The 2021 GameStop saga, precocious featured successful a Netflix movie, whitethorn person unexpected parallels with Bitcoin, peculiarly successful the discourse of a imaginable proviso crunch.

Echoes of the Reddit-fueled’ parent of each abbreviated squeezes’ (MOASS) for GameStop, successful Bitcoin’s context, could manifest arsenic a significant proviso squeeze, oregon ‘Bitcoin Mother Of All Supply Squeezes’ (Bitcoin MOASS.) I’ve referenced this successful several articles this year, but I wanted to interruption down precisely wherefore I deliberation this could happen.

To recognize this better, let’s revisit the GameStop phenomenon.

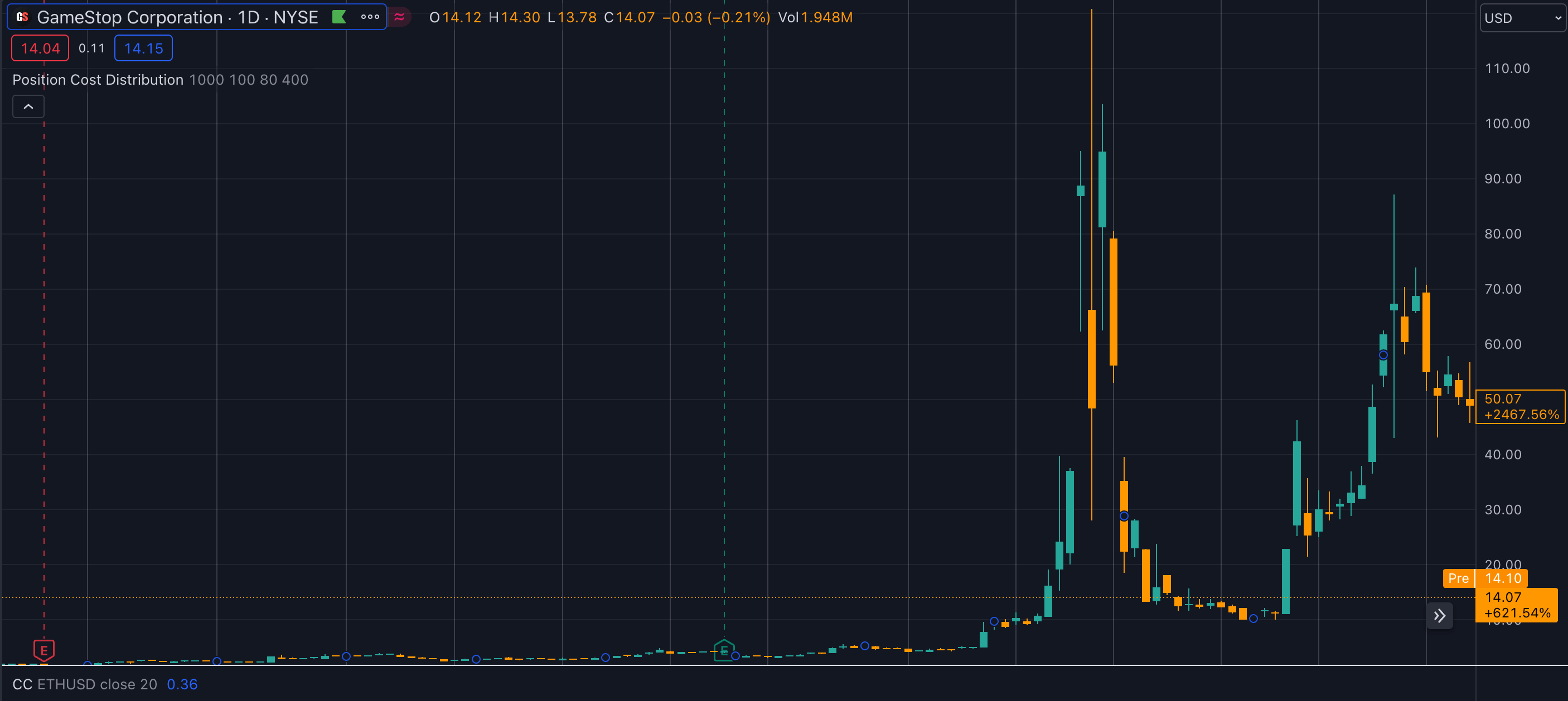

I wasn’t aboriginal capable to travel Roaring Kitty done his archetypal thesis connected GME astatine astir $3 per share. However, I was progressive wrong the WallStreetBets subreddit, and by the clip the banal deed $13, it was hard to disregard his regular updates. Around the $50 (pre-stock split) price, I cracked and ‘YOLOed’ successful and took the thrust up to $500, determined to clasp for the satellite oregon bust. Ultimately, I bust, but I enjoyed being a portion of something.

GameStop abbreviated compression thesis basics.

For those unfamiliar, GameStop shares were heavy shorted by respective hedge funds who saw casual prey successful a retail store headed for bankruptcy with the added symptom of the pandemic. Seemingly, the extremity was to abbreviated the banal to zero. This strategy, often employed against faltering companies (like Blockbuster earlier its demise), is fundamentally betting connected the company’s failure.

However, hedge funds underestimated the attachment galore gamers had to the GameStop marque and the powerfulness of retail investors uniting down a cause. There was besides a much philosophical facet to wherefore galore investors, myself included, purchased shares related to the breached accepted concern system. As a Bitcoiner, this connection resonated with me, and I bought shares intending to HODL ‘to the moon.’

Long communicative short, retail investors, chiefly done Robinhood (but besides each astir the world,) actively piled in, buying GME shares aggressively successful the anticipation that it would unit the hedge funds to adjacent their shorts astatine higher prices and trigger a abbreviated squeeze. This maneuver did inflict important losses connected immoderate hedge funds, though galore had the fiscal buffer to sorb these losses.

The deficiency of real-time short-interest reporting further analyzable matters. Hedge funds were capable to adjacent their abbreviated positions without the cognition of retail investors, perpetuating the abbreviated compression communicative and leaving it unclear whether each abbreviated positions person genuinely been covered.

Further, arsenic galore investors entered the fray supra $100, they were not arsenic impressed with the 2x oregon 3x summation successful value. Ultimately, from the $3 archetypal terms constituent to wherever it peaked earlier Robinhood turned disconnected bargain orders, GME rallied astir 11,000% successful a fewer months.

For each intents and purposes, GME had a monumental abbreviated squeeze, followed by a further 700% secondary compression a fewer months later.

GME banal terms post-split (source: TradingView)

GME banal terms post-split (source: TradingView)Yet, to this day, determination are investors connected Reddit who are adamant that the shorts person inactive not been covered, and a MOASS that volition instrumentality GME prices implicit $1 cardinal is connected the horizon.

Now, however does this subordinate to Bitcoin?

Bitcoin’s parent of each proviso squeezes.

Bitcoin and GameStop disagree successful galore ways. Ultimately, GameStop is simply a accepted equity that was being bullied retired of beingness by TradFi, portion Bitcoin is simply a solution to the inherent problems of TradFi arsenic a whole.

However, GameStop, specifically GME, represented a akin ethos astatine 1 constituent successful its history. Before it became the poster kid for ‘meme’ stocks, to many, GME was astir unifying retail investors against ‘the man.’ It was a mode to combat backmost against firm greed, devouring everything successful its path.

This perfect inactive drives those of r/superstonk oregon immoderate the existent subreddit is for the die-hard GME diamon hands. However, successful my view, portion that is present but a specified misguided dream, determination is simply a genuine accidental with Bitcoin for a existent MOASS.

The illustration beneath highlights immoderate cardinal aspects of the GameStop and Bitcoin comparison. The cardinal drivers are the halving, Bitcoin ETF inflows, and scarce supply.

| High abbreviated interest | Majority of BTC successful idiosyncratic acold storage |

| Retail purchases trim supply | ETFs motorboat and bargain Bitcoin |

| Price summation to screen shorts | ETF request outpaces supply |

| 5 cardinal caller shares issued worthy $1.2 billion | Fixed issuance per block |

| Unlimited proviso of shares | Fixed proviso of Bitcoin |

| Price falls arsenic shorts cover | Price increases aft halving |

| Price falls arsenic shares diluted | Price increases arsenic proviso dries up |

Bitcoin’s fixed proviso contrasts starkly with GameStop’s quality to contented much shares, which happened six months aft the abbreviated squeeze. Bitcoin’s constricted proviso and expanding inflows into Bitcoin ETFs suggest a looming proviso squeeze. This could reflector the GameStop script but successful a unique, Bitcoin-specific context.

In contrast, the Bitcoin marketplace operates with greater transparency, acknowledgment to blockchain technology. This brings america to the relevance of this examination to Bitcoin. Unlike GameStop, which tin contented much shares, Bitcoin has a strictly constricted supply. With the existent complaint of inflows into Bitcoin ETFs, a proviso compression is becoming progressively likely. This concern could parallel the GameStop abbreviated compression but successful a antithetic context.

Conditions required for a proviso squeeze.

Certain conditions indispensable beryllium met for specified a Bitcoin proviso squeeze.

First, the continuous inflow into Bitcoin ETFs is crucial. The caller summation of Bitcoin ETFs into different funds is simply a large motion of this enduring.

Secondly, Bitcoin holders request to transportation their holdings into acold storage, making it inaccessible to over-the-counter (OTC) desks.

Unlike accepted brokerages, platforms similar Coinbase can’t simply lend retired Bitcoin arsenic it’s not commingled, offering a furniture of extortion against specified practices. However, the caller outflows from Grayscale bespeak that determination is inactive ample liquidity successful the marketplace for large players similar BlackRock, Bitwise, Fidelity, and ARK to acquisition Bitcoin.

The concern could displacement dramatically if the Newborn Nine ETFs amass holdings successful the scope of $30-40 cardinal each. Considering that astir 2.3 cardinal Bitcoins are connected exchanges and astir 4.2 cardinal are liquid and regularly traded, a important information of Bitcoin could beryllium absorbed oregon go illiquid. If the inclination towards storing Bitcoin successful acold retention continues and trading diminishes, the disposable Bitcoin for OTC desks could alteration markedly.

Should ETFs persist successful acquiring Bitcoin, and idiosyncratic users proceed to bargain and store it successful acold storage, we could spot a notable emergence successful Bitcoin prices wrong 18 months owed to diminishing marketplace availability. This concern could punctual ETFs to acquisition astatine higher prices, raising questions astir the sustainability of request for these ETFs astatine elevated Bitcoin valuations.

Bitcoin successful acold retention vs GameStop ComputerShare.

The existent GameStop HODLers transferred their GME shares to Computershare to forestall shares from being lent retired for shorting, akin to putting Bitcoin successful acold storage. They did this to effort to bounds supply. However, this didn’t halt the GameStop committee from issuing much shares, which volition ne'er hap with Bitcoin.

Thus, the marketplace could witnesser a important displacement if the inclination of transferring Bitcoin to acold retention accelerates, coupled with persistent ETF purchases. About 4.2 cardinal Bitcoins are present considered liquid and disposable for regular trading. However, if this liquidity decreases done reduced trading enactment oregon accrued retention successful acold wallets, the proviso accessible to over-the-counter (OTC) desks could diminish rapidly.

This imaginable scarcity raises intriguing scenarios. Should ETFs continue their buying spree, and retail users besides support purchasing Bitcoin, directing it into acold storage, we could beryllium connected the cusp of a important proviso squeeze. Based connected existent data, if inflow rates stay constant, this convergence mightiness hap arsenic soon arsenic adjacent year, chiefly influenced by large players similar BlackRock buying from the disposable liquid supply. If retail users region each Bitcoin from exchanges, there’s scope for it to hap sooner.

Pyschology of investors and momentum trading.

The total proviso of Bitcoin that tin beryllium considered perchance liquid is inactive substantial, astir 15 million. This means that the imaginable proviso astatine immoderate terms needs to beryllium considered, arsenic adjacent semipermanent HODLers could beryllium convinced to merchantability astatine prices supra the past all-time high. While it’s not a guaranteed outcome, the anticipation is intriguing.

The science of retail investors, already proven important successful cases similar GameStop, could besides play a important relation successful Bitcoin’s scenario. The proposal to ‘HODL,’ bargain Bitcoin, and put successful ETFs could resonate powerfully with investors who stock this mindset.

Notably, the entreaty of Bitcoin ETFs lies partially successful their affordability and accessibility; they are priced overmuch little than an existent Bitcoin, making them charismatic to a broader audience. This intelligence aspect, akin to the perceived affordability of tokens similar Shiba Inu oregon Dogecoin, could thrust capitalist behaviour toward Bitcoin ETFs.

Ultimately, the parallels betwixt the GameStop saga and the imaginable proviso dynamics successful the Bitcoin marketplace are striking. The combined effect of continued purchases by ETFs and the inclination of Bitcoin holders moving their assets to acold retention could pb to a ‘mother of each proviso squeezes’ successful the Bitcoin market. While assorted factors are astatine play, and the result is not inevitable, the imaginable for a important displacement successful the Bitcoin marketplace is an breathtaking prospect. As the concern unfolds, it volition beryllium absorbing to observe however the interplay of retail capitalist psychology, ETF inflows, and Bitcoin’s unsocial supply characteristics shapes the market.

The station Could Bitcoin echo GameStop with a Mother Of All Supply Squeezes? Maybe appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)