- CoinShares saw a play inflow of $193 cardinal into its crypto concern products.

- Europe dominated the inflows with $147 million, portion the Americas recorded $45 million.

- Solana besides saw its highest play inflow, with $45 million.

CoinShares has published its play study connected integer assets money flows, and it holds immoderate affirmative signs for the market. The study highlights that inflows into crypto investments products totaled $193 million, the highest since December 2021.

The spike successful inflows is simply a motion that the market’s sentiment is changing. The inflow was mostly dominated by entities successful Europe, with the continent accounting for $147 million, portion the Americas made up the remainder astatine $45 million.

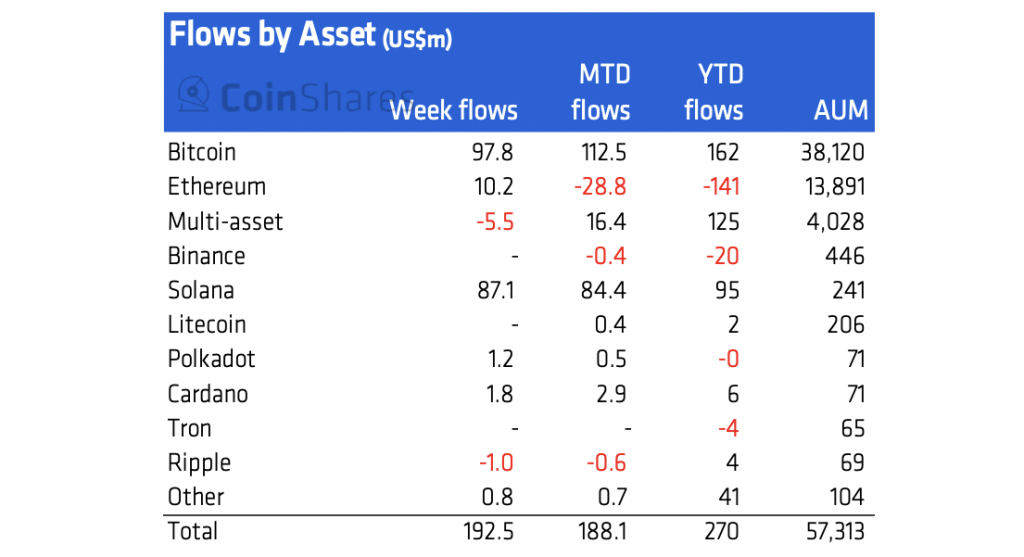

It wasn’t conscionable bitcoin and ethereum that saw accrued investment, arsenic solana recorded its largest azygous week of inflows, with a full of $87 million. That represents 36% of CoinShares’s assets nether management. The full AUM of Solana is $241 million, making it CoinShares fifth-largest concern product.

Inflow by crypto assets: CoinShares

Inflow by crypto assets: CoinSharesBitcoin saw a full inflow of $98 cardinal and ethereum $10.2 million. Bitcoin’s year-to-date inflow present stands astatine $162 million. Other assets besides mostly saw investment, though not connected the standard of the aforementioned assets.

The marketplace has been having a beardown week connected astir each accounts — astir notably the terms of assets and the wide marketplace headdress surging by treble digits implicit the past week. All of these developments person brought immoderate long-needed optimism for the market, which took a deed earlier this year.

The adjacent fewer weeks volition beryllium important successful mounting realistic targets for bitcoin and different assets. Analysts person enactment $51,000 arsenic a semipermanent absorption target, and method indicators are bullish.

A Bull Run successful Sight?

BTC price: TradingView

BTC price: TradingViewInvestors volition beryllium keeping a adjacent oculus connected the marketplace arsenic it appears connected the verge of a bull run. Up implicit 16% successful the past days, bitcoin looks similar it could beryllium breaking retired of the stagnation of the $40,000–$50,000 range. Ethereum has done adjacent amended connected the backmost of galore positive developments successful its ecosystem.

Several developments suggest that a bull tally whitethorn so beryllium astir the corner. Small holders of bitcoin and ethereum are increasing, with the fig of addresses with much than 0.1 BTC and ETH some up this year.

Clarity successful regulation, particularly successful the United States via President Biden’s enforcement order, besides tentatively suggests amended prices. At the precise least, investors person perked up astir the marketplace and spot greener days ahead.

3 years ago

3 years ago

English (US)

English (US)