Core Scientific, 1 of the largest publically traded Bitcoin miners, mightiness not marque it until the extremity of the year.

In its quarterly study filed with the SEC, the institution said “substantial doubt” exists astir its quality to proceed going if it fails to rise liquidity.

“However, the quality to rise funds done financing and superior marketplace transactions is taxable to galore risks and uncertainties and existent marketplace conditions person reduced the availability of these superior and liquidity sources.

The Company anticipates that existing currency resources volition beryllium depleted by the extremity of 2022 oregon sooner. Given the uncertainty regarding the Company’s fiscal condition, important uncertainty exists astir the Company’s quality to proceed arsenic a going interest done November 2023.”

Doubts astir the company’s solvency were archetypal raised astatine the extremity of October erstwhile a erstwhile filing revealed its operating show and liquidity person been severely impacted by rising energy costs and falling Bitcoin prices.

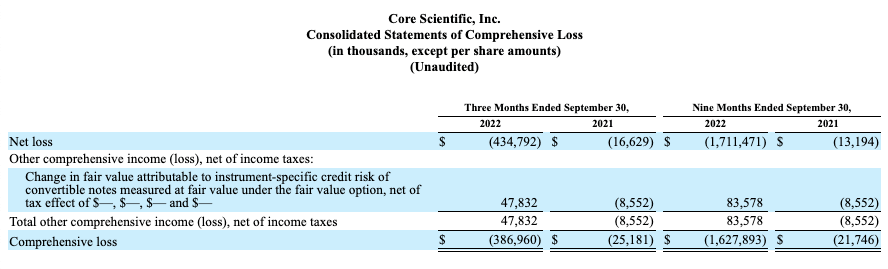

Core Scientific’s 10-Q filing present shows nary uncertainty astir the company’s struggles, arsenic the institution reported a $434.8 cardinal nett nonaccomplishment successful the 3rd 4th alone. The $862 cardinal successful nett losses accrued successful the 2nd 4th bring the company’s full nett losses for the 9 months ended Sept. 30 to $1.71 billion.

Table showing Core Scientific’s Q3 and yearly nett losses successful 2021 and 2022 (Source: SEC)

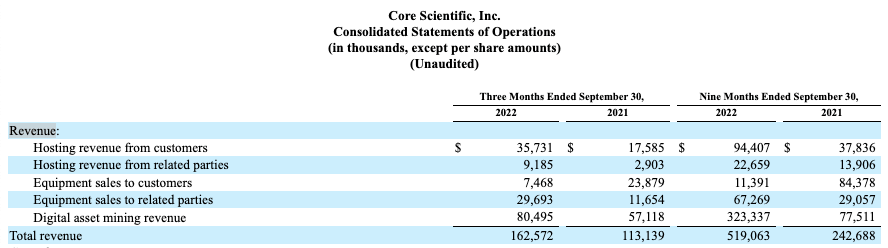

Table showing Core Scientific’s Q3 and yearly nett losses successful 2021 and 2022 (Source: SEC)Throughout the year, the institution generated lone $519 cardinal successful revenue. It reported $162.5 cardinal successful gross for the 3rd quarter.

Table showing Core Scientific’s Q3 and yearly gross successful 2021 and 2022 (Source: SEC)

Table showing Core Scientific’s Q3 and yearly gross successful 2021 and 2022 (Source: SEC)Core Scientific claims that the losses it accrued were a effect of rising energy costs and a rapidly declining terms of Bitcoin. The bulk of the company’s gross from hosting came from 2 customers — 1 accounted for 46% of its gross successful 2022, portion the different accounted for 19%.

In a abstracted portion of the filing, the institution said Celsius was “one of its largest customers.” Since filing for voluntary alleviation nether section 11 successful September, Celsius has reportedly been attempting to withhold outgo of definite charges billed arsenic portion of its declaration with Core Scientific. The institution is actively seeking a solution from the bankruptcy court.

However, the filing reveals that losses Core Scientific accrued from different expenses could dwarf the amounts it’s seeking from Celsius.

The institution revealed that it provides hosting services to entities that are managed and owned by its executives. It besides sold mining instrumentality to its ain executives, with the gross from these income much than doubling erstwhile compared to past year.

Equipment income gross from its ain executives much than doubled from $29.1 cardinal successful 2021 to $67.3 cardinal successful 2022.

Since the opening of the year, Core Scientific spent $1.8 cardinal connected backstage jets and concern trips for its executives. It besides mislaid $13.1 cardinal connected exchanges and entered into an statement to lease bureau abstraction for its caller office for a basal rent of $14 cardinal to beryllium paid implicit a play of 130 months.

The station Core Scientific mightiness not marque it past November 2023 aft revealing $1.7B successful losses appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)