Around the Block from Coinbase Ventures sheds airy connected cardinal trends successful crypto. Written by Connor Dempsey

TLDR:

- Despite the marketplace downturn, Q1 was different highly progressive 4th for crypto task funding.

- On the infrastructure side, we’re seeing a ton of enactment wrong cross-chain solutions and DAO tooling. New layer-1s are inactive being incubated.

- Familiar DeFi primitives developed connected Ethereum are expanding into newer furniture 1s, and Polkadot is picking up steam.

- NFT projects are focused connected bringing much inferior to the space, with Yuga Labs making superior waves implicit the quarter.

- The emergence of Axie Infinity has attracted palmy accepted gaming devs to physique successful Web3, with South East Asia emerging arsenic a hotbed of activity.

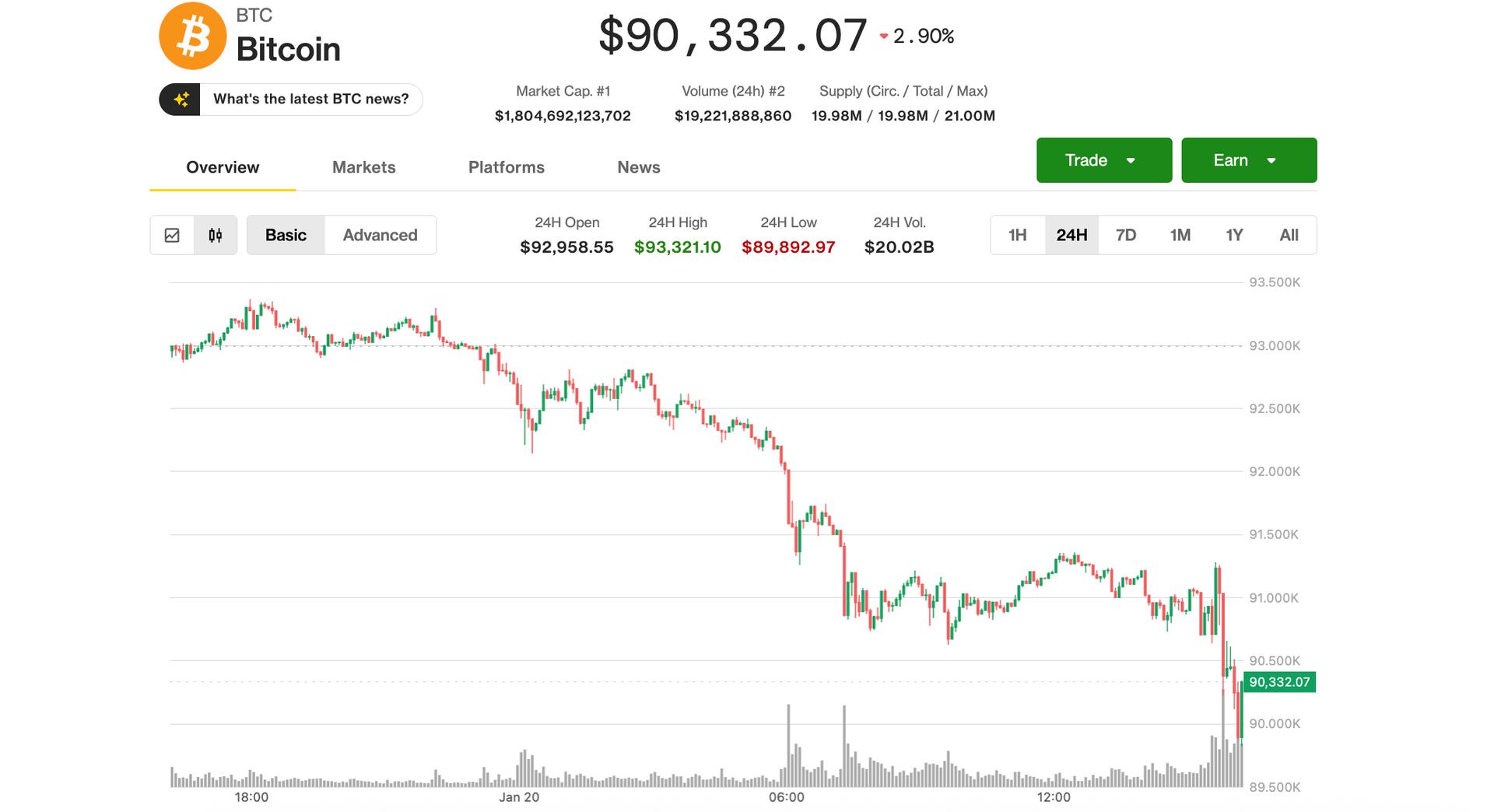

After peaking successful November 2021, liquid crypto markets fell into the caller twelvemonth and much oregon little treaded h2o successful Q1. The backstage markets, however, kept up the torrid gait acceptable past year.

According to data from The Block, Q1 2022 saw a grounds of $12.5 cardinal successful task backing — a fig that has accrued for 7 consecutive quarters. Coinbase Ventures was engaged arsenic well, closing 71 caller deals successful Q1, mostly targeting aboriginal signifier investments. We volition enactment that we’re starting to spot signs of a dilatory down, peculiarly with aboriginal signifier investments, that volition apt beryllium disposable successful our Q2 activity.

Deal measurement is simply a reflection of the continued influx of caller companies and projects being formed successful the space. This is aided by the debased startup costs that crypto & Web3 companies bask acknowledgment to open-source codification and the quality to bootstrap oregon self-fund via token issuance.

CBV overview

As a refresh:

- Coinbase Ventures advances crypto & Web3 by partnering with exceptional founders who stock Coinbase’s ngo of creating much economical state for the world.

- We’ve been recognized arsenic 1 of the astir progressive firm VCs successful the satellite by deal count.

- Ventures partners with founding teams astatine the earliest stages and passim their journey. We put crossed each categories wrong the cryptoeconomy, seeking to align ourselves with the champion and brightest minds successful the space.

- To date, we’ve invested successful 300+ teams building everything from furniture 1 protocols, Web3 infrastructure, centralized on-ramps, decentralized finance, NFTs, metaverse technologies, developer tooling, and more.

We mostly interruption down our investments crossed six categories. Within these six categories, here’s however our enactment shook retired successful Q1 ‘22.

Given that we put successful projects successful their infancy, our enactment tin connection a lens into what the manufacture has successful store successful the adjacent future. With that, let’s dive into immoderate of the trends and themes that we identified successful Q1.

Cross-chain & Web3 infrastructure bloom

In the aboriginal days of crypto, Bitcoin and Ethereum dominated. With caller furniture 1s coming online successful caller years, ecosystems extracurricular of BTC/ETH person exploded, and determination are present much than 10 chains hosting implicit $1B successful value.

The increasing worth crossed aggregate networks has brought an expanding request for worth connected 1 concatenation to travel to another. As such, we’re continuing to spot cross-chain infrastructure being built retired to facilitate enactment betwixt blockchains (CBV Q1 investments: LayerZero, ZK Link, LiFi, Foxchain, Socket, Composable Finance).

Even with the multi-chain aboriginal assured, we’re inactive seeing caller experimental furniture 1s successful development. Our investments successful Aptos (general intent L1 from erstwhile Diem employees), Celestia (modular blockchains), and Subspace (Proof-of-Archival consensus) suggest that the manufacture is not done innovating astatine the basal layer. It besides begs the question — volition the ascendant furniture 1s of contiguous someday beryllium usurped? Time volition tell.

Further up the stack, there’s much tooling connected the mode to assistance DAOs and Web3 communities flourish. Solutions for payroll (Diagonal, Zebec), societal engagement & networking (Taki, Backdrop, Bonfire), and commerce (Rain) each constituent to a aboriginal wherever these online communities tin coordinate much seamlessly.

DeFi’s multi-chain proliferation

Speaking of the multi-chain world, we’re seeing acquainted patterns look crossed these burgeoning furniture 1 networks. Basically, Ethereum acceptable the code for the foundational apps and protocols needed for an ecosystem to thrive: an AMM (Uniswap), wealth markets (Compound/Aave), an oracle (Chainlink), and output aggregators (Yearn.Finance) to sanction a few.

For an emerging furniture 1 to compete, teams recognize they’ll request those aforesaid foundational primitives. As such, it’s becoming communal to spot Ethereum’s DeFi gathering blocks replicated crossed furniture 1s similar Solana, Avalanche, NEAR, Polkadot, etc. Betting connected these foundational protocols is simply a bully mode to summation vulnerability to a broader ecosystem: a playbook we followed successful Q1.

For example, from our Q1 investments, Aurigami connected NEAR and Solend connected Solana lucifer Compound. Katana and Francium connected Solana lucifer Yearn.finance. Redstone resembles Chainlink, leveraging Arweave for cheaper retention to connection oracle services to longer process tokens and NFT information feeds. And portion these projects lucifer apps archetypal created connected Ethereum, they’re each innovating successful unsocial and differentiated ways.

Polkadot Cometh

Elsewhere successful DeFiland, we were peculiarly progressive successful the Polkadot ecosystem successful Q1. With the long-awaited motorboat of Polkadot parachains arriving astatine the extremity of 2021, we’re seeing momentum astir DOT pickup steam.

You tin deliberation of Polkadot arsenic a web that you tin motorboat furniture 1s connected apical of. Each of these furniture 1s, called parachains, are susceptible of interoperating with 1 another. With parachains live, Polkadot is present susceptible of hosting idiosyncratic applications.

We’ve present invested successful 4 of the 5 unrecorded parachains (Acala, Moonbeam, Parallel Finance, and Astar) and waded deeper into the DOT waters successful Q1 with investments successful Composable Finance, Satori, and Coinbase alum Luke Youngblood’s caller project: Moonwell.

NFT enlargement pack

After a breakout summer, NFT income person travel backmost down to world a spot from their earlier highs. Below the surface, however, innovation is much vibrant than ever.

Where NFT enactment successful 2021 centered astir elemental buying and selling (aka flippin’ JPEGs), the adjacent question of projects are gathering inferior astir NFTs. NiftyApes and PawnFi, for example, are moving to bring liquidity to NFT holders by letting them instrumentality retired loans collateralized by their NFTs. Platforms similar Cymbal purpose to bring much assemblage and societal features astir NFT ownership.

Yuga Labs, the workplace down Bored Ape Yacht Club, made waves this 4th by raising astatine a $4B valuation to physique a BAYC branded metaverse. Next, they acquired the IP rights to NFT collections CryptoPunks and Meebits. They capped it disconnected by announcing a movie trilogy (produced by Coinbase) wherever BAYC NFT holders tin taxable their NFTs to beryllium formed successful the films and get paid a licensing interest — an absorbing caller experimentation with on-chain licensing.

GameFi 2.0

Blockchain based gaming had its coming retired enactment successful 2021 centered astir the emergence of Axie Infinity. Sales of Axie Infinity NFTs peaked astatine a staggering $848M successful August earlier falling precipitously. (Note that contempt the evident inclination reversal and a major hack, Axie inactive posted a respectable $30M successful March NFT sales).

Axie’s multi-billion dollar tally was capable to enactment the full gaming satellite connected announcement and the adjacent question of blockchain based games person been softly raising ever since. Notably, galore of the teams raising person way records gathering highly palmy mobile, web, and AAA games (Clockwork Labs, Block Tackle, Summoners Arena, Third Time, Avalon).

The blockchain based games of the aboriginal volition infuse crypto NFTs into much acquainted Web2 gaming formats — MMORPGs, FPS, MOBA etc. Other CBV portfolio companies similar Joyride volition marque it easier for crippled devs to integrate crypto/NFTs into existing titles.

At present, South East Asia is establishing itself arsenic the halfway of the crypto-gaming world, led by the Philippines and Vietnam, among others. We’re peculiarly excited by developments successful this portion and the advancement of Vietnamese based gaming guild and CBV portfolio institution Ancient8.

Ventures outlook

Amidst a shaky macro picture, galore crypto investors are connected edge. More frequently, we’re getting asked however the marketplace downturn volition impact CB Ventures’ activity. To date, there’s nary shortage of precocious prime entrepreneurs gathering successful crypto and Web3. It isn’t nevertheless unreasonable to expect a slowdown should prices proceed to sag, akin to what’s been observed successful broader task backing (down 19% QoQ). Regardless, our strategy won’t alteration much.

It bears reminding that immoderate of the astir palmy projects of contiguous were funded during the carnivore marketplace of 2018/19. In that light, our aboriginal investments successful projects similar Compound, OpenSea, Polygon, Arweave, Starkware, Blockfi, NEAR, and Messari among others travel to mind. As such, we’ll proceed to put successful prime founders and projects moving the manufacture guardant careless of broader marketplace conditions.

It besides bears repeating conscionable however overmuch the investible Web3 scenery has broadened: DeFi, NFTs, DAOs, metaverses, and gaming are each evolving crossed a affluent array of furniture 1s. Then there’s cross-chain infrastructure to stitch each unneurotic arsenic good layer-2 solutions to assistance it each scale. Not to notation a 1000 different ideas not yet dreamed up. In different words, there’s much than capable innovation taking spot to support the CB Ventures’ squad engaged indefinitely.

This website does not disclose worldly nonpublic accusation pertaining to Coinbase oregon Coinbase Venture’s portfolio companies.

Disclaimer: The opinions expressed connected this website are those of the authors who whitethorn beryllium associated persons of Coinbase, Inc., oregon its affiliates (“Coinbase”) and who bash not correspond the views, opinions and positions of Coinbase. Information is provided for wide acquisition purposes lone and is not intended to represent concern oregon different proposal connected fiscal products. Coinbase makes nary representations arsenic to the accuracy, completeness, timeliness, suitability, oregon validity of immoderate accusation connected this website and volition not beryllium liable for immoderate errors, omissions, oregon delays successful this accusation oregon immoderate losses, injuries, oregon damages arising from its show oregon use. Unless different noted, each images provided herein are the spot of Coinbase. This website contains links to third-party websites oregon different contented for accusation purposes only. Third-party websites are not nether the power of Coinbase, and Coinbase is not liable for their contents. The inclusion of immoderate nexus does not connote endorsement, support oregon proposal by Coinbase of the tract oregon immoderate relation with its operators.

3 years ago

3 years ago

English (US)

English (US)