By Omkar Godbole (All times ET unless indicated otherwise)

For bitcoin bulls, it's a lawsuit of "heads I win, tails you lose."

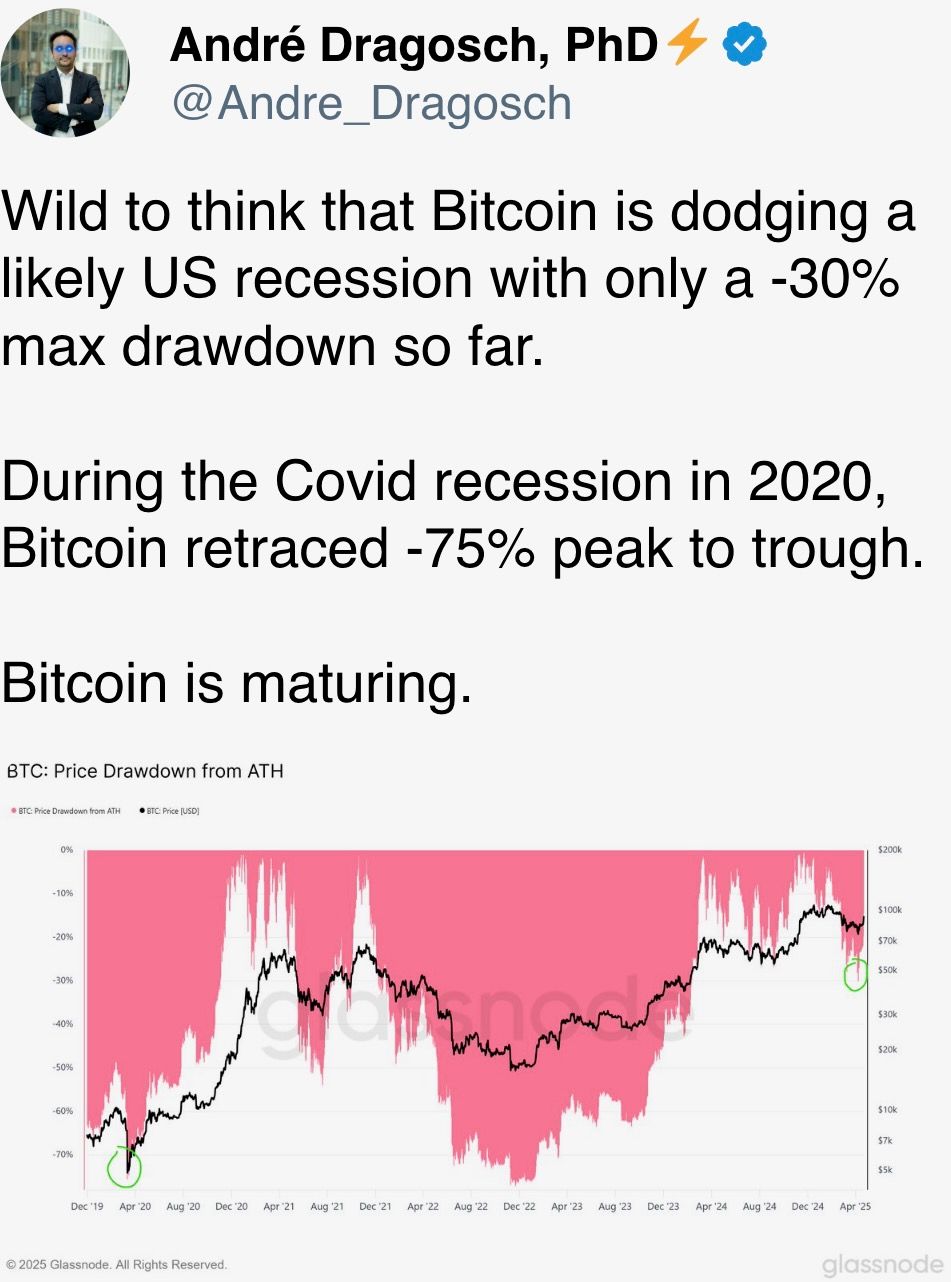

It's risk-on-time and boding good for BTC, which roseate supra $94,000 to people a much than 50% retracement of the sell-off from grounds highs supra $109,000 to $74,000.

The cryptocurrency has experienced a crisp rally successful the past 24 hours, coinciding with President Donald Trump saying helium does not intend to occurrence Fed Chair Jerome Powell and making conciliatory remarks connected commercialized tensions with China.

But BTC roseate connected Monday too. That was supposedly connected haven request arsenic traders sold the dollar, U.S. stocks and bonds connected the perceived menace to the Fed's independence.

No wonderment immoderate analysts accidental the largest cryptocurrency is simultaneously a hazard play owed to its emerging tech entreaty and a haven akin to integer gold.

The latest surge besides boosted morale successful the wider crypto market. SUI, BONK, ENA, NEAR and AGLO person climbed much than 20% successful conscionable 24 hours. IMX surged implicit 40%, portion ether (ETH), the biggest altcoin, is trading astir 10% higher. Bitcoin's dominance complaint dropped slightly, indicating a traders' renewed willingness to instrumentality connected risk.

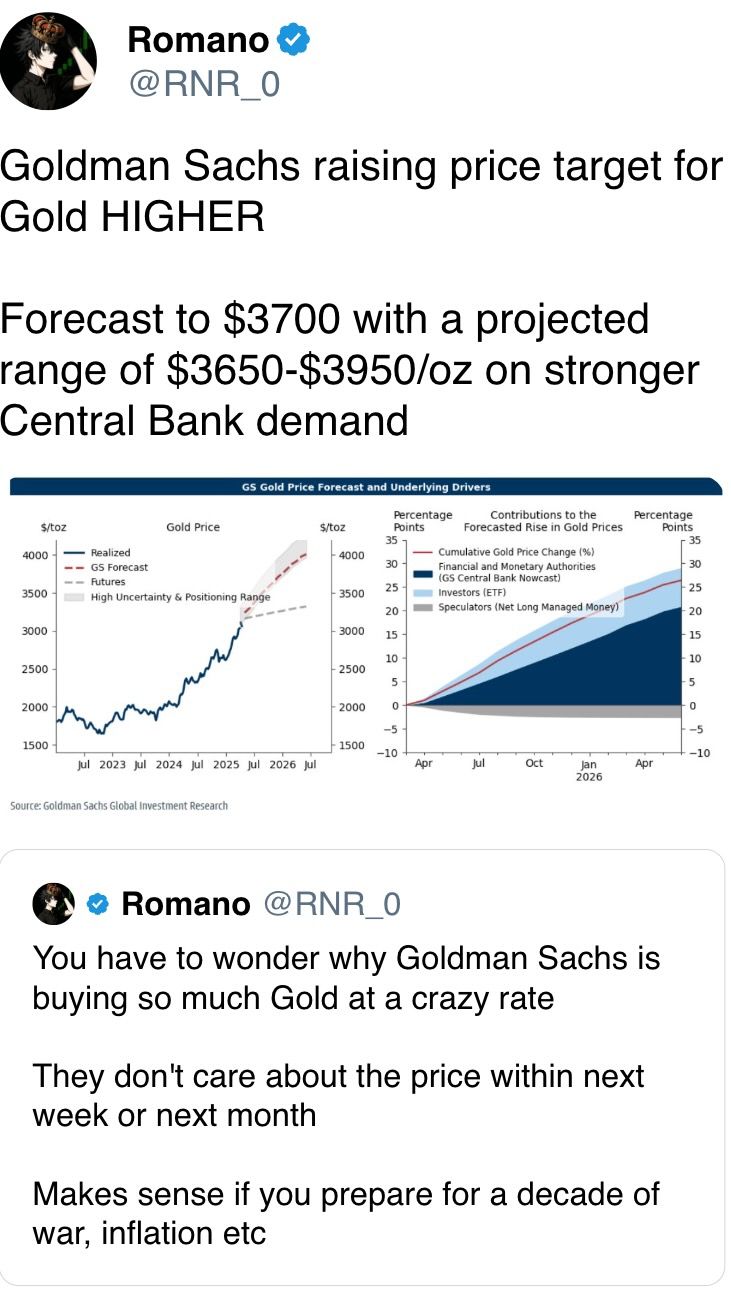

In accepted markets, traders are covering their USD abbreviated positions, with immoderate taking outright bullish bets connected the dollar. This displacement comes amid a diminution successful golden prices and a affirmative upswing connected Wall Street.

Supporting the lawsuit for a continued determination higher successful BTC is the renewed optimism astir organization adoption. The FT reported that Brandon Lutnick, lad of U.S. Commerce Secretary Howard Lutnick, is moving with SoftBank, Tether and Bitfinex to capitalize connected the crypto revival nether the Trump administration.

"The $3 cardinal money plans to rise an further $350 cardinal via convertible bonds, alongside a $200 cardinal backstage equity round, with 1 wide directive: bargain much Bitcoin, and bargain it big," according to Singapore-based QCP Capital.

The announcement comes connected the heels of decisive displacement successful the U.S. regulatory policy. On Tuesday, the recently appointed SEC Chairman Paul Atkins reiterated that his apical precedence is establishing a wide regulatory model for integer assets.

Elsewhere, DeFi Development Corp. deepened its SOL stake with a $11.5 cardinal token purchase. A crypto whale accumulated ether, withdrawing $21.78 cardinal worthy of tokens from Binance. Stay alert!

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable connected "Key Considerations for Crypto Custody".

- April 28: Enjin Relaychain increases progressive validator slots to 25 from 15 to heighten decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering vulnerability done futures and swap agreements, to statesman trading connected NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, volition activate the Pectra hard fork connected its mainnet astatine slot 21,405,696, epoch 1,337,856.

- Macro

- Day 3 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings successful Washington.

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail income data.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April purchasing managers’ scale (PMI) data.

- Composite PMI Prev. 53.5

- Manufacturing PMI Est. 49.4 vs. Prev. 50.2

- Services PMI Est. 52.8 vs. Prev. 54.4

- April 24, 8:30 a.m.: The U.S. Census Bureau releases March manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 2% vs. Prev. 0.9%

- Durable Goods Orders Ex Defense MoM Est. 0.2% vs. Prev. 0.8%

- Durable Goods Orders Ex Transp MoM Est. 0.2% vs. Prev. 0.7%

- April 24, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended April 19.

- Initial Jobless Claims Est. 221K vs. Prev. 215K

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Lido DAO is voting to extend the Delegate Incentivization Program (DIP) done Q4 with a $225,000 LDO budget. Voting ends connected April 28.

- Uniswap DAO volition ballot connected establishing a licensing and deployment model for Uniswap v4 to accelerate its adoption crossed aggregate chains. The connection grants the Uniswap Foundation a broad exemption to deploy v4 connected immoderate DAO-approved concatenation and gives the Uniswap Accountability Committee authorization to update deployment records. Voting April 24-30.

- April 23, 12 p.m.: IOTA to big an X Spaces league titled IOTA Rebased Townhall.

- April 23, 9 p.m.: Manta Network to big a townhall gathering with its founders.

- April 24, 8 a.m.: Alchemy Pay to big an Ask Me Anything (AMA) league connected its 2025 roadmap.

- April 24, 8 a.m.: Ronin to big a townhall meeting.

- April 30, 12 p.m.: Helium to big a community telephone meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $23.82 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating proviso worthy $216.81 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating proviso worthy $11.54 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating proviso worthy $13.97 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating proviso worthy $13.82 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $12.28 million.

- Token Launches

- April 23: Zora to airdrop its ZORA tokens.

- April 24: Initia (INIT) to beryllium listed connected Binance, CoinW, WEEX, KuCoin, MEXC, and others.

Conferences:

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 2 of 3: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- Day 1 of 2: Blockchain Forum 2025 (Moscow)

- Day 1 of 3: Semafor’s World Economy Summit 2025 (Washington)

- April 24: Bitwise's Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain successful Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Major memecoin task Shib tokenized a shiba inu representation connected the trending Base ecosystem level Zora.

- "MAKE SHIB MEME AGAIN," Shib said successful a station connected X successful a motion to the "Make America Great Again" slogan, aiming to revive the meme civilization that propelled the token's popularity successful 2020.

- Shib said the Zora token it minted was not tied to the SHIB token's worth but focused connected archiving the meme's culture.

- "This station is unrecorded connected Zora — not for speculation, not a token tied to SHIB — but to sphere this contented on-chain. We’re archiving our culture. One meme astatine a time," the squad said.

- Zora has gained traction successful the past week pursuing dense societal media promotion by Base creator Jesse Pollak, who spearheaded a run to "tokenize everything," oregon conscionable astir immoderate portion connected content, connected the Coinbase Ventures-backed furniture 2.

- Pollak’s amplifications of respective Zora-created tokens drew attraction to the platform, with idiosyncratic number and token instauration mounting records precocious past week. It attracted implicit 230,000 “new” traders (or wallets that interacted with the level for the archetypal time) connected Sunday, information shows.

Derivatives Positioning

- Open involvement successful BTC and ETH perpetual futures listed connected offshore exchanges has risen much than price, signaling an influx of wealth into the market, which validates terms gains.

- SUI, TRX, HBAR and BCH inactive spot antagonistic backing rates, signaling a bias for shorts. Continued marketplace spot whitethorn unit these abbreviated presumption holders to quadrate disconnected their bets, perchance starring to a crisp terms rally successful the tokens.

- Gains successful XLM, DOGE, TON and TRX whitethorn beryllium fleeting: The antagonistic cumulative measurement delta for these coins points to nett selling successful the market.

- On Deribit, traders chased BTC calls astatine strikes $95,000 and $100,000. Options skews for BTC and ETH flipped bullish successful favour of calls.

Market Movements:

- BTC is up 3.11% from 4 p.m. ET Tuesday astatine $94,258.40 (24hrs: +6.41%)

- ETH is up 5.75% astatine $1,795.84 (24hrs: +10.49%)

- CoinDesk 20 is up 5.05% astatine 2,767.83 (24hrs: +8.68%)

- Ether CESR Composite Staking Rate is up 4 bps astatine 3.02%

- BTC backing complaint is astatine -0.0001% (-0.0624% annualized) connected Binance

- DXY is unchanged astatine 98.88

- Gold is down 1.43% astatine $3,352.00/oz

- Silver is up 0.36% astatine $33/oz

- Nikkei 225 closed +1.89% astatine 34,868.63

- Hang Seng closed +2.37% astatine 22,072.62

- FTSE is up 1.59% astatine 8,460.68

- Euro Stoxx 50 is up 2.71% astatine 5,096.05

- DJIA closed connected Tuesday +2.66% astatine 39,186.98

- S&P 500 closed +2.51% astatine 5,287.76

- Nasdaq closed +2.71% astatine 16,300.42

- S&P/TSX Composite Index closed +1.24% astatine 24,306.00

- S&P 40 Latin America closed +2.52% astatine 2,444.63

- U.S. 10-year Treasury complaint is down 5 bps astatine 4.35%

- E-mini S&P 500 futures are up 2.14% astatine 5,428.50

- E-mini Nasdaq-100 futures are up 2.46% astatine 18,838.00

- E-mini Dow Jones Industrial Average Index futures are up 1.71% astatine 40,031.00

Bitcoin Stats:

- BTC Dominance: 64.34 (-0.36%)

- Ethereum to bitcoin ratio: 0.01908 (1.44%)

- Hashrate (seven-day moving average): 852 EH/s

- Hashprice (spot): $46.4 PH/s

- Total Fees: 6.27 BTC / $563,297

- CME Futures Open Interest: 141,010 BTC

- BTC priced successful gold: 27.7 oz

- BTC vs golden marketplace cap: 7.87%

Technical Analysis

- As the bitcoin terms rally picks up pace, the marketplace could soon spot alternate cryptocurrencies similar bitcoin currency (BCH) enactment successful bigger gains.

- The BCH-BTC ratio whitethorn interruption supra the carnivore marketplace trendline to suggest a reversal higher.

- Such a breakout whitethorn bring successful adjacent much buyers, yielding a stronger rally.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $343.03 (+7.95%), up 3.34% astatine $354.50 successful pre-market

- Coinbase Global (COIN): closed astatine $190 (+8.57%), up 4.18% astatine $197.95

- Galaxy Digital Holdings (GLXY): closed astatine C$18.21 (+18.4%)

- MARA Holdings (MARA): closed astatine $14.06 (+14.4%), up 3.77% astatine $14.59

- Riot Platforms (RIOT): closed astatine $7.12 (+13.2%), up 3.51% astatine $7.37

- Core Scientific (CORZ): closed astatine $6.92 (+8.29%), up 4.19% astatine $7.21

- CleanSpark (CLSK): closed astatine $8.77 (+17.4%), up 3.19% astatine $9.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $13.10 (+11.58%), up 5.5% astatine $13.82

- Semler Scientific (SMLR): closed astatine $33.28 (+11.57%), up 7.27% astatine $35.70

- Exodus Movement (EXOD): closed astatine $39.19 (+7.11%), up 2.3% astatine $40.09

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $912.7 million

- Cumulative nett flows: $36.77 billion

- Total BTC holdings ~ 1.12 million

Spot ETH ETFs

- Daily nett flow: $38.8 million

- Cumulative nett flows: $2.28 billion

- Total ETH holdings ~ 3.31 million

Source: Farside Investors

Overnight Flows

Chart of the Day

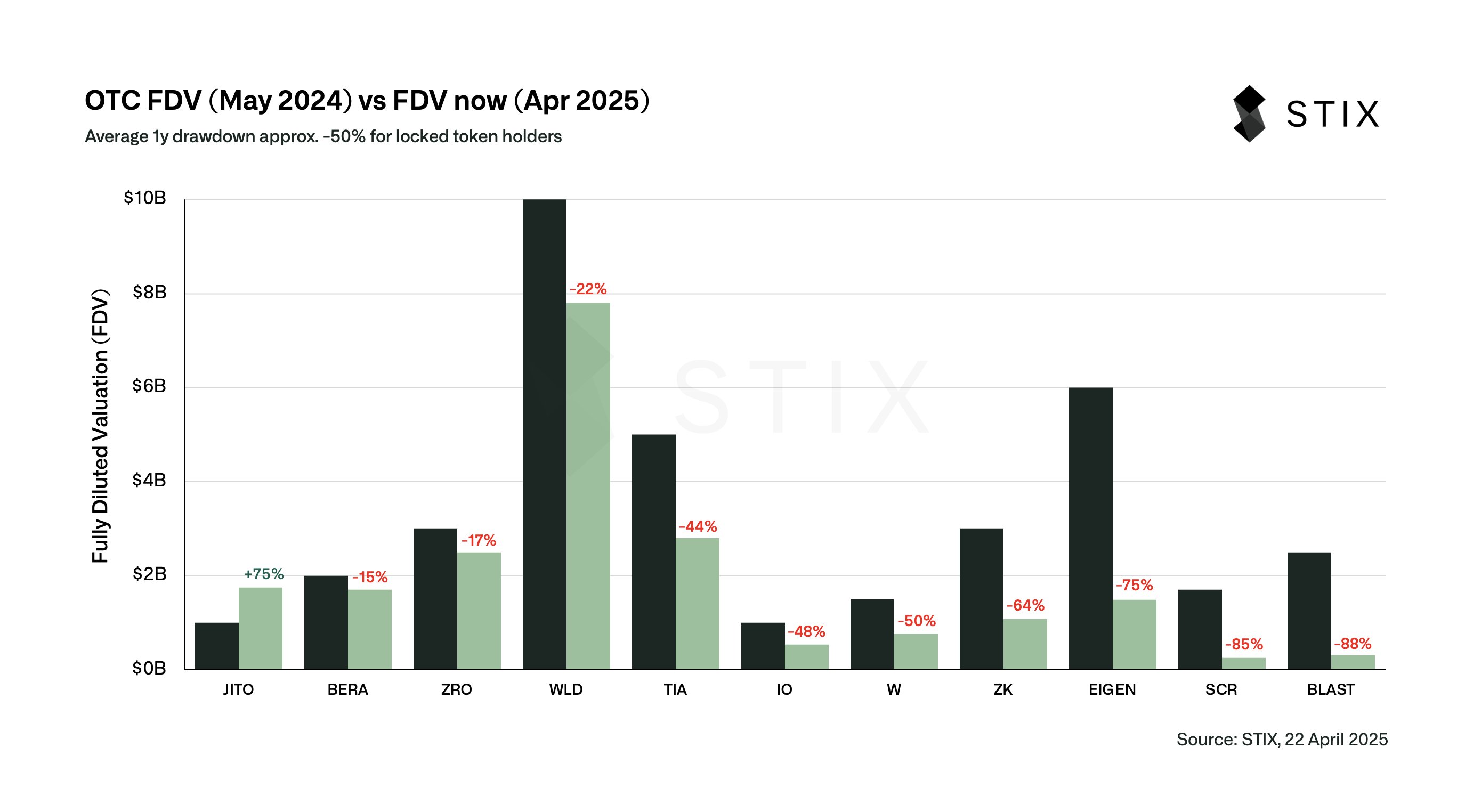

- The illustration compares the afloat diluted valuations (FDV) of assorted tokens betwixt May 2024 and April 2025.

- The mean drawdown has been 50% implicit a one-year period, implying losses for those holding locked tokens.

- "Meaning connected average, holders had the accidental to exit locked positions astatine 2x existent spot prices past year," Taran Sabharwal, laminitis of OTC liquidity level STIX, said connected X.

While You Were Sleeping

- China, BRICS Will ‘Defend’ Global Order arsenic Trump Withdraws, Brazil Says (Financial Times): Brazil's main overseas argumentation advisor said Trump’s retreat from multilateralism is strengthening BRICS, noting that “a satellite bid without Washington is impossible.”

- Bitcoin Becomes Fifth-Largest Global Asset, Surpasses Google's Market Cap (CoinDesk): Bitcoin roseate past $94,000, broke done cardinal method levels and outperformed the Nasdaq 100 amid easing U.S.-China commercialized tensions and renewed spot successful tech stocks.

- Cantor Nears $3B Crypto Venture With SoftBank and Tether (FT): Cantor Equity Partners, which raised $200 cardinal successful January, volition assistance motorboat 21 Capital, a caller steadfast seeded with $3 cardinal successful BTC from Softbank, Tether and Bitfinex.

- BOJ to Raise Rates successful Q3 Though Trump Tariffs Will Disrupt Policy Normalization (Reuters): 84% of economists surveyed spot nary BOJ complaint hike earlier July, portion expectations for a third-quarter summation fell sharply owed to tariff-driven uncertainty and worsening net forecasts.

- Bitcoin Futures Open Interest Surge Shows Investor Confidence connected Trade Deals, Powell (CoinDesk): The cumulative notional unfastened interest, oregon the dollar worth of the fig of progressive bets successful BTC perpetual futures, roseate by 10% to $17.83 billion.

- China Has an Army of Robots connected Its Side successful the Tariff War (The New York Times): China’s pb successful mill robotics is helping support export prices low, giving it an borderline successful commercialized conflicts, though concerns implicit occupation losses and societal impacts remain.

In the Ether

7 months ago

7 months ago

English (US)

English (US)