sponsored

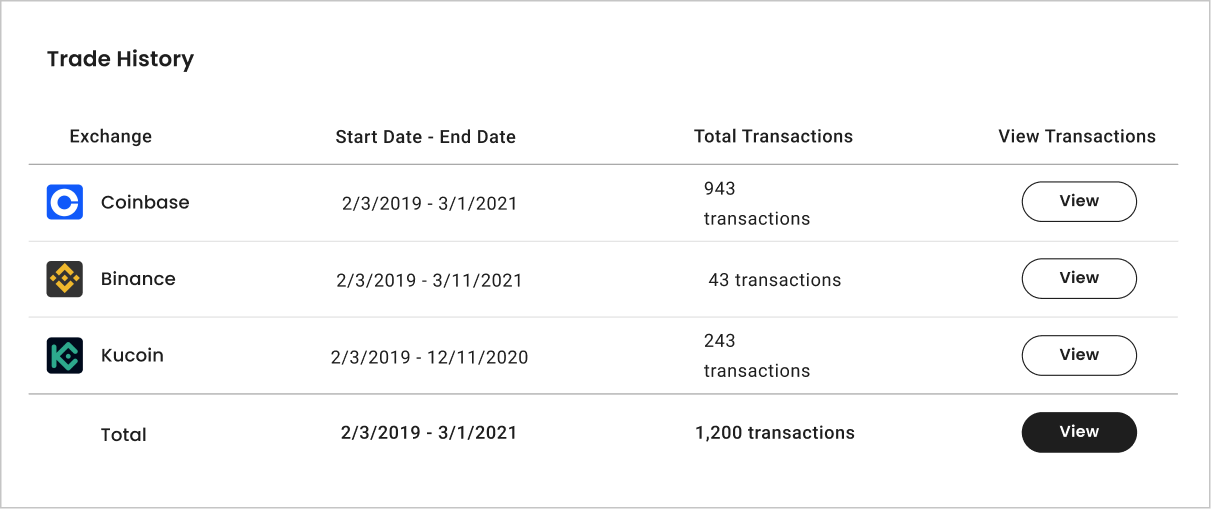

Many crypto exchanges nonstop taxation forms to the IRS, each with their ain database of supported tokens and info that doesn’t needfully lucifer up. This tin make a batch of disorder for U.S. taxpayers. Luckily, Cointelli tin swiftly and reliably make a unified taxation study with the propulsion of a button.

And if determination are immoderate inter-platform inconsistencies, Cointelli has a almighty mistake correction diagnostic that lets users easy edit data. Cointelli’s algorithms marque it casual to compile each of the information from Coinbase, Binance, Kraken, and galore others into 1 taxation report. And each for the precise affordable terms of conscionable $49!

What is the Best Software for Crypto Taxes?

American cryptocurrency traders and investors request each the assistance they tin get erstwhile it comes to navigating the taxation strategy effectively. Cryptocurrency has made things analyzable for galore people, arsenic the IRS classifies it arsenic ‘property’ for taxation purposes — dismantling a communal misconception that determination is nary tax connected crypto. U.S. investors, successful particular, are having to wage much attraction to reporting taxes connected cryptocurrency. With bullish maturation successful cryptocurrency investment, and the marketplace expected to turn massively, the U.S. authorities has ramped up its efforts to get its portion of the pie. The IRS archetypal drafted its cryptocurrency taxation rules backmost successful 2014, and Washington has precocious fixed the bureau different $80 cardinal to way and drawback taxation evaders.

Crypto taxes aren’t casual to wrapper your caput around. Doing them correctly often involves accurately reporting analyzable transactions crossed galore crypto platforms. Thus, having the close bundle tin beryllium a lifesaver erstwhile it comes to getting it close successful a timely manner. Cointelli is simply a cloud-based crypto taxation mentation bundle solution that uses its unsocial exertion to assistance individuals, businesses, and CPAs prevention much connected crypto taxes. Cointelli specializes successful helping users reap the astir crypto taxation benefits imaginable portion reporting their crypto taxes accurately.

So, what other sets Cointelli apart? Well, the captious archetypal measurement successful calculating your crypto taxes with taxation bundle is collecting and importing your transaction information from crossed aggregate exchanges and wallets. This process whitethorn look straightforward, but determination are immoderate indispensable steps you request to instrumentality to guarantee accuracy.

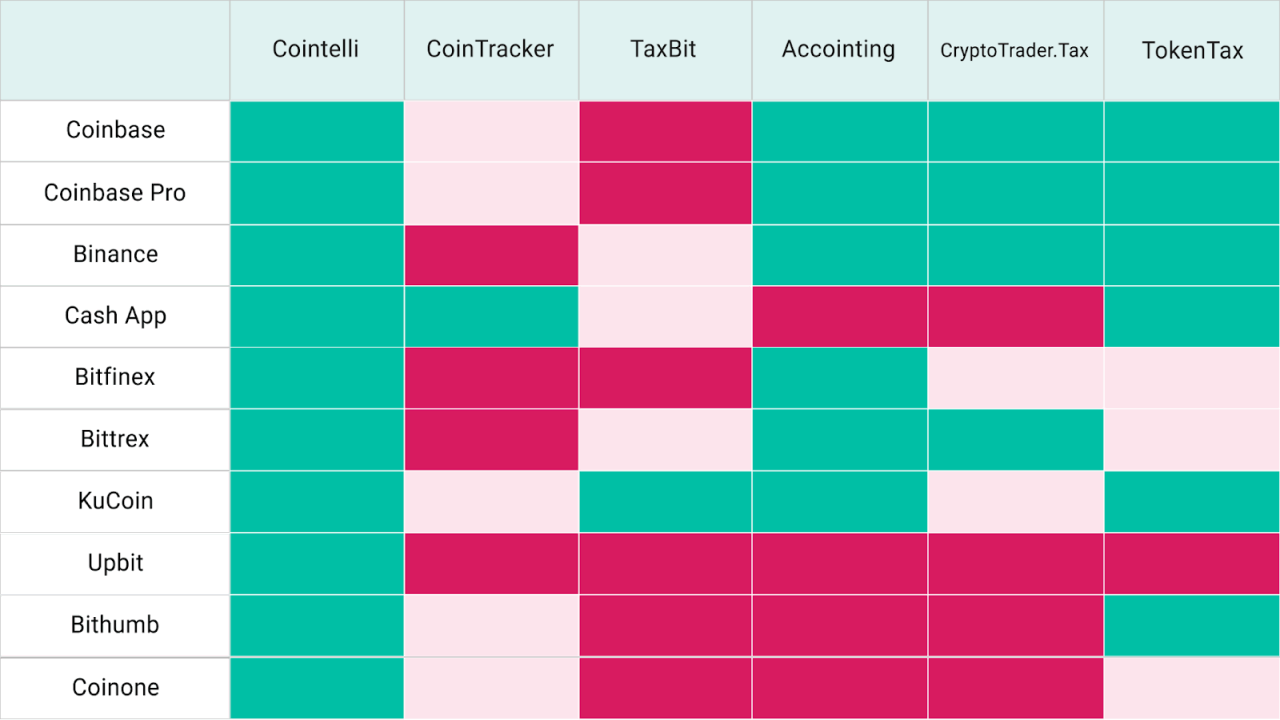

First, you person to cheque however galore crypto exchanges and wallets the bundle supports. Cointelli, for example, supports a considerably larger fig of large crypto exchanges than galore competitors — and with afloat import capabilities. Examples of exchanges supported by Cointelli see large ones similar Coinbase, Binance, KuCoin, and galore much niche exchanges arsenic well. To adhd to this, Cointelli besides features enactment for astatine slightest 15 blockchains, including fashionable ones similar Bitcoin, Ethereum, and adjacent Dogecoin.

CSV File Import Test Results: Green: Supported | Red: Not Supported | Pink: Not Fully Functional

CSV File Import Test Results: Green: Supported | Red: Not Supported | Pink: Not Fully FunctionalCointelli offers enactment for much wallets and exchanges and provides the easiest methods of importing transaction information from crossed these platforms. These benefits besides marque Cointelli precise casual to usage for first-timers, making it an fantabulous prime erstwhile choosing your crypto taxation software.

Reporting Taxes to the IRS

Many important exchanges similar Coinbase, Binance, and Kraken nonstop antithetic taxation forms to the IRS (for instance, Coinbase reports 1099-MISCs and Kraken reports further kinds of 1099 forms). However, these exchanges lone cognize astir the transactions that hap successful their ain systems. Each important speech besides has its ain database of supported cryptocurrencies, which won’t needfully lucifer up with different lists. This is wherefore it’s truthful important to person a crypto taxation bundle solution that rapidly and accurately aggregates each of this accusation successful 1 spot and processes it for you.

Cointelli not lone delivers these services, but makes them attainable for all, with afloat entree disposable for a simple, flat-fee of $49 per twelvemonth and nary hidden costs. In addition, users tin tally the programme for escaped to spot however overmuch they volition beryllium paying successful crypto taxes, and won’t wage thing until they determine to download the completed Form 8949. In summation to making it casual to capable retired and download the completed reports and forms, Cointelli besides has a seamless and easy-to-use interface and provides 24/7 lawsuit service.

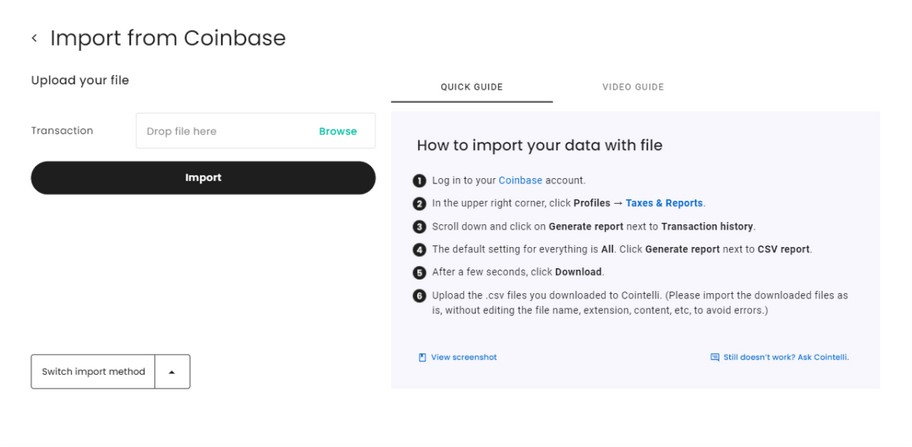

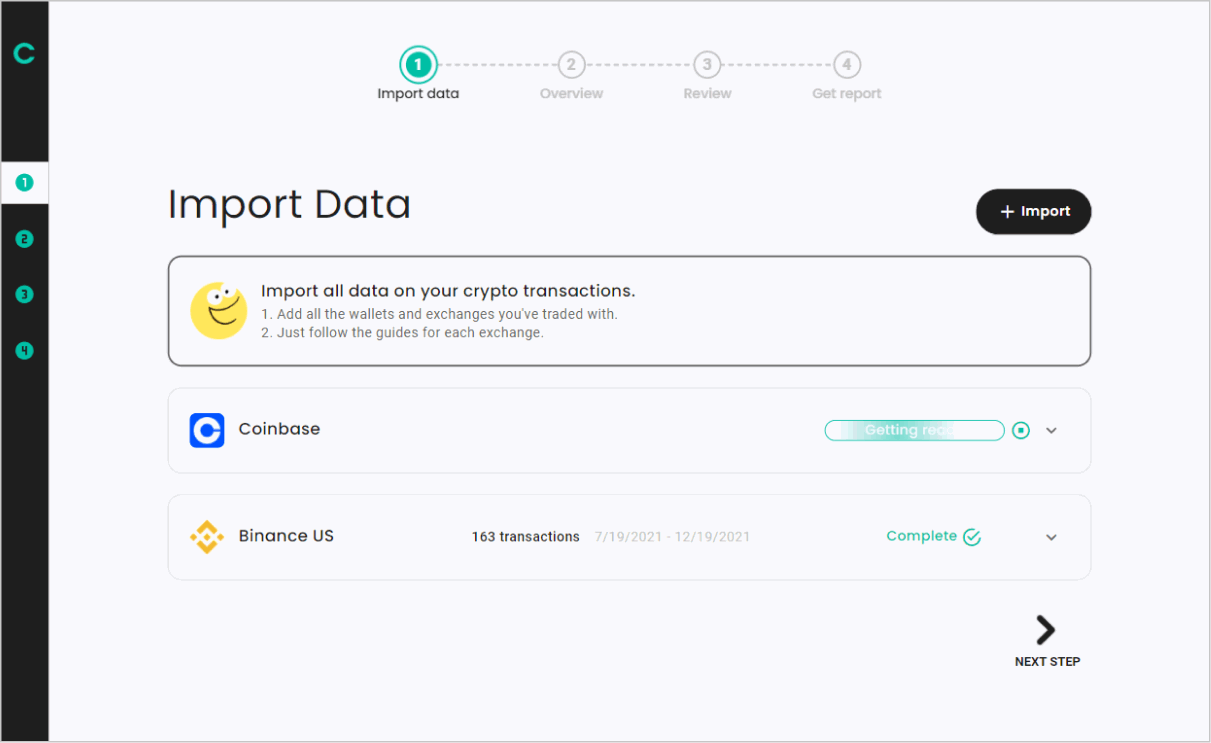

Importing transaction information into Cointelli from assorted exchanges similar Coinbase, Kraken and Binance.US is simply a straightforward affair. But for anyone having trouble, Cointelli provides elaborate and instructive guides and walkthroughs to amusement you precisely however it’s done.

For example, to import your information from Binance.US, you would simply travel the steps below:

How to Import Exchange Data from Binance.US

- First, sign up connected Cointelli

- Then, log successful to Binance and create your API key

- Copy and paste your API cardinal into the page, arsenic below

Once the import is complete, and the transaction information has been successfully added, you volition beryllium capable to corroborate your transactions. Once that’s done, Cointelli volition past prepare your Form 8949.

Once the import is complete, and the transaction information has been successfully added, you volition beryllium capable to corroborate your transactions. Once that’s done, Cointelli volition past prepare your Form 8949.

But what if you’ve traded determination else, similar connected Kraken oregon Coinbase? No problem! Just travel Cointelli’s instructions for each exchange, and soon you’ll person your taxation forms successful hand.

Click here for much information.

- This nonfiction is intended to supply wide fiscal accusation designed to amended a wide conception of the public; it does not springiness personalized tax, investment, legal, oregon different concern and nonrecreational advice. Before taking immoderate action, you should ever consult with your ain nonrecreational taxation advisor for proposal connected taxes, your investments, the law, oregon immoderate different concern and nonrecreational matters that impact yourself oregon your business.

- Cointelli is presently lone disposable successful the US. The supra fiscal and taxation accusation pertains to the US market.

This is simply a sponsored post. Learn however to scope our assemblage here. Read disclaimer below.

Bitcoin.com Media

Bitcoin.com is the premier root for everything crypto-related.

Contact [email protected] to speech astir property releases, sponsored posts, podcasts and different options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)