By James Van Straten (All times ET unless indicated otherwise)

Bitcoin (BTC) remains stuck adjacent the $95,000 mark, seemingly unfazed by the Canadian predetermination result, which saw the crypto-friendly campaigner for premier curate suffer his seat. Key macroeconomic information owed aboriginal this week could service arsenic a catalyst for bitcoin’s adjacent move, with the standout being Friday’s non-farm payrolls report.

In the meantime, the largest cryptocurrency is reaching a bid of higher lows and little highs, forming a symmetrical triangle consolidation pattern. This setup pursuing a beardown uptrend typically implies a continuation. A decisive breakout supra $95,500 could spark the adjacent limb higher, portion a driblet beneath enactment would bespeak a imaginable reversal.

On the method front, bitcoin's hashrate, which has surged implicit caller months and is present astir 10% distant from its record, is opening to decelerate. A downward trouble accommodation of much than 5% is anticipated successful 4 days and volition supply immoderate much-needed alleviation to miners, who person been grappling with hashprice levels adjacent five-year lows.

The week's macroeconomic information see idiosyncratic spending and GDP maturation figures connected Wednesday, though Friday's jobs study takes halfway stage. Economists forecast a driblet successful caller jobs to 135,000 during April, down from March’s 228,000 figure, which was the strongest successful 3 months.

The unemployment complaint is projected to person held dependable astatine 4.2%, underscoring a persistently choky labour market. The CME FedWatch Tool presently indicates a 91% probability of the Fed funds complaint being held astatine at 4.25%–4.50% astatine the May 7 FOMC meeting.

Also successful the mix, net play is heating up, peculiarly among the “Magnificent Seven” tech stocks. Microsoft (MSFT) and Meta (META) study aft the marketplace adjacent connected Wednesday, followed by Apple (AAPL), Amazon (AMZN) and Strategy (MSTR) connected Thursday. Stay alert!

What to Watch

- Crypto:

- April 30, 9:30 a.m.: ProShares volition debut 3 ETFs that volition supply leveraged and inverse vulnerability to XRP: the ProShares Ultra XRP ETF, the ProShares Short XRP ETF and the ProShares UltraShort XRP ETF.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, volition activate the Pectra hard fork connected its mainnet astatine slot 21,405,696, epoch 1,337,856.

- May 1: Coinbase Asset Management volition introduce the Coinbase Bitcoin Yield Fund (CBYF), which is aimed astatine non-U.S. investors.

- May 1: Hippo Protocol starts up its ain layer-1 blockchain mainnet built connected Cosmos SDK and completes a migration from Ethereum’s ERC-20 HPO token to its autochthonal HP token, enabling staking and governance.

- May 1, 9 a.m.: Constellation Network (DAG) activates the Tessellation v3 upgrade connected its mainnet, introducing delegated staking, node collateral, token locking and caller transaction types to heighten web security, scalability and functionality.

- May 1, 11 a.m.: THORChain activates its v3.5 mainnet upgrade, adding the TCY token to person $200 cardinal successful indebtedness into equity. TCY holders gain 10% of web revenue, portion autochthonal RUNE remains the protocol’s information and governance token. TCY activates May 5.

- Macro

- April 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases March JOLTs study (job openings, hires, and separations).

- Job Openings Est. 7.5M vs. Prev. 7.568M

- Job Quits Prev. 3.195M

- April 29, 10 a.m.: U.S. House Financial Services Committee hearing titled “Regulatory Overreach: The Price Tag connected American Prosperity.” Livestream link.

- April 30, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases March unemployment complaint data.

- Unemployment Rate Prev. 6.8%

- April 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q1 GDP maturation data.

- GDP Growth Rate QoQ Prev. -0.6%

- GDP Growth Rate YoY Prev. 0.5%

- April 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (advance) Q1 GDP maturation data.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 2.4%

- April 30, 10 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases March user income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.4%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

- PCE Price Index MoM Est. 0% vs. Prev. 0.3%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.5%

- Personal Income MoM Est. 0.4% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.6% vs. Prev. 0.4%

- April 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases March JOLTs study (job openings, hires, and separations).

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO is voting connected a connection to renew the Uniswap Accountability Committee (UAC) for Season 4, extending its mandate until the extremity of 2025. Voting ends April 29.

- Balancer DAO is voting connected allocating $250,000 worthy of ARB to a multisig controlled by contributors to money investigating of caller automated marketplace shaper (AMM) excavation models.

- April 30, 2 a.m.: NEO to big an Ask Me Anything (AMA) league with its founder, Da Hongfei.

- April 30, 12 p.m.: Helium to big a community telephone meeting.

- May 5, 4 p.m.: Livepeer (LPT) to big a Treasury Talk session connected Discord.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $24.75 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating proviso worthy $267.86 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating proviso worthy $12.10 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating proviso worthy $13.44 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating proviso worthy $14.01 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $12.35 million.

- Token Launches

- April 29: MilkyWay (MILK) to beryllium listed connected Bybit.

- April 29: Virtual (VIRTUAL) to beryllium listed connected Binance.US.

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to beryllium listed connected Kraken.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 3 of 4: Web Summit Rio 2025

- Day 2 of 2: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

Token Talk

By Shaurya Malwa

- BNB Chain's Lorentz upgrade went unrecorded earlier Tuesday, boosting BNB token fundamentals by making the web faster and much efficient.

- The upgrade improved the mode validators speech data, making the process quicker and smoother to trim delays and velocity up transaction processing.

- It besides added a method allowing validators to person aggregate blocks astatine once, alternatively of 1 by one.

- The clip it takes to make a caller artifact is reduced to astir 1.5 seconds and could autumn to arsenic debased arsenic 0.75 seconds. Faster artifact times mean transactions are confirmed much quickly, making the web consciousness snappier for users.

- The update makes decentralized apps (dapps) similar games oregon fiscal tools tally faster and smoother. Developers tin support gathering apps the aforesaid mode due to the fact that the update doesn’t alteration however the web works with their code.

- A faster, much businesslike web attracts much users and developers, which tin summation request for BNB and marque it much invaluable implicit time.

Derivatives Positioning

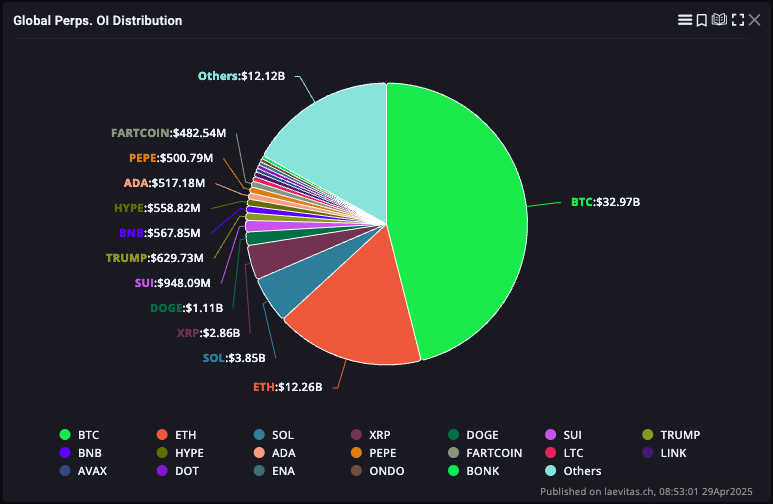

- Total unfastened involvement (OI) crossed perpetuals, options and futures present stands astatine $122 cardinal globally, according to information from Laevitas.

- SUI has seen a crisp surge successful derivatives activity, with its stock of planetary perpetuals measurement peaking astatine 5.06% ($7.12 billion) connected April 25.

- It has since sustained measurement dominance supra 3.5%, importantly higher than its humanities mean of nether 2%, suggesting renewed speculative appetite driven by caller task announcements.

- According to Coinalyze, the apical OI gainers successful the past 24 hours among tokens with marketplace caps implicit $100 cardinal are:

- SAFE: +123%

- RAY: +92%

- MOCA: +68%

Market Movements:

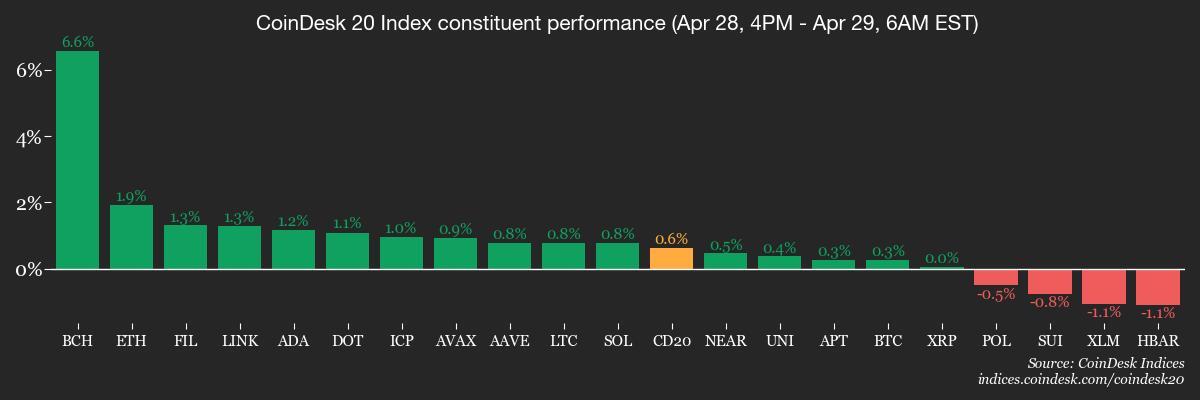

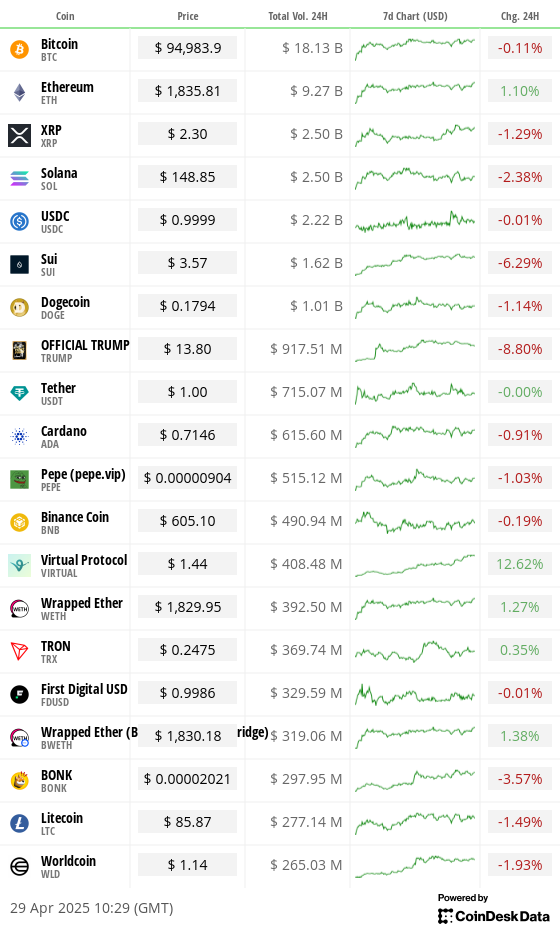

- BTC is up 0.43% from 4 p.m. ET Monday astatine $95,009.93 (24hrs: +0.33%)

- ETH is up 2.81% astatine $1,838.46 (24hrs: +1.9%)

- CoinDesk 20 is up 0.85% astatine 2,792.69 (24hrs: -0.08%)

- Ether CESR Composite Staking Rate is up 28 bps astatine 2.975%

- BTC backing complaint is astatine 0.0005% (0.5749% annualized) connected Binance

- DXY is up 0.27% astatine 99.28

- Gold is down 1.11% astatine $3,306.08/oz

- Silver is up 0.41% astatine $33.28/oz

- Nikkei 225 closed +0.38% astatine 35,839.99

- Hang Seng closed +0.16% astatine 22,008.11

- FTSE is up 0.16% astatine 8,430.89

- Euro Stoxx 50 is unchanged astatine 5,168.63

- DJIA closed connected Monday 0.28% astatine 40,227.59

- S&P 500 closed +0.06% astatine 5,528.75

- Nasdaq closed -0.1% astatine 17,336.13

- S&P/TSX Composite Index closed +0.36% astatine 24,798.59

- S&P 40 Latin America closed +0.74% astatine 2,549.44

- U.S. 10-year Treasury complaint is down 6 bps astatine 4.21%

- E-mini S&P 500 futures are up 0.14% astatine 5,561.00

- E-mini Nasdaq-100 futures are up 0.15% astatine 190557.75

- E-mini Dow Jones Industrial Average Index futures are up 0.36% astatine 40,515.00

Bitcoin Stats:

- BTC Dominance: 64.24 (-0.24%)

- Ethereum to bitcoin ratio: 0.01928 (1.80%)

- Hashrate (seven-day moving average): 842 EH/s

- Hashprice (spot): $48.7 PH/s

- Total Fees: 6.98 BTC / $651,628

- CME Futures Open Interest: 132, 750 BTC

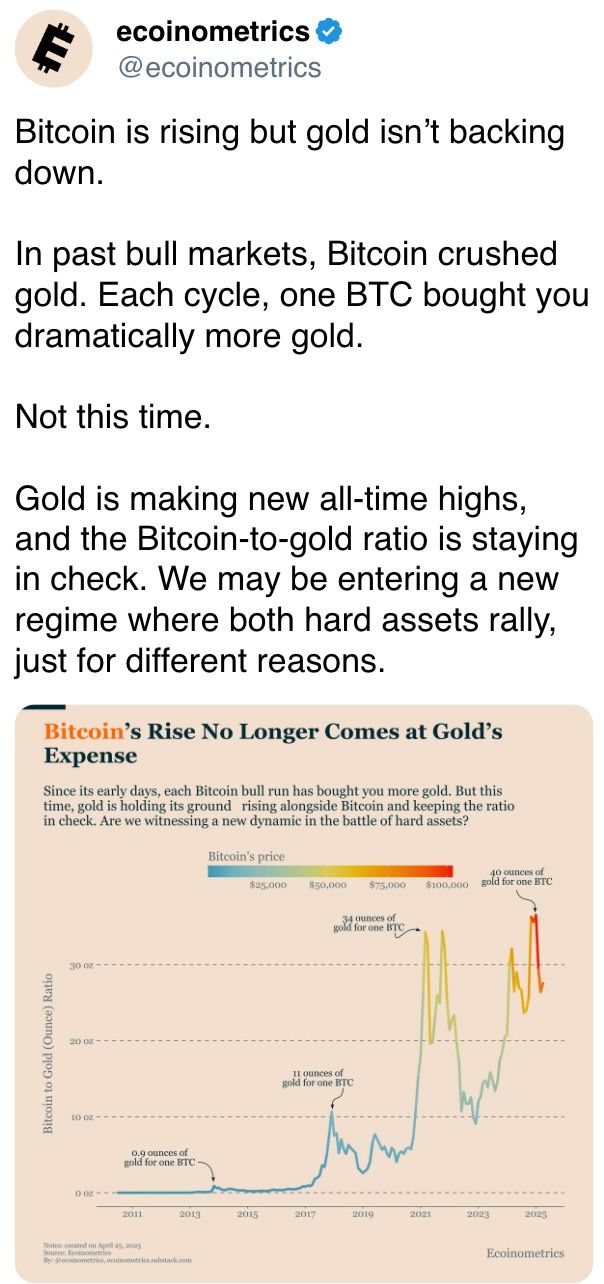

- BTC priced successful gold: 28.6 oz

- BTC vs golden marketplace cap: 8.10%

Technical Analysis

- Ether (ETH) is showing signs of betterment aft reclaiming the worth country (defined by the 2 bluish dotted lines), suggesting a instrumentality to its high-volume terms portion established since the October 2023 rally.

- The Point of Control (PoC) remains adjacent $2,200, serving arsenic a large magnet for terms enactment and a captious bullish target.

- ETH is besides approaching the 50-day exponential moving mean (EMA), a imaginable inflection constituent that whitethorn spark volatility.

- The level is peculiarly notable due to the fact that galore altcoins person beaten ether to reclaim their 50-day EMAs.

- Importantly, terms enactment has present breached supra the descending trendline stemming from the December 2024 high, a cardinal structural displacement favoring bullish momentum.

- Upside targets include:

- $2,104 to corroborate a higher high

- $2,200 (PoC), volume-weighted focal point

- $2,480 (200-day EMA), semipermanent resistance

- To support its bullish bias, ETH indispensable clasp supra the little bound of the worth country (~$1,745), oregon hazard a instrumentality to bearish sentiment.

Crypto Equities

- Strategy (MSTR): closed Monday astatine $369.25 (+0.15%), up 0.30% astatine $370.34 successful pre-market

- Coinbase Global (COIN): closed astatine $205.27 (-2.08%), up 0.58% astatine $206.47

- Galaxy Digital Holdings (GLXY): closed astatine $21.21 (2.81%)

- MARA Holdings (MARA): closed astatine $14.01 (-2.03%)

- Riot Platforms (RIOT): closed astatine $7.63 (-1.8%), up 0.39% astatine $7.66

- Core Scientific (CORZ) closed astatine $8.24 (-0.84%), up 1.21% astatine $8.34

- CleanSpark (CLSK): closed astatine $8.57 (-4.88%), up 0.12% astatine $8.58

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.33 (-1.58%)

- Semler Scientific (SMLR): closed astatine $35.37 (-3.99%), up 1.78% astatine $36.00

- Exodus Movement (EXOD): closed astatine $42.18 (-7.30%), up 1.92% astatine $42.99

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $591.2 million

- Cumulative nett flows: $38.99 billion

- Total BTC holdings ~ 1.14 million

Spot ETH ETFs

- Daily nett flow: $64.1 million

- Cumulative nett flows: $2.48 billion

- Total ETH holdings ~ 3.40 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- BTC dominates derivatives, with $32.97B successful unfastened involvement (OI), implicit 40% of the full and much than treble ETH’s $12.26B.

- Memecoins similar DOGE, TRUMP, PEPE and FARTCOIN each transcend $480M successful OI, outperforming galore large-cap assets, showing the spot of memecoins wrong derivatives positioning.

- ETH + SOL combined ($16.11B) stay autumn acold abbreviated of BTC’s OI, underscoring bitcoin's continued derivatives supremacy.

While You Were Sleeping

- Bitcoin-Friendly Poilievre Loses Seat arsenic Carney's Liberals Win 2025 Election (CoinDesk): Conservative Leader Pierre Poilievre mislaid his Ottawa-area spot arsenic Mark Carney’s Liberal Party won capable seats to signifier astatine slightest a number government.

- Canadian Dollar Slips arsenic Liberals Head for Only Narrow Victory (Bloomberg): Prime Minister Mark Carney faces unit to easiness Canada’s reliance connected its confederate neighbour arsenic the currency remains delicate to commercialized negotiations and U.S. tariff risks.

- DOJ Seeks 20-Year Sentence for Celsius Founder Alex Mashinsky (CoinDesk): Mashinsky pleaded blameworthy to deliberately misleading customers astir the information of their deposits portion manipulating the CEL token for idiosyncratic gain. Sentencing is acceptable for May 8.

- Russia Hopes Warmer Weather Will Boost Flagging Spring Offensive (The Wall Street Journal): Ukrainian forces person stalled Russia’s advances this spring, but analysts pass warmer upwind volition harden crushed and thicken cover, making aboriginal attacks harder to repel.

- Gold Prices Drop arsenic Tariff Concerns Ease; US Data successful Focus (Reuters): Growing hazard appetite, supported by U.S. Treasury Secretary Scott Bessent’s connection that respective large trading partners person made beardown proposals, is reducing request for gold.

- EU Faces Trade War connected Many Fronts (Financial Times): European Commission President Ursula von der Leyen’s strategy is to negociate with Trump, fortify commercialized with different nations, and little interior marketplace barriers to enactment EU exporters.

In the Ether

7 months ago

7 months ago

English (US)

English (US)