One of the largest publically listed bitcoin miners, Core Scientific, has shaken investors with a caller filing with the U.S. Securities and Exchange Commission that raises the anticipation the institution whitethorn use for bankruptcy protection. The filing notes that Core Scientific volition beryllium incapable to wage down indebtedness payments owed for Oct. and aboriginal Nov. 2022.

SEC Filing Shakes Core Scientific Investors, CORZ Slides 97% successful 12 Months

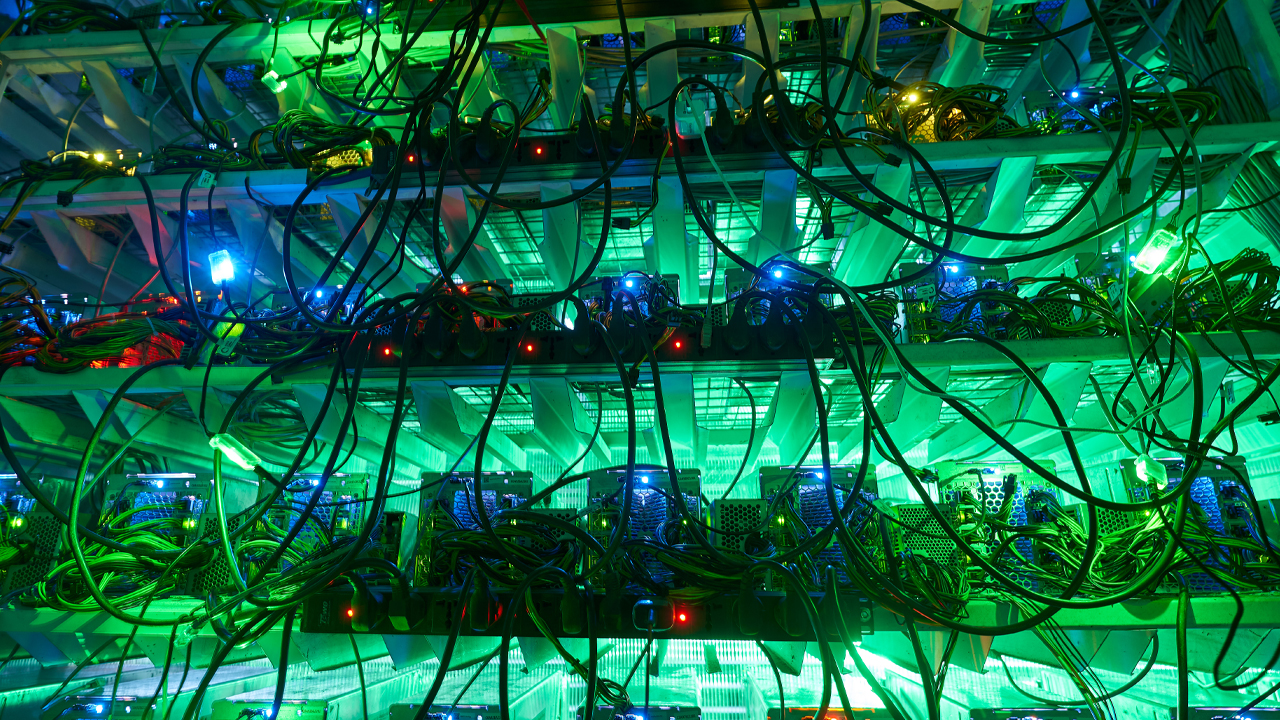

Bitcoin miners are having issues aft the terms of bitcoin (BTC) has slid astir 70% against the U.S. dollar since Nov. 10, 2021. Moreover, the network’s mining trouble is presently astatine an all-time high, making it harder than ever earlier to find a artifact subsidy. At the extremity of September, Bitcoin.com News reported connected Compute North filing for bankruptcy and however it led to Marathon Digital’s shares getting downgraded. Now Core Scientific (Nasdaq: CORZ) seems to beryllium leaning successful the absorption of filing for bankruptcy extortion oregon immoderate benignant of restructuring process.

The quality stems from a U.S. Securities and Exchange Commission (SEC) filing Core Scientific filed connected Oct. 26, 2022. Essentially, Core Scientific says it volition not beryllium capable to marque indebtedness payments for Oct. and aboriginal November, and the squad has been engaged with instrumentality firms successful bid to sermon a imaginable restructuring process oregon filing for bankruptcy protection. The institution cites that its finances person been depleted and it blames the terms of bitcoin (BTC) and different types of antagonistic exposure.

“As antecedently disclosed, the Company’s operating show and liquidity person been severely impacted by the prolonged alteration successful the terms of bitcoin, the summation successful energy costs, the summation successful the planetary bitcoin web hash complaint and the litigation with Celsius Networks LLC and its affiliates,” Core Scientific’s filing notes. As of Oct. 26, Core Scientific has astir 24 BTC successful reserves which equates to $497,901, utilizing today’s BTC speech rates.

Since the SEC filing, Core Scientific’s banal CORZ is down 97% year-to-date. Furthermore, connected Oct. 28, the B. Riley expert Lucas Pipes downgraded CORZ to neutral. “While Core has prioritized liquidity since the commencement of the crypto winter, we judge antagonistic hosting margins (during 2Q) and compressed self-mining margins person exerted other unit connected the company’s quality to conscionable its fiscal obligations,” the expert noted connected Friday.

Tags successful this story

What bash you deliberation astir Core Scientific’s SEC filing? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)