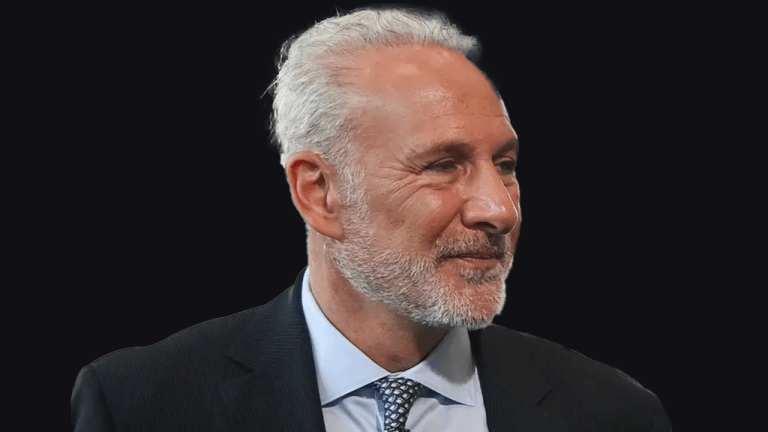

Paul Grewal, CLO of Coinbase, 1 of the largest U.S.-based cryptocurrency exchanges, has accused the U.S. Securities and Exchange Commission (SEC) of violating the instrumentality by assessing what constitutes an concern contract. Grewal’s reasoning comes from the Supreme Court of the United States’ (SCOTUS) determination thwarting President Biden’s pupil indebtedness forgiveness programme utilizing the alleged “major questions doctrine.”

Coinbase CLO Blasts SEC’s ‘Investment Contract’ Interpretation

Paul Grewal, main ineligible serviceman of Coinbase, has railed against the U.S. Securities and Exchange Commission’s (SEC) presumption regarding classifying immoderate cryptocurrency assets arsenic securities. According to Grewal, the SEC’s appraisal of what constitutes an concern declaration is incorrect and transgresses existent regulations.

He stated:

The SEC’s mentation of ‘investment contract’ violates the law.

Furthermore, Grewal affirms that the SEC’s actions spell beyond violating thew law, fixed that it claims it has the authorization to enforce rules for each cryptocurrency assets classified arsenic securities. He explained:

The ‘economic and governmental significance’ of falsely claiming authorization implicit each integer assets different than BTC is not conscionable ‘staggering,’ but untethered to the cardinal request that determination beryllium enforceable rights betwixt endeavor and purchaser.

Grewal’s reasoning comes from his introspection of the Supreme Court of the United States (SCOTUS) ruling successful the Biden v. Nebraska case, wherever the tribunal struck down the Biden administration’s $430 cardinal pupil indebtedness forgiveness program.

The Major Questions Doctrine

Grewal believes the reasoning for applying the large questions doctrine successful the Biden v. Nebraska lawsuit tin beryllium utilized successful Coinbase’s case, wherever the speech is battling the SEC, being accused of unregistered brokerage and securities violations.

According to Harvard Law School prof Noah Feldman, the large questions doctrine idea is that “if the enforcement subdivision does thing the tribunal considers truly large and truly new, past the tribunal volition look to spot if Congress truly authorized it. Absent wide legislature authority, the tribunal volition onslaught it down.”

Coinbase introduced the large questions doctrine successful its caller filing against the SEC’s complaint, arguing that the SEC’s caller mentation of the securities instrumentality would person to beryllium rejected due to the fact that Congress would person to modulate the contented archetypal to found standards regarding integer assets.

Grewal added to this idea, explaining:

Congress isn’t conscionable susceptible of fixing standards by theoretically passing authorities successful the future, it’s actively moving to bash that close now. This isn’t adjacent a adjacent call.

What bash you deliberation astir Coinbase CLO Paul Grewal’s allegations? Tell america successful the remark conception below.

1 year ago

1 year ago

English (US)

English (US)