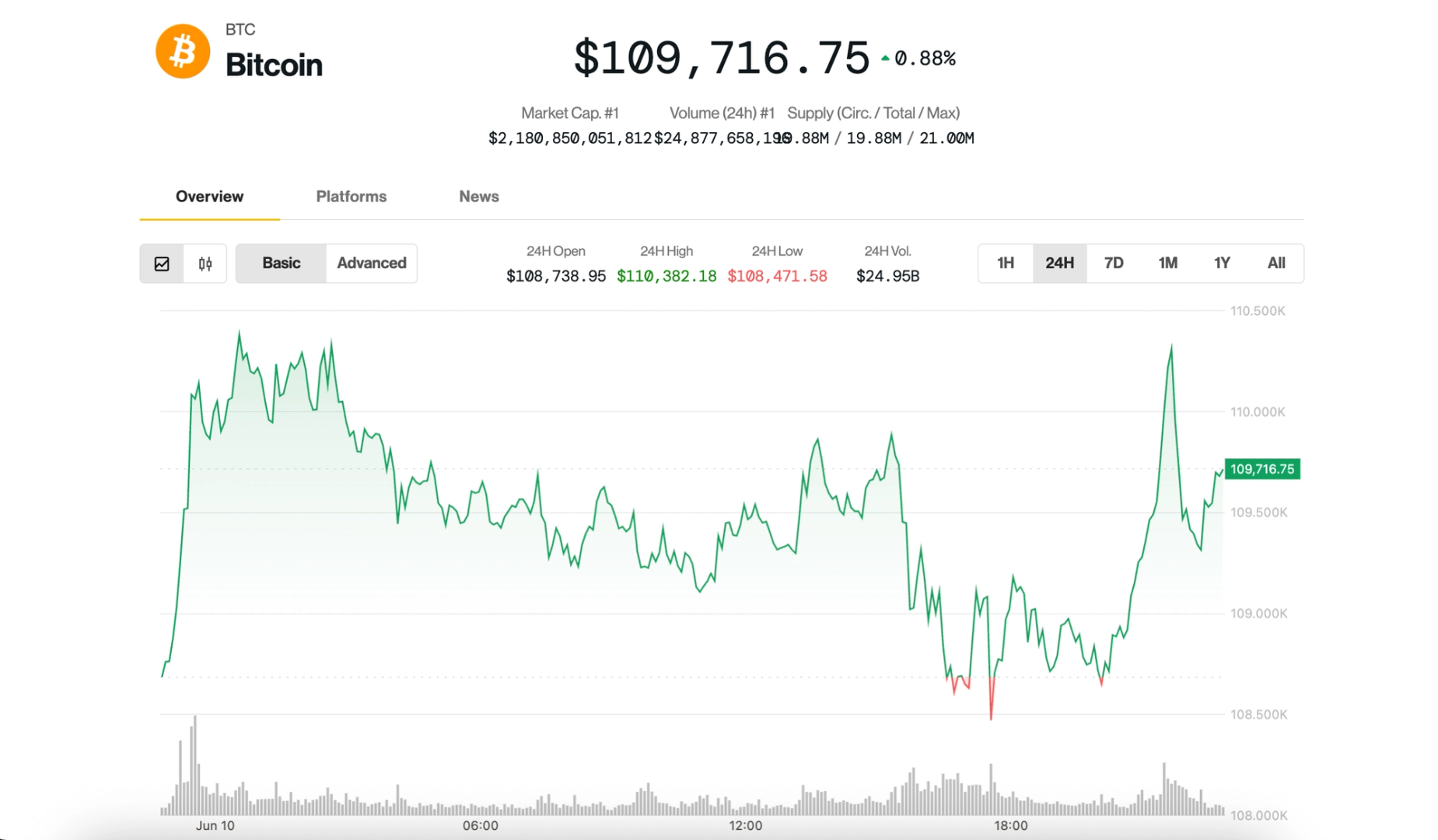

The Bitcoin terms continues to inclination beneath $60,000 arsenic a 20% diminution triggered a brutal market-wide crash. This has exposed aggregate captious enactment points for the cryptocurrency, immoderate of which the terms has already fallen below. In airy of this, a crypto expert known arsenic Norok has revealed the level the BTC terms indispensable not autumn beneath to support its bullish trend.

Bitcoin Price Must Hold Above $51,800

In an analysis posted connected the TradingView website, crypto expert Norok revealed that $51,800 is present the astir important enactment level for Bitcoin. Norok pointed retired that Bitcoin has since returned to its past support level which was past seen successful December 2023, making this a important support.

In the meantime, the enactment that had been built up by bulls astatine the $62,000 level has since been breached by bears and has present been turned into resistance. Nevertheless, the crypto expert does not judge that the Bitcoin terms has turned bearish, contempt the clang that has rocked the crypto market.

For Norok to crook bearish, helium stated that the BTC price would person to interruption down beneath enactment astatine $51,800. According to him, specified a determination volition invalidate immoderate bullish thesis is successful play for Bitcoin, ending the bullish inclination of 2023-2024.

In the abbreviated term, Norok identifies $56,900 arsenic a level that bulls indispensable hold. He explains that this could assistance to reenforce the existent bullish trend. “Price indispensable clasp present astatine this Support and past it tin recapture the unreality to resume to Bullish Trend,” the crypto expert said. “This is simply a highly decisive infinitesimal successful Price enactment today.”

BTC Suffers As A Result Of ETF Outflows

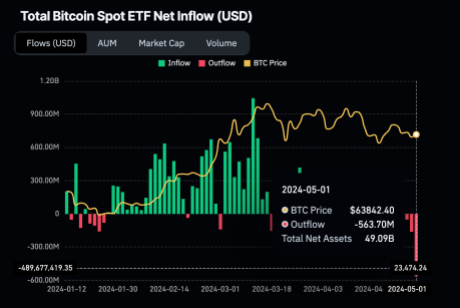

One large operator of the Bitcoin terms diminution successful the past fewer weeks has been a crook from inflows to outflows successful Spot Bitcoin ETFs. Since these ETFs necessitate the issuers to clasp BTC to enactment the assets they are selling to investors, inflows are incredibly bullish arsenic these issuers person taken to buying BTC to fulfill this requirement.

However, with investors opening to retreat their funds, the reverse has been the case, starring to a precocious selling unit successful the market. Spot Bitcoin ETFs have present recorded six consecutive trading days of outflows, reaching an all-time precocious outflow grounds $563.7 cardinal connected Wednesday, according to data from Coinglass.

If these outflows continue, past the BTC price could proceed to decline, and astatine the existent rate, the pioneer cryptocurrency mightiness beryllium investigating Norok’s $51,800 soon enough. However, a crook toward inflows would mean issuers person to bargain BTC and this tin construe to a terms recover.

Featured representation from Kiplinger, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)