By Omkar Godbole (All times ET unless indicated otherwise)

Investors are inactive rotating wealth into altcoins, lifting valuations for ETH, RAY, ENA, MKR and different tokens portion leaving bitcoin (BTC) small changed supra $100,000.

While the biggest cryptocurrency by marketplace worth is conscionable 7% abbreviated of hitting a caller high, its 30-day options-based implied oregon expected volatility, represented by Deribit's DVOL index, is hovering adjacent the lowest level since June 2024.

This benignant of calm usually precedes large moves. Georgii Verbitskii, a marketplace expert and laminitis of TYMIO, a crypto capitalist app enactment it best: "Options implied volatility is highly low, the marketplace doesn't look to judge successful beardown moves, and 1- to 3-month enactment pricing is inactive cheap. That benignant of complacency often precedes a large move."

BTC could rapidly interruption done $115,000, Verbitskii said, noting that, "If the liquidity thesis holds — wherever planetary liquidity supports bitcoin — we could spot that breakout arsenic aboriginal arsenic May." Just to punctual you, bitcoin deed a grounds precocious astir $109,000 successful January.

Still, the marketplace faces imaginable headwinds. For instance, the U.S. Senate has its past accidental to walk the bipartisan GENIUS Act, a measure introduced successful February that calls for issuers to backmost integer currencies with harmless reserves and study them monthly oregon woody with penalties. The measure was incapable to beforehand successful a recent vote. According to the Senate's rules different nonaccomplishment volition termination the measure unless each senators hold to reconsider, according to Tagus Capital.

Further, the U.S. SEC delayed a decision connected Tuesday connected whether to let in-kind redemptions for BlackRock's bitcoin exchange-traded money portion it asks for feedback.

In different news, DeFi Development Corp. purchased 172,670 SOL worthy astir $23.6 million, bringing its full Solana Treasury holdings to implicit $100 million.

That's little common, with much companies moving to bitcoin: An update from bitcoin-focused institution River points out: "Thousands of companies crossed each sectors are utilizing bitcoin to offset ostentation and physique up their treasury." Stay alert!

What to Watch

- Crypto:

- May 14: eToro (ETOR) shares begin trading connected Nasdaq aft being priced astatine $52 successful IPO.

- May 14: Neo (NEO) mainnet volition acquisition a hard fork web upgrade (version 3.8.0) astatine artifact tallness 7,300,000.

- May 14: VanEck Onchain Economy ETF (NODE) starts trading connected Cboe BZX exchange.

- May 16, 9:30 a.m.: Galaxy Digital Class A shares to statesman trading connected the Nasdaq nether the ticker awesome GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) volition replace Discover Financial Services (DFS) successful the S&P 500, effectual earlier the opening of trading.

- Macro

- May 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases April ostentation data.

- Inflation Rate MoM Est. 3.1% vs. Prev. 3.7%

- Inflation Rate YoY Est. 47.7% vs. Prev. 55.9%

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail income data.

- Retail Sales MoM Est. 1% vs. Prev. 0.5%

- Retail Sales YoY Est. -0.5% vs. Prev. 1.5%

- May 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.1%

- Core PPI YoY Est. 3.1% vs. Prev. 3.3%

- PPI MoM Est. 0.2% vs. Prev. -0.4%

- PPI YoY Est. 2.5% vs. Prev. 2.7%

- May 15, 8:30 a.m.: The U.S. Census Bureau releases April retail income data.

- Retail Sales MoM Est. 0% vs. Prev. 1.5%

- Retail Sales YoY Prev. 4.9%

- May 15, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 10.

- Initial Jobless Claims Est. 230K vs. Prev. 228K

- May 15, 8:40 a.m.: Fed Chair Jerome H. Powell volition present a code ("Framework Review") successful Washington. Livestream link.

- May 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases April ostentation data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO is voting connected a connection to fund the integration of Uniswap V4 connected Ethereum successful Oku and adhd Unichain connected Oku successful a bid to heighten Uniswap’s scope and liquidity migration to V4. Voting ends May 18,

- May 14, 11:30 a.m.: Jupiter to clasp a J.U.P Rally.

- May 15, 11 a.m.: Yield Guild Games to big a Q1 2025 community update Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to big a Discord townhall league discussing web updates.

- May 21, 6 p.m.: Theta Network to big an Ask Me Anything league in a livestream.

- Unlocks

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $23.53 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating proviso worthy $14.22 million.

- May 16: Immutable (IMX) to unlock 1.35% of its circulating proviso worthy $17.8 million.

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating proviso worthy $39.06 million.

- May 17: Avalanche (AVAX) to unlock 0.4% of its circulating proviso worthy $42.84 million.

- Token Launches

- May 15: RIZE (RIZE) to database connected Kraken.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

Token Talk

By Shaurya Malwa

- Synthetix is considering buying Derive, an Ethereum-based options trading platform, successful a $27 cardinal token-swap deal, absorbing Derive’s treasury, codebase and operations.

- Derive holders would person 27 SNX tokens for each DRV. The tokens look a three-month lockup and nine-month vesting period.

- Some members of the Derive assemblage expressed dissatisfaction, citing unfavorable valuations and deficiency of benefits.

- Derive, primitively Lyra, was spun retired from Synthetix successful 2021 but diverged by ending sUSD enactment and launching autarkic products, making this a uncommon DeFi reacquisition.

- Elsewhere, "Launch Coin connected Believe" (LAUNCHCOIN), formerly Pasternak, surged 130% successful the past 24 hours, aligning with the Clout platform’s modulation into token issuance level Believe successful a determination that has boosted visibility and capitalist interest.

- The token had implicit $100 cardinal successful trading measurement successful the past 24 hours, up from a $5 cardinal mean implicit the past week.

- Believe’s level gained accelerated traction since the weekend, attracting attraction for its low-barrier exemplary that lets Web2 and accepted companies connection tokens for fundraising.

- These tokens are inherently valueless, however, representing nary equity rights, and a strict argumentation by Believe that does not let nett sharing with tokenholders.

Derivatives Positioning

- Funding rates are greenish for astir large tokens, but BCH, implying a bullish positioning successful the perpetual futures market.

- Open interest-adjusted cumulative measurement delta (CVD) paints a mixed picture, with affirmative values for XMR, TRX, UNI, ETH, AVAX and SOL suggesting nett buying pressure. The remainder of the majors person a antagonistic 24-hour CVD.

- Block flows connected Deribit featured agelong positions successful BTC calls and abbreviated positions successful ETH puts, some hinting astatine bullish marketplace sentiment.

Market Movements

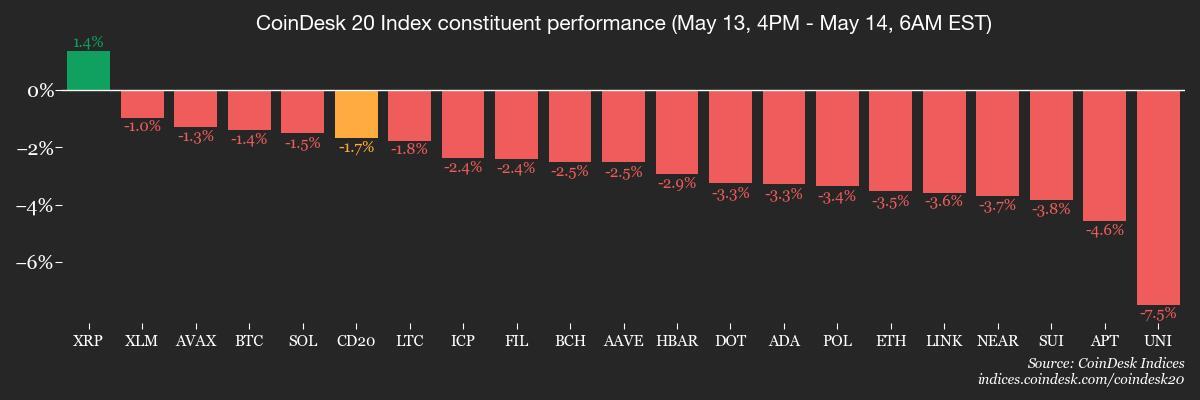

- BTC is down 1.18% from 4 p.m. ET Tuesday astatine $103,485.75 (24hrs: -0.07%)

- ETH is down 2.81% astatine $2,608.56 (24hrs: +5.09%)

- CoinDesk 20 is down 1.15% astatine 3,329.26 (24hrs: +2.51%)

- Ether CESR Composite Staking Rate is down 5 bps astatine 3.12%

- BTC backing complaint is astatine 0.0051% (5.6316% annualized) connected Binance

- DXY is down 0.63% astatine 100.37

- Gold is down 0.31% astatine $3,234.30/oz

- Silver is down 0.38% astatine $32.80/oz

- Nikkei 225 closed -0.14% astatine 38,128.13

- Hang Seng closed +2.3% astatine 23,640.65

- FTSE is down 0.13% astatine 8,591.52

- Euro Stoxx 50 is down 0.56% astatine 5,386.05

- DJIA closed connected Tuesday -0.64% astatine 42,140.43

- S&P 500 closed +0.72% astatine 5,886.55

- Nasdaq closed +1.61% astatine 19,010.08

- S&P/TSX Composite Index closed +0.33% astatine 25,616.86

- S&P 40 Latin America closed +2.41% astatine 2,640.68

- U.S. 10-year Treasury complaint is down 2 bps astatine 4.45%

- E-mini S&P 500 futures are unchanged astatine 5,900.00

- E-mini Nasdaq-100 futures are unchanged astatine 21,266.50

- E-mini Dow Jones Industrial Average Index futures are unchanged astatine 42,206.00

Bitcoin Stats

- BTC Dominance: 62.39 (+0.34%)

- Ethereum to bitcoin ratio: 0.02509 (-2.49%)

- Hashrate (seven-day moving average): 865 EH/s

- Hashprice (spot): $55.37

- Total Fees: 6.27 BTC / $650,612.82

- CME Futures Open Interest: 145,350 BTC

- BTC priced successful gold: 31.9 oz

- BTC vs golden marketplace cap: 9.04%

Technical Analysis

- The illustration shows ether's rally has stalled astatine the 200-day elemental moving mean (SMA).

- A breakout would confirm the onset of the bull market, perchance drafting much traders to the market.

Crypto Equities

Strategy (MSTR): closed connected Tuesday astatine $421.61 (+4.13%), down 2.29% astatine $411.96 successful pre-market

Coinbase Global (COIN): closed astatine $256.9 (+23.97%), down 1.38% astatine $253.36

Galaxy Digital Holdings (GLXY): closed astatine $29.39 (+3.52%)

MARA Holdings (MARA): closed astatine $16.37 (+2.63%), down 1.53% astatine $16.12

Riot Platforms (RIOT): closed astatine $9.06 (+4.14%), down 1.1% astatine $8.96

Core Scientific (CORZ): closed astatine $10.24 (+3.64%), down 0.68% astatine $10.17

CleanSpark (CLSK): closed astatine $10 (+3.95%), down 2.4% astatine $9.76

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.20 (+5.26%)

Semler Scientific (SMLR): closed astatine $36.70 (+5.34%), down 0.93% astatine $36.36

Exodus Movement (EXOD): closed astatine $42.04 (-22.58%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

- Daily nett flows: -$91.4 cardinal

- Cumulative nett flows: $41.05 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flows: $13.5 cardinal

- Cumulative nett flows: $2.48 billion

- Total ETH holdings ~ 3.44 million

Source: Farside Investors

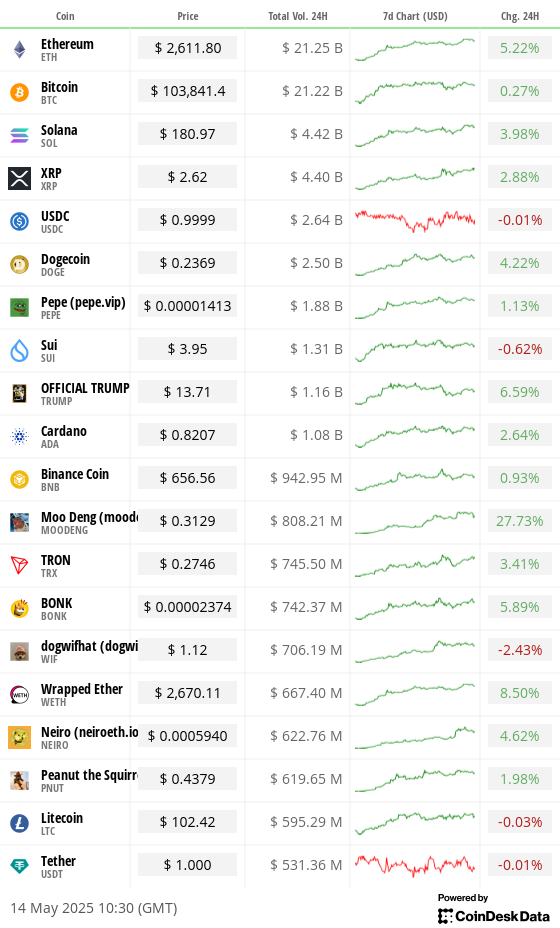

Overnight Flows

Chart of the Day

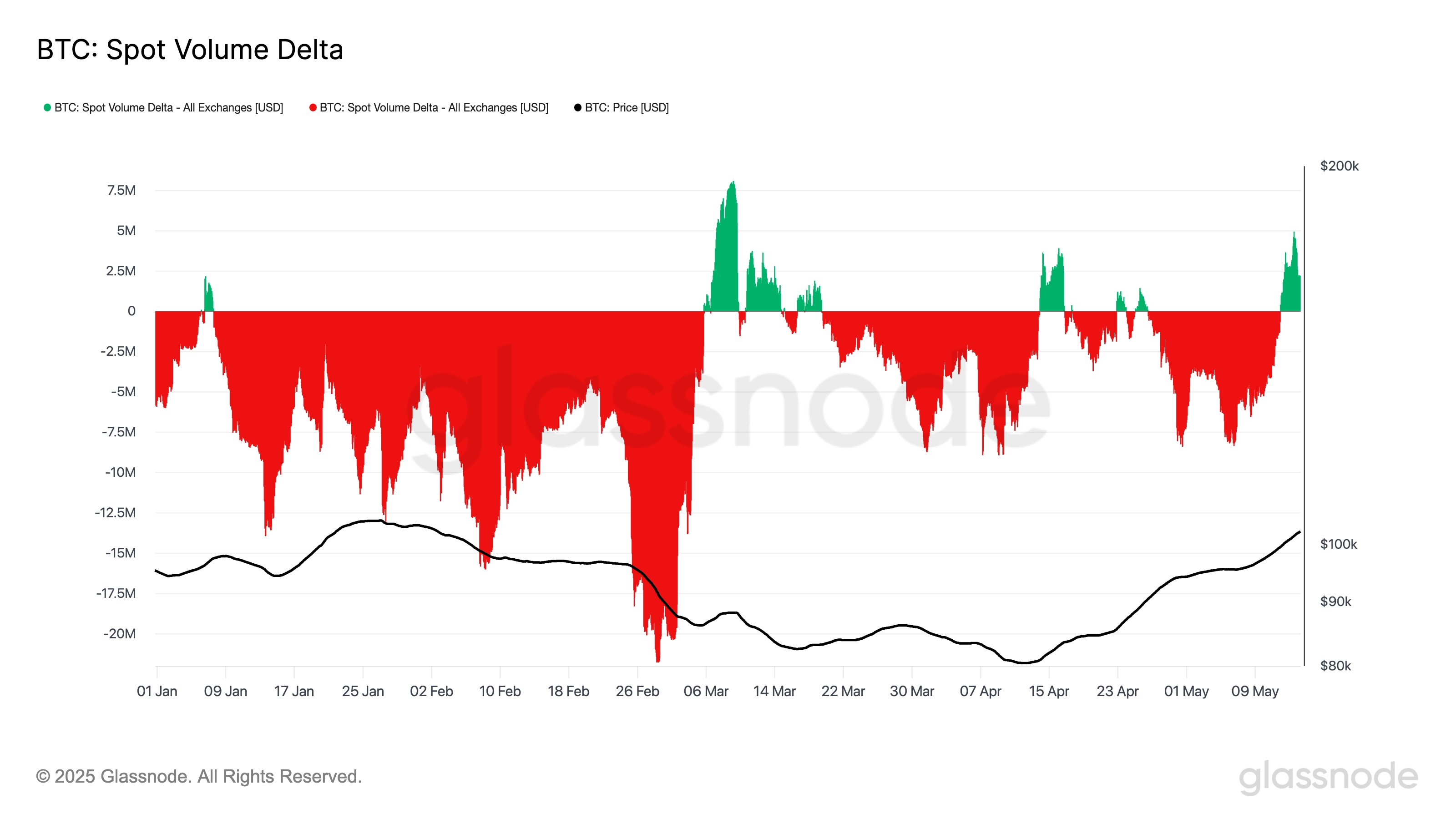

- The illustration shows BTC's spot measurement delta, which measures the nett quality betwixt buying and selling commercialized volumes.

- The metric has flipped positive, confirming that the determination supra $100,000 is backed by existent request successful the spot market.

While You Were Sleeping

- Synthetix Considers Purchase of Options Platform Derive successful $27M Token-Swap Deal (CoinDesk): A projected 27:1 SNX-to-DRV token conversion with a lockup docket requires support from some communities and has sparked backlash from Derive users implicit valuation and unclear benefits.

- Ether Nears $2.7K, Dogecoin Zooms 9% arsenic Crypto Market Remains Cheery (CoinDesk): A wide altcoin rebound is losing steam arsenic traders brace for profit-taking, with bitcoin’s momentum clouded by macro headwinds, including a firmer dollar and revived commercialized tensions.

- Dollar Steadies With Trade Talks successful Frame After Sliding connected Muted U.S. Inflation (Reuters): Commonwealth Bank analysts expect the dollar scale to emergence 2%–3% successful the coming weeks aft the U.S.-China tariff truce, but spot nary instrumentality to early-year highs adjacent 108.50.

- U.S. Scraps 'AI Diffusion' Rule successful Revamp of Biden-Era Chip Curbs (The Wall Street Journal): The Commerce Department removed export curbs it said harmed U.S. innovation and diplomatic relations, boosting AI chipmakers similar Nvidia and AMD by expanding overseas sales.

- Standard Chartered Will Provide Banking Services for FalconX to Enhance Cross-Border Settlement (CoinDesk): FalconX volition summation entree to caller currency pairs and planetary banking rails, supporting its effort to nexus integer assets with accepted concern for organization clients.

- Exporters ‘Shocked and Elated’ arsenic China Trade Cranks Back Into Gear (Financial Times): Chinese exporters expect a near-term leap successful shipments to the U.S., but are inactive diversifying abroad, viewing the tariff truce arsenic lone a short-term reprieve.

In the Ether

7 months ago

7 months ago

English (US)

English (US)