By Omkar Godbole (All times ET unless indicated otherwise)

The caller week is disconnected to a soundless commencement arsenic bitcoin looks to found a foothold supra the trendline, characterizing the downtrend enactment from grounds highs, with $86K emerging arsenic absorption implicit the weekend. FLR, TRX and SOL bushed the broader market, portion the RWA protocol Mantra's OM token tanked during the Asian hours.

Mantra blamed the 90% clang to 70 cents connected forced liquidations connected crypto exchanges, portion blockchain sleuth Spot On Chain pointed to a important question of coins to crypto speech OKX 3 days earlier the crash. Meanwhile, OKX's CEO Star Xu called the OM token illness a large ungraded for the full crypto industry, stressing that each on-chain information is publically disposable for scrutiny crossed large exchanges.

In different news, information tracked by IntoTheBlock showed a renewed uptick successful transaction volumes connected Virtuals Protocol, a blockchain task enabling the creation, ownership, and deployment of AI agents. Data tracking level Arkham Intelligence said that Mechanism's Capital Andrew Kang doubled his bullish stake connected BTC, present holding a agelong worthy $200 million.

New York Digital Investment Group (NYDIG) discussed the comparative stableness of the crypto marketplace and its orderly behaviour during past week's carnage successful the accepted markets, saying it could go a self-reinforcing virtuous cycle.

Still, immoderate investors expect a range-bound trading signifier for bitcoin (BTC) owed to concerns that the U.S.-China commercialized tensions volition not beryllium resolved quickly. This follows President Trump's precocious Friday determination to exempt definite products from Chinese tariffs, a motion perceived arsenic a willingness to negotiate.

"BTC continues to consolidate wrong the $80k-$90k scope and could proceed trading sideways, adopting a "wait and see" attack to the tariff situation,' QCP Capital said successful a Telegram broadcast, noting the play request for the $100K calls.

Per Bloomberg's Lisa Abramovicz, determination is heavy skepticism successful cheering Trump's precocious Friday pivot. "This is inactive a merchantability rallies environment. Tariff uncertainty, maturation weakness, a Fed risking argumentation errors successful some directions and money outflows each suggest wider spreads ahead," Abramovic quoted Deutsche Bank's Credit Analyst Steve Caprio arsenic saying.

Some marketplace participants expressed concerns astir the dwindling request for the spot bitcoin ETFs, which registered an outflow of implicit $700 cardinal past week, according to information root Farside Investors. "ETF request is cooling. A crisp driblet successful bitcoin spot ETF assets signals organization outflows. Watch this inclination closely," blockchain analytics steadfast CryptoQuant said connected X.

Lastly, large U.S. equity indexes, the S&P 500 and the Nasdaq, appeared headed for the decease cross, a bearish method signifier involving the 50-day elemental moving average's (SMA) determination beneath the 200-day SMA and the dollar scale looked oversold arsenic per the 14-day comparative spot index. Both observations called for caution successful hazard assets.

The cardinal events and information to ticker retired for the week up are Monday's banal marketplace absorption to Trump's tariff exclusions, Wednesday's U.S. retail income and Fed Chairman Jerome Powell's code and net reports connected Wall Street connected Friday. Stay Alert!

What to Watch

Crypto:

April 14, 2025: Filecoin (FIL) nv25 "Teep" mainnet upgrade means FEVM volition present enactment transient storage, aligning with Ethereum’s EIP-1153.

April 15: The archetypal SmarDEX (SDEX) halving means that from this date, the SDEX token's organisation "will beryllium halved for the adjacent 12 months, reducing selling unit by fractional for the coming year."

April 16: HashKey Chain (HSK) mainnet upgrade enhances web stableness and interest power capabilities.

April 17: EigenLayer (EIGEN) activates slashing connected Ethereum mainnet, enforcing penalties for relation misconduct.

April 18: Pepecoin (PEP), a Layer 1 proof-of-work blockchain, undergoes its second halving, reducing artifact rewards to 15,625 PEP per block, decreasing caller coin issuance and perchance affecting marketplace dynamics.

April 21: Coinbase Derivatives volition list XRP futures pending support by the U.S. Commodity Futures Trading Commission (CFTC).

Macro

April 14: Salvadoran President Nayib Bukele volition articulation U.S. President Donald Trump astatine the White House for an official moving visit.

April 14, 1:00 p.m.: Fed Governor Christopher J. Waller volition present an “Economic Outlook” speech. Livestream link.

April 15, 8:30 a.m.: Statistics Canada releases March user terms ostentation data.

Core Inflation Rate MoM Prev. 0.7%

Core Inflation Rate YoY Prev. 2.7%

Inflation Rate YoY Prev. 2.6%

April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail income data.

Retail Sales MoM Est. 1.3% vs. Prev. 0.2%

Retail Sales YoY Prev. 3.1%

April 16, 9:45 a.m.: Bank of Canada releases its latest involvement complaint decision; this is followed by a property league 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

April 16, 1:30 p.m.: Fed Chair Jerome H. Powell volition present an “Economic Outlook” speech. Livestream link.

Earnings (Estimates based connected FactSet data)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events

Governance votes & calls

Venus DAO is discussing the forced liquidation of the remaining debt owed by a BNB span exploiter relationship that “supplied extraneously minted BNB to Venus and generated an over-collateralized indebtedness position.”

Aave DAO is discussing taking further steps to deprecate Synthetix's sUSD connected Aave V3 Optimism implicit method developments that person “compromised its quality to consistently support its peg.”

GMX DAO is discussing the constitution of a GMX Reserve connected Solana, which would impact bridging $500,000 successful GMX to the Solana web and transferring the funds to the GMX-Solana Treasury.

April 14, 10 a.m.: Stacks to host a livestream with caller announcements from the project.

April 14, 12 p.m.: MiL.k to big an Ask Me Anything (AMA) session with Arbitrum.

April 15, 10 a.m.: Injective to clasp an X Spaces session with Guardian.

Unlocks

April 15: Starknet (STRK) to unlock 4.37% of its circulating proviso worthy $15.93 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating proviso worthy $27.82 million.

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating proviso worthy $337.71 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating proviso worthy $81 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating proviso worthy $18.33 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating proviso worthy $10.23 million.

Token Launches

April 14: KernelDAO (KERNEL) to beryllium listed connected Binance, Gate.io, LBank, KuCoin, MEXC, and others.

April 16: Badger (BADGER), Balacner (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT), and aelf (ELF) to beryllium delisted from Binance.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

April 14: ETH Seoul 2025 Conference

April 14: FinTech and InsurTech Digital Congress 2025 (Warsaw)

Day 1 of 3: Morocco WEB3FEST GITEX Edition (Marrakech)

April 15: Strategic Bitcoin Reserve Summit (online)

April 15-16: BUIDL Asia 2025 (Seoul)

April 15-16: World Financial Innovation Series 2025 (Hanoi, Vietnam)

April 15-17: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

Token Talk

By Shaurya Malwa

MANTRA’s OM token plummeted 90% successful 1 hr aboriginal Monday, dropping from implicit $6 to 37 cents, erasing $5.4 cardinal successful marketplace cap.

Since April 7, 2025, 17 wallets, including 2 linked to Laser Digital (a MANTRA investor), deposited 43.6M $OM tokens ($227M, 4.5% of circulating supply) into exchanges similar OKX and Binance, conscionable earlier a large terms crash, raising suspicions of insider selling oregon manipulation.

The MANTRA squad denied involvement, attributing the clang to “reckless liquidations” by exchanges during low-liquidity hours, claiming their tokens stay locked and verifiable on-chain, though assemblage spot is shaken.

Investors expressed devastation connected X, with users specified arsenic @Jeetburner, claiming to person mislaid implicit $3.5 million. Critics accused MANTRA and Binance of a “liquidity exit” and threatened ineligible action, portion MANTRA’s Telegram radical closed to caller users.

The incidental whitethorn interaction credibility successful the RWA assemblage arsenic real-world bigwigs - specified arsenic UAE existent property elephantine DAMAC, successful Mantra's lawsuit - support wary of projects with volatile token prices.

Derivatives Positioning

Perpetual backing rates for much large tokens, excluding XRP, stay mildly affirmative beneath the annualized 10%, reflecting a moderately bullish positioning.

BTC's rally has stalled adjacent $85K successful the past 24 hours. Futures unfastened involvement has dropped from $16.4 cardinal to $15 billion, a motion that traders are taking immoderate hazard disconnected the table.

XRP's betterment since April 7 has not been backed by an uptick successful unfastened interest, raising questions successful the marketplace astir the sustainability of gains.

On Deribit, the short-term BTC and ETH options skew remains negative, but the alleged enactment bias has weakened importantly since past Monday. The mid-term and longer-term skews person flipped backmost successful favour of calls.

Market Movements:

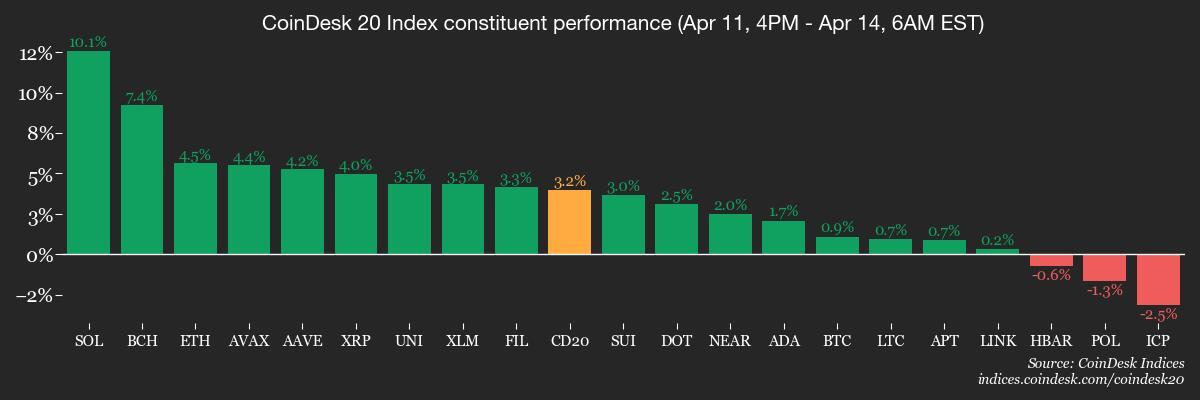

BTC is up 0.66% from 4 p.m. ET Friday astatine $84,404.14 (24hrs: -0.61%)

ETH is up 4.5% astatine $1,642.47 (24hrs: +0.94%)

CoinDesk 20 is up 3.1% astatine 2,489.90 (24hrs: -1.03%)

Ether CESR Composite Staking Rate is down 8 bps astatine 3.01%

BTC backing complaint is astatine 0.0177% (6.4725% annualized) connected Binance

DXY is down 0.67% astatine 99.44

Gold is up 2.19% astatine $3,243.50/oz

Silver is up 1.54% astatine $32.31/oz

Nikkei 225 closed +1.18% astatine 33,982.36

Hang Seng closed +2.4% astatine 21,417.40

FTSE is up 2.11% astatine 8,132.15

Euro Stoxx 50 is up 2.32% astatine 4,898.29

DJIA closed connected Friday +1.56% astatine 40,212.71

S&P 500 closed +1.81% astatine 5,363.36

Nasdaq closed +2.06% astatine 16,724.46

S&P/TSX Composite Index closed +2.49% astatine 23,587.80

S&P 40 Latin America closed +1.91% astatine 2,298.75

U.S. 10-year Treasury complaint is down 5 bps astatine 4.44%

E-mini S&P 500 futures are down 1.37% astatine 5,465.00

E-mini Nasdaq-100 futures are up 1.57% astatine 19,102.75

E-mini Dow Jones Industrial Average Index futures are up 0.99% astatine 40,800.00

Bitcoin Stats:

BTC Dominance: 63.47 (-0.12%)

Ethereum to bitcoin ratio: 0.01944 (1.94%)

Hashrate (seven-day moving average): 893 EH/s

Hashprice (spot): $44.0

Total Fees: 4.24 BTC / $358,663

CME Futures Open Interest: 133,945

BTC priced successful gold: 26.0/oz

BTC vs golden marketplace cap: 7.37%

Technical Analysis

BTC topped the carnivore marketplace trendline connected Saturday but has since struggled to physique momentum connected the breakout.

The play precocious of $86K is the contiguous resistance, followed by the April 2 highs supra $88,600.

Crypto Equities

Strategy (MSTR): closed connected Friday astatine $299.98 (+10.15%), up 1.96% astatine $305.85 successful pre-market

Coinbase Global (COIN): closed astatine $175.5 (+3.47%), up 1.83% astatine $178.51

Galaxy Digital Holdings (GLXY): closed astatine C$15.28 (+6.48%)

MARA Holdings (MARA): closed astatine $12.51 (+6.56%), up 1.12% astatine $12.65

Riot Platforms (RIOT): closed astatine $7.06 (+3.98%), up 1.98% astatine $7.20

Core Scientific (CORZ): closed astatine $7.07 (+3.67%), up 0.71% astatine $7.12

CleanSpark (CLSK): closed astatine $7.50 (+5.19%), up 2.27% astatine $7.67

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $12.91 (+3.12%)

Semler Scientific (SMLR): closed astatine $33.76 (+3.46%), down 2.22% astatine $33.01

Exodus Movement (EXOD): closed astatine $44.08 (+7.33%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$1 million

Cumulative nett flows: $35.46 billion

Total BTC holdings ~1.10 million

Spot ETH ETFs

Daily nett flow: -$29.2 million

Cumulative nett flows: $2.29 billion

Total ETH holdings ~3.38 million

Source: Farside Investors

Overnight Flows

Chart of the Day

The full worth locked successful Ostium Protocol, an open-sourced, decentralized speech connected Ethereum Layer 2 Arbitrum.

It's motion of increasing request for DeFi arsenic the sub-sector held steady, defying the past week's marketplace crash.

While You Were Sleeping

Bitcoin Options Play Shows $100K Target Back successful Bulls' Crosshair (CoinDesk): Traders pursuit telephone options arsenic BTC's terms recovers, with the $100K telephone enactment becoming the astir favored bet, with a notional unfastened involvement of astir $1.2 billion.

Mantra’s OM Crashes 90% successful Bizarre Selloff arsenic Team Alleges 'Forced Liquidations' (CoinDesk); The Mantra squad attributed the terms drop, which led to implicit $50 cardinal successful liquidations connected OM-tracked futures, to reckless liquidations by centralized exchanges, not issues with the project's fundamentals.

Bitcoin Flat arsenic White House Pushes Mixed Messages connected Technology Tariffs (CoinDesk): Bitcoin held supra $84K arsenic East Asia trading opened, with markets rebounding connected tariff alleviation for Chinese electronics, though BTSE’s Jeff Mei cautioned the rally whitethorn not last.

Goldman Puts $4,000 Gold connected the Agenda arsenic Hunt for Havens Grows (Bloomberg): Goldman sees a 45% accidental of a U.S. recession, predicting golden could deed $3,880 by year-end if it occurs, driven by ETF inflows arsenic investors hedge against falling hazard assets.

China’s Xi Says ‘Protectionism Will Lead Nowhere’ arsenic He Starts Southeast Asia Outreach Amid Tariff Worries (CNBC): Xi, visiting Vietnam contiguous and tomorrow, warned successful ruling enactment insubstantial "Nhan Dan" that commercialized wars wounded everyone and urged person China-Vietnam ties successful exertion and proviso chains.

BOJ May Mull Halting Rate Hikes If Yen Nears 130, Goldman Says (Bloomberg): A stronger yen could compression exporters’ margins, little import costs, deter concern and dampen wage maturation — making it harder for the cardinal slope to warrant further complaint hikes.

In the Ether

8 months ago

8 months ago

English (US)

English (US)