By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin's censorship-resistant, decentralized setup empowers individuals by facilitating peer-to-peer transactions without authorities interference oregon firm control.

You’ve astir apt heard that from a Bitcoin maxi galore times.

It's an thought that resonates adjacent much powerfully contiguous successful airy of reports that President Donald Trump is exploring ways to region Jerome Powell, the seat of the Federal Reserve, which is the world's astir almighty cardinal bank.

National Economic Council Director Kevin Hassett talked astir Trump's intentions Friday and markets responded aboriginal Monday by selling the dollar and the U.S. banal futures. The Dollar Index, which tracks the currency's speech complaint against large fiat currencies, slipped to a three-year debased of 98.00 portion golden touched caller highs supra $3,400 per ounce.

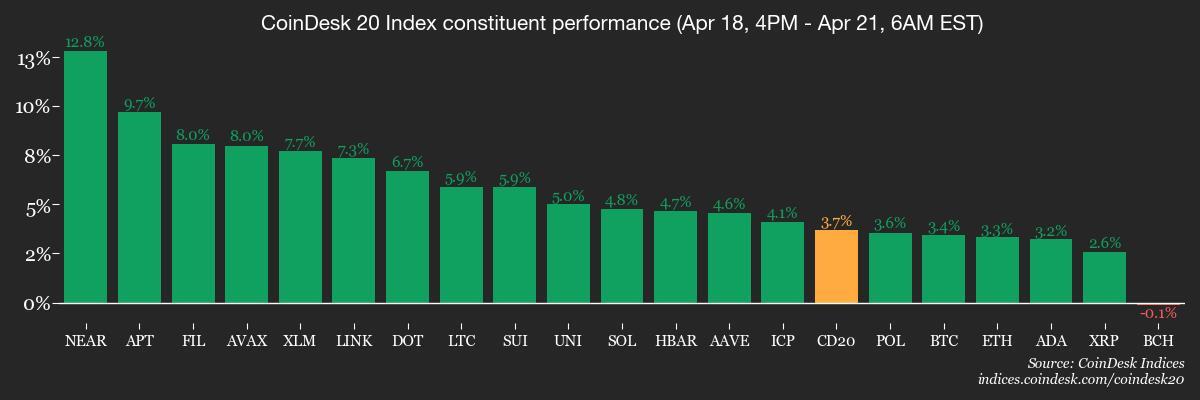

Bitcoin roseate past $87,000, confirming a bullish breakout from its caller sideways trading betwixt $83,000 and $86,000 to suggest much gains ahead. The uptick saw gaming, AI and memecoins outshine different sectors of the crypto market, with smaller tokens similar ENJ and MAGIC chalking retired gains successful excess of 50% successful 24 hours. MANTRA inactive tanked 15%.

"A weaker dollar could gully renewed attraction from American investors, highlighting bitcoin's imaginable arsenic a hedge against declining dollar value," said Matrixport, a crypto fiscal services platform.

On-chain information warned of heightened volatility arsenic prices perchance adjacent the $90,000 mark. "Cost‑basis clusters amusement small overhead proviso beneath that range, implying the marketplace could beforehand rapidly earlier a larger tranche of holders reaches break‑even and begins taking profit," analytics steadfast IntoTheBlock said successful a Telegram post.

In different news, Charles Shwab CEO Rick Wurster said the fiscal services steadfast is “hopeful and apt to beryllium able” to enactment spot crypto trading wrong the adjacent year. Wurster said that much and much clients are seeking accusation astir crypto.

Slovenia's Finance Ministry proposed a 25% taxation connected superior gains connected profits from selling cryptocurrencies for fiat oregon spending tokens for goods and services. The taxation is projected to spell into effect from 2026.

Vitalik Buterin, a co-founder of the Ethereum blockchain, proposed replacing the Ethereum Virtual Machine (EVM) with RISC-V, an open-source acquisition acceptable architecture utilized to make customized processors for a assortment of applications. Buterin said the connection code 1 of Ethereum's cardinal scaling bottlenecks by dramatically improving the ratio and simplicity of astute declaration execution.

Speaking of Ethereum, it briefly fell behind its main rival, Solana web successful presumption of the full staked worth of their respective autochthonal tokens, ETH and SOL. Uniswap laminitis Hayden Adam warned that Ethereum could autumn down Solana if it goes backmost to relying connected the furniture 1 bockchain alternatively of the layer-2 scaling products.

In macro news, China said it volition retaliate against countries that enactment with U.S. to isolate Beijing successful the commercialized warfare started by Trump. Stay alert!

What to Watch

- Crypto:

- April 21: Coinbase Derivatives volition list XRP futures pending support by the U.S. Commodity Futures Trading Commission (CFTC).

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable connected "Key Considerations for Crypto Custody".

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering vulnerability done futures and swap agreements, to statesman trading connected NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, volition activate the Pectra hard fork connected its mainnet astatine slot 21,405,696, epoch 1,337,856.

- Macro

- April 21-26: World Bank (WB) and the International Monetary Fund (IMF) spring meetings instrumentality spot successful Washington.

- April 22, 8:30 p.m.: Statistics Canada releases March shaper terms ostentation data.

- PPI MoM Prev. 0.4%

- PPI YoY Prev. 4.9%

- April 22, 6 p.m.: Fed Governor Adriana D. Kugler volition present a code titled "Transmission of Monetary Policy."

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail income data.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April purchasing managers’ scale (PMI) data.

- Composite PMI Prev. 53.5

- Manufacturing PMI Prev. 50.2

- Services PMI Est. 52.9 vs. Prev. 54.4

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Aave DAO is discussing working with Ether.fi to make a customized Aave marketplace connected EVM furniture 2 to “facilitate on-chain recognition for mundane payments done the Ether.fi Cash recognition paper program.”

- April 23, 9 p.m.: Manta Network to big a townhall gathering with its founders.

- April 24, 8 a.m.: Alchemy Pay to big an Ask Me Anything (AMA) league connected its 2025 roadmap.

- April 30, 12 p.m.: Helium to big a community telephone meeting.

- Unlocks

- April 22: Metars Genesis (MRS) to unlock 11.87% of its circulating proviso worthy $127.9 million.

- April 30: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $22.78 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating proviso worthy $167.97 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating proviso worthy $10.57 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating proviso worthy $12.12 million.

- Token Launches

- April 21: Balance (EPT) to beryllium listed connected Bitget Bybit, KuCoin, Gate.io, LBank, MEXC, BingX.

- April 22: Hyperlane to airdrop its HYPER tokens.

- April 22: BNB to beryllium listed connected Kraken.

Conferences:

- CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- April 22-24: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise's Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain successful Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador)

- April 29: IFGS 2025 (London)

Token Talk

By Shaurya Malwa

- Bitget, a centralized crypto exchange, volition reverse trades and compensate users owed to "abnormal trading" successful its perpetual futures marketplace for VOXEL, a token linked to the Polygon-based RPG crippled Voxie Tactics.

- Early Sunday, VOXEL’s trading measurement surged past bitcoin’s 24-hour measurement — with the token’s worth surging implicit 300% successful a week — contempt being lone the 723rd-largest cryptocurrency by marketplace cap.

- An X idiosyncratic claimed six-figure profits from a sub-$100 investment, attributing the surge to a imaginable bug successful Bitget’s market-making robot,. The commercialized rollback volition apt erase these gains.

- Bitget’s probe revealed imaginable marketplace manipulation by definite accounts, prompting the speech to activate its risk-control strategy and program a commercialized rollback wrong 24 hours.

- Affected users who incurred losses volition person compensation, and Bitget is continuing its investigation.

Derivatives Positioning

- The market-wide futures unfastened involvement has climbed to $37.22 billion, the highest since March 24, according to Velo Data. The fig represents unfastened involvement successful each coins listed connected Binance, Bybit, OKX, Deribit and Hyperliquid.

- ETH is the champion performing large token successful presumption of futures unfastened involvement growth, followed by BTC and LINK.

- Speaking of OI-adjusted cumulative measurement delta, ETH besides leads the battalion with the highest affirmative reading, implying an influx of buying unit successful the market.

- On Deribit, BTC and ETH hazard reversals for short- and near-dated expiries person flattened out, recovering from the caller persistent antagonistic prints that represented bias for protective enactment options.

Market Movements:

- BTC is up 3.19% from 4 p.m. ET Sunday astatine $87,270.44 (24hrs: +3.63%)

- ETH is up 2.54% astatine $1,631.90 (24hrs: +3.17%)

- CoinDesk 20 is up 0.8% astatine 2,268.01 (24hrs: +3.77%)

- Ether CESR Composite Staking Rate is up 47 bps astatine 2.47%

- BTC backing complaint is astatine 0.0044% (4.776% annualized) connected Binance

- DXY is down 1.11% astatine 98.26

- Gold is up 2.04% astatine $3,395.65/oz

- Silver is up 1.12% astatine $32.89/oz

- Nikkei 225 closed -1.3% astatine 34,279.92

- Hang Seng closed +1.61% astatine 21,395.14

- FTSE is closed astatine 8,275.66

- Euro Stoxx 50 is closed astatine 4,935.34

- DJIA closed connected Thursday -1.33% astatine 39,142.23

- S&P 500 closed +0.13% astatine 5,282.70

- Nasdaq closed -0.13% astatine 16,286.45

- S&P/TSX Composite Index closed +0.36% astatine 24,192.81

- S&P 40 Latin America closed +1.64% astatine 2,383.75

- U.S. 10-year Treasury complaint is unchanged astatine 4.33%

- E-mini S&P 500 futures are down 1.04% astatine 5,275.00

- E-mini Nasdaq-100 futures are down 1.16% astatine 18,168.25

- E-mini Dow Jones Industrial Average Index futures are down 0.92% astatine 38,969

Bitcoin Stats:

- BTC Dominance: 64% (0.23%)

- Ethereum to bitcoin ratio: 0.1873 (0.54%)

- Hashrate (seven-day moving average): 858 EH/s

- Hashprice (spot): $45.22

- Total Fees: 5.48 BTC / $479,045

- CME Futures Open Interest: 141,280 BTC

- BTC priced successful gold: 25.7 oz

- BTC vs golden marketplace cap: 7.2%

Technical Analysis

- Bitcoin's breakout has acceptable the signifier for a continued determination higher to $90,000.

- However, trading measurement has dipped, suggesting debased information successful the terms recovery.

- A low-volume rally often ends up being short-lived.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $317.20 (1.78%), up 3.13% astatine $327.12 successful pre-market

- Coinbase Global (COIN): closed astatine $175.03 (1.64%) up 1.4% astatine $177.49

- Galaxy Digital Holdings (GLXY): closed astatine C$15.36 (-1.41%)

- MARA Holdings (MARA): closed astatine $12.66 (2.76%), up 2.69% astatine $13.00

- Riot Platforms (RIOT): closed astatine $6.46 (1.57%), up 2.63% astatine $6.63

- Core Scientific (CORZ): closed astatine $6.63 (0.61%), down 0.45% astatine $6.60

- CleanSpark (CLSK): closed astatine $7.51 (3.16%), up 1.86% astatine $7.65

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $12.04 (1.09%), up 2.41% astatine $12.33

- Semler Scientific (SMLR): closed astatine $32.49 (4.79%)

- Exodus Movement (EXOD): closed astatine $36.58 (-1.64%), up 2.1% astatine $37.35

ETF Flows

U.S. equity markets were closed connected Friday.

Overnight Flows

Chart of the Day

- XRP's short- and near-dated hazard reversals proceed to beryllium priced negative, a motion of persistent request for enactment options, which connection downside protection.

While You Were Sleeping

- Pope Francis, Voice for the Poor Who Transformed the Catholic Church, Dies astatine 88 (CNN): The archetypal Latin American pope died weeks aft returning to nationalist beingness pursuing a life-threatening lawsuit of pneumonia.

- China Vows Retaliation Against Countries That Follow U.S. Calls to Isolate Beijing (CNBC): China said it volition respond to U.S. tariff deals that undermine its interests, accusing Washington of "unilateral bullying" and informing it risks returning planetary commercialized to "law of the jungle."

- BNB, SOL, XRP Spike Higher arsenic Bitcoin 'Digital Gold' Narrative Makes a Comeback (CoinDesk): Bitcoin’s correlation with U.S. equities appears to beryllium weakening arsenic its terms progressively tracks gold, which has held steadfast portion stocks decline, according to LVRG Research’s Nick Ruck.

- Stablecoin Giant Circle Is Launching a New Payments and Remittance Network (CoinDesk): The fintech steadfast volition unveil a caller payments and cross-border remittance merchandise connected Tuesday.

- Over $380M Worth of Crypto Stolen During Bybit's $1.4B Hack Has Gone Dark (CoinDesk): The exchange's CEO said that 27.6% of the funds stolen by the North Korean Lazarus Group "flowed into mixers past done bridges to P2P and OTC platforms."

- Bitcoin's Breakout Signals BTC Potentially Rallying to $90K-$92K: Technical Analysis (CoinDesk): Bitcoin's terms surged past $87,000, breaking retired of a week-long consolidation betwixt $83,000 and $86,000. The people scope antecedently served arsenic a beardown enactment zone.

In the Ether

5 months ago

5 months ago

English (US)

English (US)