Russia · Ukraine› Bitcoin · Ethereum › Analysis

What galore person suspected, but was hard to really prove, has present been confirmed by crypto cybercrime experts Chainalysis: There is nary evidence, whatsoever, that sanctioned Russian entities are utilizing crypto to evade sanctions.

Cover art/illustration via CryptoSlate

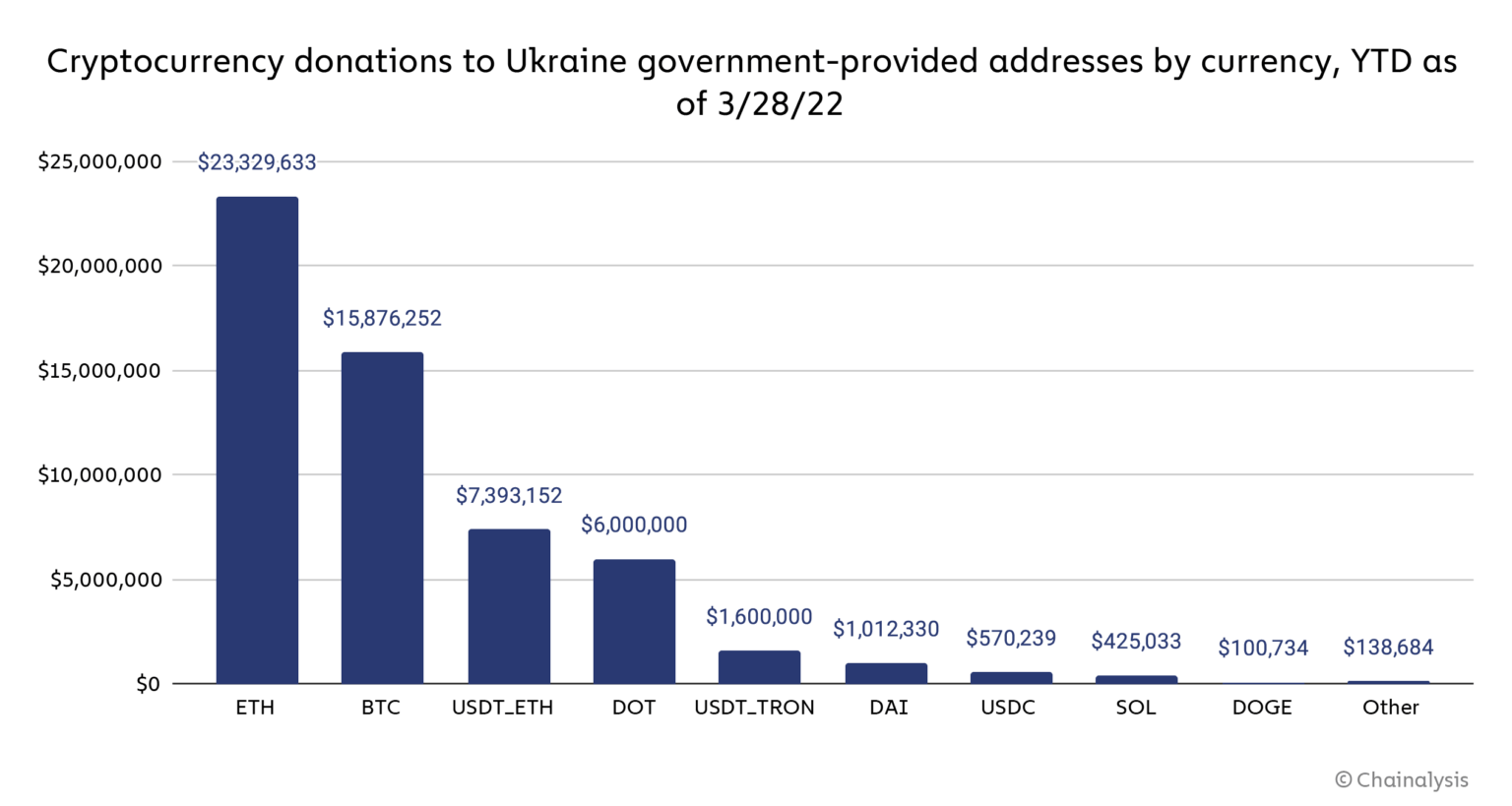

As Russia’s warfare successful Ukraine continues, cryptocurrencies are taking connected an important relation successful the conflict, but not successful the capableness of evading sanctions connected Russian entities oregon oligarchs. On the contrary, crypto has proven itself to beryllium precise utile successful supporting Ukraine arsenic users astir the satellite person donated implicit $56 cardinal successful cryptocurrency to addresses provided by the Ukrainian authorities alone.

This is “showcasing not conscionable the crypto community’s generosity but besides virtual assets’ unsocial inferior for cross-border payments,” Chainalysis report connected the substance reads.

As astir readers know, the United States and galore of its allies successful the EU and elsewhere person taken unprecedented actions against Russia, including adding Russian oligarchs, their household members, and their businesses, arsenic good arsenic each large state-owned banks and galore vigor exporters, to the Office of Foreign Assets Control’s (OFAC) Specially Designated Nationals And Blocked Persons List (SDN).

Western powers person besides removed prime Russian banks from the SWIFT system, fundamentally cutting them disconnected from the planetary fiscal system, and sanctioned Russia’s cardinal bank, preventing it from utilizing its $650 cardinal successful reserves to mitigate the interaction of the sanctions.

There’s nary grounds sanctions evasion is happening

Many are present wondering however Russia’s concern and governmental elites could usage cryptocurrency, specified arsenic bitcoin (BTC) oregon ether (ETH), to evade sanctions. “While there’s nary nonstop grounds this is happening, It’s a tenable interest arsenic Russia accounts for a disproportionate stock of respective categories of cryptocurrency-based crime, and is location to galore cryptocurrency services that person been implicated successful wealth laundering activity,” the study reads.

As Chainalysis co-founder Jonathan Levin explained portion testifying earlier the U.S. Senate, if cryptocurrency-based sanctions evasion is happening, it would astir apt look much similar emblematic wealth laundering activity, successful which comparatively tiny amounts of cryptocurrency are moved gradually to disparate cashout points, alternatively than each astatine erstwhile successful immense transactions.

Chainalysis’ study goes connected to database the antithetic ways sanctions could beryllium evaded and dismisses each of them.

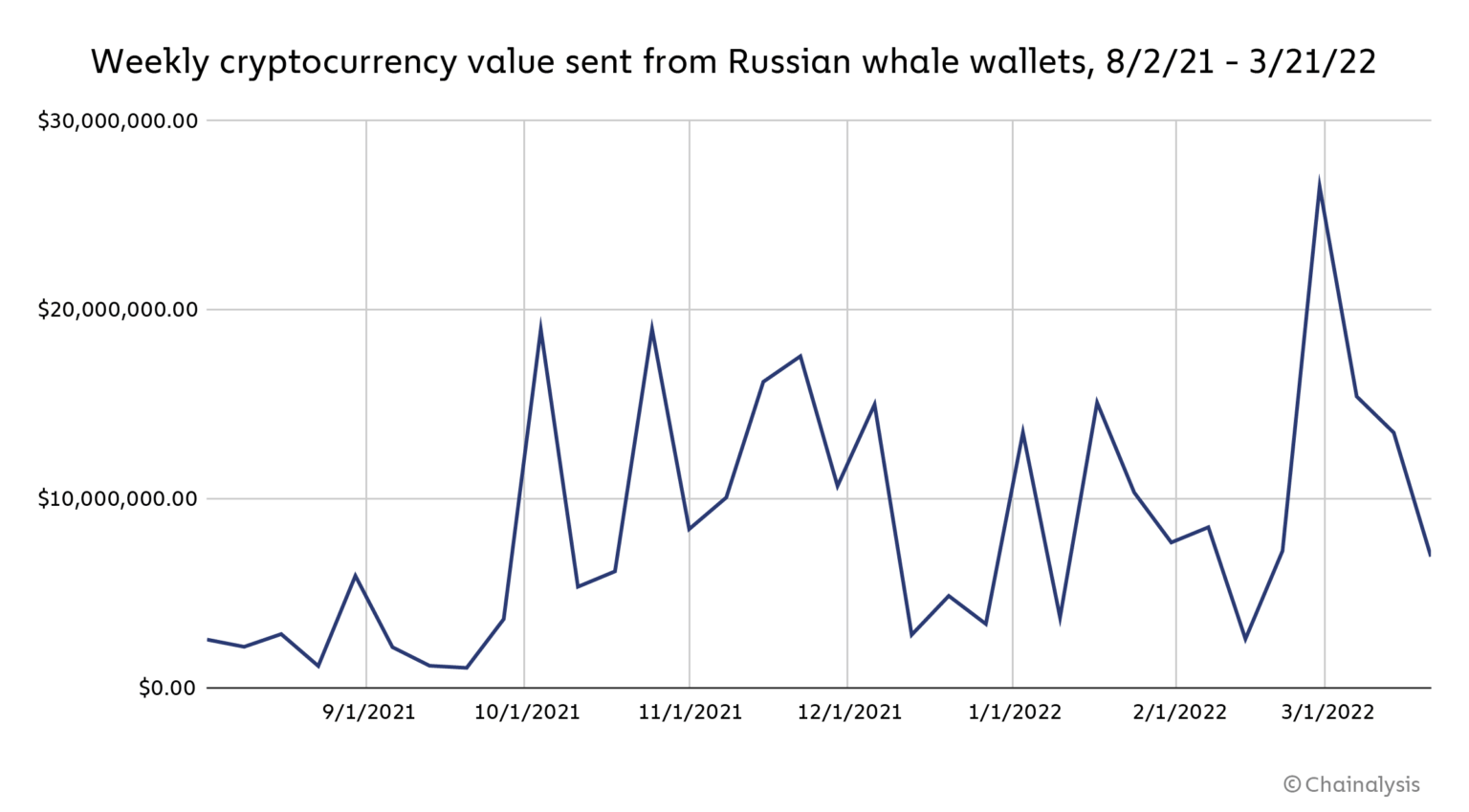

First, if Russian crypto whales – wallets with much than $1 cardinal worthy of crypto – would effort to determination these funds, it would show. Between the commencement of the penetration and the 21st of March, Chainalysis tracked conscionable implicit $62 cardinal worthy of cryptocurrency sent from Russia-based whales to different addresses, galore of which are associated with OTC desks and exchanges, immoderate of them high-risk.

Image by Chainalysis.

Image by Chainalysis.“While spikes successful this enactment are common, Russian whale sending deed its highest levels successful astir 8 months during the week of February 28 soon aft the invasion, reaching $26.5 million. On-chain enactment unsocial can’t archer america if these transfers represent sanctions evasion, arsenic we don’t cognize if the whale wallets are controlled by sanctioned individuals and entities,” the study reads.

Sbercoin to zero

Chainalysis besides looked into the recently created cryptocurrency issued by Russia’s biggest slope Sberbank, which was enactment connected the sanctions database astatine the opening of the war. The Sbercoin, arsenic it is named, had antecedently been announced successful precocious 2020.

According to CoinMarketCap, Sbercoin has seen astir $4.5 cardinal successful full transaction volume, each connected 1 fashionable decentralized exchange. Sbercoin’s terms has dropped implicit 90% since its motorboat and presently sits astatine $0.00003329 arsenic of March 28, 2022, with a marketplace headdress of $113,089. Sbercoin is frankincense evidently not utilized for sanctions evasion.

Chainalysis besides looked astatine different cryptocurrency services and usage typologies that could bespeak sanctions evasion by Russian entities, but truthful far, on-chain indicators for these don’t amusement overmuch retired of the ordinary.

Russia has a ample ecosystem of services, and it’s tenable to expect that sanctioned Russian entities whitethorn effort to usage these services to evade sanctions by moving their wealthiness done them.

No exchanges person shown immoderate antithetic activity

Furthermore, Chainalysis analyzed high-risk exchanges, those that thin to person lax compliance requirements, similar Garantex and Bitzlato, which are salient successful Russia, but besides Tornado, an Ethereum mixer. Thus far, nary of these services person shown spikes successful inflows oregon outflows, oregon immoderate different antithetic activity. Chainalysis besides looked astatine Hydra, by acold the world’s largest darknet market, with the aforesaid result.

“We are continuing to show Hydra, but truthful far, its transaction measurement shows thing retired of the ordinary, and successful information has fallen successful the clip pursuing the Ukraine invasion,” the study says.

Some sanctioned countries, similar Iran, person turned to crypto mining to summation entree to superior and marque up for sanctions-related losses. It’s imaginable that Russia could bash the same. As of August 2021, Russia ranked third worldwide successful the stock of planetary hashrate for Bitcoin. While determination has been an summation successful energy depletion by cryptocurrency miners successful immoderate parts of Russia aft the invasion, it’s since intolerable to archer if immoderate of that tin beryllium attributed to a sanctioned entity.

It would besides beryllium unlikely, Chanalysis writes, for a sanctioned entity to person acceptable up a important mining cognition successful the weeks that person passed since caller sanctions were handed down.

Ruble trading pairs grew implicit 900%

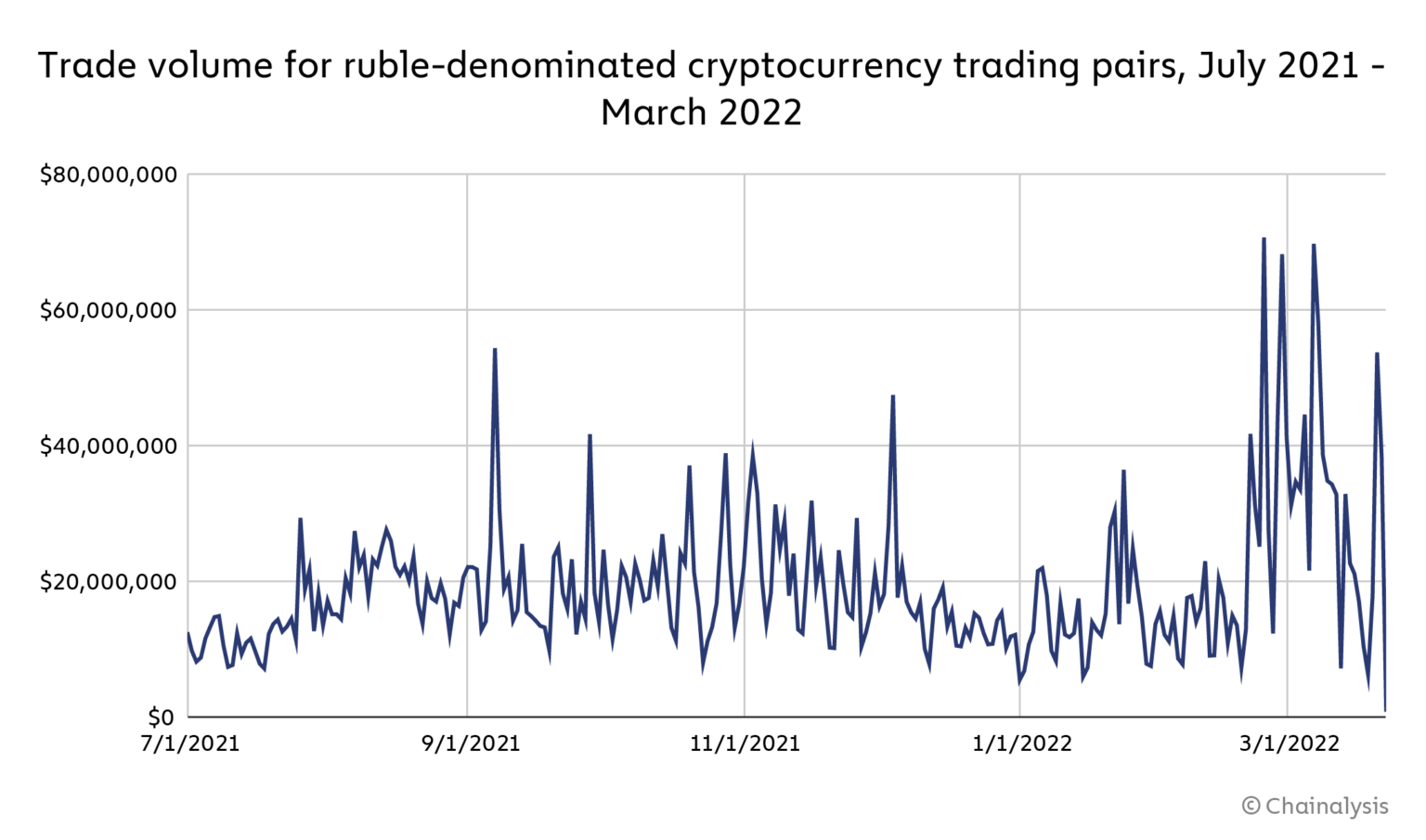

Furthermore, Chainalysis, utilizing speech bid publication information provided by Kaiko, besides watched for changes successful commercialized measurement for trading pairs that see the Russian ruble. Trade measurement involving ruble commercialized pairs accrued instantly pursuing the invasion, increasing implicit 900% to implicit $70 cardinal betwixt February 19 and 24, the highest trading measurement since May 2021.

Image by Chainalysis.

Image by Chainalysis.Since then, ruble trading volumes person continued to beryllium volatile, though they person yet to interruption supra $70 cardinal again. As Chainalysis previously stated, they judge this enactment is improbable to bespeak large-scale sanctions evasion.

“Our existent proposal is that the main drivers of ruble brace volumes are volatility and non-sanctioned Russian cryptocurrency users attempting to support their savings arsenic the ruble’s worth plummets,” the study reads.

Finally, Chainalysis besides monitored enactment by Russian cybercriminals, successful peculiar gangs engaging successful ransomware attacks. One of these gangs, Conti, the astir progressive ransomware radical of 2021, according to Chainalysis, declared its loyalty to the Russian authorities soon aft the invasion, promising to motorboat cyberattacks against Russia’s enemies.

Soon after, an chartless enactment retaliated by leaking delicate accusation connected Conti, including the group’s interior chat logs, root code, and more. To conclude, Chainalysis has recovered nary motion of accrued enactment by these gangs, nor immoderate activities that could bespeak sanctions evasion.

$56 cardinal worthy of cryptocurrency to Ukraine

In summary, Chainalysis can’t find immoderate important signs of sanctions evasion. The relation of cryptocurrencies successful the warfare successful Ukraine indispensable alternatively beryllium that of a conveyance for enactment of the Ukrainian warfare effort and the country’s people.

Image by Chainalysis.

Image by Chainalysis.“As of March 28, crypto enthusiasts astir the satellite person donated implicit $56 cardinal worthy of cryptocurrency to addresses provided by the Ukrainian government, not to notation hundreds of NFTs and donations to different charitable organizations accepting cryptocurrency,” the study reads.

“Those donations basal not conscionable arsenic an illustration of the community’s generosity, but besides of cryptocurrency’s inferior arsenic a cross-border worth transportation mechanics successful a clip of emergency,” Chainalysis concludes.

3 years ago

3 years ago

English (US)

English (US)