By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace has regained immoderate stability, with BTC rising backmost to astir $95K arsenic order books signaled the beingness of bargain hunters. Late Wednesday, prices tested the long-standing enactment portion of $90K-$93K, which has successfully halted downward movements astatine slightest six times since the 2nd fractional of November.

This latest bounce volition beryllium tested by Friday's U.S. nonfarm payrolls report, which is anticipated to amusement an summation of 164,000 jobs successful December, pursuing November's summation of 227,000, per FXStreet. The unemployment complaint is expected to lucifer November's gait of 4.2%, portion mean hourly net are projected to chill somewhat to 0.3% month-on-month, down from 0.4%.

A stronger-than-expected jobs study could adhd to the existing hawkish Fed fears, further expanding inflation-adjusted enslaved yields. These yields person been rising owed to ostentation worries, complicating matters for hazard assets. The ostentation scare and rates volatility apt catalyzed BTC's accelerated descent from $102K to $93K successful the past 4 days.

To exemplify conscionable however bearish sentiment was aboriginal today, the backing complaint successful perpetual markets turned negative, representing a dominance of shorts, that excessively astatine a clip erstwhile BTC is conscionable 15% distant from its grounds high.

The prevalence of the Fed-led pessimism means immoderate motion of weakness successful the payrolls fig volition apt trigger crisp marketplace reactions, reviving the lawsuit for Fed complaint cuts and shifting sentiment markedly successful favour of hazard assets. If the information misses estimates by a wide margin, BTC could easy marque different effort astatine $100K, provided the U.S. government, which holds astir $18.50 cardinal worthy of BTC, refrains from flooding the marketplace with offers to sell. Stay alert.

What to Watch

Crypto

No large crypto events scheduled today.

Jan. 12, 10:30 p.m.: Binance volition halt Fantom token (FTM) deposits and withdrawals and delist each FTM trading pairs. FTM tokens volition beryllium swapped for S tokens astatine a 1:1 ratio.

Jan. 13: Solayer (LAYER) "Season 1" airdrop snapshot for staking participants, liquidity providers, and spouse ecosystem users. Eligibility details and presumption volition beryllium disposable connected the Solayer dashboard.

Jan. 15: Derive (DRV) to make and administer caller tokens successful token procreation event.

Jan. 15: Mintlayer mentation 1.0.0 release. The mainnet upgrade introduces atomic swaps, enabling autochthonal BTC cross-chain swaps.

Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is acceptable to commencement connected Binance, featuring pairs similar S/USDT, S/BTC, and S/BNB.

Macro

Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

Nonfarm payrolls Est. 160K vs. Prev. 227K.

Unemployment complaint Est. 4.2% vs Prev. 4.2%.

Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 73.8 vs. Prev. 74.0.

Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI data.

PPI MoM Prev. 0.4%.

Core PPI MoM Prev. 0.2%.

Core PPI YoY Prev. 3.4%.

PPI YoY Prev. 3%.

Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ending connected Jan. 11. Prev. 6.8%.

Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Consumer Price Index Summary.

Core Inflation Rate MoM Prev. 0.3%.

Core Inflation Rate YoY Prev. 3.3%.

Inflation Rate MoM Prev. 0.3%.

Inflation Rate YoY Prev. 2.7%.

Jan. 16, 2:00 a.m.: The U.K.’s Office for National Statistics November 2024’s GDP estimate.

GDP MoM Prev. -0.1%

GDP YoY Prev. 1.3%.

Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ending connected Jan. 11. Initial Jobless Claims Prev. 201K.

Token Events

Governance votes & calls

No large events scheduled today.

Jan. 14: Mantra community call with its co-founder

Unlocks

No large unlocks scheduled today.

Jan. 11: Aptos to unlock 1.13% of its APT circulating supply, worthy $98.85 million.

Jan. 12: Axie Infinity to unlock 1.45% of its circulating supply, worthy $14.08 million.

Jan. 14: Arbitrum to unlock 0.93% of its circulating supply, worthy $70.65 million.

Token Launches

No large token launches scheduled today.

Jan. 15: Derive (DRV) volition launch, with 5% of proviso going to sENA stakers.

Jan. 17: Solv Protocol (SOLV) to beryllium listed connected Binance.

Conferences:

Day 5 of 14: Starknet, an Ethereum furniture 2, is holding its Winter Hackathon (online).

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Shaurya Malwa

Usual protocol's USD0++, which is simply a peculiar mentation of USD0 wherever users tin gain involvement by "staking" it, has dropped from being worthy $1 to astir 93 cents aft the squad made changes to however users tin get their wealth backmost early.

Traders showed a penchant for AI Agent tokens aiXBT, Cookie DAO’s COOKIE, and ChainGPT arsenic they roseate arsenic overmuch arsenic 50% connected Binance spot listings. Viral token ai16z was up 11% and the agents class up was 8% connected average, starring maturation among each different crypto sectors.

A deposit vault connected the upcoming web Berachain deed $1.1 cardinal successful holdings, led by StakeStone astatine $370 million.

The Arbitrum DAO is voting connected an betterment connection (AIP) to instrumentality the Bounded Liquidity Delay (BoLD) connected Arbitrum One and Nova. If approved, it volition regenerate the existent validator strategy with a permissionless one, allowing broader information successful securing the network.

Ronin and Virtuals person collaborated to present an AI cause named $JAIHOZ, fashioned aft Ronin's cofounder @Jihoz_Axie. The token was launched with a proviso divided betwixt Base and Ronin blockchains, with immoderate tokens airdropped to assemblage members.

Derivatives Positioning

HYPE, LTC, SHIB, SUI and TON person experienced an uptick successful perpetual futures unfastened involvement successful the past 24 hours, with XLM starring the driblet successful unfastened positions successful different large tokens.

The front-end BTC and ETH hazard reversals amusement enactment bias portion longer duration calls proceed to gully premium comparative to puts.

Block trades successful BTC options painted a mixed picture. In ETH's case, the largest artifact commercialized progressive a abbreviated presumption successful the $3,700 telephone expiring connected Feb. 28 to money a agelong presumption successful the $3,200 enactment with the aforesaid expiry.

Market Movements:

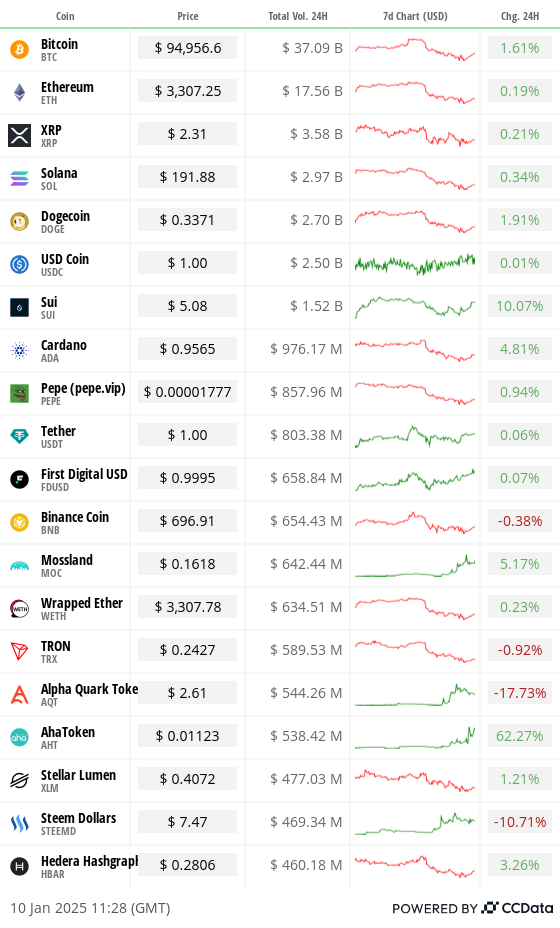

BTC is up 3.06% from 4 p.m. ET Thursday to $94,967.46 (24hrs: +1.52%)

ETH is up 3.46% astatine $3,306.56 (24hrs: +0.11%)

CoinDesk 20 is unchanged astatine 3,375.16(24hrs: -0.74%)

Ether staking output is down 1 bp to 3.14%

BTC backing complaint is astatine 0.0013% (1.38% annualized) connected Binance

DXY is unchanged astatine 109.18

Gold is up 0.91% astatine $2,708.1/oz

Silver is up 1.3% to $31.19/oz

Nikkei 225 closed -1.05% astatine 39,190.4

Hang Seng closed -0.92% astatine 19,064.29

FTSE is down 0.18% astatine 8,304.75

Euro Stoxx 50 is up 0.19% astatine 5,027.38

DJIA closed connected Thursday +0.25% astatine 42,635.20

S&P 500 closed +0.16% astatine 5,918.25

Nasdaq closed +0.83% astatine 19,480.91

S&P/TSX Composite Index closed unchanged astatine 19,478.88

S&P 40 Latin America closed +0.27% astatine 2,210.99

U.S. 10-year Treasury is up 2 bps astatine 4.71%

E-mini S&P 500 futures are unchanged astatine 5,948.00

E-mini Nasdaq-100 futures are unchanged astatine 21,313.75

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 42,846.0

Bitcoin Stats:

BTC Dominance: 58.02

Ethereum to bitcoin ratio: 0.034

Hashrate (seven-day moving average): 772 EH/s

Hashprice (spot): $54.3

Total Fees: 6.6 BTC/ $653,353

CME Futures Open Interest: 497,207 BTC

BTC priced successful gold: 35.2 oz

BTC vs golden marketplace cap: 10.09%

Technical Analysis

BTC has bounced to $95K, having held the head-and-shoulders (H&S) neckline enactment Thursday.

Prices request to determination supra $102,750, the little precocious oregon the close enarthrosis created Monday to awesome a renewed bullish outlook.

A UTC adjacent nether the horizontal enactment enactment would corroborate the H&S apical and displacement absorption to deeper enactment astatine $75,000.

Crypto Equities

MicroStrategy (MSTR): closed connected Thursday astatine $331.7 (-2.85%), up 2.03% astatine $338.44 successful pre-market.

Coinbase Global (COIN): closed astatine $260.01(-1.63%), up 0.73% astatine $261.91 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$26.85 (-2.79%)

MARA Holdings (MARA): closed astatine $18.34 (-3.83%), up 0.93% astatine $18.51 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.02 (-3.14%), up 0.83% astatine $12.12 successful pre-market.

Core Scientific (CORZ): closed astatine $14.05 (-0.5%), up 1% astatine $14.19 successful pre-market.

CleanSpark (CLSK): closed astatine $10.09 (-5.79%), up 1.09% astatine $10.20 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $23.15(-4.93%).

Semler Scientific (SMLR): closed astatine $50.19 (-9.14%), unchanged successful pre-market.

ETF Flows

U.S. exchanges were closed connected Jan.9 successful a nationalist time of mourning for erstwhile President Jimmy Carter, who passed distant connected December 29, 2024.

The ETF information beneath is from Jan.8 and remains unchanged.

Spot BTC ETFs:

Daily nett flow: $676 million

Cumulative nett flows: $31.70 billion

Total BTC holdings ~ 1.080 million.

Spot ETH ETFs

Daily nett flow: $132.6 million

Cumulative nett flows: $733.6 million

Total ETH holdings ~ 3.077 million.

Source: Farside Investors

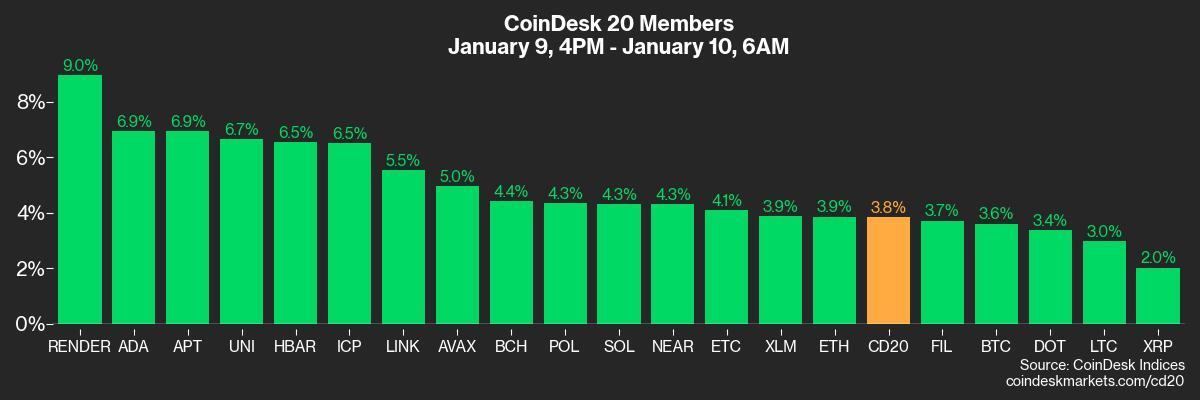

Overnight Flows

Chart of the Day

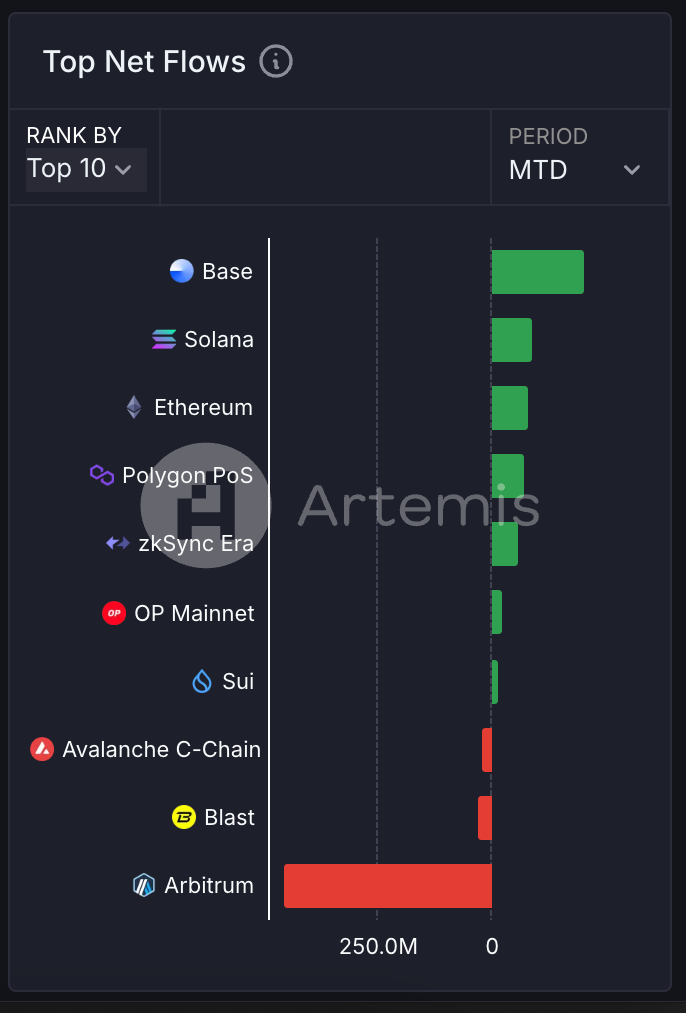

The illustration shows the apical 10 chains of the period successful presumption of the nett measurement of assets received utilizing a crypto bridge.

Coinbase's furniture 2 scaling solution leads the battalion with nett inflows of $208 cardinal followed by Solana's distant 2nd $92 million.

While You Were Sleeping

The Bitcoin Iceberg: Buyers Await Beneath the Bearish Surface (CoinDesk): Bitcoin faces selling unit from ostentation concerns, portion beardown bids astatine little prices suggest imaginable stabilization. Traders and investors await the U.S. nonfarm payrolls study for Federal Reserve argumentation cues.

Polymarket's Customer Data Sought by CFTC Subpoena of Coinbase, Source Says (CoinDesk): The U.S. CFTC has allegedly subpoenaed Coinbase for information connected Polymarket customers amid ineligible battles with blockchain-powered prediction markets. Coinbase has seemingly warned users it whitethorn disclose the requested information.

Standard Chartered Debuts Crypto Services successful Europe With New License (Cointelegraph): On Thursday, Standard Chartered launched crypto custody services successful Europe via Luxembourg, utilizing it arsenic an E.U. regulatory introduction constituent nether the Markets successful Crypto-Assets (MiCA) framework.

China Swap Curve Inverts arsenic Traders Dial Back Rate-Cut Bets (Bloomberg): China’s wealth markets expect delayed monetary easing to support the yuan, deepening a uncommon swap curve inversion arsenic policymakers conflict to equilibrium currency stableness and economical support.

Japan November Household Spending Falls As Price Pressures Persist (Reuters): Japan’s November spending diminution eased, but rising prices and stagnant wages bounds depletion recovery, leaving analysts skeptical astir existent wage maturation oregon a Bank of Japan complaint hike this month.

Whitehall Braced for Spending Cuts After UK Hit by Bond Market Turmoil (Financial Times): The U.K. faces rising borrowing costs arsenic 10-year gilt yields deed 4.93%, the highest since 2008, and the lb drops to a year-low, prompting warnings of tighter authorities budgets.

In the Ether

11 months ago

11 months ago

English (US)

English (US)