The flagship cryptocurrency, Bitcoin, is accelerated approaching $31,000 pursuing its gains implicit the weekend. Analyzing this terms action, crypto expert Ali Martinez has predicted Bitcoin’s aboriginal trajectory arsenic helium suggests that the bears could regain dominance soon enough.

A Price Correction Imminent For Bitcoin

In a post shared connected his X (formerly Twitter) platform, Martinez noted the imaginable head-and-shoulders signifier that was forming connected the Bitcoin regular illustration pursuing its upward trend. This illustration signifier has ever been considered bearish arsenic it suggests that a inclination reversal mightiness beryllium connected the horizon, meaning determination could beryllium a dip successful prices soon enough.

Confirming this assumption, Martinez stated that the regular illustration (which helium shared alongside the post) “hints astatine a imaginable merchantability awesome emerging time [October 23].” According to him, this prediction is backed by the TD Sequential indicator, which is flashing “a greenish 9 candlestick.” The TD Sequential indicator helps traders place the nonstop clip of a imaginable reversal.

Martinez besides alluded to the Relative Strength Index (RSI), which helium mentioned has reached 74.21. He noted that this has been “a level triggering crisp corrections since March.” An RSI of implicit 70 besides suggests that Bitcoin whitethorn beryllium overbought with a terms correction imminent. This impending terms correction tin lone beryllium averted if Bitcoin manages to timepiece “a regular candlestick adjacent supra $31,560.”

As of the clip of writing, Bitcoin is trading astatine astir $30,700, up by implicit 2% successful the past twenty-four hours and a further 10% successful the past 7 days.

Options Market Could Contribute To Bitcoin’s Upward Momentum

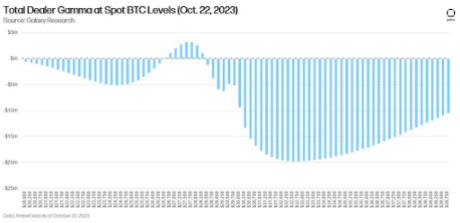

In a post connected his X platform, Alex Thorn, Head of Firmwide Research, highlighted the relation that options traders (short gammas successful particular) could play successful driving Bitcoin’s terms higher successful the abbreviated term.

Source: X

Source: X

He noted that the options market makers successful Bitcoin are “increasingly abbreviated gamma arsenic BTC spot terms moves up.” This existent positioning could assistance “amplify the explosiveness of immoderate short-term upward determination successful the adjacent term,” considering that these abbreviated gammas person to bargain much Bitcoin to enactment “delta neutral” arsenic Bitcoin’s terms continues to rise.

From his analysis, Thorn was simply explaining that the enactment marketplace makers volition person to spot ‘buy orders’ to hedge against their abbreviated positions arsenic Bitcoin’s terms continues to climb, thereby adding to buying pressure, which could origin the crypto’s terms to emergence higher.

Meanwhile, helium believes that the long gammas could supply a information nett for Bitcoin’s terms successful the lawsuit of a terms reversal. These agelong gammas would person to bargain backmost spots successful bid to stay delta-neutral, thereby providing enactment and helping defy immoderate further diminution (in the abbreviated term, astatine least).

Featured representation from Crypto Buyers Club UK, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)