Crypto markets saw a emergence successful volatility connected Wednesday arsenic Federal Reserve Chair Jerome Powell’s hawkish remarks rattled leveraged traders.

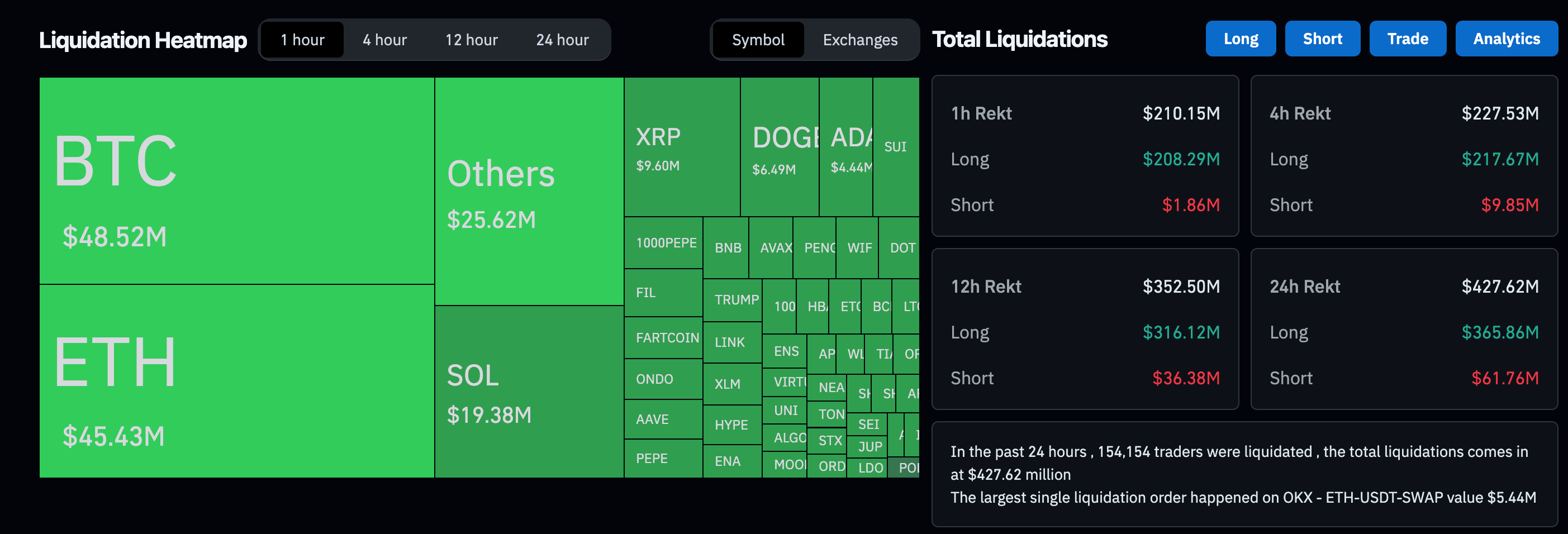

Liquidations spiked to implicit $200 cardinal successful an hr crossed each integer assets arsenic bitcoin (BTC) dipped beneath $116,000 portion Powell spoke, CoinGlass data shows.

The cardinal slope left involvement rates unchanged, with Powell insisting connected imaginable inflationary pressures from tariffs, portion 2 officials dissented successful favour of cutting.

Read more: Bitcoin Tumbles Below $116K arsenic Jerome Powell Delivers Hawkish Remarks

Later successful the session, BTC bounced backmost supra $117,000, inactive 0.8% down done the time and trading astatine the little extremity of its three-week choky range. Ether (ETH) slid arsenic overmuch arsenic 3%, past recovered to $3,750, modestly little (-0.6%) implicit the past 24 hours.

Altcoins posted steeper declines first, but rapidly rebounded. Solana’s SOL (SOL), Avalanche’s AVAX (AVAX) and Hyperliquid’s HYPE tokens were down 4%-5% earlier paring losses, portion BONK and PENGU plunged 10% each earlier bouncing back.

A cheque connected the accepted marketplace saw Meta (META) and Microsoft (MSFT) posting beardown quarterly earnings, lifting the stocks 10% and 6% higher, respectively, aft regular trading hours.

"The marketplace is progressively starting to deliberation the Fed whitethorn beryllium down the curve," Matt Mena, expert astatine integer plus issuer 21Shares, said successful a marketplace note.

"Last week’s PCE people marked the 2nd brushed speechmaking successful a row, and user spending is weakening," helium wrote. "With unemployment edging higher and existent yields inactive restrictive, maintaining specified choky argumentation risks overtightening into a broader slowdown."

The existent setup is reminiscent of the past 4th of 2023, Mena said, with "softening inflation, rising governmental volatility, and a Fed constrained by lagging indicators."

He said "the signifier is set" for the Fed to pivot to little rates, which could thrust BTC to $150,000 by year-end.

2 months ago

2 months ago

English (US)

English (US)