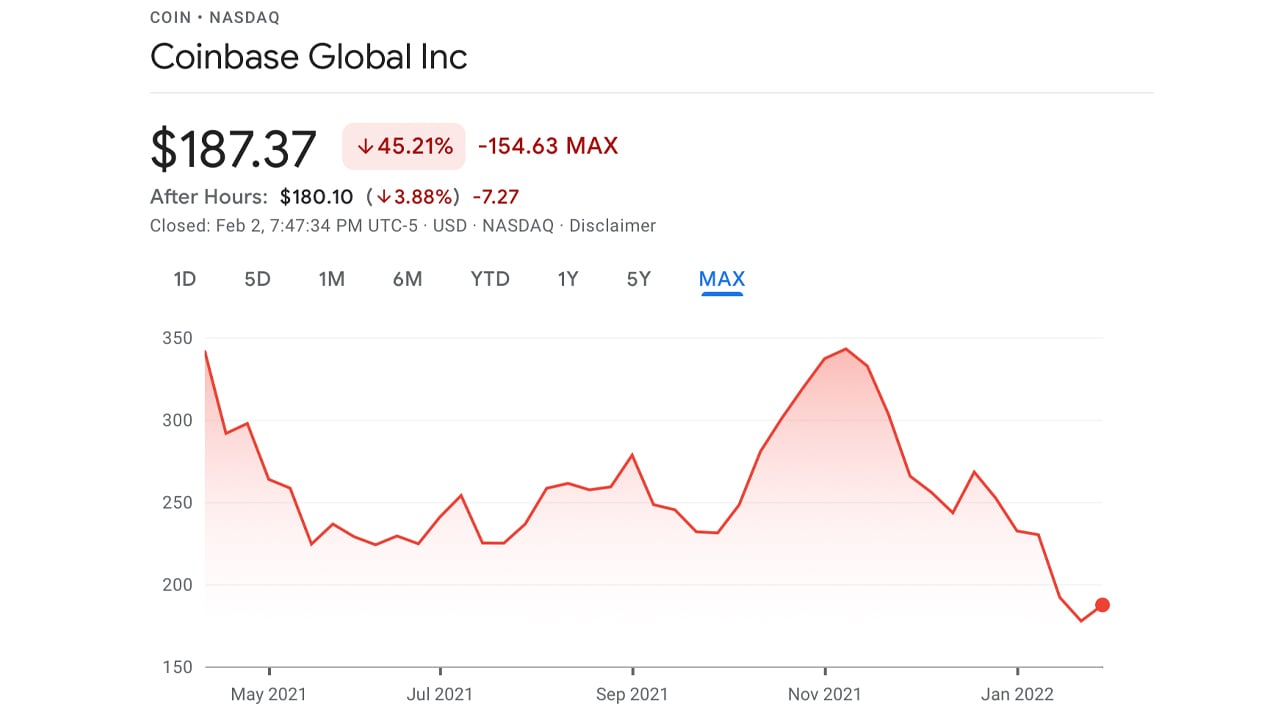

Roughly 9 months ago, Coinbase’s archetypal nationalist offering (IPO) via a nonstop listing connected Nasdaq launched, and shares swapped for $342 per stock connected April 16, 2021. Since then, Coinbase shares person dropped by adjacent to fractional that worth and today, COIN is swapping for much than 45% little astatine $187 per unit.

Coinbase Follows Bitcoin With Shares Down 45% From ATH

Coinbase (Nasdaq: COIN) is simply a fashionable crypto steadfast and integer plus speech with 8.8 cardinal monthly transacting users during its tallness successful Q2 2021. The concern founded by Fred Ehrsam and Brian Armstrong successful 2012 officially went nationalist connected Nasdaq connected April 14, 2021, via a nonstop listing. As the institution heads into its tenth operational year, COIN shares person been trading for overmuch little than the stock’s worth connected April 16 and November 12, 2021.

When COIN archetypal launched, the banal speech Nasdaq decided connected an archetypal $250 per stock notation price. Two days aboriginal — and portion bitcoin (BTC) reached $64K per portion — COIN tapped a precocious of $342 per share. The Coinbase banal dropped successful worth aft that day, and dipped to a consolidated debased of $242 during the months of May done September, with a fewer jumps to the $250-278 scope during that time.

Coinbase stock: February 2, 2022, closing price.

Coinbase stock: February 2, 2022, closing price.The Nasdaq-traded banal follows alongside BTC’s fluctuations similar galore crypto-asset firms that person vulnerability to this caller plus class. So erstwhile BTC ran up to different terms precocious beyond $64K to an all-time precocious of $69K, COIN deed different $342 terms high. The banal is present adjacent to fractional the $342 terms high, and is 45.16% little successful value, trading astatine $187 per share. Similar to BTC, the terms is overmuch little than the ATH and successful December COIN had a little Holiday rally alongside the crypto economy’s passing comeback that month.

‘Fed’s Stance connected Interest Rates Could Hurt the Stock’s Momentum,’ Says Boston Data Analyst Firm Trefis

In a caller blog post, the Boston-based information and analytics steadfast Trefis asked if the Coinbase banal was a bully bargain aft specified a sizeable correction. “The banal presently trades astatine conscionable astir 22x our projected 2021 earnings, which is not a peculiarly affluent valuation for a highly profitable and futuristic banal with coagulated semipermanent net potential,” Trefis said connected Wednesday. “For perspective, Coinbase’s nett margins stood astatine an unthinkable 57% implicit the archetypal 3 quarters of 2021.”

The information and analytics steadfast added:

However, the cryptocurrency marketplace is inherently cyclical, and the likelihood are that we could beryllium approaching a marketplace highest fixed the Fed’s stance connected involvement rates. This could wounded momentum for Coinbase successful the adjacent term. That said, the banal could inactive beryllium worthy a look for semipermanent investors.

Tags successful this story

What bash you deliberation astir the existent worth of Coinbase’s banal and the sizeable correction shares person seen since its ATH? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)