Bitcoin mislaid enactment astatine $18,600 and trended little adjacent to its yearly bottommost astatine $17,900. The cryptocurrency managed to halt the bleeding astatine these levels, but the wide sentiment successful the markets seems to person flipped from dubious to fearful.

At the clip of writing, Bitcoin was trading astatine $18,300 with a 4% nonaccomplishment successful the past 24 hours and a 9% nonaccomplishment successful the past week, but it has been rebounding implicit the past hour. Other large cryptocurrencies followed BTC’s terms into the abyss and are signaling monolithic losses connected debased timeframes with Cardano and Solana showing the worst performance.

BTC’s terms experiencing volatility connected the regular chart. Source: BTCUSDT Tradingview

BTC’s terms experiencing volatility connected the regular chart. Source: BTCUSDT TradingviewInflation Yet To Find A Bottom, Will Bitcoin Follow?

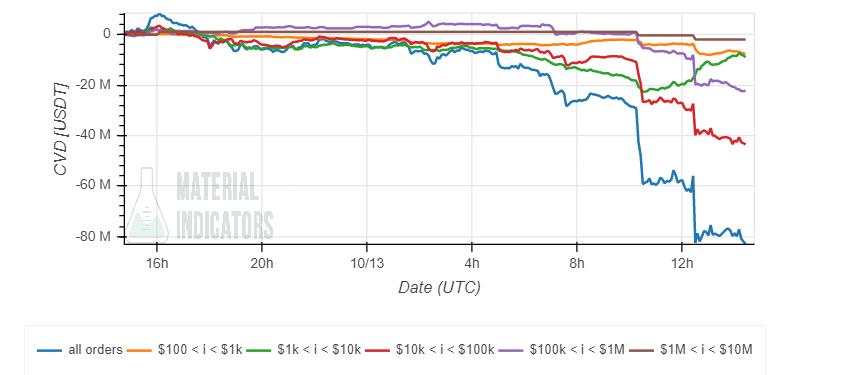

Data from Material Indicators amusement a spike successful selling unit from each investors heading into the Consumer Price Index (CPI), the benchmark for ostentation successful the United States. This metric roseate supra marketplace expectations printing an 8.2% for the period of September 2022.

As seen successful the illustration below, from retail to whales property down connected Bitcoin pricing successful a caller involvement complaint hike from the U.S. Federal Reserve (Fed). The fiscal instauration has been trying to dilatory down ostentation by expanding rates and reducing its equilibrium sheet.

Investors selling into the CPI study connected debased timeframes. Source: Material Indicators

Investors selling into the CPI study connected debased timeframes. Source: Material IndicatorsHowever, today’s CPI people confirms that ostentation is sticky and apt not highest successful 2022. This world on with affirmative economical maturation metrics successful the U.S. volition supply the Fed with the enactment to proceed hiking involvement rates negatively impacting Bitcoin, the crypto market, and accepted finances.

The illustration supra shows the crypto market’s absorption to an assertive monetary argumentation from the Fed, but bequest markets person reacted successful a akin way. Commenting connected BTC’s terms enactment and inflation, an expert for Material Indicators said:

Inflation whitethorn not person peaked, yet FED complaint hikes volition proceed aggressively. 75 BPS baked successful for Nov, 75 BPS apt for Dec TradFi and Crypto markets are Bearish AF THE BOTTOM isn’t in.

Additional information provided by Caleb Franzen indicates that the marketplace expects different 2 consecutive 75 ground points (bps) hikes successful the upcoming Federal Open Market Committee (FOMC). As a result, BTC’s terms is experiencing precocious volatility triggered by utmost marketplace sentiment.

Investors look to beryllium pricing successful a hawkish Fed with less and less chances of a displacement successful its direction, contempt the monolithic unit enactment connected planetary markets. At the clip of writing, $17,600 remains arsenic beardown enactment and $20,500 arsenic captious resistance.

If Bitcoin breaks supra oregon beneath these levels, traders should expect a caller debased oregon a reclaimed successful antecedently mislaid territory. This unit connected planetary markets volition proceed arsenic agelong arsenic ostentation trends to the upside.

CME futures present pricing successful a 95.8% accidental that the Federal Reserve raises the people fed funds complaint by +0.75%.

Zero accidental of +50bps, with the marketplace repricing a 4.2% accidental of +100bps.

Core CPI continues to accelerate, indicating that underlying measures of ostentation are hot. pic.twitter.com/CqKKebjRR9

— Caleb Franzen (@CalebFranzen) October 13, 2022

3 years ago

3 years ago

English (US)

English (US)