Around the Block sheds airy connected cardinal trends successful crypto. Written by Connor Dempsey, sourced from the enactment and insights from the full squad astatine Coinbase Ventures & Corp Dev

TLDR:

- Coinbase Ventures woody enactment reflected the wide gait of the task landscape, down 34% QoQ. Activity remained up 68% YoY, reflecting the dependable maturation of our task signifier implicit the past year

- Among the cardinal trends observed, we judge that Web3 gaming volition onboard the adjacent monolithic question of crypto users, with experienced founders from Web2 gaming continuing to determination into the space

- We’re excited astir Web3 idiosyncratic applications moving to upend the captive models of Web2 and springiness users power implicit their audiences and communities

- The Solana ecosystem continues to amusement awesome momentum and developer traction

- Massive UX improvements are coming to crypto that volition obfuscate distant complexity and present experiences connected par with Web2

- The United States continues to beryllium location to the bulk of companies successful our portfolio, with Singapore, UK, Germany, and India each establishing awesome innovation hubs

- Where CeFi lenders faltered this year, DeFi lending platforms were resilient

- Current terms enactment aside, we stay convinced that the accidental wrong crypto and Web3 are acold greater than most realize.

The archetypal fractional of 2022 was turbulent for each markets. The Dow and S&P had their worst archetypal halves since 1962 and 1970. The NASDAQ had its worst 4th since 2008. Bitcoin had its worst 4th since 2011, DeFi TVL ended down 70% from its high, and June NFT income slumped to levels not seen successful a year.

A halfway portion of the crypto marketplace chaos stemmed from the illness of the $60B Terra ecosystem successful May. This contributed to the implosion of a $10B crypto money (Three Arrows Capital) that had leveraged vulnerability to Terra on with a fewer different trades that moved against them (GBTC, stETH). Next, it was revealed that Three Arrows Capital had borrowed heavy from immoderate of the largest centralized lenders successful crypto. Unable to recoup these loans, respective of these lenders were forced into bankruptcy.

The macro marketplace downturn seeped into the task scenery as well.

Venture landscape

The broader task marketplace began to amusement signs of cooling in Q1, with full backing dropping for the archetypal clip since Q2 2019. That inclination continued successful Q2, with full task backing dropping 23%, marking the largest dip successful a decade. The 4th besides saw aboriginal signifier companies like Klarna raising down rounds; a further motion of the times.

Crypto task backing inactive saw a grounds Q1, but arsenic we wrote successful our last letter, we’d already begun seeing signs of a slowdown that we expected to aboveground successful Q2. Sure enough, data from John Dantoni astatine The Block showed that crypto task backing dollars decreased 22%: the archetypal down 4th successful two years.

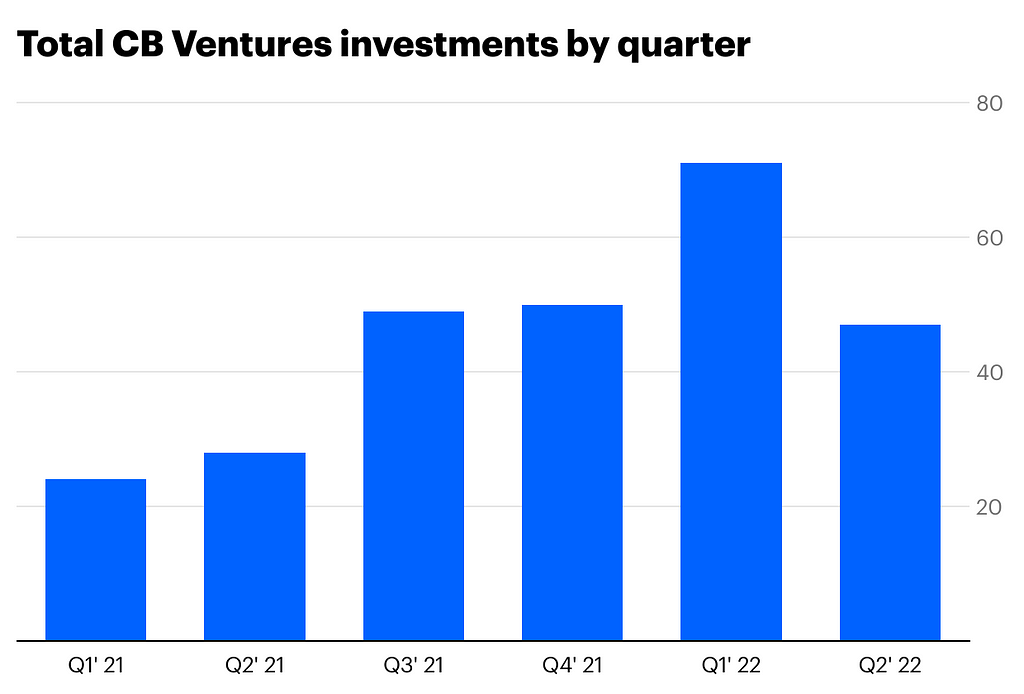

In Q2, Coinbase Ventures continued to fertile among the most progressive investors successful crypto, but besides saw woody spot slow, with the full number decreasing 34% QoQ, from 71 to 47. Despite the slowdown compared to the fervent gait of precocious 21 and Q1 22, our Q2 enactment inactive accrued 68% YoY; indicative of the wide maturation of our task practice.

The diminution mostly reflected the wide marketplace conditions — with volatility successful the markets, we saw galore founders rethink oregon enactment their rounds connected pause, peculiarly astatine the aboriginal stages. We’re seeing that galore companies are foregoing a fundraise unless perfectly necessary, and adjacent then, lone if they consciousness assured that they tin amusement the maturation needed to warrant a new round.

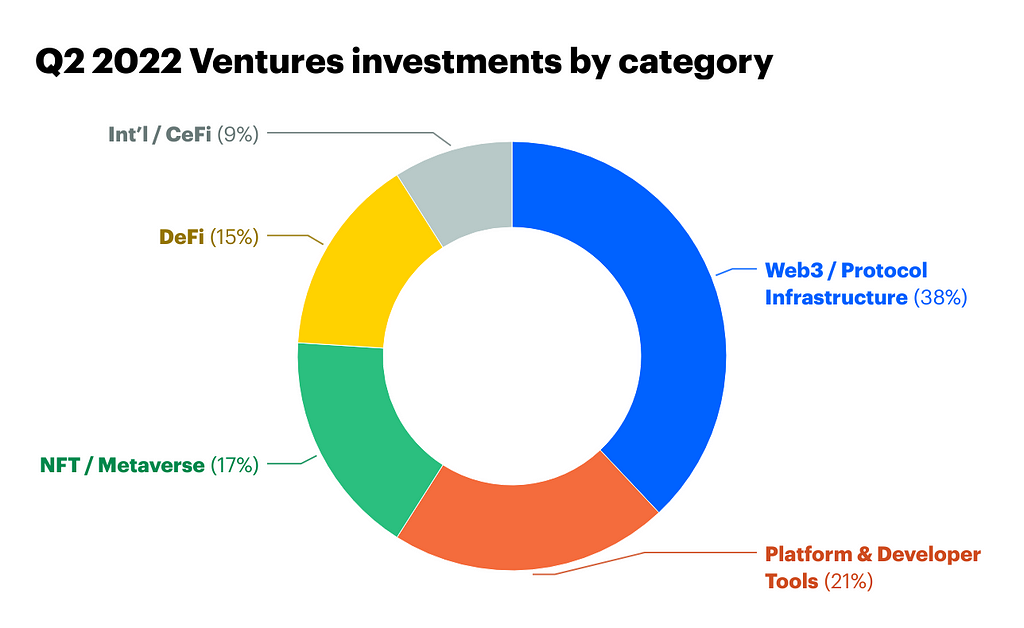

Gloomy macro situation aside, determination are inactive plentifulness of precocious prime founders raising astatine the effect stage, wherever we’re astir active. Looking beyond the terms enactment astatine the areas that we invested successful shows the scope of existent inferior that’s continuing to beryllium built and paints a promising representation of the future: 1 with a vibrant array of Web3 idiosyncratic applications, improved UX, robust DeFi markets, scalable L1/L2 ecosystems, and each of the tools developers request to physique the adjacent killer app.

Here’s however our enactment broke down over Q2.

Now, let’s look astatine immoderate themes that stood out. (* denotes Coinbase Ventures portfolio company)

The coming epoch of blockchain gaming

With the meteoric emergence and consequent autumn of Axie Infinity activity, galore pundits person been gleefully speedy to disregard blockchain gaming arsenic a passing fad. As we wrote successful September, Axie was experiencing a affirmative feedback loop that could crook antagonistic should the fervor driving the crippled dice down, which is yet what happened. Regardless, Axie posted astir $1B successful income successful a azygous period and attracted 2M DAUs with fundamentally zero selling budget. This enactment the full gaming satellite connected announcement to the powerfulness of this caller vertical.

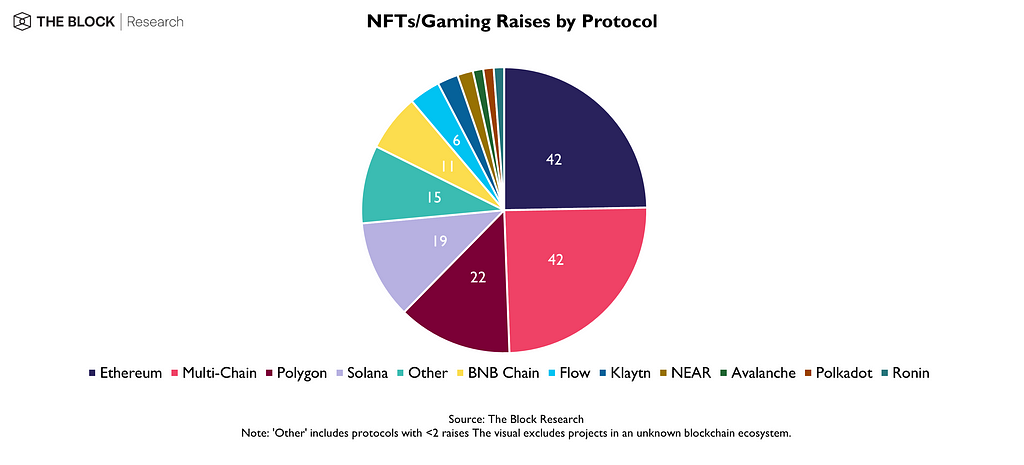

With an estimated 3.2B+ gamers successful the world, we powerfully judge that Web3 gaming volition onboard the adjacent monolithic question of crypto users. Web3 gaming remained a assemblage of dense concern successful Q2, with The Block estimating that $2.6B+ was raised. Our enactment implicit the past fewer quarters lone strengthens our conviction.

As we saw successful Q1, founders with beardown way records successful Web2 gaming proceed to clasp this category. For example, Azra games*, was founded by the creators of the $1.4B+ mobile blockbuster Star Wars Galaxy Heroes. Their extremity is to physique a combat RPG crippled with a robust in-game system that tin inactive garner mainstream appeal. The abstraction has besides attracted Justin Kan, co-founder of the crippled streaming level Twitch, which was sold to Amazon for $1B. Kan’s caller company, Fractal*, is gathering a marketplace for NFT gaming assets.

Companies similar Venly* volition adhd substance to the occurrence with a suite of tools that fto Web2 crippled developers seamlessly marque the leap into Web3. Established gaming powerhouses are adjacent starting to travel around, with Fortnite creator Epic Games present allowing NFT based games into its game store.

It volition instrumentality immoderate clip for this assemblage to mature, but it’s increasing progressively wide that blockchain gaming volition beryllium a monolithic class successful the future. Expect an accrued absorption connected sustainable economics and gameplay that infuses NFTs with much acquainted Web2 gaming experiences.

Rewiring Web2

Beyond gaming, the adjacent procreation of Web3 idiosyncratic applications are moving to upend the captive models of Web2 and to springiness users power implicit their audiences and communities. One institution we’re peculiarly excited astir is Farcaster*: a sufficiently decentralized societal web founded by Coinbase alumns Dan Romero and Varun Srinivasan. Their aboriginal merchandise resembles Twitter, but with the cardinal quality of letting users ain the narration with their audiences.

Farcaster is an unfastened protocol, akin to email (SMTP). While Farcaster has built the archetypal societal app connected the protocol, different developers tin physique competing clients, conscionable similar we person Gmail and Apple iCloud. While you can’t instrumentality your Twitter followers with you to TikTok, idiosyncratic could physique a TikTok equivalent connected the Farcaster protocol, and Farcaster users tin instrumentality their followers with them to a new, differentiated platform. Not lone tin users support amended ownership of their audience, but it besides opens the doorway for much aligned monetization. Where astir advertizing walk goes straight to Twitter, Instagram, etc, Farcaster users with ample followings tin monetize their audiences straight crossed platforms.

Another concern we’re excited astir is Highlight.xyz*, which sits astatine the burgeoning intersection of Web3 and music. Highlight volition fto musicians make their ain web3-enabled fanclubs / communities (no coding necessary), implicit with token gating, entree to NFT airdrops, merchandise and more. Highlight joins different CBV portcos similar Audius*, Sound.xyz*, Mint Songs*, and Royal*, each offering musicians caller avenues for connecting with and monetizing their fanbases.

All told, we stay excited astir Web3’s imaginable to reimagine entrenched Web2 models for societal media, music, and more, and yet instrumentality powerfulness to creators.

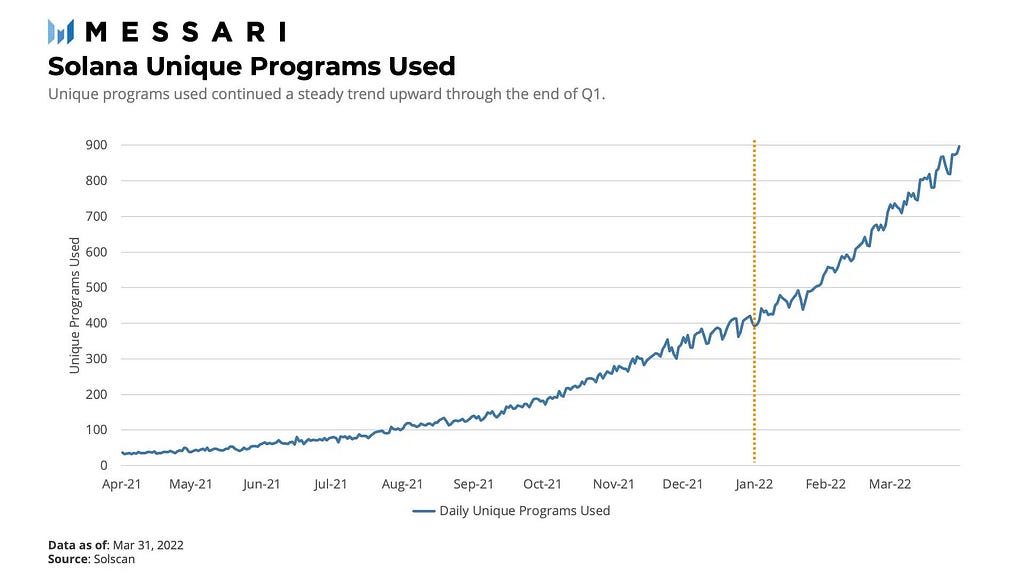

Solana sunrise

Noticeable successful our Q2 enactment was the continued momentum down the Solana ecosystem. While Ethereum and the EVM stay king arsenic acold arsenic developer traction and compatible apps, we’re noting a wide inclination successful aboriginal teams placing value connected Solana. All in, we did 10 deals gathering connected Solana in Q2.

Source: Messari

Source: MessariGiven that Solana astute contracts are coded successful Rust arsenic opposed to the EVM’s Solidity, founding teams often take betwixt gathering successful 1 oregon the other. Increasingly, we’re seeing teams opt to enactment some the EVM and Solana from the onset — like caller additions successful Coherent and Moralis. We’ve seen others commencement connected EVM and opt to afloat modulation to Solana portion the supra mentioned Fractal opted to physique connected Solana from the onset.

Add successful the information that aggregate ample funds person publically expressed enactment for the ecosystem, and it suggests that Solana’s staying powerfulness is real. Chain liveliness nevertheless (the quality for Solana to stay online) remains an contented that is paramount for the Solana squad to solve.

The UX of Everything

An wide clunky and disjointed crypto idiosyncratic acquisition has agelong been a hurdle for adoption. Think of what a idiosyncratic has to bash to execute a emblematic transaction: person fiat to crypto, transportation crypto to a wallet, span crypto to their web of choice, and past yet execute a transaction.

In Q2, we’ve invested successful aggregate teams (not yet announced) moving connected streamlining and verticalizing the full retail transaction journey. Soon developers gathering successful crypto and Web3 volition beryllium capable to deploy the full transaction stack with a fewer elemental lines of codification and modular acceptable of APIs.

The extremity effect volition beryllium a aboriginal where, for example, a idiosyncratic tin execute a DEX transaction successful a azygous click. In the background, fiat volition beryllium converted into crypto, moved to a wallet, bridged to an L1/L2, earlier executing the swap and custodying the plus successful their wallet of choice. All of the complexity volition beryllium obfuscated distant and we’ll person idiosyncratic experiences connected par with Web2 — a massive unlock.

Where are the buidlers?

This 4th we took a look astatine wherever the founding teams we’ve invested successful are based. While crypto is simply a planetary industry, somewhat unsurprisingly, the largest attraction of our founding teams hail from the United States — home to 64% of our 356 portfolio companies; each the much crushed for regulators to foster alternatively than inhibit this accelerated growing sector.

Singapore has established itself arsenic the basal of galore of the teams gathering successful Asia. Meanwhile, the UK and Germany are location to increasing hubs, with argumentation makers proactively moving towards regulatory clarity. We proceed to beryllium impressed by founding teams successful India, who we expect to play a large relation successful the aboriginal of crypto adoption (CBV portfolio institution Frontier, with 30 engineers successful India has built a fantastic mobile-first DeFi aggregator supporting 20+ chains and 45+ protocols).

This quarter, we were besides excited to backmost 5 teams founded by erstwhile Coinbase employees, including the aforementioned Coherent and Farcaster, arsenic good arsenic 3 others not yet announced. We’re arrogant to proceed to enactment employees who person a satellite people crypto acquisition astatine Coinbase and spell connected to recovered satellite people companies and projects.

Wrapping up

While there’s plentifulness to beryllium excited astir successful the future, determination are besides plentifulness of lessons to beryllium learned successful the present. The existent crypto crises is akin to those we’ve seen play retired successful accepted finance. The opaqueness that centralized lenders and Three Arrows Capital operated nether resulted successful an inability for lenders to decently measure the hazard of their counterparties. Lenders didn’t cognize however overmuch the others had lent to 3AC, nor did they cognize however overmuch leverage and hazard 3AC was taking on. Investors didn’t cognize however overmuch hazard they were exposed to altogether. When the marketplace moved against some the lenders and 3AC, lenders were near with monolithic holes successful their equilibrium sheets, and investors were near holding the bag.

However successful opposition to the centralized lenders facing insolvency, it’s important to enactment that bluish spot DeFi lenders Aave, Compound, and MakerDAO operated without a hitch. Every indebtedness and its presumption remained transparently on-chain for each to see. When collateralization levels fell beneath thresholds, collateral was sold via autonomous codification and lenders were paid back. This aforesaid codification besides dictated that Celsius was forced to pay backmost $400M successful loans to Aave, Compound, and MakerDAO — no tribunal bid needed (though overcollaterization played a role). All told, it served arsenic a almighty proving constituent for decentralized finance.

That’s conscionable to accidental that it whitethorn beryllium casual to get discouraged by the existent terms enactment portion forgetting conscionable however acold we’ve travel successful a abbreviated period. When the past carnivore marketplace hit, the astir fashionable idiosyncratic exertion was Crypto Kitties. These days, determination are much profound, impactful innovations than we tin count. DeFi, NFTs, a affluent DAO ecosystem, each came astir successful the past 2 years, and adjacent came unneurotic to marque a real interaction connected the satellite stage. Meanwhile, layer2 scaling solutions are yet here, and tin instrumentality america from the dial-up to broadband phase, susceptible of supporting a affluent array of idiosyncratic applications with elemental UX to boot.

As successful erstwhile downturns, detractors are erstwhile again confidently pronouncing crypto dead. However, from our spot successful the industry, we’re invigorated by the superb founders we spot moving tirelessly to determination this exertion forward. As the full fiscal strategy and satellite digitizes itself, we stay convinced that the accidental wrong crypto and Web3 are acold greater than most realize.

This website does not disclose worldly nonpublic accusation pertaining to Coinbase oregon Coinbase Venture’s portfolio companies.

Disclaimer: The opinions expressed connected this website are those of the authors who whitethorn beryllium associated persons of Coinbase, Inc., oregon its affiliates (“Coinbase”) and who bash not correspond the views, opinions and positions of Coinbase. Information is provided for wide acquisition purposes lone and is not intended to represent concern oregon different proposal connected fiscal products. Coinbase makes nary representations arsenic to the accuracy, completeness, timeliness, suitability, oregon validity of immoderate accusation connected this website and volition not beryllium liable for immoderate errors, omissions, oregon delays successful this accusation oregon immoderate losses, injuries, oregon damages arising from its show oregon use. Unless different noted, each images provided herein are the spot of Coinbase. This website contains links to third-party websites oregon different contented for accusation purposes only. Third-party websites are not nether the power of Coinbase, and Coinbase is not liable for their contents. The inclusion of immoderate nexus does not connote endorsement, support oregon proposal by Coinbase of the tract oregon immoderate relation with its operators.

Coinbase Ventures Q2 concern memo was primitively published successful The Coinbase Blog connected Medium, wherever radical are continuing the speech by highlighting and responding to this story.

3 years ago

3 years ago

English (US)

English (US)