Bitcoin has recorded an wide affirmative terms question successful the past week, gaining by 2.39%, according to data from CoinMarketCap. The premier cryptocurrency suffered a flimsy dip betwixt Tuesday and Thursday but soon roseate connected Friday to commercialized supra $27,000 again.

Meanwhile, successful celebrating the caller period of October, fashionable crypto expert Michaël van de Poppe has predicted an incoming bullish tally for Bitcoin successful Q4 2033 based connected definite expected events.

Analyst Projects Bitcoin To Reach $40K In Q4 2023 Starting With A Positive ‘Uptober’

Via a post connected X connected October 1, Michaël van der Poppe welcomed his 667,000 followers to October with overmuch optimism towards the BTC market, renaming the period arsenic “Uptober.”

In general, the well-known expert believes the crypto carnivore marketplace is astir over, and Bitcoin could soon grounds immoderate important gains, arsenic helium expressed successful a erstwhile post connected September 30.

Interestingly, van de Poppe’s optimism extends beyond October to the full of Q4 2023, arsenic helium predicts Bitcoin could attain $40,000 earlier the twelvemonth runs out. Albeit, this prediction is hinged connected the occurrence of definite events.

Welcome to Uptober.

Welcome to Q4, which is starring towards a large quarter, perchance fueled by ETF approvals and the pre-halving rally.

Potentially #Bitcoin to $40,000 is reasonable.

— Michaël van de Poppe (@CryptoMichNL) October 1, 2023

Firstly, Michaël van der Poppe mentions the imaginable support of ETF applications. The ongoing Bitcoin spot ETF saga successful the US has drawn overmuch attraction implicit the past fewer months owed to its imaginable effects connected the BTC market.

Currently, analysts are rather optimistic astir the chances of support of a Bitcoin spot ETF, which could effect successful massive gains for the largest crypto plus upon realization.

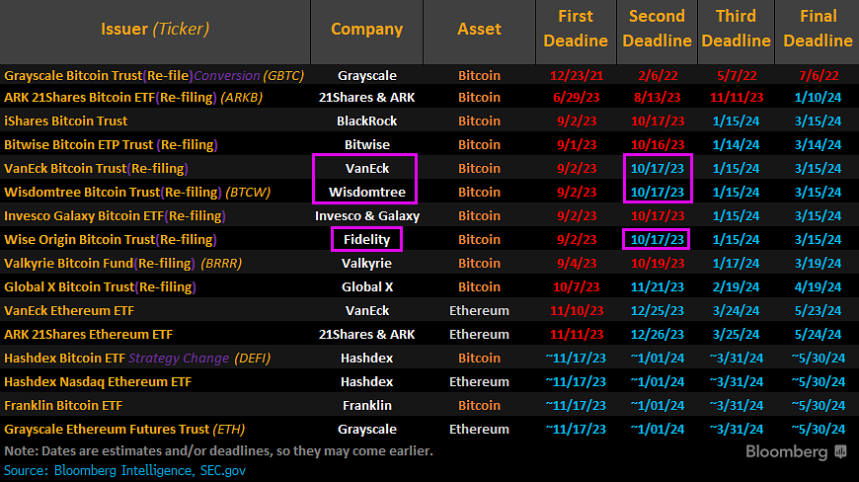

Realistically, this support could hap successful Q4 2023, arsenic it contains the 2nd deadline day for astir applications.

However, the US Securities and Exchange Commission could determine to hold its responses to these proposals till the last deadlines, astir of which are slated for Q1 2024. The US securities regulator is already employing specified tactics, arsenic seen with the archetypal deadline dates for astir applications.

In the past week, the SEC besides announced it would beryllium pushing backmost its effect to definite applications beyond their 2nd deadline date. These applications included proposals from BlackRock, 21Shares, Bitwise, and Valkyrie.

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

The Bitcoin Pre-Halving Rally

In summation to imaginable ETF approvals, Michaël van de Poppe besides mentioned a imaginable bitcoin pre-halving rally arsenic a origin that could spur the plus maturation to $40,000 successful Q4 2023.

Historically, the months starring up to the halving lawsuit are marked by a Bitcoin rally, arsenic seen successful 2012 and 2016.

Based connected van de Poppe’s prediction, helium foresees a akin BTC terms question successful the coming months up of the adjacent Bitcoin halving acceptable for April 2024, during which the mining rewards volition beryllium slashed from 6.25 BTC to 3.125 BTC.

However, investors should instrumentality enactment of achromatic swan events, arsenic seen with the past Bitcoin halving successful 2020. In the months earlier this halving lawsuit occurred, the BTC pre-halving rally was temporarily affected by the antagonistic marketplace effects of the COVID-19 pandemic.

At the clip of writing, Bitcoin is trading astatine $27.138 with a 1.07% summation successful the past day. Meanwhile, the asset’s regular trading measurement is down by 21.37% and valued astatine $6.28 billion.

Featured representation from Analytics Insight, illustration from Tradingview

2 years ago

2 years ago

English (US)

English (US)