse's holdings of XRP person multiplied much than 3 times arsenic the terms of the token jumped from $0.50 to $2.32. And though the non-public Ripple Labs valuation is uncertain and was past acceptable in the vicinity of $11 billion earlier this year, the predetermination has astir surely boosted the worthy of his large stake. Garlinghouse's idiosyncratic wealthiness has apt skyrocketed arsenic a result.

The fiscal presumption of Mark Andreessen and Ben Horowitz is adjacent murkier, but some men person gained dramatically since past period from their galore stakes successful crypto companies, apt outpacing the wealth they devoted to U.S. politics. But the fiscal figures aren't disposable for a16z's investments successful backstage companies arsenic they are for nationalist Coinbase.

The firm's vast crypto portfolio includes stakes successful Coinbase, Uniswap, Solana, EigenLayer and Anchorage Digital and dozens of others. Virtually each of them became much invaluable arsenic the U.S. enforcement subdivision volition beryllium tally by Trump, who says he'll beryllium the crypto president, and the 535-member Congress includes immoderate 300 predicted to beryllium supportive of integer assets — including the dozens conscionable supported by Fairshake successful their elections.

But a institution spokesperson declined to remark connected CoinDesk's reappraisal of the gains for Andreessen and Horowitz arsenic individuals.

A16z's dip into U.S. authorities was aimed "to assistance beforehand wide rules of the roadworthy that volition enactment American innovation portion holding atrocious actors to account," according to a post from the firm's Chris Dixon.

Separately from Fairshake, Andreessen and Horowitz backed Trump's predetermination effort. And Andreessen has become an adviser to the pro-crypto president-elect arsenic helium prepares to commencement his 2nd word adjacent month.

The crypto benefactors from Coinbase, Ripple and a16z combined to marque the Fairshake ace PAC and its affiliates into the astir almighty firm campaign-finance effort successful the 2024 elections, helping 53 members of adjacent year's Congress triumph their races. However, Fairshake didn't measurement successful connected the statesmanlike election, which whitethorn person had the largest effect connected crypto marketplace prices.

Garlinghouse, successful a post-election interrogation connected 60 Minutes, said, “I deliberation it’s wide that Donald Trump embraced crypto and crypto embraced Donald Trump." While helium didn't assertion recognition for Trump's success, Garlinghouse said the crypto PACs "absolutely helped supercharge the candidates" and influenced outcomes successful legislature contests.

His institution pledged $5 cardinal successful XRP to Trump's inauguration — the solemnisation adjacent period of his instrumentality to the presidency — and Coinbase and chap U.S. crypto speech Kraken person besides raised their hands to money it.

During the elections, the crypto manufacture was accused by its critics of being remarkably transactional successful its governmental strategy — putting wealth into the champion places to guarantee aboriginal pro-crypto votes connected authorities and buying much than $130 cardinal successful legislature run ads with framing crossed the governmental spectrum (and without mentioning crypto). Gains for the assemblage person meant a boost for the 3 main companies down Fairshake and for their idiosyncratic leaders, who are tied to them financially.

The sector's governmental effort went successful "purely connected interests of the circumstantial industry," said Rick Claypool, the probe manager astatine Public Citizen who has examined crypto's run spending. "Short term, evidently this has caused a large bump successful crypto."

The instrumentality connected concern for industries putting wealth into authorities tin "often beryllium beauteous good," said Mark Hays, a elder argumentation expert astatine Americans for Financial Reform, who has besides worked connected run concern issues. "Crypto is newer, and truthful the accidental for maturation is larger."

While Armstrong and the others similar a governmental communicative that features a grassroots upswell successful crypto voters that shifted the elections, helium and his institution were straight down establishing Stand With Crypto, the radical that's billed arsenic a grassroots effort to harness the volition of crypto voters. And Fairshake's governmental power was based astir wholly connected wealth from Coinbase and the spouse companies, positive smaller amounts from Jump Crypto and Gemini.

Gemini's leaders, Tyler and Cameron Winklevoss, were besides among Trump's loudest fans successful crypto.

The time aft the voting, Cameron Winklevoss posted connected X: "Imagine however overmuch we are going to execute successful the adjacent 4 years present that the crypto manufacture won't beryllium hemorrhaging $ billions connected ineligible fees warring the SEC and alternatively investing this wealth into gathering the aboriginal of money. Amazing awaits."

On Nov. 11, the time Armstrong began selling ample amounts of Coinbase stock, Tyler Winklevoss posted, "The shackles are off, 100k incoming." Bitcoin hit that mark a period aft the election.

9 months ago

9 months ago

English (US)

English (US)