The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Speculation And Yields

This rhythm has been ace charged by speculation and yield, starring each the mode backmost to the archetypal Grayscale Bitcoin Trust premium arbitrage opportunity. That accidental successful the marketplace incentivized hedge funds and trading shops from each implicit the satellite to lever up successful bid to seizure the premium spread. It was a ripe clip for making money, particularly backmost successful aboriginal 2021 earlier the commercialized collapsed and switched to the important discount we spot today.

The aforesaid communicative existed successful the perpetual futures marketplace wherever we saw 7-day mean annualized backing rates scope up to 120% astatine peak. This is the implied yearly output that agelong positions were paying successful the marketplace to abbreviated positions. There were an abundance of opportunities successful the GBTC and futures markets unsocial for output and speedy returns to beryllium had — without adjacent mentioning the bucket of DeFi, staking tokens, failed projects and Ponzi schemes that were generating adjacent higher output opportunities successful 2020 and 2021.

There’s an ongoing, vicious feedback loop wherever higher prices thrust much speculation and leverage, which, successful turn, thrust higher yields. Now, we’re dealing with this rhythm successful reverse. Lower prices hitch retired much speculation and leverage portion washing retired immoderate “yield” opportunities. As a result, yields everyplace person collapsed.

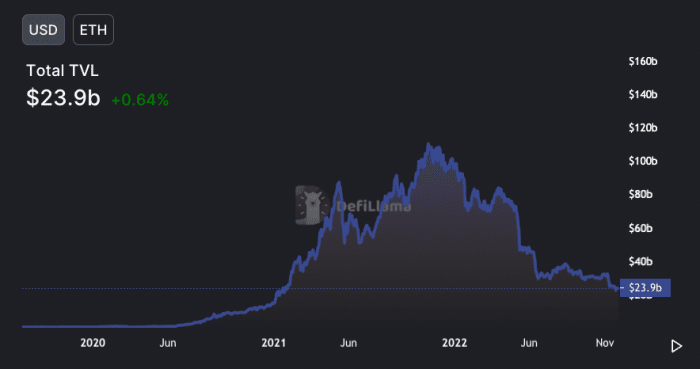

“Total worth locked” successful the Ethereum DeFi ecosystem surpassed implicit $100 cardinal successful 2021 during the speculative mania, and is present a specified $23.9 cardinal today. This leverage-fueled mania successful the crypto ecosystem fueled the maturation of the “yield” products offered by the market, astir of which person each collapsed present that the figurative tide has drawn out.

This dynamic brought astir the emergence of bitcoin and cryptocurrency yield-generating products, from Celsius to BlockFi to FTX and galore more. Funds and traders seizure a juicy dispersed portion kicking backmost immoderate of those profits to the retail users who support their coins connected exchanges to get a tiny magnitude of involvement and yield. Retail users cognize small astir wherever the output comes from oregon the risks involved. Now, each of those short-term opportunities successful the marketplace look to person evaporated.

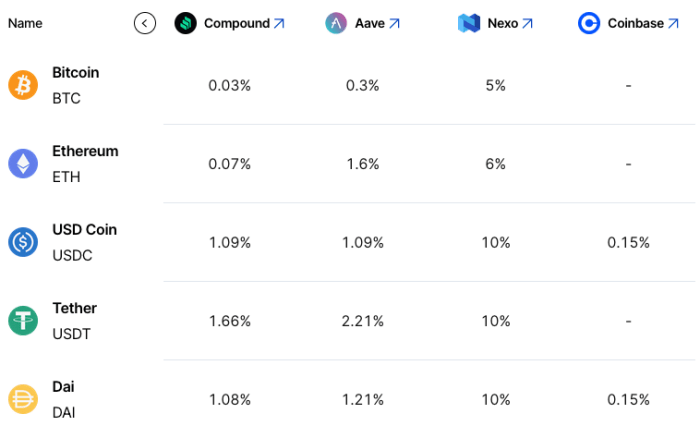

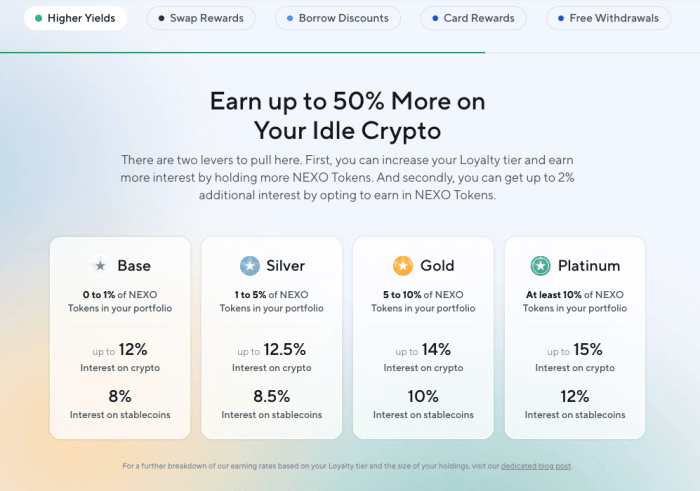

With each of the speculative trades and output gone, however tin companies inactive connection specified high-yielding rates that are good supra accepted “risk-free” rates successful the market? Where does the output travel from? Not to azygous retired oregon FUD immoderate circumstantial companies, but instrumentality Nexo for example. Rates for USDC and USDT are inactive astatine 10% versus 1% connected different DeFi platforms. The aforesaid goes for bitcoin and ethereum rates, 5% and 6% respectively, portion different rates are mostly nonexistent elsewhere.

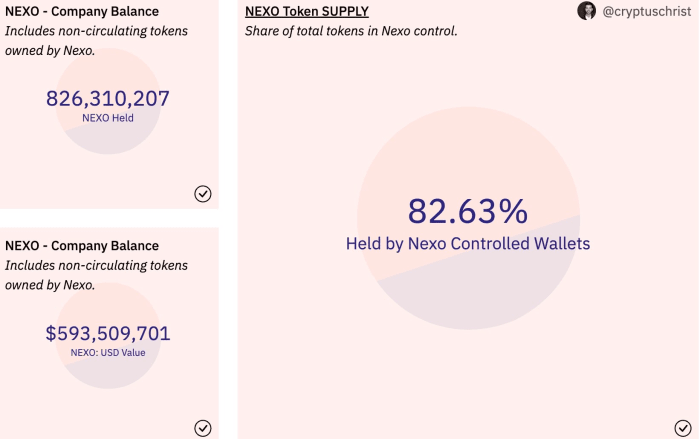

These precocious get rates are collateralized with bitcoin and ether offering a 50% LTV (loan-to-value ratio) portion a fig of different speculative tokens tin beryllium utilized arsenic collateral arsenic good astatine a overmuch little LTV. Nexo shared a elaborate thread connected their concern operations and model. As we’ve recovered retired clip and clip again, we tin ne'er cognize for definite which institutions to spot oregon not to spot arsenic this manufacture de-leveraging continues. However, the main questions to inquire are:

- Will a 13.9% indebtedness request beryllium a sustainable concern exemplary going guardant into this carnivore market? Won’t rates person to travel down further?

- Regardless of Nexo’s hazard absorption practices, are determination heightened counterparty risks presently for holding lawsuit balances connected galore exchanges and DeFi protocols?

Here is what we know:

The crypto-native recognition impulse — a metric that is not perfectly quantifiable but imperfectly observable via a assortment of datasets and marketplace metrics — has plunged from its 2021 euphoric highs and present looks to beryllium highly negative. This means that immoderate remaining product that is offering you crypto-native “yield” is apt to beryllium nether utmost duress, arsenic the arbitrage strategies that fueled the detonation successful output products passim the bull marketplace rhythm person each disappeared.

What remains, and what volition look from the depths of this carnivore marketplace volition beryllium the assets/projects built connected the strongest of foundations. In our view, determination is bitcoin, and determination is everything else.

Readers should measure counterparty hazard successful each forms, and enactment distant from immoderate of the remaining output products that beryllium successful the market.

3 years ago

3 years ago

English (US)

English (US)